13-26 - Where can my students do assignments that require creating

advertisement

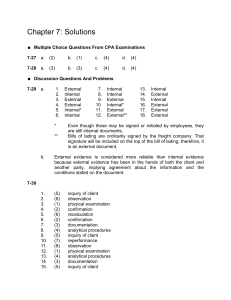

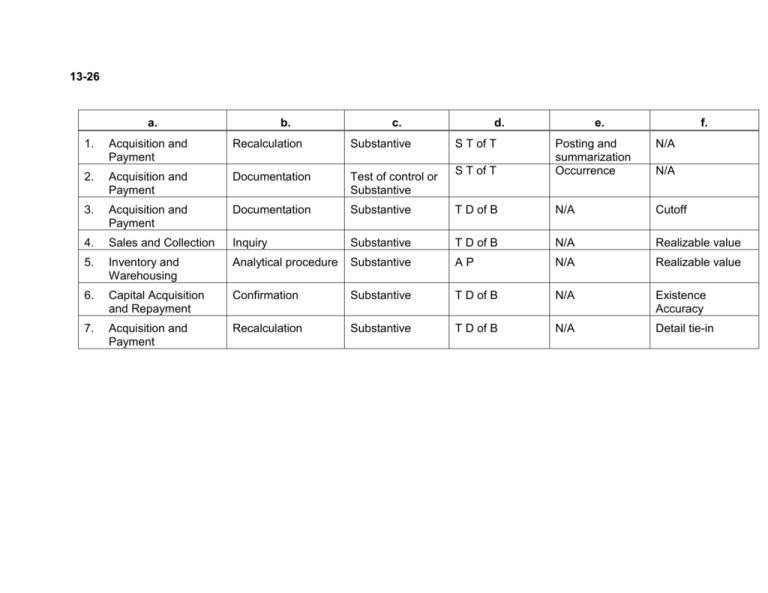

13-26 a. b. c. d. 1. Acquisition and Payment Recalculation Substantive S T of T 2. Acquisition and Payment Documentation Test of control or Substantive 3. Acquisition and Payment Documentation 4. Sales and Collection 5. e. f. N/A S T of T Posting and summarization Occurrence Substantive T D of B N/A Cutoff Inquiry Substantive T D of B N/A Realizable value Inventory and Warehousing Analytical procedure Substantive AP N/A Realizable value 6. Capital Acquisition and Repayment Confirmation Substantive T D of B N/A Existence Accuracy 7. Acquisition and Payment Recalculation Substantive T D of B N/A Detail tie-in N/A 13-32 a. The sequence the auditor should follow is: 3. 1. 4. 2. Assess control risk. Determine whether it is cost effective to perform tests of controls. Perform tests of controls. Perform substantive tests of details of balances. The only logical sequences for parts b through e are shown as follows: E F A B G H C D D D Any other sequence is not cost effective or incorrect. For example: E, A, G, C would be the sequence when there is planned reduced assessed control risk and effective results of tests of controls. b. c. d. e. The sequence is E, A, H, D. The logic was reasonable. The auditor believed the internal controls would be effective and it would be cost effective to perform tests of controls. In performing the tests of controls the auditor concluded the controls were not effective. Therefore, expanded substantive tests of details of balances were needed. The sequence is E, B, G, C. The auditor concluded the internal controls may be effective, but it was not cost effective to reduce assessed control risk. The auditor should not have performed tests of controls. It would have been more cost effective to skip performing tests and instead follow the sequence E, B, D. The sequence is F, A, G, C. The logic is not reasonable. When the auditor concluded the controls were not effective he or she should have gone immediately to D and performed expanded substantive tests of details of balances. The sequence is F, D. The logic was reasonable. The auditor concluded that internal controls were not effective, therefore the auditor went directly to substantive tests of details of balances and performed expanded tests. 13-33 PROCEDURES TO OBTAIN AN UNDERSTANDING OF INTERNAL CONTROL AUDIT TESTS OF CONTROLS SUBSTANTIVE TESTS OF TRANSACTIONS ANALYTICAL PROCEDURES TESTS OF DETAILS OF BALANCES 1 E E S E S 2 M N S M E 3 E E M E S, E* E M S N = = = = Extensive amount of testing. Medium amount of testing. Small amount of testing. No testing. S,E* = Small amount of testing for the gross balance in accounts receivable; extensive testing done for the collectibility of the accounts. a. b. c. For audit 1 the recommended strategy is to maximize the testing of internal controls and minimize the testing of the details of all ending balances in inventory. The most important objective would be to minimize the number of locations that need to be visited. The justification for doing this is the quality of the internal controls and the results of prior years' audits. Assuming that some of the locations have a larger portion of the ending inventory balance than other locations, the auditor can likely completely eliminate tests of physical counts of some locations and emphasize the