Presentation Slides

advertisement

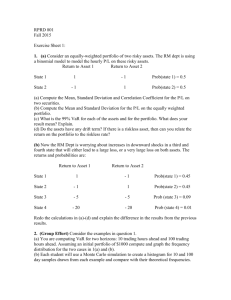

Welcome to the Financial Engineering Practitioners Seminar Series Speaker: Prof. Philip Maymin Sponsored by: Any Regulation of Risk Increases Risk Presentation by Philip Maymin Joint work with Zak Maymin Columbia IEOR Financial Engineering Practitioners Seminar September 15, 2014 Any Regulation of Risk Increases Risk (not legislation) Approaches: Mathematical Empirical Experimental Algorithmic (systemic risk) Regulation vs. Legislation What’s the Difference? 1. Legislation is what you’re supposed to do and regulation is how you are supposed to do it. 2. Elected officials make legislation, appointees make regulation. 3. Basically no difference. Regulation vs. Legislation • Legislation: – 2009 United States Code: 38,712 pages, 6 feet of shelf space. • Regulation: – 2007 Code of Federal Regulation: 145,816 pages, 25 feet of shelf space. – 2008 Federal Register: 80,700 pages (these are changes). Photos from http://extent-of-regulation.dhwritings.com/ Regulation vs. Legislation Histogram of Laws per Regulation Histogram of Regulations per Law Data source: Government Printing Office, Parallel Table Of Authorities And Rules Do Risk Regulations Work? BACKFIRE ? WORK ? NOT WORK ? Image Sources: http://www.thirdage.com/image/businessmantightrope http://www.damaideparte.ro/index.php/asumarea-riscurilor/359/ http://ent12cooper.blogspot.com/2010/09/embracing-risk.html The Problem The “Solution” Why Did You Pick Your Bank? 1. Offered safety and the absence of risk. 2. Location of branch. 3. Connection through work, or a personal relationship, or friend recommended. 4. Low fees or high rates, or many different services. How People Choose Banks The Fed and the IRS: Survey of Consumer Finances What Would Banks Do? Enter: Regulators What Would YOU Do, If You Were a Bank? Part I Say there are two otherwise identical assets. But asset 1 has a lower regulatory risk requirement. Which would YOU buy? 1. Buy asset 1 2. Buy asset 2 What Would YOU Do, If You Were a Bank? Part II Say asset 1 is essentially a leveraged version of asset 2, e.g. asset 1 = 1.1 * asset 2. But asset 1 and asset 2 have the same regulatory risk requirement. Which would YOU buy? 1. Buy asset 1 2. Buy asset 2 What’s a Basel? • The Basel Committee on Banking Supervision • A group of top global economists • Working together to define standards • That are recommended to the BIS (Bank for International Settlements) • Which then flow down to the member states and their own central banks A Rough History of Risk Regulation • Constant amounts depending on asset class • Value-at-Risk (VaR) measures • Combination of VaR and Stress VaR • Basel I • Basel II • Basel 2.5, Basel III Values-at-Risk • • • • Value-at-Risk Basel, BIS, Fed Volatility Standard Deviation 3 times the 10-day 99% VaR ≈ 3 10 ⋅ 2.33 ⋅ 𝜎 = 22𝜎 Assets are Riskier than they Appear For 1000 securities and 60 months of (normal) 10 securities to exhibit returns, we should expect ___ volatility less than 80% of their true value? Month 1 Month 2 … Month 60 Volatility Security 1 𝑅1,1 𝑅1,2 … 𝑅1,60 𝜎1 Security 2 𝑅2,1 𝑅2,2 … 𝑅2,60 𝜎2 … … … … … Security 1000 𝑅1000,1 𝑅1000,2 … 𝑅1000,60 𝜎1000 𝜎𝑖2 = 12 60 2 𝑅𝑖,𝑡 𝑡 Assets are Riskier than they Appear Conditional Expected Value of Sample Standard Deviation Suppose 𝑦𝑖 , 𝑖 = 1,2, … , 𝑛, are independent and