1 Multiple Deposit Creation and the Money Supply Process

advertisement

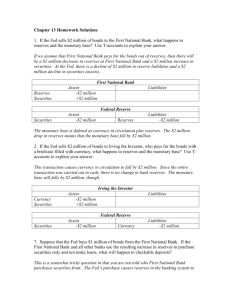

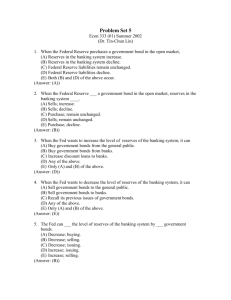

ECON248: Money and Banking Ch 8 Money Supply (MS) Process • Money supply (MS) process refers to the mechanism that determines the money supply. • It refers to the implementation of monetary policy. • It is important to understand the MS Process to understand exactly how open market operations (OMOs) change the money supply, and thereby affect the economy (interest rates, inflation, output, employment, money, etc.) CHAPTER 8 (Ch. 13 in the Text) Multiple Deposit Creation and the Money Supply Process Dr. Mohammed Alwosabi 1 2 3 Four Players in the Money Supply Process: 1. Central Bank (CB): Most important player since it ultimately controls the supply of money in the economy. 2. Commercial banks: Depository institutions that accept deposits and make loans. 3. Depositors: Bank customers (individuals, companies and institutions holding bank deposits - checking and savings accounts. 4. Borrowers from banks: Individuals and companies who borrow money from 4 banks. • The majority of money (M1) is in the form of deposits. • Therefore, we want to understand how the banking system creates deposits, and in the process, creates money. • The central bank is a key player in the money supply l process but b not the h only l player. The Central Bank's Balance Sheet (BS) and the Monetary Base (MB): • In this simplified version of the Central bank’s BS, we will focus on only 4 items to see how they affect the economy’s money supply. C Central l Bank’s B k’ Si Simplified lifi d BS Assets Government securities Discount loans Dr. Mohammed Alwosabi Liability Currency in circulation Reserves 5 Assets 1. Government securities: • The CB holds government securities (Treasury bills, bonds, notes) for two reasons: (i) buying and selling of government securities is one of the CB’s major tool (known as OMO) in controlling the economy’s money supply, and (ii) holding government securities provides a return. 6 1 ECON248: Money and Banking Ch 8 2. Discount loans: • The CB makes loans to banks through its discount window operation. • The CB does not encourage banks to borrow through its discount window on a regular basis since the CB is acting as a l d off last lender l resort for f the h banks. b k Dr. Mohammed Alwosabi Liabilities 1. Currency in circulation (C): • Cash in the hands of the public, outside the banking system. • They are basically IOUs from the government issued by the CB, like a government bonds, but pays zero interest. • Currency is a liability of the CB, because a BD20 bill could be redeemed for 2 tens, or 4 fives, etc; or if it is worn out, banks can redeem it for a new BD20 bill 7 8 2. Reserves (R): • All banks have to keep a certain percentage of the deposits as the reserve requirements established by the CB. • The banks do so in two ways: (a) Banks are required to open an account with the CB and they can maintain their reserves by making a deposit into that account. (b) They can keep cash in the banks’ vaults. • Reserves are a liability of the CB, an asset for commercial banks. • We can further break that reserve into two components: (i) Required reserve (RR): • This is the amount of money a bank needs to keep by law. • This is determined by the reserve requirement ratio (expressed as a percentage of a bank’s total deposit) set by the CB. (ii) Excess reserve (ER): • This is the additional amount of money a bank chooses to hold for liquidity reason.10 9 Monetary base or high-powered money: • The two liabilities of the CB are called the Monetary Base (MB). • MB = currency in hands of public + reserves of banking system MB = C + R • MB is also called High-powered Money, or M0. • It is called high-powered because an increase in the MB leads to a multiple increase in the MS (M1 or M2). 11 • CB directly controls the monetary base by increasing or decreasing government securities and thereby increasing or decreasing bank reserves and/or currency. • If CB purchases a Treasury bill for BD100, it increases assets by BD100 and liabilities by BD100. • By increasing bank reserves by $100, the MS is increased. • Monetary policy works by affecting the CB's balance sheet. 12 2 ECON248: Money and Banking Ch 8 Control of the Monetary Base (MB) • OMOs always affect MB, one to one. (OMO = UMB) and (UMB = UR + UC) • However, whether the OMO increases or decreases R or C depends on the public's g to hold cash,, which depends p willingness on MD. • This mean that although OMOs always affect MB it is not always affecting reserves. 13 15 17 (2) CB Open Market Purchase from the nonbank public, and the person makes a bank deposit. • A person gives the $100 government bond to the CB in exchange for a $100 check issued by the CB, and the person deposits the check from CB into a bank, • The net effect on the economy is exactly the same • When a CB check is deposited in a bank, the net result of the OMP from nonbank public is identical to the effect of its OMP from a bank with OMP = $100, Res.