Occurs in 18% of Financial Statement Frauds

advertisement

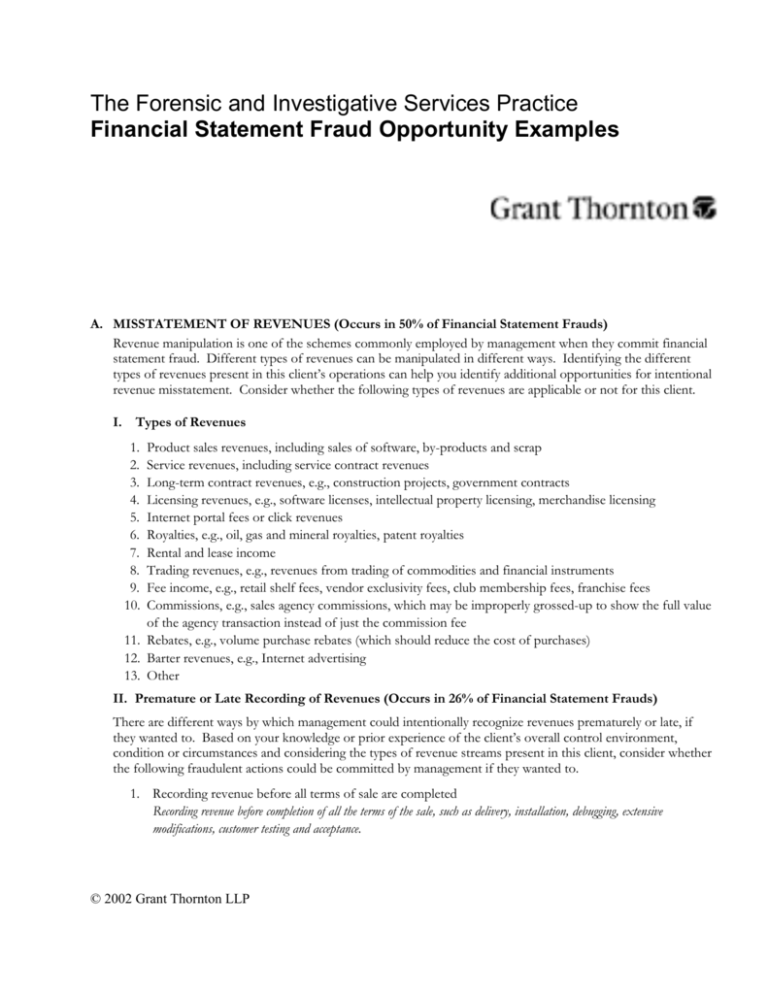

The Forensic and Investigative Services Practice Financial Statement Fraud Opportunity Examples A. MISSTATEMENT OF REVENUES (Occurs in 50% of Financial Statement Frauds) Revenue manipulation is one of the schemes commonly employed by management when they commit financial statement fraud. Different types of revenues can be manipulated in different ways. Identifying the different types of revenues present in this client’s operations can help you identify additional opportunities for intentional revenue misstatement. Consider whether the following types of revenues are applicable or not for this client. I. Types of Revenues 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Product sales revenues, including sales of software, by-products and scrap Service revenues, including service contract revenues Long-term contract revenues, e.g., construction projects, government contracts Licensing revenues, e.g., software licenses, intellectual property licensing, merchandise licensing Internet portal fees or click revenues Royalties, e.g., oil, gas and mineral royalties, patent royalties Rental and lease income Trading revenues, e.g., revenues from trading of commodities and financial instruments Fee income, e.g., retail shelf fees, vendor exclusivity fees, club membership fees, franchise fees Commissions, e.g., sales agency commissions, which may be improperly grossed-up to show the full value of the agency transaction instead of just the commission fee 11. Rebates, e.g., volume purchase rebates (which should reduce the cost of purchases) 12. Barter revenues, e.g., Internet advertising 13. Other II. Premature or Late Recording of Revenues (Occurs in 26% of Financial Statement Frauds) There are different ways by which management could intentionally recognize revenues prematurely or late, if they wanted to. Based on your knowledge or prior experience of the client’s overall control environment, condition or circumstances and considering the types of revenue streams present in this client, consider whether the following fraudulent actions could be committed by management if they wanted to. 1. Recording revenue before all terms of sale are completed Recording revenue before completion of all the terms of the sale, such as delivery, installation, debugging, extensive modifications, customer testing and acceptance. © 2002 Grant Thornton LLP 2. Improper bill and hold transactions Sales are billed to customers prior to the delivery of the goods, which are held by the seller, without complying with all the requirements for recording bill and hold transactions as sales. 3. Conditional sales/right of return granted Transactions are recorded as sales even though they involved unresolved contingencies or the terms of sale were amended by side agreements that gave the customer the right to return the goods. 4. Consignment sales Sales in which evidence indicates the customer’s obligation to pay for the product is contingent on resale to another (third) party. 5. Improper matching of revenues Revenues are recognized without matching them with their associated costs or with the time period to which they apply. 6. Improper sales cutoff Sales just before or after the period-end are not recorded in the correct period. 7. Improper use of the percentage of completion method The percentage of completion method of accounting for long-term contracts is intentionally manipulated so as to misstate revenues and profits. 8. Shipments not requested by customer Sales are improperly recorded for items that have not been ordered by the customer. III. Fictitious Revenues (Occurs in 24% of Financial Statement Frauds) There are different ways by which management could intentionally record fictitious revenues, if they wanted to. Based on your knowledge or prior experience of the client’s overall control environment or condition, consider whether management could commit the following fraudulent actions if they wanted to. 1. Sham Sales Sales to fictitious customers or inflated or unauthorized sales to real customers. 