locations with larger dollar balances. The entire strategy is oriented to minimizing the need to visit locations. Audit risk for this audit should be low because of the plans to sell the business, severe under-financing and a first year audit. The lack of controls over accounts payable and the large number of adjusting entries in accounts payable indicate the auditor cannot consider the internal controls effective. Therefore the plan should be to do extensive tests of details of balances, probably through accounts payable confirmation and other end of year procedures. No tests of controls are recommended because of the impracticality of reduced assessed control risk. Some substantive tests of transactions and analytical procedures are recommended to verify the correctness of acquisitions and to obtain information about the reasonableness of the balances. The most serious concern in this audit is the evaluation of the allowance for uncollectible accounts. Given the adverse economic conditions and significant increase of loans receivable, the auditor must be greatly concerned about the adequacy of the allowance for uncollectible accounts and the possibility of uncollectible accounts being included in loans receivable. Given the internal controls, the auditor is not likely to be greatly concerned about the gross accounts receivable balance, except for accounts that need to be written off. Therefore, for the audit of gross accounts receivable there will be a greatly reduced assessed control risk and relatively minor confirmation of accounts receivable. In evaluating the allowance for uncollectible accounts, the auditor should test the controls over granting loans and following up on collections. However, given the changes in the economy, it will be necessary to do significant additional testing of the allowance for uncollectible accounts. Therefore an "S" is included for tests of details of balances for gross accounts receivable and an "E" for the tests of net realizable value. 11-33 – ACL Problem a. b. c. The invoice amount column totals $278,641.33. There are no exceptions in the calculation of unit cost x quantity. (Create a filter with the expression Unit_Cost * Quantity <> Invoice_Amount.) There are three items where the unit cost exceeds $100 (product # 090584072, 090585322, and 090081001). See the following printout. (Filter used Unit Cost >100.) Page ... 1 04/10/2007 14:10:33 Produced with ACL by: ACL Educational Edition - Not For Commercial Use INV._DATE INV._NO PRODNO QUANTITY VENDOR_NO INVOICE_AMT UNIT_COST 10/21/2002 87 090584072 41 11475 7125.80 10/21/2002 22 090585322 29 11837 3996.20 04/09/2002 090081001 3 10134 467.40 73 11589.40 d. e. f. 173.80 137.80 155.80 467.40 The three vendors with the largest total dollars for 2002 were: vendor #s 10025, 11475, and 12130. (Summarize by vendor number, then Quick Sort to find the largest three.) The following amounts are over $15,000: vendor #10025 for $56,767.20, vendor #11475 for $20,386.19, and vendor #12130 for $15,444.80. [Filter used is (VENDOR_NO = “10025” OR VENDOR_NO = “11475” OR VENDOR_NO = “12130”) AND INVOICE_AMOUNT > 15000.] See the following printout. (Filter, then print report). Total transactions for vendor #10134 = $22.618.62. (Edit filter to include only vendor #10134 and use Total command) Page ... 