Ç and MB Ç. 18 Liabilities Central Bank Assets Securities +$100 • Also, when the CB increases the monetary base (MB) by supplying the banking system with BD1 of additional reserves, deposits (D) and M1 increase by a multiple greater than 1, a process called multiple deposit creation. • When the CB wants to increase the MS, it engages in i an open market k purchase h off government securities from the public and adds them to its portfolio. • For contractionary (restrictive) policy, it engages in an open market sale of government securities from its portfolio to the public. 14 (1) CB Open Market Purchase from a Bank. • CB implements expansionary monetary policy and purchases $100 government bond from Bank A. • Bank A gives CB a $100 Bond and CB writes a check to Bank A for $100. • When the check clears at the CB the Bank's reserves at CB increased by $100. • Bank A has exchanged $100 government security for $100 Reserves. • CB has a new $100 bond, an increase in Assets, and bank reserves (liab. for CB) also increase by $100. • Thus, with OMP = $100, Res.Ç and MB Ç16 Illustration of Open Market Operations, 3 Scenarios: • Government securities represent an asset and the reserve represents a liability for the CB balance sheet. • On the other hand, Government securities p assets for a and reserve both represent depository institution. • There is a direct relationship between money supply in the economy and the reserves in the banking system, i.e. when the reserves go up, the money supply also goes up. Bank A Assets Securities -$100 Reserves +$100 Dr. Mohammed Alwosabi Liabilities Reserves +$100 3 ECON248: Money and Banking Ch 8 Nonbank Public Assets Liabilities Securities -$100 Checkable Deposits +$100 Bank A Res. Assets +100 Liabilities Checkable Deposits +$100 Dr. Mohammed Alwosabi (3) CB Open Market Purchase from the nonbank public, and they cash the check for $100 in currency. • In that case, the investor has exchanged a $100 security for $100 in cash. • The CB has increased its assets by $100 ((new securities)) and increased its liabilities by $100 (increased currency in circulation). Central Bank Assets Securities +$100 • • Res. Liabilities +$100 19 The bank has given out $100 in vault cash to the person who cashed the CB check (R = -$100), but get an increase in reserves (R=+$100) from the CB check, for their account at the CB. Bank reserves remain unaffected, net effect is 0 for bank reserves (R). In this case: with i h OMP = $100, $100 Res. R unchanged, h d Currency Ç and MB Ç 20 Nonbank Public Assets Liabilities Securities -$100 Currency +$100 Central Bank Assts Securities +$100 21 Conclusion: • The Open Market Sale is just the opposite of what have been discussed above • The effect on the MB is always the same, equal to OMO • (OMO = UMB). • The effect of OMO on MB is certain, the effect of OMO on Reserves (R) and currency (C) is not. 23 Liabilities Currency +$100 22 Shifts from Deposits into Currency • The shift from deposits into currency affects reserves in the banking system but has no affect on MB. • If a $100 withdrawn from a deposit , then 24 4 ECON248: Money and Banking Ch 8 Nonbank Public Assets Checkable Deposits -$100 Currency +$100 Liabilities Bank A Assets Res. Liabilities Checkable Deposits -$100 -100 Central Bank Liabilities Currency +$100 Res. -$100 25 Assets Making and recalling discount loans • Discount loans are loans made by the CB to commercial banks through its discount window operation. • Discount loans represent assets for the CB but represent liabilities for a d depository i institution. i i i • Suppose the CB made a $100 loan to Bank A through its discount window. 26 • When the CB makes the $100 discount loan (DL) to Bank A, that represents an increase of $100 in its asset (since a discount loan represents an asset to the CB). And the CB simply “deposit” the money in Bank A’s account with the CB. • In the above example, we see that when the h CB makes k a di discount loan l to a bank, b k Res.Ç and MB Ç • Similarly, we can easily verify that when the CB recalls a discount loan from a bank, the reserve will go down by the amount of the loan. Bank A Assets Liabilities Reserves +$100 Discount Loans +$100 C Central Bank Assets Discount Loans Dr. Mohammed Alwosabi Liabilities +$100 Reserves +$100 27 MULTIPLE DEPOSIT CREATION: A SIMPLE MODEL • In the above scenarios, we have seen that the CB can change the reserve of a bank simply by buying/selling government securities and making/recalling loans. • With Wi h these h scenarios i in i mind, i d we will ill proceed to examine the impact of such changes in a bank’s reserve on the economy’s money supply. 