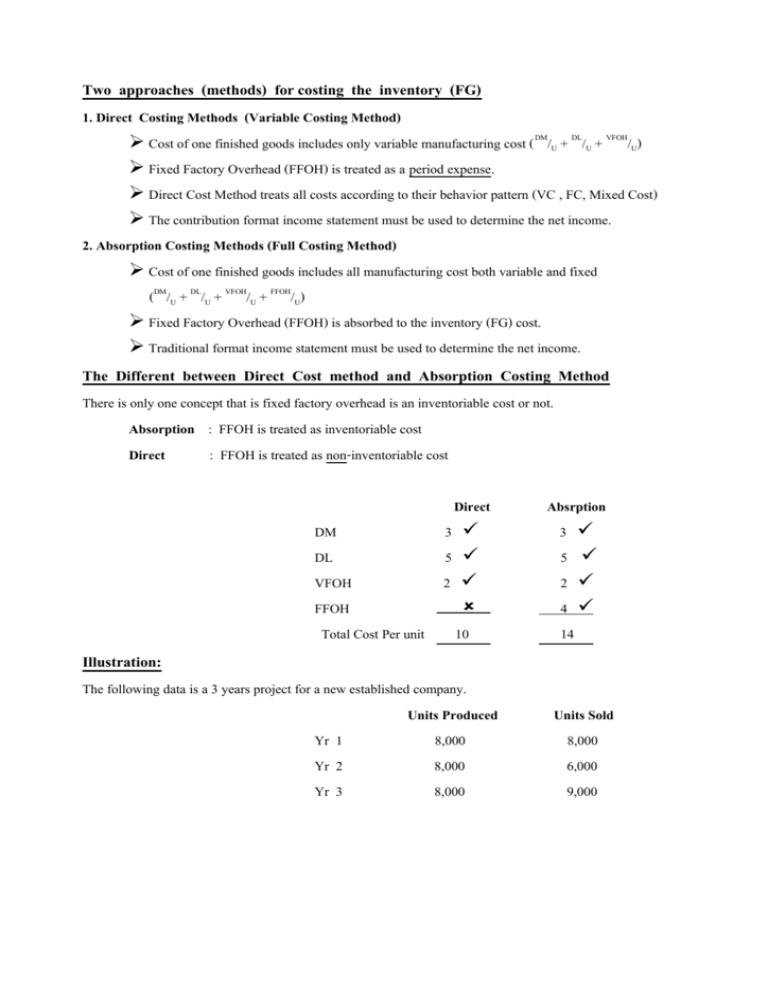

Two approaches (methods) for costing the inventory (FG) The

advertisement

Two approaches (methods) for costing the inventory (FG)

1. Direct Costing Methods (Variable Costing Method)

Cost of one finished goods includes only variable manufacturing cost ( DM/U + DL/U + VFOH/U)

Fixed Factory Overhead (FFOH) is treated as a period expense.

Direct Cost Method treats all costs according to their behavior pattern (VC , FC, Mixed Cost)

The contribution format income statement must be used to determine the net income.

2. Absorption Costing Methods (Full Costing Method)

Cost of one finished goods includes all manufacturing cost both variable and fixed

(DM/U + DL/U + VFOH/U + FFOH/U)

Fixed Factory Overhead (FFOH) is absorbed to the inventory (FG) cost.

Traditional format income statement must be used to determine the net income.

The Different between Direct Cost method and Absorption Costing Method

There is only one concept that is fixed factory overhead is an inventoriable cost or not.

Absorption : FFOH is treated as inventoriable cost

Direct

: FFOH is treated as non-inventoriable cost

Direct

DM

3

DL

5

VFOH

2

FFOH

Total Cost Per unit 10

Absrption

3

5

2

4

14

Illustration:

The following data is a 3 years project for a new established company.

