Lecture 2

advertisement

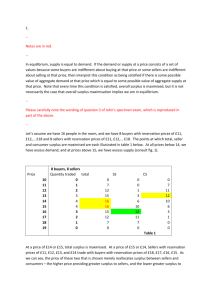

Microeconomics 2 Lecture 2 Gains from exchange Who will win the Nobel Prize in economics in 2013? In 2012 - below Lloyd Shapley Al Roth See the Guardian video What did I ask you to do? • Recall/find the definition of a reservation price for a buyer (perhaps you used a different expression for it?). • Recall/find the definition of a reservation price for a seller(perhaps you used a different expression for it?). • Assume a discrete good – single units. • You might also have done this below: • Recall/find the definition of surplus for a buyer. • Recall/find the definition of surplus for a seller. Today’s lecture • We are going to study some different exchange/market mechanisms; is there a ‘best’? • In the olden days, when there were not many students, I used to get the students to play a little game. • I cannot do it here as there are too many of you, but you can imagine it. • And you could do it with your friends tonight. An imaginary market/an experiment • • • • Buyers and Sellers, a discrete good. Each Buyer wants to buy at most one unit. Each Seller wants to sell at most one unit. Each Buyer has a reservation price for the one unit – this is the maximum that he or she will pay for that one unit. • Each Seller has a reservation price for the one unit – this is the minimum that he or she will accept for that one unit. Profit/Surplus • The profit/surplus of a buyer is the difference between the reservation price and the price paid. • The profit/surplus of a seller is the difference between the price received and the reservation price. • We will formalise this later. • Both want to maximise their surplus. A Particular Market Mechanism • Bilateral Trades • Buyers and Sellers negotiate individually and see if they can agree on a price. • I asked students to pretend that this was a real experiment and I would pay them their surpluses. • So for the buyers I would pay the difference between the reservation price and the price paid; and for the buyers I would pay the difference between the price recieved and the reservation price. What do you think of this exchange mechanism? • • • • • • What do you think of it? Do you think it might be efficient? Do you think that it might be fair? There are lots of other market mechanisms. Is there a ‘best’? Let us study a particular mechanism – a competitive market – in which a price is chosen such that the demand equals the supply. • What are the properties of this mechanism? • Let us go to the html file. Properties of Competitive Market Mechanism • Total surplus is maximised. • With any other single price (not a competive equilibrium price) the total surplus is less. • So this mechanism maximises the total surplus extracted from the market. • Note however that it says nothing about the distribution of the surplus or whether it is a fair mechanism. • You should also think of other exchange mechanisms and see if they are efficient and/or fair. Goodbye!! • See you next week.