29 28 • To understand the impact of the changes in a bank’s reserve (due to the CB’s actions) on the economy’s money supply, we will illustrate with the following example. • Before we proceed, it is important to note that this example is based on a very simple model with the following three assumptions: 30 5 ECON248: Money and Banking Ch 8 1. Banks hold no excess reserve because excess reserve earns no return (and they are not required by law). 2. Individuals prefer to hold checking deposits than hold cash (i.e. individuals conduct all transactions with checks and not cash). cash) 3. RRR = 10% Dr. Mohammed Alwosabi • Assume that CB conducts OMP of a $100 bond from bank A (or from an investor who deposits the $100 into Bank A). • Bank A Assets Liabilities Securities - $100 Res. +$100 Central Bank Assets Liabilities Securities +$100 Res. +$100 31 • Since the increase in Bank A’s reserve is a result of a sale of government securities to the CB and not an acceptance of deposit, it does not need to keep any of it as required reserve. Hence, the $100 increase in reserve represents a $100 increase in excess reserve reserve. Since reserve earns no return for the bank, it is assumed that the bank will “get rid” of the excess reserves by using them to make loans. 32 • To simplify our scenario, we will assume that Bank A makes a loan of $100 to a borrower. Bank A Assets Liabilities Loans +$100 Checkable Deposit +$100 33 34 Since Bank B is not earning return for holding excess reserve, it will keep only the required reserves and make loan of the remaining ER Because checkable deposits are part of money supply the bank’s act of lending has created money. The borrower of the loan deposits it in it bank, say bank B Bank B AAssets Li bili i Liabilities Reserves + 10 Checkable Deposit +$100 Loan +90 Bank B Assets Liabilities Reserves +$100 Checkable Deposit +$100 35 36 6 ECON248: Money and Banking Ch 8 The borrower deposited the $90 loan in Bank C Dr. Mohammed Alwosabi Bank C would keep only 10% of the $90 and loaned out the ER Bank C Bank c Assets Liabilities Reserves +$90 Checkable Deposit +$90 Assets Liabilities Reserves + 9 Checkable Deposit +$90 Loan +81 37 The $81 will be deposited in another bank. From the initial $100 increase of reserves in banking system the total increase in the checkable deposits so far is $271 ($100 + $90 + $81) 39 The multiple increase in deposits generated from an increase in the banking system’s reserves is called simple money (or deposit) multiplier (SDM). 1 1 = = 10 RRR 0 . 10 • The total change in deposit are equal to SDM times the initial change in reserves = UD = (SDM) (UR) =10x100 = $1000 • Total change in loans are equal to SDM times the initial change in loans SDM = 41 38 This process will continue from one bank to another bank until there is no more ER. We can observe that the amount of loan a bank can make decreases as the process continues. It will get to a point where banks are making ki very small ll amount loans. l 40 So far, we have seen how the banking system is able to create deposits based on an initial increase in reserves (by selling securities to the CB or taking a loan from the CB). The same situation can easily be applied to the case when the CB reduces the reserves by selling securities to the banks or recalling loans from the banks. 42 7 ECON248: Money and Banking Ch 8 Dr. Mohammed Alwosabi • Note that if a bank decides to use its excess reserves to make loans or to purchase securities, the effect on deposit expansion is the same. • Assume that Bank A bought a $100 Treasury bill instead of making a $100 loan. The process would be the same because the bank would write a check for $100, which would get deposited at another bank, Bank B, and increases Bank B's reserves by $100. • Thus, whether excess reserves are used for making loans or buying securities, the deposit expansion is the same. 43 Problems with the simple model • There are several problems with this simple model of determining the impacts of the CB’s actions on the economy’s money supply. This model assumes that (i) banks do not like to keep excess reserves and like to loan out any money that they are nott required i d to t keep, k and d (ii) individuals have preference for checkable deposits over currency. SDM really shows the potential maximum effect that an OMO can have on deposits (D) and the money supply (M). • However, this is not the case in the real world. • There are many reasons why a bank would like to keep excess reserves and why an individual would like to have currency rather than checkable deposit. • So it is important to observe that CB directly controls the MB, but can't directly control M1. M1 is influenced by public's behavior (cash demand) and bank's behavior (holding excess reserves). • Also, observe that reserve requirements are not used very often for monetary policy, they are typically set and left in place for years at a time. 45 44 46 47 8