2. Less than Arm’s Length Transactions Sales to affiliates and undisclosed related parties 3. Misclassification of Gains Manipulation of gains between ordinary and extraordinary items. 4. Unrecorded Discounts and Allowances 5. Unrecorded Sales Returns © 2002 Grant Thornton LLP 2 B. MISSTATEMENT OF EXPENSES/LIABILITIES (Occurs in 18% of Financial Statement Frauds) There are different ways by which management could intentionally understate or overstate liabilities and their related expenses, if they wanted to. Based on your knowledge or prior experience of the client’s overall control environment, condition or circumstances, consider whether management could commit the following fraudulent actions if they wanted to. 1. Understating or overstating recorded liabilities and their related expenses Liabilities and their related expenses are recorded but the amounts are intentionally overstated or understated. 2. Failing to record some liabilities and their related expenses, including some contingent liabilities Liabilities (including contingent liabilities that are required by accounting standards to be recorded) and their related expenses are intentionally not recorded. 3. Recording revenues instead of a liability for payments received for certain transactions Revenues are recorded instead of a liability for deferred/unearned revenue when payment has been received for goods or services that have not been provided by the seller; OR revenues are recorded instead of a liability for payments received for customer deposits, client funds, advances, loans, or other non-revenue cash flows. © 2002 Grant Thornton LLP 3 C. MISSTATEMENT OF ASSETS (Occurs in 50% of Financial Statement Frauds) In financial statement frauds, assets are usually overstated rather than understated. However, assets may be understated as part of a scheme to understate reported earnings (e.g., when earnings targets have already been met, to reduce taxable income and/or to boost earnings in future periods). You can overstate assets in three ways. However, management often use multiple schemes to overstate assets: - Overstating existing assets (occurs in 37% of financial statement frauds) Recording fictitious assets or assets not owned (12%) Capitalizing items that should be expensed (6%) Assets may be overstated by manipulating the processing of transactions within the accounting system, or by creating unusual transactions such as large journal entries that increase income and overstate net assets. Any account may be changed by such journal entries - they do not have to make sense. Existing assets are most often misstated initially, because financial statement frauds often start out small. Frauds tend to grow quickly in size, making it difficult to conceal a large fraud only among existing assets. So large fictitious or assets not owned may be required to continue the cover-up. Particular assets may be selected for misstatement because it is easier to conceal a misstatement there due to the size of the asset, the complexity of the determination of the asset's value, the judgment involved in determining the asset's value, or the relative difficulty of auditing that asset. Ways to Intentionally Misstate Assets There are a few basic ways in which assets can be intentionally misstated: - Manipulating the quantity of the asset Manipulating the pricing of the asset Manipulating allowances (e.g., bad debts or excess and obsolete inventory allowances) Manipulating or avoiding write-downs for permanent diminution in value Improperly writing-up assets to claimed appraisal or market values Recording real assets that are not owned by the company Recording fictitious assets Improperly capitalizing expense items (or expensing capital additions) Other (describe in detail below) I. Common Schemes of Misstating Assets There are common schemes by which fraudulent misstatement of assets can be committed by management. Based on your personal knowledge of this client’s overall environment, condition or circumstances, consider whether the following fraudulent actions could be committed by management, if they wanted to. 1. Cash Misstatement Schemes a. Manipulation of bank reconciliations b. Failing to disclose that cash balances are pledged as collateral for loans c. Failing to disclose that cash