1 04/10/2007 15:45:19 Produced with ACL by: ACL Educational Edition - Not For Commercial Use INV._DATE INV._NO PRODNO QTY VENDOR_NO INVOICE_AMOUNT UNIT_COST 09/29/2002 030303343 100 11/12/2002 0302303 458 04/09/2002 090081001 3 09/30/2002 010551340 278 02/14/2002 052484405 115 10/15/200255 060102096286 1240 10134 883.00 10134 18883.34 10134 467.40 10134 1823.68 10134 561.20 13440 11068.20 8.83 41.23 155.80 6.56 4.88 38.70 33686.82 256.00 12-30 – ACL Problem a. There are three transactions with missing dates. There are several negative balance transactions with no indication that they are purchase returns. b. Total purchases are $300,682.04 (use the Total command on the Amount column). c. There are twelve gaps and many duplicates (Gaps and Duplicates commands). For gaps, the auditor is concerned that there may be unrecorded purchases. For duplicates, the auditor is concerned that purchases may be recorded more than once. In this case, no duplicate has the same amount as the transaction with the same document number. d. Using the Summarize command to summarize total purchases by product, the total is the same as in requirement b: $300,682.04. See printout on pages 12-26 and 12-27. e. Product #024133112 represents 6.15% of total purchases. See report on pages 12-28 and 12-29. See highlighted amount for product #024133112. f. Starting with the classified table from requirement e, students should filter out items less than $1000. Next, run the Stratify command using a minimum value of $1210 (smallest amount in table) and a maximum value of $20,439 (2nd largest amount in table). See report on page 12-29. Printout for requirement d: Page ... 1 04/05/2007 17:35:00 Produced with ACL by: ACL Educational Edition - Not For Commercial Use PRODNO AMOUNT COUNT 010102710 010102840 010134420 010155150 010155170 010207220 010226620 010310890 010311990 010551340 010631190 010803760 023946372 023973042 024104312 024121332 024128712 024128812 024128932 024130572 024133112 024139372 030030323 030303343 030305603 030321663 030321683 030324883 030364163 030412553 030412903 030934423 034255003 040224984 040225014 040226054 040240284 040240664 040240884 040241754 040247034 040270354 040276054 65.89 11859.40 7107.44 3183.60 5858.55 3223.22 5594.40 735.28 2157.52 974.96 1483.70 -2481.33 270.06 5323.64 435.60 39.20 3609.69 1271.00 177.99 31.80 18497.00 148.50 1210.00 35.32 310.69 291.27 946.68 874.20 644.80 1625.73 12.40 4407.30 6627.20 44.00 208.80 43.50 10293.40 3552.00 3967.50 6029.24 7650.80 1242.56 4124.50 2 3 11 2 2 2 2 2 1 1 5 6 2 6 2 1 26 2 2 1 9 1 3 1 3 4 3 1 1 6 2 2 8 2 2 1 4 1 1 4 3 5 2 12-30 (continued) Requirement d, cont. 052204515 052208805 052210545 052484425 052484435 052504005 052530155 052720305 052720615 052770015 060100306 060100356 060102066 060102106 060112296 060217066 070104177 070104347 070104397 070104657 080101018 080102618 080102628 080123438 080123938 080126008 080126308 080935428 080938748 090010011 090069591 090081001 090501051 090501551 090504761 090506331 090507811 090508191 090509561 090585322 090599912 090669611 093788411 1997.94 10618.25 0.00 726.24 864.00 200.94 122.88 164.00 15826.00 90.52 190.40 318.00 39.80 5014.80 10964.80 2359.80 -6155.52 144.27 4046.43 185.49 8.14 3595.20 413.00 700.29 2798.64 7919.26 381.12 20438.93 5.98 330.67 3647.52 6282.00 1688.80 2774.28 376.37 -27.20 7425.52 101.06 664.02 58702.80 2803.40 7317.00 907.20 1 3 1 1 5 3 32 1 2 2 2 2 1 2 2 3 4 1 1 2 1 4 2 1 1 31 10 5 1 2 4 2 3 11 4 1 7 2 4 3 7 4 8 300682.04 339 12-30 (continued) Printout for requirement e: Page ... 