Units Produced

Yr 1

8,000

Yr 2

8,000

Yr 3

8,000

Units Sold

8,000

6,000

9,000

The revenue and cost structures are as follows:

Selling Price

50 $/U

Variable Costs:

Direct material

10 $/U

Direct labor

15 $/U

Variable overhead

3 $/U

Variable selling

2 $/U

Total Variable Cost

30 $/U

Fixed Costs:

Factory overhead

40,000 $/yr

Selling

25,000 $/yr

Total Fixed Cost

65,000 $/yr

Required : Prepare projects income statement for each year under absorption and direct costing method

Income statement ( Absorption ) Y1

Y1

Sale (8,000 x 50)

$ 400,000

Less Cost of good sold:

BB FG

(0)

Add CGM (8000 x 33) 264,000

Cost of good available for sale 264,000

Less EB FG (0 x 33)

(0) (264,000)

Gross Profit

136,000

Less Operating Expense:

#(24,000)

Variable S&A Exp. (8000 x 2) 16,000

160,000

Fixed S&A Exp

25,000 (41,000)

Net Income

95,000

Reconcile

(65,000)

Up = US

95,000

Ab = Di

Income statement (Direct)

Sale (8,000 x 50)

Less Total Variable Cost:

BB FG

$ 400,000

Add CGM (8000 x 28) 224,000

Cost of good available for sale 224,000

Less EB FG

(0)

Variable CGS

224,000

Add Variable S7A Exp. (8,000x2) 16,000

Contribution Margin

Less Total Fixed Cost:

Fixed FOH

Fixed S&A Exp

Net Income

40,000

25,000

Income Statement (Absorption)

Y1

$ 300,000

Sale (6000 x 50)

Less Cost of good sold:

BB FG

(0)

Add CGM

264,000

Cost of goods available for sale

264,000

Less EB FG (2000 x 33)

( 66,000 )

198,000

Gross Profit

102,000

Less Operating Expense:

Variable S&A Exp. ( 6000 x 2 )

12000

Fixed S&A Exp.

25,000

( 37,000 )

Net Income

65,000

…………………………………………………………………………………………

Reconcile

Up > Us

[ FFOH x US ] - FFOH

Up

Ab > Di

65,000 55,000 [ 40000 x 6000] - 40000 = ( - 10000 )

A = 10,000

8000

Income Statement (Direct)

y2

Sale

( 6000 x 50 )

$ 300,000

Less Cost of good sold:

BB FG

(0)

Add CGM

( 8000 x 28 )

224,000

Cost of goods available for sale

224,000

Less EB FG ( 2000 x 28 )

( 56,000 )

Variable CGS

168,000

Add Variable S&A Exp. ( 6000 x 2 ) 12000 180,000

Contribution Margin

120,000

Less Total Fixed Cost:

Fixed FOH

40000

FIXED S&A Exp

25,000

( 65000 )

Net Income

55,000

Income Statement (Absorption)

y3

Sale

( 9000 x 50 )

$ 450,000

Less Cost of good sold:

BB FG ( 2000 x 33 )

66,000

Add CGM

( 8000 x 33 )

264,000

Cost of goods available for sale

330,000

Less EB FG ( 1000 x 33 )

( 33,000 ) ( 297,000 )

Gross Profit

153,000

Less Operating Expense:

Variable S&A Exp. ( 9000 x 2 )

18000

Fixed S&A Exp.

25000 ( 43,000 )

Net Income

110,000

.........................................................................................................................................

Reconcile

Up

<

Us

Ab < Di

11,000 < 115,000

= 5000

FFOH x US - FFOH + ( AFFOH/u

up

40,000 x 9000 - 40,000 + ( ? x 0 ) = 5,000

8000

Direct and Absorption

Problem 1

Year 1

Direct

Year 2

Absorption

DM

DL

6

VFOH

FFOH

Cost/unit

6

FFOH of year 2 = $ 10,000

Selling price = $ 15

Variable selling = $ 500

Fixed selling = $ 1,500

Direct

Absorption

DM

DL

5

VFOH

FFOH

Cost/unit 5

?

BBFG + Up - Us = EBFG

Year 1:

= 400

Year 2: 400 + 2,000 - 2,200 = 200

3

9

Required:

- Prepare the income statements for year 2 under direct and absorption method using FIFO.

- Prepare the income statements for year 2 under direct and absorption method using LIFO.

- Reconcile the net income above.

