2012 Annual Report

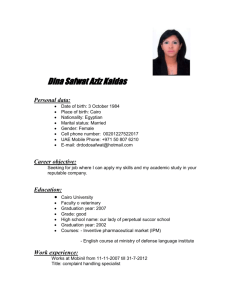

advertisement