balances are controlled by others d. Creation of fictitious cash balances 2. Investments/Marketable Securities a. Manipulating the pricing of the asset b. Manipulating or avoiding write-downs for permanent diminution in value c. Improperly writing-up assets to claimed appraisal or market values © 2002 Grant Thornton LLP 4 d. Recording real assets that are not owned by the company e. Recording fictitious assets 3. Accounts Receivable Misstatement Schemes a. Premature or late revenue recognition (see revenue recognition section) b. Manipulation of allowance for bad debts c. Creation of fictitious accounts receivable 4. Inventory Misstatement Schemes a. b. c. d. e. f. g. Manipulation of allowance for excess and obsolete inventory Manipulation of write-down to lower of cost or market value Manipulation of physical inventory counts Manipulation of inventory pricing Manipulation of inventory compilation Creation of fictitious inventory Manipulation of costs capitalized into inventory 5. Fixed Asset Misstatement Schemes a. Improperly capitalizing expenses as fixed assets b. Creation of fictitious fixed assets c. Improperly writing-up fixed assets to claimed appraisal or market values 6. Loans or Notes Receivable Misstatement Schemes a. Manipulation of allowance for loan losses b. Creation of fictitious loans or notes receivable 7. Patents (and Other Intellectual Property) Misstatement Schemes a. b. c. d. Improperly writing-up assets to claimed appraisal or market values Recording real assets that are not owned by the company Recording fictitious assets Improperly capitalizing expense items (or expensing capital items) 8. Oil, gas & mineral reserves a. Improperly writing-up assets to claimed appraisal or market values b. Recording real assets that are not owned by the company c. Recording fictitious assets 9. Other Asset Misstatement Schemes a. Recording fictitious assets © 2002 Grant Thornton LLP 5 D. INADEQUATE DISCLOSURES (Occurs in 8% of Financial Statement Frauds) There are various areas where management could intentionally withhold or provide inadequate financial information to commit financial statement fraud if they wanted to. Based on your knowledge or prior experience of the client’s overall control environment, condition or circumstances, consider whether management could intentionally withhold or provide inadequate information on the following: 1. Liabilities Failing to disclose commitments, contingent liabilities, loan covenants, loan defaults, and other key facts that may give rise to liabilities and impact the company’s financial condition. 2. Significant events Failing to disclose significant events impacting the company, thus making the financial statements misleading. 3. Related party transactions Failing to disclose transactions between one party and a second party that is under the control or significant influence of the first party or of a common third party. Although not necessarily fraudulent, transactions with undisclosed related parties are likely to be fraudulent. 4. Legal and regulatory compliance violations Failing to disclose violations of laws and regulations that may have a significant adverse impact on the company’s financial position or on its ability to continue to operate. 5. Significant changes in accounting policy and estimates Failing to disclose significant changes in accounting policy and estimates, which renders the financial statements misleading. 6. False statements Making false or misleading statements, orally or in writing, that may mislead people as to the company’s financial condition or prospects. E. MISAPPROPRIATION OF ASSETS (Occurs in 12% of Financial Statement Frauds) Based on your knowledge or prior experience of the client’s overall control environment, condition or circumstances, consider whether management or employees could commit material embezzlement in the Company if they wanted to: 1. Material Embezzlement A substantial amount of money or other assets is stolen and the theft is concealed such that the financial statements are misstated in a way that is material to the company as a whole. Note that it is extremely rare for embezzlement to be material to a large public company. © 2002 Grant Thornton LLP 6