File

advertisement

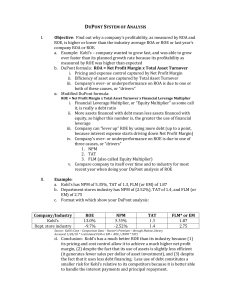

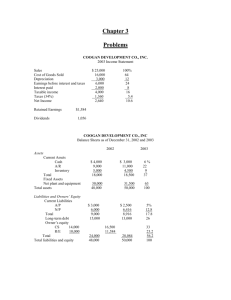

MGMT 326: Chapter 3 Practice Problem KEY Bayley Chapter 3: What you need to know for the midterm and final exams... The last two slides of the Ch. 3 PowerPoint (emailed to all students the week of 6/9) include some of the questions you will need to be able to answer. Note that almost all information on all of the slides is important in Ch. 3. Practice problems (applying the slide questions): "Chapter Review and Self-Test Problems," pp. 82-84, problems 3.1 and 3.3 (answers are provided on pp. 84-85.) "Questions and Problems," pp. 87-89, problems 1 (quick ratio only), 2, 5, 7, 8, 10, 16 (b. and d. only), 17-19, 22, 23, 25, 27 (some answers are in Appendix C of the text; others will be provided by 6/18) Page 82, Problem 3.1: Common-Size Statements: Prepare a common-size income statement for Wildhack. Sales 3756/3756 100% COGS 2453/3756 65.3% Depreciation 490/3756 13.0% EBIT 813/3756 21.6% Interest paid 613/3756 16.3% Taxable Income 200/3756 5.3% Taxes (34%) 68/3756 1.8% Net Income 132/3756 3.5% • • Dividends 46/3756 1.2% Retained Earning 86/3756 2.3% How do you interpret the standardized net income? For every dollar of sales (revenue), 3.5 cents has been earned in net income (profit). This is also the firm’s profit margin (3.5%) What percentage of sales goes to cost of goods sold? Sixty-five-point-three percent (65.3%) of each dollar in sales (revenue) goes to the expense of cost of goods sold (COGS). MGMT 326, Ch 3 Key Page 1 of 7 Page 84, Problem 3.3: ROE and the DuPont Identity 2014 ROE for the Wildhack Corporation, then break this down into the parts of the DuPont Identity. ROE = Net Income/Total Equity = NI/TE = $132/$2,742 (all numbers in millions) = 0.0481 = 4.81% According to the DuPont equation, ROE also = Profit Margin x TAT x Equity Multiplier = (NI/Sales) x (Sales/TA) x (TA/TE) = (132/3,756) x (3,756/6,002) x (6,002/2,742) = 0.0351 x 0.6258 x 2.189 = 0.0481 = 4.81% Page 87, #1: Calculating Liquidity Ratios (Quick Ratio only): Quick ratio = (Current assets – Inventory)/Current Liabilities We need to find the value of current assets for the formula above. We know that NWC = CA – CL. So 1,730 = CA – 5,140. Therefore, current assets = $6,870. Quick ratio = (6,870 – 2,170) / 5,140 = 0.914 What does this information mean? The firm can cover 91.4% of its current liabilities with its current assets, not including its inventory. Page 87, #2: Calculating Profitability Ratios Looking at our ratio formula slide, we need to decide which profitability ratio is the easiest to solve given the information we have. The questions we have to answer: net income, ROA, and ROE We are given sales, total assets, total debt, and the profit margin. What is the net income? We can solve for net income using profit margin and sales: Profit margin = NI/Sales, so NI = Profit margin x sales = .07 x 15,000,000 = $1,050,000 = Net Income What is ROA? We can solve for ROA using net income and total assets: ROA = NI/TA = 1,050,000/9,000,000 = 11.67% = Return on Assets What is ROE? We can solve for ROE using net income and total equity. But to do this, we must remember the balance sheet identity: Assets = Liabilities + Equity So 9,000,000 = 3,700,000 + Equity Equity = $5,300,000 ROE = NI/TE = 1,050,000/5,300,000 = 19.81% = Return on Equity MGMT 326, Ch 3 Key Page 2 of 7 Page 87, #5: Calculating Leverage Ratios (This type of problem would not be on the midterm or final: leverage ratio calculations will only require you to know the formulas highlighted in yellow on your slides. This problem gives you extra practice in reasoning about ratios.) What is the debt-equity ratio? D/E ratio = Total Debt/Total Equity. But we are given the Total Debt Ratio. Total Debt Ratio = (Total Assets – Total Equity)/Total Assets = Debt / Assets = 0.34 Remember, Total Assets = Total Debt – Total Equity. If Debt/Assets = 0.34, then Equity/Assets must = 0.66. If we take Debt/Assets and divide it by Equity/Assets, we get Debt/Equity, our D/E ratio. 