The Cash Conversion Cycle

advertisement

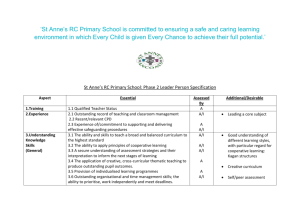

This column covers fundamental analysis, which involves examining a company’s financial statements and evaluating its. The analysis concentrates only on variables directly related to the company itself, rather than the stock’s price movement or the overall state of the market. The Cash Conversion Cycle Through the normal course of business, companies acquire inventory on credit, which they in turn use to create products. These products are then sold, oftentimes on credit. These actions generate accounts payable and accounts receivable, with no cash exchanged until the company collects accounts receivable and settles the accounts payable. The cash conversion cycle (CCC) measures the time—in days—that it takes for a company to convert resource inputs into cash flows. In other words, the cash conversion cycle reflects the length of time it takes a company to sell inventory, collect receivables, and pay its bills. As a rule, the lower the number, the better. This is because, as the cash conversion cycle shortens, cash becomes free for a company to invest in new equipment or infrastructure or other activities to boost investment return. Also, the cash conversion cycle can be useful in comparing close competitors and assessing management efficiency. Calculating the Cash Conversion Cycle ratios” related to the turnover in inventory (accounts receivable), all of which are expressed in days. The formula for the cash conversion cycle is as follows: CCC = days inventory outstanding (DIO) + days sales outstanding (DSO) – days payable outstanding (DPO) Days Inventory Outstanding This measure addresses the question of how long—in days—it takes for a company to sell its entire inventory. The smaller the number, the better. DIO = average inventory ÷ cost of goods sold per day Where: Average inventory = (beginning inventory + ending inventory) ÷ 2 Cost of goods sold per day = annual cost of goods sold ÷ 365 Days Sales Outstanding Here we calculate the number of days a company needs to collect on sales. Cash-only sales have a DSO of zero, but many companies allow customers to buy on credit. Again, the smaller the number, the better. DSO = average accounts receivable ÷ revenue per day The cash conversion cycle is actually a collection of three “activity Where: Average accounts receivable = (beginning accounts receivable + ending accounts receivable) ÷ 2 Revenue per day = annual revenue ÷ 365 Days Payable Outstanding Lastly, we measure how long it takes for a company to pay its bills (accounts payable). The longer a company is able to hold its cash, the better its investment potential. In this case, a longer DPO is better. DPO = average accounts payable ÷ cost of goods sold per day Where: Average accounts payable = (beginning accounts payable + ending accounts payable) ÷2 Cost of goods sold per day = annual cost of goods sold ÷ 365 Table 1 presents data for American Eagle Outfitters (AEO), a casual apparel chain, covering its last seven fiscal years. The top of the table provides the annual income statement and balance sheet data needed to calculate the three activity ratios and, ultimately, the cash conversion cycle. Time Series Analysis Analyzing financial ratios on a stand-alone basis doesn’t yield meaningful results. Instead, tracking trends in an individual company over several years, as well as comparing Table 1. Calculating Cash Conversion Cycle American Eagle Outfitters (AEO) Revenue Cost of Goods Sold Inventory Accounts Receivable Accounts Payable Average Inventory Average Accounts Receivable Average Accounts Payable Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cash Conversion Cycle 20 2010 2,990.5 1,832.5 326.5 34.7 158.5 310.7 38.1 155.3 61.9 4.7 30.9 35.6 2009 2,988.9 1,814.8 294.9 41.5 152.1 290.7 36.7 155.0 58.5 4.5 31.2 31.8 2008 3,055.4 1,632.3 286.5 31.9 157.9 275.1 29.0 164.6 61.5 3.5 36.8 28.2 2007 2,794.4 1,454.0 263.6 26.0 171.2 237.2 27.6 155.2 59.5 3.6 39.0 24.2 2006 2,322.0 1,244.2 210.7 29.1 139.2 190.7 27.8 124.1 55.9 4.4 36.4 23.9 2005 1,881.2 1,003.4 170.6 26.4 108.9 145.6 25.3 90.1 