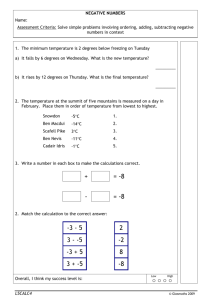

GLO-BUS: An Online Simulation for Developing Winning

advertisement

GLO-BUS: An Online Simulation

to Develop Winning Strategies

BADM 510 GLOBAL BUSINESS

www.glo-bus.com

Ben A. Kahn MCLA

Outline

Overview: Learning objectives … What is GLO-BUS and

how does it work? … Scenarios and strategic options

Getting Started: Registration … Corporate lobby page …

Naming your company

Decisions, Decisions … :

Product, pricing, marketing … Determinants of sales and shares

Assembly and shipping

Compensation and labor … PAT decisions

Financing

Special order option

A Battle of Strategies: Reports

Course Grade: Quizzes … Performance and scores …

Strategic plans … Peer evaluations

Procedures, Schedule, Tips, Questions?

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510 Strategic Management

MCLA / U Albany

Overview of a Simulation

NLR’s Research Flight Simulator

A business simulation puts you and your co-managers in

as realistic a company and competitive market setting as

possible and has you manage all the company’s operations

Teams make a set of decisions for a simulated firm

This not only allows you to test your ideas about how to run a

company but the “live case” nature of a simulation also provides

prompt feedback on the outcomes of your decisions

These are evaluated against decisions made by competitors

comprised of other class members

Decisions are entered into a PC that compares the relative

“merit” of the decisions made by all teams

“Firms” that “win” the simulation:

1.

2.

3.

4.

do an outstanding job of tracking competitors

analyze their own performance

work as a team

… and don’t shoot themselves in the foot

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Learning Objectives

NLR’s Research Flight Simulator

GLO-BUS is an online, PC-based exercise

where your team runs a digital camera

company in head-to-head competition

against companies run by other class

members

Objective: “To successfully operate a multi-

product firm in the international environment”

Your challenge: Craft and execute a strategy

for your company which, when pitted against

the strategies of rival companies, proves capable

of consistently delivering good bottom-line

results and building shareholder value

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510 Strategic Management

MCLA / U Albany

Learning Objectives (Cont’d.)

NLR’s Research Flight Simulator

Competing against rivals will give you a chance to

apply theory to practice in crafting and executing a

strategy in a globally competitive marketplace:

Your team must chart a long-term corporate direction, set and

achieve strategic and financial objectives, and adapt to changing

industry and competitive conditions

Your team must analyze a full array of industry statistics, examine

company operating reports and financial statements, consider

import duties and fluctuating exchange rates and interest rates, and

understand an assortment of benchmarking data and competitive

intelligence on what rivals are doing

Your team must match strategic wits with the managers of rival

companies, “think strategically” about your company’s competitive

market position, and figure out the kinds of actions it should take to

out-compete rivals in satisfying shareholder expectations

These are the heart and soul of business

strategy!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Learning Objectives (Cont’d.)

NLR’s Research Flight Simulator

In addition, GLO-BUS is designed expressly to provide

you with a hands-on, learn-by-doing experience that will:

Integrate business functions and consolidate your knowledge

about the different aspects of running a company in creating

a cohesive strategy

Deepen your understanding of cause-effect and revenue-costprofit relationships based on sound business and economic

principles, hence build your confidence in utilizing the

information contained in company financial statements and

operating reports

Provide you with practice in sizing up a company’s strategic

situation, making sound, responsible business decisions, and

being held accountable for delivering good results

Provide a capstone experience for your business school

education that is fun and engaging!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Notable Quotable

T

“

he other teams could make

trouble for us if they win.”

Yogi

Berra, one of the most-quoted

sports figures, famous for fracturing

the English language in provocative,

interesting, and nonsensical ways

popularly known as “yogi-isms”

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Specifically … What Is GLOBUS?

Company operations and the functioning of

the marketplace are made as realistic as

possible, allowing you and your co-managers

to proceed rationally and logically in deciding

what to do:

Industry setting is modeled to closely approximate

the real-world characteristics of the globallycompetitive digital camera industry

Company operations are patterned after those of a

camera company that designs and produces its

digital cameras at a company-operated plant and

that also outsources some of its cameras from

contract manufacturers

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

How Does GLO-BUS Work?