0.34/0.66 = 0.52 What is the Equity Multiplier? EM = 1 + D/E ratio = 1 + 0.52 = 1.52 Page 87, #7: DuPont Identity What is ROE? ROE = PM x TAT x EM = .06 x 1.8 x 1.65 = 17.82% Page 87, #8: DuPont Identity What is the D/E ratio? We are given PM, TAT, and ROE. So let’s solve for the missing piece of the DuPont equation, the EM. ROE = PM x TAT x EM So EM = ROE/(PM x TAT) = .143/(.08 x 1.24) = 1.44 = Equity Multiplier EM = 1+ D/E ratio D/E ration = EM -1 = 1.44 – 1 = 0.44 = D/E ratio MGMT 326, Ch 3 Key Page 3 of 7 Page 87, #10: Equity Multiplier and Return on Equity D/E ratio = 0.95 ROA = .075 = NI/TA TE = $735,000 What is the Equity Multiplier? EM = 1 + D/E ratio = 1.95 = TA/TE What is ROE? (We need NI to figure out ROE, so skip down and figure out NI first…) What is Net Income? Given what we know, how can we find NI? EM = 1.95 = TA/TE We know TE. 1.95 = TA/735,000 TA = 1,433,250 -----------------------We need NI: We know ROA = NI/TA. We now have ROA and TA: 0.075 = NI/1,433,250 NI = 0.075 x 1,433,250 = 107,493.75 -------------------------ROE = NI/Equity = 107,493.75/735,000 = 14.63% Page 88, #16 (b. and d. only) b. Quick Ratio = (CA – Inv)/CL 2013: (194,755-121,807)/313,436 = 0.233 = 23.3% 2014: (226,318-143,615)/326,988 = 0.253 = 25.3% d. D/E ratio and Equity Multiplier 2013: D/E ratio = (313,436 + 271,700) / 332,481 = 1.76 = D/E ratio; EM = 1 + 1.76 = 2.76 2014: D/E ratio = (326,988 + 285,300)/ 371,358 = 1.65 = D/E ratio; EM = 1 + 1.65 = 2.65 MGMT 326, Ch 3 Key Page 4 of 7 Page 88, #17: DuPont Identity What is the DuPont Identity? ROE = PM x TAT x EM = (NI/Sales) x (Sales/Assets) x (Assets/Equity) = (89,351/2,945,376) x (2,945,376/983,646) x (983,646/371,358) = 24.1% Page 88, #18: DuPont Identity (This problem is more complex than what you would see on an exam. It gives you additional practice in reasoning about ratios.) We know ROA, PM, and ROE What is the TAT? ROE = PM x TAT x EM = = PM x TAT x (Assets/Equity) -------------We can find Assets/Equity this way: ROE/ROA = (NI/TE)/(NI/TA) = TA/TE = Assets/Equity = 0.17/0.09 = 1.89 -------------ROE = PM x TAT x EM = = PM x TAT x (Assets/Equity) 0.17 = 0.06 x TAT x 1.89 TAT = 1.5 ------------What is the EM? EM = Assets/Equity = 1.89 Page 88, #19: Return on Assets ROA = NI/TA We know that PM = NI/Sales, so NI = PM x Sales: NI = 0.058 x $16,000,000 = $928,000 ROA = NI/TA = 928,000/14,000,000 = 6.63% Note that the debt number is not needed to solve this problem. MGMT 326, Ch 3 Key Page 5 of 7 Page 89, #22: Total Asset Turnover We are given PM, Sales, and TA. What is the TAT? TAT = Sales/TA = $16,000,000/$6,800,000 = 2.35: every $1 in assets generated $2.35 in sales Management wants to increase TAT to 2.75. If TA stays the same, what would sales need to be? TAT = Sales/TA = 2.75 = Sales/$6,800,000 Sales would need to equal 2.75 x $6,800,000 = $18,700,000 Page 89, #23: Return on Equity (This type of problem would not be on the midterm or final: leverage ratio calculations will only require you to know the formulas highlighted in yellow on your slides. This problem gives you extra practice in reasoning about ratios.) ROE = NI/TE We know NI. We need to figure out TE. Total Debt Ratio = (Total Assets – Total Equity)/Total Assets = Debt/Assets = 0.65 So debt is 65% of Assets. Debt = $345,000. $345,000 = 0.65 x Assets Assets = $530,769 Equity = Assets – Debt = $530,769 - $345,000 = $185,769 = Equity ROE = NI/TE = 31,280/185,769 = 16.8% MGMT 326, Ch 3 Key Page 6 of 7 Page 89, #25: Profit Margin We know TA, TAT, and ROA. What is the PM? PM = NI/Sales We need NI and Sales to figure out PM. We know TA, TAT, and ROA. ROA = NI/TA 0.085 = NI/8,500,000 NI = 0.085 x 8,500,000 = $722,500 Now we need Sales to figure out PM. TAT = Sales/TA = 1.8 = Sales/8,500,000 Sales = 1.8 x 8,500,000 = $15,300,000 PM = NI/Sales = 722,500/15,300,000 = 4.72% Page 89, #27: DuPont Identity What is NI? We know Sales, TA, D/E ratio, and ROE. ROE = PM x TAT x EM = (NI/Sales) x (Sales/Assets) x (Assets/Equity) [Note: we can figure out the EM: 1 + D/E ratio = 1.25] 0.15 = (NI/9,310) x (9,310/4,390) x 1.25 NI = $526.80 MGMT 326, Ch 3 Key Page 7 of 7