53.0 4.9 32.8 25.1 2004 1,435.4 885.9 120.6 24.1 71.3 Computerized Investing Table 2. Comparing Cash Conversion Cycles Among Competitors American Eagle Outfitters (AEO) Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cash Conversion Cycle Abercrombie & Fitch (ANF) Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cash Conversion Cycle Urban Outfitters (URBN) Days Inventory Outstanding Days Sales Outstanding Days Payable Outstanding Cash Conversion Cycle 2010 61.9 4.7 30.9 35.6 2009 58.5 4.5 31.2 31.8 2008 61.5 3.5 36.8 28.2 2007 59.5 3.6 39.0 24.2 2006 55.9 4.4 36.4 23.9 2005 53.0 4.9 32.8 25.1 2010 124.7 9.0 35.5 98.2 2009 114.8 5.6 31.8 88.6 2008 114.6 4.8 31.5 87.8 2007 130.0 4.7 30.8 103.8 2006 114.6 5.3 34.0 85.8 2005 116.9 4.1 38.1 82.9 2010 56.4 7.0 22.3 41.1 2009 55.6 6.2 22.3 39.6 2008 64.0 5.7 25.9 43.8 2007 69.6 5.2 23.4 51.4 2006 67.9 3.8 22.8 48.9 2005 60.5 3.3 24.8 39.0 these trends to key competitors, can prove enlightening. From the data in Table 1, we see that American Eagle’s cash conversion cycle has risen almost 42% since 2005, from 25.1 days to 35.6 days. This trend is not favorable for the company, as money is tied up for longer periods of time before the company is able to convert its own expenditures back into cash. Looking at the three activity ratios that make up the cash conversion cycle, we can further dissect the cash conversion trend. From Table 1, it appears that the biggest contributor to the rise of the cash conversion cycle for American Eagle is days inventory outstanding, which has risen from 53.0 days to almost 62 days since 2005. This means that the company is having a harder time turning over its inventory. The days sales outstanding ratio has been relatively stable over the entire period, but it has risen from 3.5 days in 2008 to 4.7 days in 2010. This may mean that the company is relaxing its collection policies or extending credit to customers who are having a hard time paying. Lastly, days payable outstanding has fallen only slightly since 2005, but Second Quarter 2011 has seen a sizable decline from 39.0 days in 2007 to 30.9 days in 2010. Unlike the other two activity ratios, a longer days payable outstanding is preferable. This may be an indication of creditors tightening their terms with American Eagle. Competitive Analysis When comparing the cash conversion cycle across companies, it is important to compare companies within the same industry. Otherwise, your analysis may not be helpful. Table 2 shows the activity ratio and cash conversion cycle data for American Eagle along with Abercrombie & Fitch (ANF) and Urban Outfitters (URBN). The three companies are in direct competition with each other, so we are making a meaningful comparison. American Eagle has the lowest cash conversion ratio value at 35.6 days, followed by Urban Outfitters (41.1 days) and Abercrombie & Fitch (98.2 days). Urban Outfitters has been able to lower its cash conversion cycle from 51.4 days in 2007 by significantly increasing its inventory turnover: its days inventory outstanding has fallen nearly 20% from 69.6 days in 2007 to 56.4 days in 2010. Abercrombie & Fitch takes more than twice as long to turn over its inventory as Urban Outfitters and American Eagle. The company’s days inventory outstanding stands at 124.7 days, although it has fallen from a high of 130.0 days in 2007. Abercrombie’s days sales outstanding jumped from 5.6 days in 2009 to 9.0 days in 2010. This means that customers are taking significantly longer to pay for their purchases. Both factors are contributing to Abercrombie’s cash being tied up nearly three times as long as that of American Eagle and more than twice as long as that of Urban Outfitters. This does not reflect well on Abercrombie in regard to management’s efficiency relative to some of its competitors. Conclusion The cash conversion cycle is a useful tool in evaluating a company’s management. By breaking down the cash conversion cycle into its three component activity ratios and studying the trends in individual companies, as well as comparing direct competitors, you can gain insights in the operating efficiency of a firm. 21