Problem Set 6 Solution

advertisement

Dirk Bergemann

Solutions prepared by Vincent Pohl

Department of Economics

Yale University

Economics 121b: Intermediate Microeconomics

Problem Set 6: Concavity

2/17/10

Common mistakes:

• Graphs were not labelled, for example f (λx + (1 − λ)y) and min {f (x),

f (y)}were not indicated in problem 1(a).

• In problem 1(d), the negative second deritive of a concave function was

used in the argument without showing that concavity implies a negative

second dericative.

• In problem 2(f), the price change led to a consumption bundle on a different indifference curve, which is not the case for compensated demand.

1. Concavity and quasi-concavity

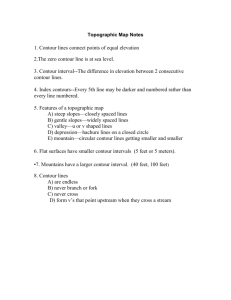

(a) See Figures 1 and 2.

(b) The function in Figure 2 is quasi-concave, but not concave. It has

parts on the left and right that are convex. As we can see in this

graph,

λf (z) + (1 − λ) f (y) ≥ f (λz + (1 − λ) y) ,

which violates concavity. In terms of the second derivative the difference between concave and quasi-concave functions is that concave

functions have f !! (x) < 0, which is not necessarily the case for quasiconcave functions.

(c) Let’s start with the definition of concavity:

f (λx + (1 − λ) y)

≥ λf (x) + (1 − λ) f (y)

= f (y) + λ [f (x) − f (y)]

≥ f (y)

if f (x) ≥ f (y). We can also write this definition as follows:

f (λx + (1 − λ) y)

≥ λf (x) + (1 − λ) f (y)

= f (x) + (λ − 1)f (x) + (1 − λ)f (y)

= f (x) + (1 − λ) [f (y) − f (x)]

≥ f (x)

1

y

f(y)

f(!z+(1-!)y)

!f(z)+(1-!)f(y)

f(z)

!z+(1-!)y

z

Figure 1: A concave function

z

f(z)

!f(z)+(1-!)f(y)

!z+(1-!)y

f(!z+(1-!)y)

y

f(y)=min{f(y),f(z)}

Figure 2: A quasi-concave function

2

if f (y) ≥ f (x). Hence, we have either

f (λx + (1 − λ) y) ≥ f (y)

or

f (λx + (1 − λ) y) ≥ f (x),

which implies

f (λx + (1 − λ) y) ≥ min {f (x), f (y)} ,

the definition of quasi-concavity.

(d) Note that the question should have read “Argue that all extrema

(critical points) of a concave function are global maxima.”

Start with the definition of concavity:

f (λx + (1 − λ) y) ≥ λf (x) + (1 − λ) f (y) ,

which can be rewritten as

f (y + λ(x − y)) ≥ f (y) + λ [f (x) − f (y)]

and further as

f (y + λ(x − y)) − f (y)

≥ f (x) − f (y).

λ

Taking the limit as λ goes to zero we get (note that the RHS does

not depend on λ):

f (y + λ(x − y)) − f (y)

= f ! (y) ≥ f (x) − f (y).

λ→0

λ

lim

(1)

Suppose y is a critical point so that f ! (y) = 0. Hence equation (1)

simplifies to

f (x) − f (y) ≤ 0 ⇔

f (x) ≤ f (y).

Since this inequality holds for all x, we get that the function f is

lower at any point other than the critical point y, implying that y is

a global maximum of f .

2. Quasi-concavity and the upper contour set

(a) See Figure 3. Note that for points y and z the linear combination

is identical to the (linear part of) the function. Hence the strict

inequality in the definition of strict quasi-concavity is violated.

