ACC 101 INTRO TO ACCOUNTING I Eva Lord

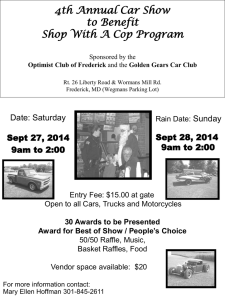

advertisement

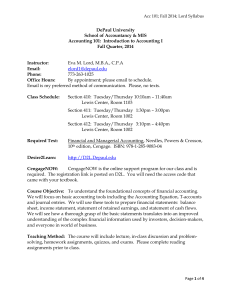

Acc 101; Fall 2015; Lord Syllabus DePaul University School of Accountancy & MIS Accounting 101: Introduction to Accounting I Fall Quarter, 2015 Instructor: Eva M. Lord, M.B.A., C.P.A Email: elord1@depaul.edu Phone: 773-263-1025 Office Hours: By appointment; please email to schedule. Email is my preferred method of communication. Please, no texts. Class Schedule: Section 411: Monday/Wednesday Section 412: Monday/Wednesday 1:30pm – 3:00pm 3:10pm – 4:40pm Location: Lewis Center, Room 1002 Required Text: Financial and Managerial Accounting, Needles, Powers & Crosson, 10th edition, Cengage. ISBN: 978-1-285-90830-4 CengageNOW: CengageNOW is the online support program for our class and is required. To register for the program, use the access code that came with your textbook. Registration instructions are posted on D2L, or use the appropriate link below: Section 411: MW 1:30 http://login.cengagebrain.com/course/E-HY7WUGPLPR9CQ Section 412: MW 3:10 http://login.cengagebrain.com/course/E-HY7W2AAFMXJTZ Desire2Learn: http://D2L.Depaul.edu All course materials including the syllabus and chapter outlines are posted on D2L. Please use the Discussions forum in D2L to ask homework questions. Course Objective: To understand the foundational concepts of financial accounting. We will focus on basic accounting tools including the accounting equation, T-accounts and journal entries. We will use these tools to prepare financial statements: balance sheet, income statement, statement of retained earnings, and statement of cash flows. We will see how a thorough grasp of the basic statements translates into an improved understanding of the complex financial information used by investors, decision-makers, and everyone in world of business. Teaching Method: The course will include lecture, in-class discussion and problemsolving, homework assignments, quizzes, and exams. Please complete reading assignments prior to class. Page 1 of 4 Acc 101; Fall 2015; Lord Syllabus Class participation, Career Management Passport, and Handshake: Class participation points can be earned by 1) asking questions, 2) answering questions, and 3) contributing to classroom discussion. Points will be deducted for 1) skipping class, 2) texting or using a phone during class, and 3) using a laptop for any reason other than ACC 101 during class. Participation in the Career Management Passport program and Registration with Handshake are mandatory and will count for 1% of your Class Participation grade. More information is posted on D2L. Lab Sessions: Enrollment in a weekly ACC 100 lab session is mandatory. Quizzes: There will be four quizzes over the course of the term. Your lowest-scoring quiz will be dropped from your grade calculation. Quizzes are short, taken in-class, and consist of multiple choice questions. Quizzes are usually returned the following class period. We will review any challenging questions. If you wish to contest a quiz score, you must return the quiz to me before leaving the classroom. When you agree with your quiz score, you may keep the quiz as a study tool. Homework: Homework is important for reinforcing your grasp of the material, and an excellent way of preparing for exams. There will be eight homework assignments over the course of the term. See the attached calendar for due dates. Note that on-line homework assignments are due at 9:00 a.m. on the day of class. We will review any challenging questions. Your two lowest-scoring homework assignments will be dropped from your grade calculation. Most homework will be done using CengageNOW. You can submit homework assignments up to twenty times; only your highest score will count towards your grade. You can also “check your work” along the way with no penalty. Exams: There will be a Midterm Exam in week six, and a Final Exam at the end of the term. ACC 101 Exams do not follow the university schedule – please see the calendar below. Exams include multiple choice questions and problems. Personal calculators are not allowed. The School of Accountancy will provide standard calculators. Grading: Class Participation/Career Passport Lab Quizzes Homework Midterm Exam Final Exam Total 5% 5% 5% 10% 35% 40% 100% Page 2 of 4 Acc 101; Fall 2015; Lord Syllabus Grading scale: 93 and above 90 – 92 87 – 89 83 – 86 80 – 82 A AB+ B B- 77 – 79 73 – 76 70 – 72 67 – 69 60 – 66 Below 60 C+ C CD+ D F Students with Disabilities: Students seeking disability-related accommodations are required to register with DePaul's Center for Students with Disabilities (CSD) enabling you to access accommodations and support services to assist your success. There are two office locations that can provide you with enrollment information. Email or call with questions; csd@depaul.edu or (312) 362-8002 (Loop Campus - Lewis Center #1420). Students are also invited to contact me privately to discuss your challenges and how I may assist in facilitating the accommodations you will use during this course. This is best done early in the term and our conversation will remain confidential. Academic Integrity: Students are expected to conduct themselves in this course in a manner consistent with the University’s standards of academic honesty. Any student found cheating on an assignment or exam may result in the failure of the assignment, failure of the course, and/or additional disciplinary actions including dismissal. The DePaul Student Handbook details the academic integrity policy. SOA Code of Conduct: In order to address specific issues that ACC and MIS faculty want to emphasize, the School of Accountancy (ACC) and Management Information Systems (MIS) faculty has prepared the ACC and MIS Student Code of Conduct. Students enrolled in any ACC or MIS course are expected to abide by the School of ACC & MIS Student Code of Conduct. The link to the SOA code of Conduct is: SOA Code of Conduct Drop Policy: See the published DePaul Academic calendar. The last day to drop with no penalty is September 22, 2015. Page 3 of 4 Acc 101; Fall 2015; Lord Syllabus Class Calendar Date Sept 9 Readings Chapter 1 Sept 14 Sept 16 Chapter 2 Sept 21 Measurement Concepts: Recording Business Transactions 1-6 1-7 Chapter 3 Measuring Business Income: Adjusting the Accounts Oct 5 Chapter 5 Foundations of Financial Reporting and the Classified Balance Sheet Accounting for Merchandising Operations 1-3 Quiz 2 1-5 HW Ch. 3-4 due 9am Midterm Review Oct 12 Oct 19 Accounting for Merchandising 1-5 Operations (Continued) Midterm Exam (Chapters 1-4): Friday, October 16, 2015 at 2:00 – 3:45 p.m. Chapter 5 Chapter 6 Inventories 1-4, 6 Chapter 7 Chapter 8 Appendix B Cash and Internal Control Receivables 3 1-3 Chapter 9 Long Term Assets 1-4, 6 Chapter 10 Current Liabilities and Fair Value Accounting 1-3 Oct 21 Oct 26 Oct 28 Nov 2 Accounting for Investments Nov 11 HW Ch. 5-6 due 9am Quiz 3 HW Ch. 6 - 8 due 9am Nov 4 Nov 9 Quiz 1 HW Ch. 3 due 9am Chapter 4 Oct 14 HW Ch. 1 due 9am 1-5, Supplement Sept 30 Oct 7 Homework Assignments/ Quizzes HW Ch. 2 due 9am Sept 23 Sept 28 Topic Course Introduction; Uses of Accounting Information and the Financial Statements Learning Objectives HW Ch. B,9 due 9am Quiz 4 HW Ch. 9-10 due 9am Final Review Nov 16 Final Exam (Chapters 5-10 and App. B): Friday, November 20, 2015 at 11:45 – 2:00 p.m. Page 4 of 4