identically distributed 𝒩 𝜇, 𝜎 2 normal returns and the sample standard variances 𝑠𝑛2 are defined as usual by: 𝑠𝑛2 = 1 𝑛−1 𝑛 𝑖=1 𝑦𝑖 − 𝑦 2 , where 𝑦 = 1 𝑛 𝑛 𝑖=1 𝑦𝑖 . We derive a closed-form solution for the conditional expected value of the sample standard deviation as a percentage of the true standard deviation for any tail probability 𝛼: 𝐸 𝑠𝑛 𝑠𝑛 ≤𝑠𝑛,𝛼 ) 𝜎 𝑛 Γ 2 where 𝐾𝑛 = Γ 𝑛−1 2 1 𝑛−1 2 2 = 𝐾𝑛 2 ≤ 𝜒2 𝑃 𝜒𝑛 𝑛−1,𝛼 𝛼 Portion of true Sigma for bottom 10%, 1%, and 0.1% What about fat tails? What about daily returns? • Simulate fat tails with normal distribution, with all draws within 𝜖 of zero replaced by a constant h of the same sign. E.g. if 𝜖 = 0.01 and ℎ = 10, then −0.005 becomes −10. • Calculate 1,000 sample standard deviations for 1,260 periods, which is equivalent to about 5 years of daily returns. Stressed VaR • Basel II, Basel 2.5, Basel III • In addition to regular VaR, also add the highest VaR that would have been calculated during a historically stressful environment, e.g. 2008-2009. What about Stressed VaR? • For same fat tailed distribution, for each asset, calculate the sum of the five year standard deviation and the highest rolling one year standard deviation. Then look at the distribution over assets. Even more assets exhibiting ≤ 𝟖𝟎% of average risk. Future 5-year Vol / Past 5-year Vol Future 5-year Vol / Past 5-year Vol Future 5-year Vol / Past 5-year Vol Future 5-year Vol / Past 5-year Vol Experimental Results (Gedanken) • Flip a coin ten times. • Count the number of heads. • What do you think will happen with your next ten flips? – Expected Profit: # heads – Risk: Square root of (# heads) * (10 – #heads) / 10 – Sharpe Ratio: Expected Profit / Risk • Now all banks invest in the few low-risk coin tossers. – So not only does each individual bank’s risk go up, but systemic risk goes up. Informal Algorithmic Intuition • Imagine a portfolio Π of investments that: – Generate outsized returns in general – Crash during times of systemic collapse • Regulated banks incentivized to tend towards Π • By definition, Π not historically detectable a priori • Objective regulation cannot prevent Π because it is effectively defined by overconcentration • Subjective regulation may prevent Π but violate the rule-of-law Any solutions? • Results hold for any objective regulation of risk – Not just Value-at-Risk or standard deviation. • So risk must be subjectively measured. • Two solutions: – Complete nationalization of all banks • Single central banker/risk manager decides however they want – Complete deregulation of all banks • No more deposit insurance. No more Federal Reserve. • Probably no more demand deposits. (Depends on market.) • Free market lets you put your money where you think it is safe. A Bank in Every Garage Links • Technical Paper: Maymin, Philip Z.; Maymin, Zakhar G. (2012), “Any Regulation of Risk Increases Risk”, Financial Markets and Portfolio Management 26:3, 299-313. • Less Technical Papers: – Maymin, Philip Z., “Why Financial Regulation is Doomed to Fail,” Library of Economics and Liberty, March 2011, http://www.econlib.org/library/Columns/y2011/Mayminfinancial.html – Maymin, Philip Z.; Maymin, Zakhar G., “Viewpoints: An Experiment in Risk,” American Banker, June 2010, http://www.americanbanker.com/issues/175_106/vp-experiment-securities-risk1020284-1.html – More at http://philipmaymin.com/academic-papers#risk