Auditing Revenue Recognition

advertisement

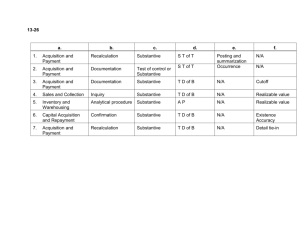

Auditing Revenue Recognition Presented by: Larry L. Perry, CPA CPA Firm Support Services, LLC Learning Objectives Explain the basic principles of revenue recognition. Describe the basic procedures for auditing revenues. Explain the impact of audit strategies on revenues auditing procedures. Outline the mix of evidence and the design of tests of balances auditing procedures for revenues. www.cpafirmsupport.com Slide 3 Understanding Revenue Recognition Starting with FASB’s Accounting Standards The recognition of revenue and gains involves considering two factors—605-10-25-1: 1. 2. Being realized or realizable—when products, merchandise, or other assets are exchanged for cash or claims to cash. Being earned—when the entity has substantially accomplished what it must do to be entitled to the benefits represented by the revenues. www.cpafirmsupport.com Slide 5 Installment and Cost Recovery Methods of Revenue Recognition 605-10-25-3: …unless the circumstances are such that the collection of the sale price is not reasonably assured, the installment method of recognizing revenue is not acceptable. 605-10-25-4: …where receivables are collectible over an extended period of time and, because of the terms of the transactions or other conditions, there is no reasonable basis for estimating the degree of collectability. When such circumstances exist, and as long as they exist, either the installment method or cost recovery method of accounting may be used. www.cpafirmsupport.com Slide 6 SFAC No. 5—Additional Revenue Recognition Guidelines If a sale precedes production and delivery, revenue is recognized with production and delivery. If sale is by contract before production, percentage of completion method may be used. Revenue may be earned as time passes if services or right to use assets extend continuously. If there is a ready market, revenues and some gains and losses may be recognized when production is completed or the price of assets change. If product, services or other assets are exchanged for nonmonetary assets, revenues, or gains or losses may be recognized assuming fair value can be determined. If collectability of assets received is doubtful, revenues may be recognized on the basis of cash already received. www.cpafirmsupport.com Slide 7 Sale of Product When Right of Return Exists 605-15-25-1: When right of return exists revenue can be recognized at the time of sale if all conditions are met: • Seller’s price is fixed or determinable • The buyer has paid the seller or is obligated to do so • The buyer’s obligation would not change if product damaged or stolen • A reseller has economic substance • The seller doesn’t have to perform to bring about resale • Returns can be reasonably estimated www.cpafirmsupport.com Slide 10 Polling Question No. 1 www.cpafirmsupport.com Slide 8 Multiple-Element Arrangements All elements in such an arrangement must be evaluated to determine if separate accounting is required. 605-25-25-5: All these criteria must be met for separate accounting: Delivered items have value on a standalone basis There is evidence of fair value If a general right of return exists, delivery or performance is considered in the control of vendor www.cpafirmsupport.com Slide 12 Extended Warranty and Product Maintenance Contracts 604-20-25-3: Sellers of extended warranty or product maintenance contracts have an obligation to the buyer to perform services throughout the period of the contract and, therefore, revenue shall be recognized in income over the period in which the seller is obligated to perform. www.cpafirmsupport.com Slide 13 Principal vs. Agent Revenues can be recorded gross or net based on circumstances Indicators of gross reporting The entity is the primary obligor, has general and physical loss inventory risk, has pricing latitude, can change the product or perform part of the service, can choose supplier, sets product or service specifications, has credit risk Indicators of net commission reporting The supplier is the primary obligor, the amount earned is fixed, the supplier has credit risk www.cpafirmsupport.com Slide 14 ASU 2014-09 Revenue Recognition (Topic 606) Revenue from Contracts with Customers Main provisions: Step 1: Identify the contract with a customer. Step 2: Identify the separate performance obligations in the contract. Step 3: Determine the transaction price. Step 4: Allocate the transaction price to the separate performance obligations in the contract. Step 5: Recognize revenue when (or as) the entity satisfies a performance obligation. Polling Question No. 2 www.cpafirmsupport.com Slide 19 Auditing Revenue Recognition