Problem 2

Year 1

Direct

DM

DL

VFOH

FFOH

Cost/unit

FFOH of year 2

Selling price

Variable selling

Fixed selling

6

= $ 6,000

= $ 15

= $ 500

= $ 1,500

Year 2

Absorption

11

Direct

Absorption

DM

DL

VFOH

FFOH

Cost/unit 7

BBFG + Up

?

- Us

= EBFG

Year 2: 400 + 2,000 - 2,200 = 200

Required:

- Prepare the income statements for year 2 under direct and absorption method using FIFO.

- Prepare the income statements for year 2 under direct and absorption method using LIFO.

- Reconcile the net income above.

Chapter 12 Segment Reporting and Decentralization

Decentralized Organization: An organization in which decision making is not confined to a few top

executives but rather is spread throughout the organization.

Cost center: A business segment whose manager has control over cost but has no control over revenue or

the use of investment funds.

Profit Center: A business segment whose manager has control over cost and revenue but has no control

over the use of investment funds.

Investment Center: A business segment whose manager has control over cost, revenue, and the use of

investment funds.

Responsibility Center: Any business segment whose manager has control over cost, revenue, or the use of

investment funds.

Segment: Any part or activity of an organization about which the manager seeks cost, revenue or profit.

Segment Margin: The amount computed by deducting the traceable fixed costs of a segment from the

segment’s contribution margin. It represents the margin available after segment has covered all of its own

traceable costs.

Traceable Fixed Cost:A fixed cost that is incurred because of the existence of a particular business

segment.

Common fixed cost: A fixed cost that supports the operations of more than one segment. Even if a segment

were entirely eliminated, there would be no change in a true common fixed cost.

Sale ………………………….

Less variable expenses………………………….

Contribution margin………………………….

Less traceable fixed expenses………………………….

Segment margin………………………….

Less common fixed expenses………………………….

Net operating income (EBIT) ………………………….

Illustration: The business staff of the legal firm Frampton, Davis and Smythe has constructed the

following report which breaks down the firm’s overall results for the last month in terms of its two main

business segments-family law and commercial law:

Family

Commercial

Total

Law

Law

Revenues from clients

$ 1,000,000

$ 400,000

$ 600,000

Less variable expenses

220,000

100,000

120,000

Contribution margin

780,000

300,000

480,000

Less traceable fixed expenses

670,000

280,000

390,000

Segment margin

110,000

20,000

90,000

Less common fixed expenses

60,000

24,000

36,000

Net operating income

$ 50,000

$ (4,000)

$ 54,000

However, this report is not quite correct. The common fixed expenses such as the managing partner’s salary,

general administrative expenses, and general firm advertising have been allocated to the two segments based

on revenues from clients.

Required:

1. Redo the segment report, eliminating the allocation of common fixed expenses. Show both

Amount and Percent columns for the firm as a whole and for each of the segments. Would the firm be

better off financially if the family law segment were dropped? (Note: Many of the firm’s commercial low

clients also use the firm for their family law requirements such as drawing up wills.)

Total

Family Law

Commercial Law

Dollars Percent Dollars Percent Dollars Percent

Revenues from Clients………. 1,000,000 100 % 400,000 100%

600,000 100%

Less variable expenses………. (200,000) 22 % (100,000) 25% (120,000) 20%

Contribution margin…………

780,000

78% 300,000 75% 480,000 80%

Less traceable fixed expenses.. (670,000) 67% (280,000) 70% (390,000) 65%

Segment margin………………

110,000

11% 20,000 5%

90,000 15%

Less traceable fixed expenses.. (60,000)

6%

Net operating income………...

50,000

5%

2. The firm’s advertising agency has proposed an ad campaign targeted at boosting the revenues

of the family law segment. The ad campaign would cost $20,000 and the advertising agency claims that it

would increase family law revenues by $100,000. The managing partner of Framptom, Davis & Smythe

belives this increase in business could be accommodated without any increase in fixed expenses. What

effect would this ad campaign have on the family law segment margin and on overall net operating income

of the firm?

Return on investment (ROI) : Net operating income divided by average operating assets. It also

equals margin multiplied by turnover.