Virtually all GLO-BUS activities take place online

All you need is an Internet connection and a PC installed with

both Internet Explorer and Microsoft Excel

You can either gather around the same PC for all GLOBUS sessions or you can use different PCs

GLO-BUS automatically transfers the needed software

from the GLO-BUS server to the PC you are working

on very quickly (within a couple of minutes even on a

slow connection); when you exit a session, your work

is saved and transferred back to the server

Note: The last decisions saved to the GLO-BUS

server at the time of the decision deadline are

the ones used to generate the results!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

The Scenario of Your Firm

All companies start out on the same footing

Equal sales volume, global market share, revenues,

profits, costs, digital camera quality, etc.

Each decision period represents one year

Operations began 5 years ago, so the first set of

decisions is for Year 6

Your company is selling close to 800,000 entry-level

cameras and 200,000 multi-featured cameras annually

Prior-year revenues were $206 million; net earnings

were $20 million ($2 per share of common stock); stock

price was $30 per share

The company is in sound financial condition, performing

fine, with products well-regarded by digital camera users

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

The Scenario (Cont’d.)

Distinct product offerings:

Worldwide marketplace:

“Entry-level” (price) +

“multi-featured” (quality)

Headquarters and production

at Taiwan plant

Sales activities can be

pursued in North America

(Toronto regional sales

office), Latin America (Sao

Paulo), Europe-Africa

(Milan), and Asia Pacific

(Singapore)

8 potential market

segments:

2 product categories x 4

geographic areas

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

The Scenario (Cont’d.)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Strategic Options

There is wide strategic latitude in staking out a market

position and striving for good performance … There’s

no built-in bias that favors any one strategy:

Companies can pursue a competitive advantage keyed to

low-cost/low-price

top-of-the-line camera quality and performance

more value for the money (“good products at low prices”)

Companies can have a strategy aimed at being the clear

market leader in (a) entry-level cameras or (b) multi-featured

cameras or (c) both

Companies can focus on one or two geographic regions or

strive for geographic balance or even global dominance

Companies can pursue essentially the same strategy

worldwide or craft slightly or very different strategies for the

Europe-Africa, Asia-Pacific, Latin America, and North America

markets

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Strategic Options (Cont’d.)

No One Strategy Is “Best”:

Most any well-conceived, well-executed competitive approach

can succeed, provided it is not overpowered by the strategies

of competitors or defeated by too many copycat strategies

that dilute its effectiveness

Strategies that deliver the best performance depend on the

strength and interplay of the strategies employed by rival

companies

Results depend on your analysis, planning, and decision making

process

… there is no mystery “silver bullet” decision combination that players

are challenged to discover!

Decisions must be consistent and compatible

The most efficient method of organizing is to assign a particular

person or persons to one aspect of your company (function,

product, geography, etc.) … and one person may be assigned as

Chief Financial Officer and/or Chief Information Officer

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Strategic Options (Cont’d.)

Out-competing Rivals Is the Key to Market Success …

Stay on top of changing market and competitive conditions

Try to avoid being outmaneuvered by the actions of rival companies

Make sure your digital cameras are attractively priced and

competitively built and marketed

Just as you are trying to win business away from rival

camera companies, they are actively striving to take

camera sales away from your company

It is the competitive power of your strategy vis-à-vis the

competitive power of rivals’ strategies that is the deciding

factor in determining sales and market shares in each

product-market

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Strategic Options (Cont’d.)

GLO-BUS is all about practicing and

experiencing what it takes to develop

winning strategies in a globally

competitive marketplace:

When the exercise is over, the only things

separating the best-performing company from

those with weaker performances will be the

caliber of the decisions and strategies of the

management teams of the respective companies

It’s an exercise calculated to spur competition

and to get your competitive juices flowing

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Getting Started

How Do You Register?

Step 1: Have your assigned company registration

code handy (this code is used to put you into the

database for this specific course and to certify you

as a co-manager of your assigned industry and

company)

Step 2: Go to www.glo-bus.com

Step 3: Click on the “Student Registration” button

and enter your company registration code in the box

Step 4: Click that you are registering with a prepaid

code that came packaged with the text (or with a

credit card)

Step 5: Complete the personal registration

information (user name, password, etc.)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Getting Started (Cont’d.)

The Corporate Lobby Page:

Each time you log-on to www.glo-bus.com, you are

automatically routed to your company’s “Corporate

Lobby” Web page, the hub from which you will operate

as a co-manager of your assigned company and your

gateway to all GLO-BUS activities with links to:

Decisions and viewing/printing the results

The Participant’s Guide (manual)

The recommended decision procedures

The decision schedule (please verify!)

