Chapter 12 - Jb-hdnp

advertisement

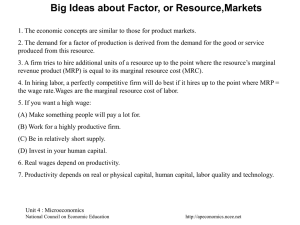

AP Microeconomics – Chapter 12 Outline I. Learning Objectives—In this chapter students will learn: A. The significance of resource pricing. B. How the marginal revenue productivity of a resource relates to a firm’s demand for that resource. C. The factors that increase or decrease resource demand. D. The determinants of elasticity of resource demand. E. How a competitive firm selects its optimal combination of resources. II. Review Circular Flow Model (Figure 2.2) A. In resource markets, firms demand factors of production (land, labor, capital, and entrepreneurial ability). B. In resource markets, households supply the factors of production in return for money income. III. Resource Pricing A. Resources must be used by all firms in producing their goods or services. The prices of these resources will determine the costs of production. B. Significance of Resource Pricing 1. Resource prices are a major factor in determining money incomes of households. Firm expenditures flow back to households in wages, rent, and interest (Figure 2.2 – see above). AP Microeconomics – Chapter 12 Outline 2. Resource prices are input costs. Firms try to minimize these costs to achieve productive efficiency and profit maximization. 3. Resource prices determine resource allocation among industries and firms. 4. Policy issues include income distribution, income taxes, minimum wage laws, agricultural subsidies, and labor union policy. IV. Marginal Productivity Theory of Resource Demand A. The theory for a firm selling its product in a purely competitive product market (“price taker”) and hiring its resources in a purely competitive resource market (“wage taker”). 1. Derived demand—resource demand is derived from the demand for the products that the resources produce; as demand for cars increases, the demand for autoworkers increases. 2. Demand for a resource depends on: a. the productivity of the resource b. the market price of the product being produced 3. Using Table 12.1: a. Review the law of diminishing returns (declining MP). b. Review the significance of the fixed product price (pure competition). c. Determine total revenue (TR) and marginal revenue product (MRP); MRP is the increase in total revenue that results from the use of each additional unit of a variable input. The equation is: 4. MRP depends on the productivity of input (recall that marginal product of inputs falls beyond some point in the production process due to the law of diminishing returns). 5. MRP also depends on the price of the product being produced. 6.. The rule for employing resources is to produce where MRP = MRC. a. To maximize profits, a firm should hire additional units of a resource as long as each unit adds more to revenue than it does to costs. (MRC is the marginal resource cost, or the cost of hiring the added resource unit). Equation form: AP Microeconomics – Chapter 12 Outline b. Under conditions of pure competition in the labor market, where the firm is a “wage taker,” the wage is equal to the MRC. c. MRP will be the firm’s resource (labor) demand schedule in a competitive resource market, because the firm will hire (demand) the number of resource units where their MRC is equal to their MRP. For example, the number of workers employed when the wage (MRC) is $12 will be 2; the number of workers hired when the wage (MRC) is $6 will be 5. In each case, it is the point where the wage (MRC of the worker) equals the MRP of the last worker. d. This rule is very similar to the MR = MC rule for determining the profit‐ maximizing output for a firm. B. The theory for a firm selling its product in an imperfectly competitive product market (“price maker”) and hiring its resources in a purely competitive resource market (“wage taker”). 1. Using Table 12.2: a. Note that the product price decreases as more units of output are sold. b. TR = output x product price c. 2. MRP of an imperfectly competitive seller falls for two reasons: a. Marginal product diminishes, as in pure competition. b. Product price falls as output increases, because imperfectly competitive sellers face a downward‐sloping demand curve for their products (Figure 12.2 – see next page for figure). AP Microeconomics – Chapter 12 Outline 3. Resource demand of an imperfectly competitive seller is less elastic than that of a purely competitive seller. a. When the imperfectly competitive seller expands production, the marginal revenue for each additional unit falls. b. The imperfectly competitive seller must also lower its price on all earlier units, which further reduces marginal revenue below the price of the last product sold. c. As a result, when resource prices decline, purely competitive firms expand output more than imperfectly competitive firms do. C. Market demand for a resource is the sum of the individual firm demand curves for that resource. D. CONSIDER THIS … Superstars 1. Some markets are what economist Robert Frank calls “winner‐take‐all markets,” where a few of the top performers in the market receive extraordinary incomes, and the vast majority earn very little. 