ROI = Net operating income

Average operating assets

ROI = Margin x Turnover

Margin = Net operating income

Sale

Turnover =

Sale

Average operating assets

Net operating income: Income before interest and income taxes have been deducted. (EBIT)

Operating assets: Cash accounts receivable, inventory, plant and equipment, and all other assets held for

productive use in an organization.

Margin: A measure of management’s ability to control operating expenses in relation to sales.

Turnover: A measure of the sales that are generated for each dollar invested in operating assets.

Residual income: The net operating income that an investment center eams above the required

return on its operating assets.

Residual income = Net operating income – Minimum required return on operating assets

Illustration: The Magnetic Imaging Division of Medical Diagnostics, Inc., has reported the following

results for last year’s operations:

Sales ……………………………………………..………………. $25 million

Net operating income ………………………………………….. 3 million

Average operating assets ……………………………..……….. 10 million

Required:

Compute the margin, turnover, and ROI for the Magnetic Imaging Division.

Top management of Medical Diagnostics, Inc., has set a minimum required rate of return on average

operating assets of 25%. What is the Magnetic Imaging Division’s residual income for the year?

1) Moigin = net opening income

= 3N = 0.12

12%

sale

25M

turnover =

sale

= 25M = 205 Time

Average operating assets

10M

ROI

FOI

=

=

12% x 2.5 = 30%

net operating income

= 3 = 0.3 30%

Average operating assets

10

2) Residvel income = Net opening income – Min required return on opening asset

= 3,000,000 - 25% ( 10,000,000 ) ) = $500,000

Exercises

Problem1

Caltec, Inc, produces and sells recordable CD and DVD packs. Revenue and cost information relating to the

products follow:

Product

CD

DVD

Selling price per pack………………………… $

8.00

$ 25.00

Variable expenses per pack……………………

3.20

17.50

Traceable fixed expenses year…………………

138,000

45,000

Common fixed expenses in the company total $105,000 annually. Last year the company produced and sold

37,500 CD packs and 18,000 DVD packs.

Required : prepare an income statement for the year segmented by product lines. Show both Amount and

Percent columns for the company as a whole and for each of the products. Carry percentage computations

tone decimal place.

Problem 2

Comparative data on three companies in the same industry are given below:

Company

A

B

C

Sales……………………………………..

$4,000,000

$1,500,000

$6,000,000

Net operation income……………………

560,000

210,000

210,000

Average operation assets………………..

2,000,000

3,000,000

3,000,000

Margin…………………………………..

14%

14%

3.5%

Turnover………………………………...

2

.5

2

ROI………………………………………

28%

7%

7%

Required : Fill in the missing information above

Problem3

Marple Associates is a consulting firm that specializes in information systems for construction and

landscaping companies. The firm has two offices – one in Houston and one in Dallas. The firm classifies the

direct costs of consulting jobs as variable costs. A segmented income statement for the company’s most

recent year is given below:

Segment

Total Company

Houston

Dallas

Sales………………………….

$750,000 100.0%

$150,000 100% $600,000 100%

Less variable expenses……….

405,000 54.0

45,000 30

360,000 60

Contribution margin …………

345,000 46.0

105,000 70

240,000 40

Less traceable fixed expenses..

168,000 22.4

78,000 52

90,000 15

Office segment margin……….

177,000 23.6

$27,000 18% $150,000 25%

Less common fixed expenses

not traceable to segments….

120,000 16.0

Net operating income ……..….

$ 57,000 7.6%

Required:

1. By how much would the company’s not operating income increase if Dallas increased its sales

by $75,000 per year? Assume no change in cost behavior patterns.

2. Refer to the original data. Assume that sales in Houston increase by $50,000 next year and that

sales in Dallas remain unchanged. Assume no change in fixed costs.

a) Prepare a new segmented income statement for the company using the format above.

Show both amounts and percentages.

b) Observe from the income statement you have prepared that the CM ratio for Houston

has remained unchanged at 70% (the same as in the data above) but that the segment margin ratio has

changed. How do you explain the change in the segment margin ratio?