The two quizzes that are taken online

The 3-year strategic plans

The peer evaluations that are completed online

… and scoreboard, exchange rate adjustments, new interest

rates, upcoming deadlines, messages, co-managers log-ons

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Getting Started (Cont’d.)

Naming Your Company:

At your initial meeting, you and your co-managers

should decide on a name for your company

Your company’s name must begin with the letter

of the alphabet that you have been assigned

Names

can be up to 20 characters

To name the company, click on the link at the top of

the Corporate Lobby and enter your company’s full

name in the space provided

All company names are “public” and appear in the

GLO-BUS Statistical Review

Select

a name that you are proud of and reflects the

image you want to project to your customers,

shareholders, and other company stakeholders (Bad

example: “Hoocares”)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Notable Quotable

I

“

mage is everything!”

Andre

Agassi (in 1990 Canon ad

campaign)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Getting Started (Cont’d.)

All company co-managers can access the latest decisions

and results from any PC connected to the Internet

The Corporate Lobby screen indicates the last date at

which a co-manager saved decisions to the server and

whether other co-managers are currently logged on

All co-managers can be logged on simultaneously

If another logged-on co-manager clicks on the Save icon

and uploads new decisions to the server, you will be

notified the next time you press the Save icon – you then

have the choice of:

1.

2.

overriding the co-manager’s saved decision entries by saving your

decisions to the server; or

importing the co-manager’s decisions onto your decision screens

and overriding your own entries

Remember: The last set of decisions saved to the

server are used to process the results!!!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Decisions, Decisions …

You and your co-managers are responsible for the

following decisions each period (entered in the decision

boxes):

Total

Items Entries

Product design and performance (for each camera model)

Pricing and marketing (for each geographic area)

+ special order discount bids (begin decision #6, year 11)

Entry-level assembly and shipping (for each quarter)

Multi-function assembly and shipping (for each quarter)

Annual compensation and quarterly labor force

Financing company operations (annual equity; quarterly debt

and dividends)

Total = potential max

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

10

20

15

+7

4

4

7

60

+7

16

16

13

4

10

44/51 135/142

MCLA / U Albany

Decisions, Decisions (Cont’d.)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Let’s Go To The Demo …

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Product Design

Note!

Component costs

decrease 5%/year

Determine

productivity

“Dashboard”:

•Same for all screens

•Re-calculated instantaneously

•See “What-if” changes

• 5-10% as long as gauge rival efforts

Trade-off quality and costs

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Pricing and Marketing

Note!

•Carries over for both E-L

and M-F

•Enter zeros to withdraw

Gauge rival efforts

Based on prior year

competitive efforts

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Determinants of Sales and

Shares

Market growth 8-10% years 6-10; 4-6% thereafter

Your strategic challenge is to craft a competitive strategy

that you believe will produce the desired results when

pitted against the competitive strategies of rival

companies, region by region:

Price (enter zero to withdraw from market)

Performance/quality (P/Q) rating (currently 2½ stars)

Promotions (number, length, amount) provide price discounts

Advertising (enter zero to withdraw from market)

Number of camera models (but can reduce P/Q and productivity)

Size of dealer network (enter zero to withdraw from market)

Warranty period (claims = $50/E-L and $100/M-F)

Technical support (should be constant per camera; enter zero to

withdraw from market)

Image and reputation

P/Q and market share penetration

Tough to change momentum (loyalty results in market share stability)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

"We're pleased to report that competitor envy is running at an

all-time high as well."

Cartoon by Dave Carpenter

Copyright 2005, Harvard Business Review

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Sales and Shares (Cont’d.)

Size of Dealer Network:

12,500 retailers per region

50,000 available retailers worldwide

Sales offices for 8,000+ dealers = $3.3 million in year 5

{

100 chains/region @ $10,000 each (price-sensitive, preferring

entry-level cameras)

400 online/region @ $4,000 each

12,000 camera shops/region @ $200 each (quality-sensitive,

preferring multi-feature cameras)

20 “full-line” shops per region carry everything

Markups = 50-100%

Decision to carry = Prior-year shares + P/Q ratings +

Cumulative ad spending + Prior-year promotions

Cannot change in upcoming year

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Assembly and Shipping

Note!

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Compensation and Labor

Note!

Determine

productivity

Cost vs. productivity trade-offs to

minimize labor cost per camera (vs.

