answers

advertisement

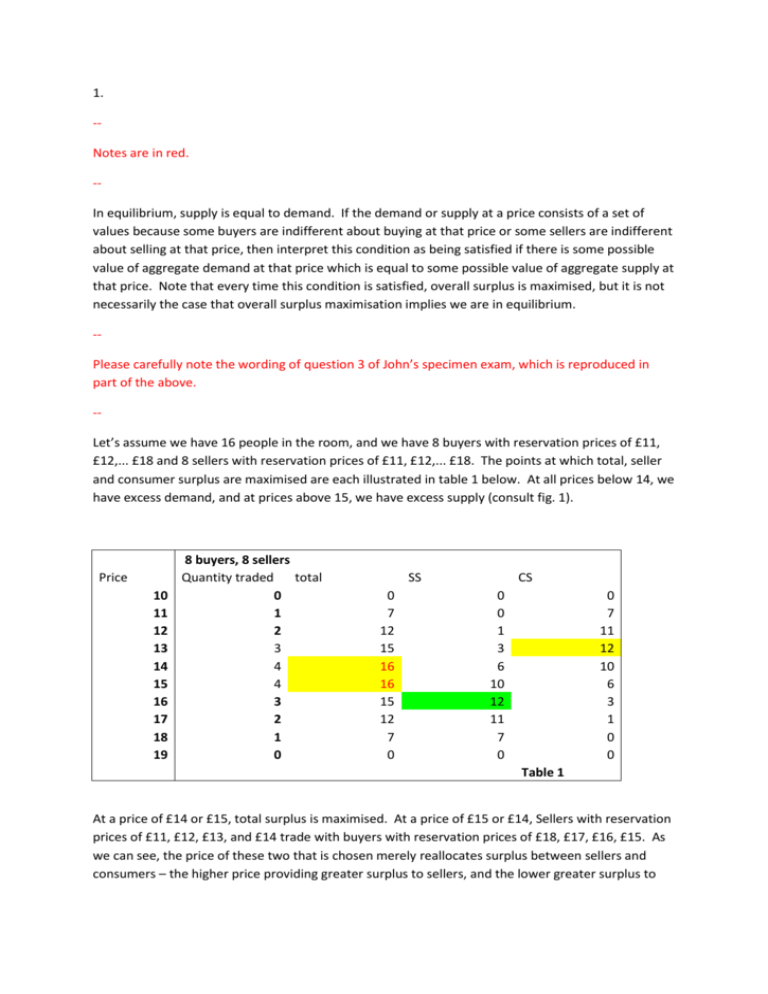

1. -Notes are in red. -In equilibrium, supply is equal to demand. If the demand or supply at a price consists of a set of values because some buyers are indifferent about buying at that price or some sellers are indifferent about selling at that price, then interpret this condition as being satisfied if there is some possible value of aggregate demand at that price which is equal to some possible value of aggregate supply at that price. Note that every time this condition is satisfied, overall surplus is maximised, but it is not necessarily the case that overall surplus maximisation implies we are in equilibrium. -Please carefully note the wording of question 3 of John’s specimen exam, which is reproduced in part of the above. -Let’s assume we have 16 people in the room, and we have 8 buyers with reservation prices of £11, £12,... £18 and 8 sellers with reservation prices of £11, £12,... £18. The points at which total, seller and consumer surplus are maximised are each illustrated in table 1 below. At all prices below 14, we have excess demand, and at prices above 15, we have excess supply (consult fig. 1). Price 10 11 12 13 14 15 16 17 18 19 8 buyers, 8 sellers Quantity traded total 0 1 2 3 4 4 3 2 1 0 SS 0 7 12 15 16 16 15 12 7 0 CS 0 0 1 3 6 10 12 11 7 0 0 7 11 12 10 6 3 1 0 0 Table 1 At a price of £14 or £15, total surplus is maximised. At a price of £15 or £14, Sellers with reservation prices of £11, £12, £13, and £14 trade with buyers with reservation prices of £18, £17, £16, £15. As we can see, the price of these two that is chosen merely reallocates surplus between sellers and consumers – the higher price providing greater surplus to sellers, and the lower greater surplus to buyers. This would seem to make intuitive sense – sellers would, all else equal, prefer higher to lower prices, and buyers lower to higher. 2) & 3) If we allow sellers to act as a cooperative and set a single price for all buyers, they will seek to maximise their own surplus, and choose a higher price – sellers prefer, all else equal, higher prices. In this case, seller surplus is maximised by choosing a price of £16, which gives a lower total combined surplus (£15, compared to £16) but a higher total surplus for sellers (£12, compared to £10). If we allow buyers to act as a cooperative and set a single price for all sellers, they will seek to maximise their own surplus, and choose a lower price – buyers prefer, all else equal, lower prices. In this case, buyer surplus is maximised by choosing a price of £13, which gives a lower total combined surplus (£15, compared to £16) but a higher total surplus for buyers (£12, compared to £10). If we treat each unit of consumer and producer surplus equivalently in calculating social welfare, allowing either monopoly (a seller cooperative) or monopsony (a buyer cooperative) to exist reduces social welfare. From a utilitarian point of view (although note that this is only one conception of social justice, or fairness), this is less fair, as the total amount of surplus in society is reduced. The entirety of the above can be illustrated as below (fig 1 – the red step function illustrates supply, and the blue step function demand), with the yellow area representing the loss of overall surplus under monopoly or monopsony at a price of £16 or £13 respectively: Fig 1 4) If we allow both groups to form cooperatives, the outcome is indeterminate. All we can say is that a price between the two optimum prices for buyers and sellers will prevail, i.e. 13 ≤ p* ≤ 16. A price lower than 13 or higher than 16 would reduce surplus for both sellers and buyers, and so would be in neither party’s interest. 5) We can maximise the number of voluntarily-undertaken trades by allowing buyers and sellers to trade at their reservation prices, i.e. by forcing buyers with a reservation price of x to trade with the seller with a reservation price of x. This would, however, generate zero overall surplus.