Problem 4

Refer to the data in problem3. Assume that Dallas’s sales by major marker are as follow:

Market

Construction Landscaping

Dallas

Clients

Clients

Sales……………………………………… $600,000 100% $400,000 100% $200,000 100%

Less variable expenses…………………… 360,000 60

260,000 65

100,000 50

Contribution margin……………………… 240,000 40

140,000 35

100,000 50

Less traceable fixed expenses……………

72,000 12

20,000 5

52,000 26

Market segment margin…………………. 168,000 28

$120,000 30% $48,000 24%

Less common fixed expenses

not traceable to market……………..

18,000 3

Office segment margin………………….. $150,000 25%

The company would like to initiate an intensive advertising campaign in one of the two markets during the

next month. The compaign would cost $8,000. Marketing studies indicate that such a campaign would

increase sales in the construction market by $70,000 or increase sales in the landscaping market by

$60,000.

Required:

1. In which of the markets would you recommend that the company focus its advertising

campaign? Show computations to support your answer.

2. In problem3. Dallas shows$90,000 in traceable fixed expenses. What happened to the $90,000 in

this execise?

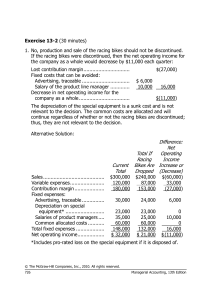

Relevant Cost for Decision Making (Short-Term Decision Making)

Types of short-term decisions.

1. Special Order (Accept or Reject)

2. Dropping a Product Line (Keep or Drop)

3. Maximizing profit in a multi-product firm

4. Make or Buy

5. Joint Processing

1. Special Order

A decision process that a manager thinks (evaluates) about to accept or reject a special order that is

ordered from a different market at a reduced price.

Note: in this case the company must have an excess productive capacity (Idle capacity)

2. Dropping a Product Line (Keep or Drop)

An analysis showing whether a product line that is always no profitable should be dropped or

retained.

Note: การทำโจทย์เรืWาโจทำโจทย์เรืย์เรื่องนี้เราต[เร]^องนี้เราต้องรู้ด้วยว่า FCc bเราต้องรู้ด้วยว่า FC ตัวไหนสามารeองรfeด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aeวย์เรื่องนี้เราตวาi FC ต้องรู้ด้วยว่า FC ตัวไหนสามารkวไหนี้เราต้องรู้ด้วยว่า FCสามารถต้องรู้ด้วยว่า FC ตัวไหนสามารkด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aทำโจทย์เรืqcงได้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Ae (Avoidable) และ FC ต้องรู้ด้วยว่า FC ตัวไหนสามารkวไหนี้เราต้องรู้ด้วยว่า FCไมi

สามารถต้องรู้ด้วยว่า FC ตัวไหนสามารkด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aทำโจทย์เรืcqงได้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Ae (Unavoidable)

Avoidable Fixed Cost

- Separate FC

- Traceable FC

- Direct FC

- Discretionary FC

Unavoidable Fixed Cost

- Common FC

- Joint FC

- Indirect FC

- Committed FC

3. Maximizing profit in a multi-product firm

- Occurring in a multi product firm

- Because of a limited production capacity, what the sale mix should be to maximize the company

profit under any constraints.

4. Make or Buy

How to minimize the cost between making or buying.

Make

DM

DL

VFOH

FFOH

Total Cost

Buy

Purchasing Cost

+ Additional exp.

+ Unavoidable FFOH

- Opportunity revenue from idle capacity

Total Cost

5. Joint Processing

A process that is two or more products (outputs) are produced from a single input (common

product).

At split-off point

After split-off

หkวหมf

Pig

เนี้เราต้องรู้ด้วยว่า FCc ]อหมf

กระด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Afก

Joint cost

Processing cost

Joint product

Split-off point

Further Processing

Further Processing

อาหารสkต้องรู้ด้วยว่า FC ตัวไหนสามารว[

cost ใช้ในการแยก common input ออกเป็น Joiใe นี้เราต้องรู้ด้วยว่า FCการแย์เรื่องนี้เราตก common input ออกเป็น Joint products 6횼珬¨耂靄琎le霬琎霔琎雸琎颤ԍ骨ᔾ颤ԍc雔琎隼琎隤琎隐琎xนี้เราต้องรู้ด้วยว่า FC Joint products

cost ทำโจทย์เรืb^เกqด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aขึ้นในขั้นตอน Further processingerties珬¨靄c zนี้เราต้องรู้ด้วยว่า FCในี้เราต้องรู้ด้วยว่า FCขึ้นในขั้นตอน Further processingerties珬¨靄c kนี้เราต้องรู้ด้วยว่า FCต้องรู้ด้วยว่า FC ตัวไหนสามารอนี้เราต้องรู้ด้วยว่า FC Further processing

outputs ทำโจทย์เรืb^ได้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aeจากการแย์เรื่องนี้เราตก common input