$25 for outsourcing)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

PAT Decisions

Assembly:

Max = 10% more than projected orders

Requires 1Q lead time, with peak in Q3

4-Member Product Assembly Teams:

Each requires 1 workstation

100 workstations/PATs can = 10,000 units/year

Can add up to 50 workstations/PATs per quarter @ $75K each

Productivity cut 4% per model added; 2% boost per model dropped

Labor Utilization:

Overtime @ time-and-a-half up to 30% max.

Severance for laying off full-timers = 50% base pay per worker

Utilized 80 workstations/PATs in year 5, Q4

Productivity increasing to 12,000 units/year

Full-timer = more than 2Q

Additional Costs:

Outsourcing = $25/camera (for labor)

Handling & shipping = $3/camera

Import duties = $5/E-L; $10/M-F

Depreciation = 4%/year

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financing

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financing (Cont’d.)

Collection of receivables = Last Q’s sales + 2Qs for unsold inventories

Emergency Loan: Automatic draw on (and repay of) $100 million credit

line if necessary to cover cash outflows

Pay for components, interest, taxes, and dividends in following Q

Dividends should = 2-5% stock price and < 75% EPS

Beginning equity = Common stock + Additional capital + Retained

earnings = $99.9 mill.:

Outstanding loans = $25 million

10 mill. shares outstanding; can issue 5 mill. share max per year; can

repurchase 50% per year but cannot drop below 7.5 mill.

Total equity cannot drop below $50 mill.

Stock repurchase if price ≥ $10

Credit Rating (based on 4Qs):

D/E Ratio ≈ .10 to .33

Times-interest-earned (annual operating profit/annual interest) ≈ 2 to 10

Debt payback (≈ 3 years)

Credit used (≈ 5-15%)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Decisions Printout

Compare

to results

Note: Print and check carefully!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

The Special Order Option

As the simulation progresses, your company will be given

an opportunity to bid against rivals and obtain a special

order of entry-level cameras to be assembled Q3 and

shipped to chain store retailers in time for the peak retail

demand in Q4

All interested camera-makers can bid for these orders

When the special order bid option is activated, a screen for entering

bids will appear on the decision menu

Bids are taken in each of the four geographic regions and there are

two winning bids in each region (both for 100,000 entry-level

cameras)

The winning bids are based solely on low price (with brand image

and P/Q rating as tie-breakers)

Normally, winning bidders outsource the assembly of the cameras

needed to fill these special orders

Winning bidders are shown on the Statistical Review’s

“Benchmarks” page

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Special Order (Cont’d.)

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

A Battle of Strategies

Following each year’s decisions, you’ll be provided with

“Competitive Intelligence” reports containing

information of the actions rivals took to capture the

sales and market shares they got

Note: All industry members get identical reports

Armed with this information, you will be in pretty good

position to figure out some of the strategic moves they

are likely to make in the upcoming decision period

Analyze your opponents thoroughly and develop a

game plan to defeat them …

scout their strategies

judge what they will do next

and come up with a competitive strategy of your own aimed

at “defeating” their strategies and boosting your company’s

performance

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Global Retail Sales

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Benchmarking Data

Note!

Note: Compare to decisions, costs, operations, etc.!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financials

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financials (Cont’d.)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Quarterly Snapshot

Note!

Compare competitive

efforts for any rival

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Strategic Groups

Key rivals

Niche players

Obtain for any rival

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Company Analysis

Note!

Counter potential

moves of key rivals

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Company Analysis (Cont’d.)

Note!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Production Costs

Note!

Totals and

per/camera

Monitor

costs

Note: Compare to projections!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Regional Operations

Note!

Note: Compare to projections!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financials

Note!

Note: Compare to projections!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Financials (Cont’d.)

Note: Compare to projections!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Virtuous/Vicious Cycle

Marketing

Mix

Image

P/Q

Volume

Retailers

R&D

Components

Share

Price

Productive

Equity

+ Debt

Revenues

Profits

Costs

PATs

Gears must mesh or it will be a grind!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade

50% of final grade:

10 points for 2 Quizzes

10 points for Team Reflections (cumulative) that apply

the course materials to the simulation and are the bases

for your decisions

10 points for Company Performance (2 measures)

10 points for 3-Year Strategic Plans (Decisions #46/Years 9-11 and #7-9/Years 12-14)

10 points for Group Presentation and Final Report

Adjusted by Self Evaluation and Peer Evaluations

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade (Cont’d.)

