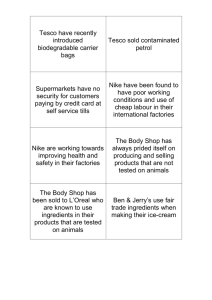

SUSTAINABLE BUSINESS PERFORMANCE SUMMARY

advertisement