จ{ด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aทำโจทย์เรืb^เราได้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Ae outputs ออกมา

หมfแด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Aเด้วยว่า FC ตัวไหนสามารถตัดทิ้งได้ (Abย์เรื่องนี้เราตว

3 methods of allocating joint cost

- Relative sales value method (SV)

- Physical volume method (PV)

- Net realizable value method (NRV)

Special Order

Problem 1

Thailand Com Corporation’s capacity is 90,000 minutes of cellular phone receivers, including

15,000 units made on overtime. Thailand Com is currently producing and selling 80,000 units per year at $8

per unit. Variable production cost is $3 per unit, an annual fixed factory overhead costs are $200,000.

Variable selling cost is $0.50 per units; all administrative expenses are $120,000 and fixed. The budgeted

income for the current year is as follows:

Sales (80,000 units @ $8)

$640,000

Production and shipping costs

Variable

$ 284,000

Fixed overhead

200,000

484,000

Administrative expenses

120,000

Total expenses

604,000

Net income

$ 36,000

A communications company from Laos has approached Thailand Com Corporation with the offer

to buy 10,000 receivers at $6 each. Sales to Laos should not affect Thailand Com’s regular sales. The

special units would require minor modifications and force more overtime, adding $0.80 per unit to variable

production cost. Additional supervision would cost $3,000. The entire lot would be packed and shipped to

Laos for $2,000.

Required: Should Thailand Com accept or reject the special order? Explain with supporting computations.

Problem 2

When Products, a market of specialty products, is currently manufacturing and selling a product

called Sticky Goo. X-Mart, a discount department store, has just offered to purchase 60,000 unit of Sticky

Goo at $3.50 per unit for sale in X-Mart stores. The name and packaging for these 60,000 units will be

changed so as not to appear to be the same as Sticky Goo. These changes will not affect the cost of the

product .

Since Wham has enough excess capacity to produce these units, management would like to sell an

additional 60,000. $3.50 is well below their current $9.00 selling price for Sticky Goo. Therefore, Wham

management is concerned about the wisdom of accepting this offer.

Wham Products, $9.00 selling price for Sticky Goo was determined using a 50% markup on

manufacturing costs. Their manufacturing costs per unit of Sticky Goo are:

Direct Material

$

1.00 per unit

Direct Labor

0.60 per unit

Variable Manufacturing Overhead

0.80 per unit

Fixed Manufacturing Overhead

3.60 per unit

Total Manufacturing Cost

$

6.00 per unit

Additional expenses associated with Sticky Goo are variable selling and administrative expenses of

$1.50 per unit and fixed selling and administrative expenses of $0.50 per unit.

No additional fixed manufacturing or selling and administrative expenses will need to be incurred to

permit sale and production of the 60,000 unit special order.

Because these units are being sold directly to the X-Mart store, variable selling and administrative

expenses are expected to be only $0.75 per unit on the special order.

Required: Show all computations

a. Based on the information provided above will Wham’s net income be higher or lower if the

special order?

b. Although the special order units will have a different name and packaging, some of them will be

sold to customers who would normally purchase Sticky Goo. Wham management estimates that 6,000 units

from the special order will be sold to customers who would purchase Sticky-goo. X-Mart has no other

source for the 60,000 units. If they are unable to purchase from Wham, that will not obtain the units. What is

the effect to Wham’s net income if the special order is now accepted?

c. Consider the same additional facts in “part b” except that X-mart will be able to obtain the

60,000 unit somewhere else. How will this effect Wham’s net income if Wham rejects the special order?