Occurs within the framework of the risk assessment standards—see evidence sources in text Begins with questions about relevant assertions Completeness Occurrence and cutoff Valuation Existence www.cpafirmsupport.com Slide 20 Audit Evidence and Auditing Procedures for Revenues Nature, extent and timing of detailed tests of balances is in response to the assessed risks at the financial statement (assertion) level. Tests of controls should be performed when Controls are being relied upon to reduce control risk Substantive procedures alone are not sufficient to verify relevant assertions Systems walk-through procedures are risk assessment procedures that provide substantive evidence www.cpafirmsupport.com Slide 21 More Evidence Performing highly-effective analytical procedures reduce tests of balances procedures. Reading the General Ledger provides HUGE amounts of substantive evidence and can reduce tests of balances procedures. Evaluating the completeness assertion may require more than substantive tests. www.cpafirmsupport.com Slide 22 AU-C 240 and Planning AU-C 240 • • • Improper revenue recognition is always a potential fraud risk. If not identified as a fraud risk, the auditor is required to document why not. Requires planning and performing audits with appropriate professional skepticism. www.cpafirmsupport.com Slide 23 Conditions Increasing the Risk of Misstatement Key conditions that may increase the risk of misstatement. • • • • • • • Significant sales recorded at or near year-end Individually significant sales Unusual or complex revenue transactions Unusual volume of sales to distributors or resellers Sales billed prior to delivery Use of letters of authorization or intent instead of contracts Transactions with related parties www.cpafirmsupport.com Slide 24 Auditor’s Responses to Potential Revenue Fraud Risks Comparing revenue with prior period at lowest level of detail Confirming contracts Inquiring about sales near year-end Appropriate sales cutoff procedures Testing controls for IT systems Detailed review of unusual client adjusting entries www.cpafirmsupport.com Scanning the general ledger, accounts receivable subledger and sales journal during year and for subsequent events period Analyzing deferred revenue Reviewing credit memos and other accounts receivable adjustments Reviewing large contracts at year-end for later changes Confirming sales agreements terms that might affect the period of recognition Slide 27 Polling Question No. 3 www.cpafirmsupport.com Slide 26 Sales and Collection Cycle Flowchart May be most efficient annual IC documentation Facilitates systems walk-through procedures Can be easily replicated and carried forward In addition to all records, documents, data, procedures and personnel, flowchart should include: Shipping terms, locations, carriers, drop ships, pick ups Different types of customers www.cpafirmsupport.com Slide 28 Focusing on Key Controls Key controls exist At both the entity and activity level for larger entities Primarily at the entity level for smaller entities Properly designed and operating key controls Can detect and prevent most misstatements Can be informal Can be performed by one or a few persons Are a primary defense against error or fraud occurring and going undetected www.cpafirmsupport.com Slide 29 Tests of Controls vs. Systems Walk-through Procedure TOC are required by GAO, PCAOB; are not required for non- public entities and NPOs For larger entities, TOCs would normally be required to reduce control risk to moderate or low For smaller entities, some tests of key controls and other risk assessment procedures may enable an auditor to assess control risk at less than high to moderate SWT with larger number of transactions and other risk assessment procedures may also enable auditor to assess control risk less than high to moderate www.cpafirmsupport.com Slide 30 Carrying Out the Audit Strategy Check the illustrative risk assessment documentation Internal Control Deficiency Worksheet Risk of Material Misstatement Form Linking Working Paper Modify the Tests of Balances Audit Program Consider the impact of evidence from risk assessment and analytical procedures on financial statement assertions Modify program before beginning fieldwork See illustrative programs in text www.cpafirmsupport.com Slide 32 Polling Question No. 4 www.cpafirmsupport.com Slide 33 The End What to do if you want more • E-mail Larry Perry: larry@cpafirmsupport.com with questions. • Visit www.cpafirmsupport.com for more webcast resources. • Read Larry Perry’s weekly blog, Today’s World of Audits, at www.accountingweb.com under the Bloggers Crew tab for small audit and other subjects. www.cpafirmsupport.com Slide 35