Declaration of Sandeep Gupta

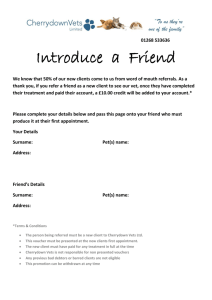

advertisement