1 04/05/2007 18:08:49 Produced with ACL by: ACL Educational Edition - Not For Commercial Use PRODNO COUNT Percent Percent AMOUNT of Count of Field 010102710 010102840 010134420 010155150 010155170 010207220 010226620 010310890 010311990 010551340 010631190 010803760 023946372 023973042 024104312 024121332 024128712 024128812 024128932 024130572 024133112 024139372 030030323 030303343 030305603 030321663 030321683 030324883 030364163 030412553 030412903 030934423 034255003 040224984 040225014 040226054 040240284 040240664 040240884 040241754 040247034 040270354 040276054 052204515 052208805 052210545 052484425 052484435 052504005 052530155 052720305 052720615 052770015 060100306 060100356 060102066 060102106 060112296 2 3 11 2 2 2 2 2 1 1 5 6 2 6 2 1 26 2 2 1 9 1 3 1 3 4 3 1 1 6 2 2 8 2 2 1 4 1 1 4 3 5 2 1 3 1 1 5 3 32 1 2 2 2 2 1 2 2 0.59 0.88 3.24 0.59 0.59 0.59 0.59 0.59 0.29 0.29 1.47 1.77 0.59 1.77 0.59 0.29 7.67 0.59 0.59 0.29 2.65 0.29 0.88 0.29 0.88 1.18 0.88 0.29 0.29 1.77 0.59 0.59 2.36 0.59 0.59 0.29 1.18 0.29 0.29 1.18 0.88 1.47 0.59 0.29 0.88 0.29 0.29 1.47 0.88 9.44 0.29 0.59 0.59 0.59 0.59 0.29 0.59 0.59 0.02 3.94 2.36 1.06 1.95 1.07 1.86 0.24 0.72 0.32 0.49 -0.83 0.09 1.77 0.14 0.01 1.20 0.42 0.06 0.01 6.15 0.05 0.40 0.01 0.10 0.10 0.31 0.29 0.21 0.54 0.00 1.47 2.20 0.01 0.07 0.01 3.42 1.18 1.32 2.01 2.54 0.41 1.37 0.66 3.53 0.00 0.24 0.29 0.07 0.04 0.05 5.26 0.03 0.06 0.11 0.01 1.67 3.65 65.89 11859.40 7107.44 3183.60 5858.55 3223.22 5594.40 735.28 2157.52 974.96 1483.70 -2481.33 270.06 5323.64 435.60 39.20 3609.69 1271.00 177.99 31.80 18497.00 148.50 1210.00 35.32 310.69 291.27 946.68 874.20 644.80 1625.73 12.40 4407.30 6627.20 44.00 208.80 43.50 10293.40 3552.00 3967.50 6029.24 7650.80 1242.56 4124.50 1997.94 10618.25 0.00 726.24 864.00 200.94 122.88 164.00 15826.00 90.52 190.40 318.00 39.80 5014.80 10964.80 12-30 (continued) requirement e, cont. 060217066 070104177 070104347 070104397 070104657 080101018 080102618 080102628 080123438 080123938 080126008 080126308 080935428 080938748 090010011 090069591 090081001 090501051 090501551 090504761 090506331 090507811 090508191 090509561 090585322 090599912 090669611 093788411 3 4 1 1 2 1 4 2 1 1 31 10 5 1 2 4 2 3 11 4 1 7 2 4 3 7 4 8 339 0.88 1.18 0.29 0.29 0.59 0.29 1.18 0.59 0.29 0.29 9.14 2.95 1.47 0.29 0.59 1.18 0.59 0.88 3.24 1.18 0.29 2.06 0.59 1.18 0.88 2.06 1.18 2.36 99.79 0.78 -2.05 0.05 1.35 0.06 0.00 1.20 0.14 0.23 0.93 2.63 0.13 6.80 0.00 0.11 1.21 2.09 0.56 0.92 0.13 -0.01 2.47 0.03 0.22 19.52 0.93 2.43 0.30 99.90 2359.80 -6155.52 144.27 4046.43 185.49 8.14 3595.20 413.00 700.29 2798.64 7919.26 381.12 20438.93 5.98 330.67 3647.52 6282.00 1688.80 2774.28 376.37 -27.20 7425.52 101.06 664.02 58702.80 2803.40 7317.00 907.20 300682.04 Printout for requirement f: Page ... 1 04/05/2007 18:26:44 Produced with ACL by: ACL Educational Edition - Not For Commercial Use <<< STRATIFY over 1,210.00-> 20,439.00 >>> >>> Minimum encountered was 1,210.00 >>> Maximum encountered was 58,702.80 AMOUNT 1,210.00 -> 3,132.90 -> 5,055.80 -> 6,978.70 -> 8,901.60 -> 10,824.50 -> 12,747.40 -> 14,670.30 -> 16,593.20 -> 18,516.10 -> > 20,439.00 3,132.89 5,055.79 6,978.69 8,901.59 10,824.49 12,747.39 14,670.29 16,593.19 18,516.09 20,439.00 COUNT 12 11 6 5 2 2 0 1 1 1 1 <-- % 28.57% 26.19% 14.29% 11.90% 4.76% 4.76% 0.00% 2.38% 2.38% 2.38% 2.38% % --> 7.91% 14.31% 12.06% 12.64% 7.06% 7.71% 0.00% 5.34% 6.25% 6.90% 19.82% AMOUNT 23413.37 42371.76 35715.03 37420.02 20911.65 22824.20 0.00 15826.00 18497.00 20438.93 58702.80 42 100.00% 100.00% 296120.76