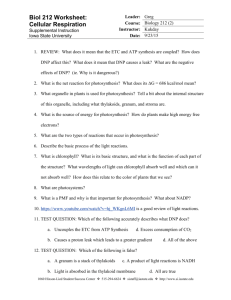

E_Tanshin15 3_DNP528.2

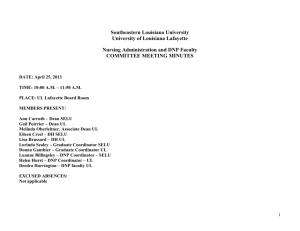

advertisement