3

y !y+(1-!)z

f(!y+(1-!)z)

=min{f(y),f(z)}

z

!x+(1-!)y

x

Figure 3: A quasi-concave function that is not strictly quasi-concave

(b) From Figure 2, which depicts a strictly quasi-concave function, and

the quasi-concave function in Figure 3 it is clear that the former

can only have at most one global maximum, whereas the latter may

have many. More formally, the definition of strict quasi-concavity

contains a strict inequality, and this inequality has to hold for all

x %= y. Suppose the strictly quasi-concave function has a maximum

and calling it

z = λx + (1 − λ)y

we see that f (z) has to be strictly larger than both f (x) and f (y).

Since we can pick x and y as close to z as we want, the function

is lower at any point other than z. This means that z is a global

maximum. In Figure 3, however, we can pick x and y such that

f (z) = f (x) = f (y), which means that all three points are global

maxima.

(c) See Figure 4. The shaded area is the set of all consumption bundles

that yield higher utility than ū, which is the utility level associated

with the depicted indifference curve.

(d) Note that this question should have read “Argue that strict quasiconcavity (1) implies the convexity of the upper contour sets (2).”

Consider Figure 5, which shows the same strictly quasi-concave function as Figure 2. The upper contour set U C(z) is convex. Why are

these two definitions equivalent? A strictly quasi-concave function

has only at most one global maximum. Hence, the function cannot

raise once it started to drop. In other words, when the function

drops below the cutoff z, it stays below z. The upper contour set can

therefore not consist of several segments, which would make it non4

good 2

x

#x+(1-#)y"x

{x!R!|u(x)>"}

y

"

good 1

Figure 4: The upper contour set of a utility function

z

UC(z)

Figure 5: Equivalence of the two definitions of strict quasi-concavity

5

z

UC(z)

UC(z)

Figure 6: A non-convex upper contour set

convex. Consider Figure 6 where the upper contour set is not convex

as a counterexample. Obviously this function is not quasi-concave.

(e) In part (d) we showed that strict quasi-concave functions have convex

upper contour sets and in part (c) we illustrated a convex upper contour set for a utility function. In Figure 4, the convex combination

between two points on the same indifference curve is an element of

the upper contour set (note that the upper contour set does not include the indifference curve itself). Hence, this consumer has strictly

convex preferences.

(f) See Figure 7, which depicts an increase in the price of good 1. The

∂xc (p,U )

substitution effect or 1∂p1

is the change in demand for good 1

given the change in its price holding utility constant. This is labelled

as “SE” in the graph. We move along the indifference curve as the

slope of the budget line becomes steeper. With strictly convex preferences, the demand for good 1 has to decrease as its price increases. A

bundle to the right of the initial bundle also has to be below the initial bundle to be on the same indifference curve. This is inconsistent

with an increase in p1 . Hence we have that

!

"

∂xci p, U

< 0.

∂pi

(p,M )

The same does not hold for uncompensated demand because ∂xi∂p

i

consists of substitution and income effect. The income effect can

prevail as we will see in question 3, making the own-price effect of

uncompensated demand positive.

6

good 2

bundle after price change

bundle with same utility as initial

initial bundle

IE

SE

good 1

Figure 7: Income and substitution effects

3. Giffen good. Starting with the definition of a Giffen good we have

∂xi (p, M )

> 0.

∂pi

Using the Slutsky equation for the own-price effect of good i this implies

!

"

∂xci p, U

∂xi (p, M )

− xi

>0

∂pi

∂M

or

!

"

∂xci p, U

∂xi (p, M )

> xi

.

(2)

∂pi

∂M

From question 2(f) we know that

!

"

∂xci p, U

< 0.

∂pi

Hence, for inequality (2) to hold we need at least

∂xi (p, M )

< 0.

∂M

This is the definition of an inferior good, which means that every Giffen

good is also an inferior good. On the other hand, not every inferior good

is a Giffen good because the RHS of equation (2) could be negative but

larger than the LHS. In that case the own-price effect would be negative.

In other words, for a good to be a Giffen good, we need the income effect

(p,M )

times demand xi ∂xi∂M

to be smaller (or larger in absolute value) than

∂xci (p,U )

the substitution effect

.

∂pi

7