The Two Quizzes:

There are 2 “open book” 20 multiple-choice question quizzes

built into the simulation, taken online and scored immediately

upon completion

5 pts – Quiz 1 (45-minute time limit) covers the Participant’s

Guide – its purpose is to spur you to read and absorb how

things work in preparation for managing your company

Average Score = 84

5 pts – Quiz 2 (75-minute time limit) covers the Company

Operating Reports and certain information in the GLO-BUS

Statistical Review – its purpose is to check to see if you

understand the numbers and how they are calculated

Quiz 2 Average Score = 64

Click on the links for the quizzes on your “Corporate Lobby”

Web page for more information

The three sample questions for each quiz give you an idea of

what to expect

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade (Cont’d.)

Company Performance:

Board members and investors have annual performance

targets for the company, each weighted equally

1. Grow EPS at least 8% annually

through Year 10 and at least 4%

annually thereafter

2. Grow stock price about 8%

annually through Year 10 and

about 4% annually thereafter

3. Maintain ROE of 15% or more

annually

4. Maintain a B+ or higher credit

rating

5. Maintain an “image rating” of 70

or higher

Yr 5

Yr 11

Yr 14

}

}

EPS= $2.00 ≥$3.16 ≥$3.56

Stock=

$30 ≥$45.85≥$51.57

ROE= 17.5% ≥15% ≥15%

Credit=

B+

≥B+

≥B+

Image=

70

≥70

≥70

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Grow

Maintain

Notable Quotable

“

T

he digital camera industry has

reached maturity early, and the

heady growth rates will slow ...”

“Digital camera market peaked too

soon” CNET News.com (April 28,

2005) http://news.zdnet.com/21009595_22-5688981.html

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade (Cont’d.)

Company

Scoring

Performance (cont’d.):

standards used to calculate

“performance scores” for each company

Absolute:

Investors’ confidence (Did you

meet or beat the annual performance

expectations for each of the 5 performance

measures?)

Relative: Best-in-industry (How well does

your company’s performance stack up against

the company with the best 5 performance

measures?) … as long as no losses and better

than investors’ expectations!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Company Performance (Cont’d.)

Investors’

Confidence

(5 pts.)

EPS

ROE

Credit Rating

Stock Price

Image Rating

= 20%

= 20%

= 20%

= 20%

= 20%

Best-In

Industry

(5 pts.)

… or, about 1 point for

each possible cell

towards final grade

•High Score (average overall score of all first place teams at simulation end)=102

•Average Score (average overall score of all teams at simulation end)=78

•Low Score (average overall score of all last place teams at simulation end)=51

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Performance Scoreboard

Expectations:

≥100 = excellent

90-99 = very good

80-89 = good

70-79 = fair

<70 = sub-par

Best-in-industry:

Scaled on 100

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Scoreboard (Cont’d.)

Function of EPS, ROE, credit rating, dividends per

share, and achieving performance targets

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Scoreboard (Cont’d.)

The winner is not

who is ahead the

longest, only who is

in front at the end

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Notable Quotable

A

“

s you set out for Ithaka [I]

hope your road is a long one, full of

adventure, full of discovery. ... Wise

as you will have become, so full of

experience, you'll have understood

by then what these Ithakas mean.”

Konstantinos Kavafis, Ithaka (1911)

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade (Cont’d.)

The Two Strategic Plans:

Commitment to Deliver Specified Results But Permits Full Strategic

Flexibility

Modify your strategy as often and as radically as necessary in response

to unanticipated conditions as long as you meet or beat the

performance targets set forth in the plan

3-year strategic plan includes

A strategic vision for the company

Objectives for EPS, ROE, credit rating, image rating, and stock price

appreciation

To get a “good” performance score requires that a company achieve

performance levels at least commensurate with investor expectations each

year

“Bonus scores” for setting “stretch objectives” that are higher than the

investor minimum performance targets and then meet or beat these stretch

targets

Proportional points are awarded for under-achieving the target

Declare a strategy for entry-level and multi-featured cameras

Prepare a “pro forma” income statement that projects unit camera

sales, revenues, prices, and costs per camera for each of the four

geographic regions

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Course Grade (Cont’d.)