2. Both the product and resource markets connected with the “winner‐take‐all markets” would be characterized as imperfectly competitive, although the high earnings for the top performers do attract a large number of competitors to the resource market. 3. Top music performers such as Beyoncé Knowles receive high earnings that reflect their high MRPs from selling millions of songs and drawing thousands to concerts. V. Determinants of Resource Demand A. Changes in product demand will shift the demand for the resources that produce it in the same direction. B. Productivity (output per resource unit) changes will shift demand in same direction. The productivity of any resource can be altered in several ways. 1. Quantities of other resources AP Microeconomics – Chapter 12 Outline 2. Technical advance 3. Quality of the variable resource C. Prices of other resources will affect resource demand. 1. A change in the price of a substitute resource (capital) has two opposite effects. a. Substitution effect—lower machine prices decrease the demand for labor. b. Output effect—lower machine prices lower output costs, raise equilibrium output, and increase the demand for labor. c. These two effects work in opposite directions; the net effect depends on the magnitude of each effect. 2. A change in the price of a complementary resource causes a change in the demand for the current resource in the opposite direction. a. A decrease in the price of a complement leads to an increase in the demand for the related resource. b. If the price of a machine falls, lowering the cost of production, and the firm must have one worker for each machine, demand for workers will increase (Table 12.3). D. Occupational Employment Trends 2. Changes in labor demand affect occupational wage rates and employment. AP Microeconomics – Chapter 12 Outline 3. Fastest‐Growing Occupations (Table 12.5) 4. Most Rapidly Declining Occupations (Table 12.6) VI. Elasticity of Resource Demand A. Formula for elasticity of resource demand: B. It measures the sensitivity of producers to changes in resource prices. C. If Erd > 1, the demand is elastic; if Erd < 1, the demand is inelastic; and if Erd = 1, demand is unit‐elastic. D. Determinants of Elasticity of Demand 1. Ease of resource substitutability—the easier it is to substitute, the more elastic the demand for a specific resource. 2. Elasticity of product demand—the more elastic the product demand, the more elastic the demand for its productive resources. AP Microeconomics – Chapter 12 Outline 3. Ratio of resource cost to total cost—the larger the proportion of total production costs accounted for by a resource, the more elastic its demand. VII. Optimal Combination of Resources A. Two questions are considered. 1. What combination of resources will minimize costs at a specific level of output? 2. What combination of resources will maximize profit? B. The least‐cost rule states that costs are minimized when the last dollar spent on each resource yields the same marginal product. 1. 2. Long‐run cost curves assume that each level of output is being produced with the least‐cost combination of inputs. 3. The least‐cost production rule is analogous to Chapter 6’s utility‐maximizing combination of goods. C. The profit‐maximizing rule states that in a competitive market, the marginal revenue product must equal the resource price. (formula below) 1. 2. The profit‐maximizing rule is analogous to the MR=MC rule for maximizing profit. D. The least‐cost rule requires that the MRPs of two resources be proportionate to their prices; the profit‐maximizing rule requires that the MRPs of the two resources be equal to their prices (Table 12.7). VIII. Marginal Productivity Theory of Income Distribution A. The theory states that workers receive wages equal to the marginal contributions they make to their employers’ revenue; workers are paid according to the value of the labor services that they contribute to production. B. There are criticisms of the theory. 1. Income distribution is unequal because many resources are distributed unequally in the first place. AP Microeconomics – Chapter 12 Outline 2. Monopsony, monopoly, discrimination, and other market imperfections interfere with competitive market results. IX. LAST WORD: Input Substitution: The Case of ATMs A. Theoretically, firms achieve the least‐cost combination of inputs when the last dollar spent on each makes the same contribution to total output; the rule implies that firms will change inputs in response to technological change or changes in input prices. B. In the banking industry, ATMs are replacing human bank tellers, as firms use the least‐cost combination of inputs. 1. Between 1990 and 2000, 80,000 human tellers lost their jobs, and more positions will be eliminated in coming years. 2. ATMs are highly productive; a single machine can handle hundreds of transactions daily and millions over the course of several years. 3. The more productive, lower‐priced ATMs have reduced the demand for a substitute in production.