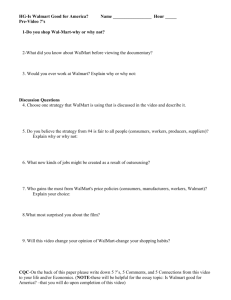

tax revenue - Making Change at Walmart

advertisement

MAKING CHANGE AT WALMART Walmart: Always Low Prices Brought to you by America’s Taxpayers What Walmart says… ✖ As Walmart attempts to enter large cities like Washington DC, the ✖ ✖ company says it will not ask for pub lic financing.1 “Our stores are often magnets for gro wth and development all across the country. We’re proud of the contributions we make in communities across the country-fr om creating jobs and generating tax revenue to helping customers sav e and contributing to local nonprofits.” - Steve Restivo, Senior Director of Community Affairs.2 In cities like Chicago, Walmart says it boosts the economy by generating tax revenue for the City and County.3 What Walmart doesn’t say… n Walmart finds ways to finance its operations on the backs of taxpayers. Using tactics such as deducting rent payments made to itself (through a captive real estate investment trust), it avoids an estimated $300 million a year in state corporate income tax payments.4 n Walmart costs taxpayers an estimated $1 billion per year subsidizing low wages and benefits.5 n Walmart systematically challenges property tax assessments to chip away at its property tax bills, costing local governments several million dollars a year in lost revenues and legal expenses.6 n In New York State, for example, at least eight Wal-Mart locations have challenged their property tax assessment, recouping about $766,000.7 n A national study examined a 10 percent random sample of Walmart’s 2,833 Supercenters and discount stores as of the beginning of 2005, and found that at least one assessment challenge had been filed at 35 percent of the stores. If that rate applies to all Walmart stores, the company has brought challenges at more than 1,000 retail outlets nationwide.8 n Recent studies have shown that the tax revenue big box stores like Walmart produce is often vastly overstated. For more information, go to www.ChangeWalmart.org MAKING CHANGE AT WALMART n A study conducted in Asheville, NC found that a downtown mixed-use development would generate $83,600 per acre per year in retail taxes, vs. $47,500 for a Walmart. Similarly, the mixed-use development would generate $634,000/acre per year in total property taxes vs. $6,500 for a Walmart.9 Another study by the organization Smart Growth also concluded that mix-used developments are generally more productive tax-generating spaces.10 n A study by the organization Smart Growth revealed that big box stores only contribute slightly more in taxes than single family homes. Single family homes generate roughly $8,200 per year, and big box stores about $150 to $200 more.11 Check the facts… 1. www.walmartwashingtondc.com/10-facts-you-should-know-about-walmart-in-washington-d-c/ 2. Sarah Siguenza, “Wal-Mart Met With Mixed Reactions,” Rockville Patch, 26 Jan 2012 3. www.walmartchicago.com/whats-at-stake/ 4. Phillip Mattera, “Shifting the Burden for Vital Public Services: Walmart’s Tax Avoidance Schemes”, Good Jobs First, Feb 2011 5. Figure is a calculation of the percentage of Massachusetts Walmart associates receiving subsidized care (42%), applied to the 1.4 million associates in the United States, at the cost to Massachusetts per each associate ($1,753.00) receiving aid. Using the data from Massachusetts for 2009 found the percentage of Associates using publicly subsidized care. Percentage is 42%. Then applied this to the entire Walmart workforce to determine number of Associates nationally who would receive publicly subsidized care using the rate in Massachusetts. From the Massachusetts data found the per Associate cost by dividing the total cost of providing subsidized care in MA to Associates by the number of MA Associates receiving subsidized care. This yielded a per Associate cost of $1,753. Multiplied that by 42% of Walmart’s total US workforce (1.4 million). Results in $1 billion. 6. Mattera, 2011 7. www.Wal-Martsubsidywatch.org/index.html 8. Ibid 9. Stephen Duffy, “Sometimes Walmart is Better: Walmart, Sprawl and Dumb Fiscal Policy,” New York Observer, 25 Jan 2012 10. Duffy, Jan 2012 11. Conor Dougherty, “Big Box Stores Don’t Produce Tax Gains,” Wall Street Journal Blog, 14 Jul 2010 For more information, go to www.ChangeWalmart.org