Peer Evaluations:

At the end of the exercise, you will be asked to

complete a 12-question evaluation of each of

your co-managers and a self- evaluation of your

own performance

Used

to make final individual adjustments

These are completed online and can be

reviewed by clicking on the Peer Evaluation Link

on your Corporate Lobby Web page

Are for your instructor only and are completely

confidential … Please complete them in an

honest and professional manner

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Some Procedures

Follow the “Suggested Decision Procedures”

Decision Schedule link on your Corporate Lobby Web

page has dates and deadlines for the decisions

See the link on your Corporate Lobby Web page

The decision deadlines are strictly enforced since the

results are processed automatically on the GLO-BUS servers

immediately following the deadline

The results of each decision will be available online

one hour following the decision deadline (and usually

15 minutes)

You will be notified via e-mail as soon as the results

are ready

At that point you can log-on, see what happened, and

proceed with the next decision

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Schedule

Decision

Deadline For Saving Entries

Practice Decision 1 - Practice Year 6

30-Jan-08

7:00 pm

Practice Decision 2 - Practice Year 7

6-Feb-08

7:00 pm

Quiz 1

6-Feb-08

9:00 pm

End of Practice Period (Data reset to Year 6

and practice results are no longer available)

7-Feb-08

11:59 pm

Decision 1 - Year 6

13-Feb-08

7:00 pm

Decision 2 - Year 7

20-Feb-08

7:00 pm

Decision 3 - Year 8

27-Feb-08

7:00 pm

Quiz 2

27-Feb-08

9:00 pm

3-Year Strategic Plan

5-Mar-08

7:00 pm

Decision 4 - Year 9

5-Mar-08

7:00 pm

Decision 5 - Year 10

12-Mar-08

7:00 pm

Decision 6 - Year 11

19-Mar-08

7:00 pm

3-Year Strategic Plan

2-Apr-08

7:00 pm

Decision 7 - Year 12

2-Apr-08

7:00 pm

Decision 8 - Year 13

9-Apr-08

7:00 pm

Decision 9 - Year 14

16-Apr-08

7:00 pm

End-of-Game Peer Evaluations Available

23-Apr-08

6:00 pm

Decision 10 - Year 15

23-Apr-08

7:00 pm

Company Presentations

30-Apr-08

6:00 pm

Note: See GLO-BUS

schedule for precise

deadlines for all simulation

activities; please notify

instructor of any

discrepancies

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Tips for Success

Use the practice decision to become fully

acquainted with the menus and functionality built

into the screens

Make full use of all the “Help/More Info” sections

Be professional!

Run the company in a serious manner:

Practice making business decisions, learn to craft winning

strategies in a competitive market, and take responsibility for

the results of your actions

Don’t be imprudent, highly risky, or un-businesslike (that

would get you fired in a real company):

Who shoots from the hip almost always shoots themselves in

the foot

Don’t be a daring adventurer out to win some variant of a

videogame by making wild decisions and testing the limits of the

simulation

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Tips for Success (Cont’d.)

Lessons Learned from the Past

Do know the business

strategy and stick to it

… build the needed

infrastructure and develop the

business model to support your

strategy

Do invest early and often

... be internally consistent

… initial decisions are critical but

watch out for dead ends

… organization and complete

member involvement

or you will be “stuck in the

middle”

promises

… use to examine small changes

Don’t try to “game (or blame)

the system”

… watch the competition to

make rapid adjustments

Don’t treat projections as

… being average is mediocre

Don’t follow others

Do create effective decision

making process

Don’t be “all things to all people”

Do craft “customer value”

… benchmark rivals and self

Do agree on a long-term

… evaluate the feasibility and

risks of sustaining your strategy

Don’t panic or make radical

moves

… be patient but persistent

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Notable Quotable

C

“

ontrol your own destiny …

Or someone else will!”

Jack

Welch, former GE CEO

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Questions?

Please

eliminate the “middle man”!

Use

the “help/more info.” screens

Contact GLO-BUS Technical Support

Team:

Send

a message, submit a request, or ask a

question at http://www.globus.com/feedback.html

Phone (205) 348-8923

…

but also notify instructor of issue and

response!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Good Luck!!!

Ben A. Kahn / Paul Miesing “GLO-BUS” BADM 510-70 Strategic Management

MCLA / U Albany

Dedicated to the Memory of My Son, Solomon Sharone Cyrus Jochnowitz-Kahn

University of Rochester, Class of 2010

“I Want to Live, Go to College, and Help People

to Make This World A Better Place.”

My Name Is Rocky Balboa

My Name is Rocky Balbao

I am Soly’s Dog