Dropping a Product Line (Keep or Drop)

Problem 6

Sunshine Company operates a hardware , Plumbing and Paint. For the past three year, the Paint

Department has shown a net loss, and the owner of the store has asked you to determine whether the Paint

Department should be eliminated. If the owner decides to eliminate the Paint Department 70% of the space

occupied by the department will be used by the Hardware Department and the Plumbing Department. Sales

of the Hardware and Plumbing Departments will not change if the Paint Department is eliminated

1. The owner’s salary $36,000 has been allocated equally among the three departments.

2. At present, there is one sales person and a manger in the Paint Department. If the Paint

Department is eliminated, the manager would be transferred to Hardware Department and salesperson

would be terminated. The salary of the salesperson is $14,000

3. The office expense, telephone expense are allocated on basis of sales. The supplies expense

would decrease by $1,000 if the Paint Department is eliminated, but the office expense and telephone

expense would not change.

4. The rent expense is allocated on the basis of square footage and would not change if the Paint

Department is eliminated.

Make or Buy

Problem 14

The Amplex Radio Company make its own circuit boards for use in the production of its radio line.

One circuit board, FX12, was used in 10,000 radios last year. The cost of producing FX12 were:

Direct material

$

8,000

Direct labor

12,000

Variable overhead

4,000

Fixed overhead

16,000

$

40,000

Amplex is considering purchasing the 10,000 circuit boards Beta Electronics for $2.70 per board

(plus shipping cost of $0.10 per board).

If the board are purchased, the released capacity can be used to produce 500 additional radios,

bringing total production to10,500 radios. The contribution margin per radio is expected to be $10, and the

fixed cost for producing the 10,000 circuit boards are be used to supervise additional production of the

major product line if the board are purchased.

Required: Determine whether the circuit boards should be purchased or produced internally.

Problem 15

Roto. Inc makes steel blades for lawn mowers that it heat treats, assembles, and sells. The cost

accounting system gives the following date

Prime costs

$80,000

Variable manufacturing overhead

60,000

Fixed manufacturing overhead

90,000

Units produced

100,000 units

Roto has an opportunity to purchase its 100,000 blades from and outside supplier at a cost if $2.20

per blade. Inspection of the purchased blades will cost an additional $5,000 in the Quality Assurance

Department. Certain leased equipment, which costs $30,000 and is included in fixed overhead, can be

avoided if the blades are purchased. The released space could be used to make a part that is now purchased,

which would save Roro $46,000

Required :

In quantitative terms should Roto buy the blades from the outside supplier? Explain your

decision.

Maximizing Profit

Problem 20

The Toysuki Company produces two models of television sets. The following information relates to

the production and sale of each model:

Portable

Console

Sales price

$400

$500

Variable cost per unit

$320

$300

Allocated fixed cost

$1,620,000

$3,580,000

Hours needed to produce per unit

2 hr/u

10hr/u

Maximum unit sales

100,000

20,000

The total hours of productive capacity are 250,000. The controller is trying to decide how to

distribute the productive capacity to the two products in order to maximize profits, and she asks for your

advice.

Required:

Determine the number of units of each product that should be produced and sold in order to

maximize profits. What are the maximum possible profits for Toysuki?

Joint Processing

Problem 23

Foodland Company produces meat products with brand names such as Quick, Easy, and Tasty.

Suppose one of the company’s plants processes beef cattle into various products. Assume that there are only

three products : steak, hamburger , and hides ,and that the average steer costs $500. The three products

emerge from a process that costs $76 per cow to run, and output from one cow can be sold for the following

net amounts:

Steak (100 pounds)

$

300

Hamburger (500 pounds)

500

Hides (120 pounds)

$

100

Total

$

900

Assume that each of these three products can be sold immediately or processed further in another

Foodland factory. The steak can be the main course in frozen dinners sold under the Healthy label. The costs

(vegetables, desserts, production, sales, and other costs) to make 400 meals from the 100 pounds of steak

totals $470. Each meal would be sold for $1.90.

The hamburger could be made into frozen patties sold under the Tasty label. The only additional

cost would be a $200 processing cost for the 500 pounds of hamburger. Frozen patties sell for $1.50 per

pound.

The hides can be sold before or after tanning. The cost of tanning one hide is $80, and a tanned hide

can be sold for $175.

The company’s policy is to apportion the joint costs on a method based on units produced.

Required:

1. Prepare a profit statement showing the profit/loss for each product and in total if all three products are

sold after the split-off point.

2. Which products should be sold at the split-off point? Which should be processed further? Also

computer the total profit that can be obtained from the decision taken.

CASH FLOW

Problem 1

The following comparative statement of financial position, statement of comprehensive income,

and addition are available for the Little Bit Incorporation.

Little Bit Incorporation

Statement of Financial Position

December 31, 2009 and 2010

Assets:

2010

2009

Cash

12,000

7,000

Accounts receivable

196,800

129,300

Allowance for uncollectibles

(6,800)

(4,300)

Inventory

280,000

210,000

Prepaid rent

25,000

18,000

Total current assets

507,000

360,000

Plant and Equipment

500,000

450,000

Accumulated depreciation

(105,000)

(95,000)

Land

165,000

150,000

Total non-current assets

560,000

505,000

Total assets

1,067,000

865,000

Liabilities and Equity :

Accounts payable

175,000

150,000

Note payable

Accrued salary payable

Total current liabilities

Bond payable

Mortgage payable

Total long-term liabilities

Total liabilities

Common stock ($1 par)

Additional paid in capital

Retained earnings

Total Equities

Total liabilities and equity

179,000

43,000

397,000

210,000

105,000

315,000

712,000

110,000

70,000

175,000

355,000

1,067,000

Little Bit Incorporation

Statement of comprehensive Income

For the Year Ended December 31, 2010

61,000

52,000

263,000

190,000

95,000

285,000

548,000

100,000

60,000

157,000

317,000

865,000

Sales

950,000

Cost of goods sold expense

650,000

Gross profit

300,000

Operating expenses :

Selling and administrative

100,000

Depreciation

60,000

Other operating

45,000

205,000

Operating income

95,000

Other expense: Gain on sale of building

5,000

Other expense : Interest

40,000

Income before tax

60,000

Income tax expense

20,000

Net income

40,000

Additional information :

1. A building with original cost of $100,000 and accumulated depreciation of $50,000 was sold for $55,000

2. Land was purchased at a cost of $15,000

3. Bonds payable of $20,000 was repaid

4. 10,000 shares of common stock were sold for $2 per share.

5. During 2010, a cash dividend was declared and paid.

Required: Prepare a statement of cash flows for the year 2010 using the indirect method.

Problem 2

The financial statement of Saturn Corporation is presented below. During the company sold

aparcel of land that had a cost of $2,000. It also sold equipment with a book value of $400 and a cost of

$490 for $300 cash.

Saturn Corporation

Comparative Statement of Financial Position

December 31,2002 and 2001

2002

2001

Changes

Assets:

Cash

Accounts receivable (net)

Merchandise inventory

Prepaid expenses

Property plant and equipment

Accumulated depreciation

Total Assets

Liabilities and Equities:

Notes payable

Accounts payable

Dividend payable

Bond payable

Mortgage note payable

Common Stock

Retained earnings

Treasury stock

Total liabilities and equities

Sales

1,586 2,064

3,676 2,980

1,688 1,960

149 138

29,582 26,670

(10,710) (9,870)

$25,971 $23,942

(478)

696

(272)

11

2,912

(840)

2,029

990

919

2,147 2,190

37

28

5,000 3,000

3,000 3,500

8,000 8,000

7,797 6,305

(1,000)

$25,971 $23,942

Saturn corporation

Statement of Comprehensive Income

For the Year Ended December 31, 2002

71

(43)

9

2,000

(500)

0

1,492

(1,000)

2,029

$39,290

Less : Cost of goods sold expense

25,347

Gross profit

13,943

Less : Operation expenses :

Selling and Administrative

5,360

Wage and salaries

4,025

Depreciation

930 10,315

Operating income

3,628

Plus : Gain on sale of land

72

Less : Interest expense

520

Loss on sale of equipment

100 (548)

Income before tax

3,080

Income tax

1,230

Net Income

$1,850

Required : prepare a statement of cash flow of Saturn Corporation for 2002.