Best Buy - SAE Design

advertisement

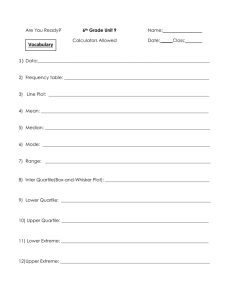

Best Buy Company Inc. Research Analysis Shannon A. Ebert Retail Management- MRKT 480 Professor Chris Ward 10 October 2014 1 Table of Contents I. Background ………………………………………………………………………………3 II. Mission Statement…………………………………………………………………………3 III. Current Chief Executive Officer (CEO) and History……………………………………3 IV. Michael Porter’s Five Forces Model……………………………………………………..…4-5 V. Strengths, Weaknesses, Opportunities, and Threats (S.W.O.T. analysis) ………...…...……5-6 VI. Strategy for Rate of Expansion………………………………………………………………..6 VII. Store Demographics…………………………………………………………………….……7 VIII. Sustainability……………………………………………………………….…………..……7 IX. Recent News…………………………………………………………………..………….…7-8 X. Target Market…………………………………………………………………..………………8 XI. Company Life Cycle…………………………………………………………………..………8 XII. Pricing Policies and Product Offerings………………………………………………………8 XIII. Competition, Marketing Strategies, and Business Strategies………………………….……9 XIV. Social Media Marketing……………………………………………………..………………9 XV. Stock Pricing…………………………………………………………………..……………10 XVI. Financial Ratios……………………………………………………………………...…10-11 XVII. Financial Ratio Analysis…………………………………………………………………..11 XVIII. Cash Flow Analysis…………………………………………………………………………….……...…12-14 XIX. Appendix (Financial Statements, Calculations, Works Cited)………………………….…15 2 I. Background Richard M. Schulze founded Sound of Music in 1966, and sold high quality stereos. During this first year the company was able to buy out two of its competitors and reach profits of over 50,000 dollars. By 1969, the company became a part of the NASDAQ exchange. In 1983, Sound of Music was revolutionized and renamed Best Buy Company Incorporated. This organization is multichannel in the technology retail industry, operating both domestically and internationally. They offer a variety of technology products such as computers, phones, tablets, appliances, and televisions. Along with their products, Best Buy also provides services such as technical support, repairs, and installations. Some of their segmented brands include Best Buy Mobile, Five Star, Future Shop, Geek Squad, Magnolia Audio Video, and Pacific Sales. Today, Best Buy has successfully developed a recognizable, substantial brand that continues to be a powerhouse in the retail industry. II. Mission Statement The mission statement for Best Buy Inc. reads, "Our formula is simple: we’re a growth company focused on better solving the unmet needs of our customers—and we rely on our employees to solve those puzzles. Thanks for stopping.” One short phrase may be small in length, but large in its value. This vision statement communicates to investors, employees, and customers the strong beliefs and goals that this firm strives for. Utilizing strengths of employees, developing relationships with customers, and exceeding expectations with investors are just some of the other goals associated with the company’s mission statements. Another important slogan that Best Buy uses reads, “People. Technology. And the pursuit of happiness.” This message is geared more internally, toward employees and management. It serves as the corporate vision, allowing the company to communicate and implement a common goal from within. In order to implement these statements, Best Buy works to have happy customers, shareholders, investors, and community. III. Current Chief Executive Officer (CEO) and History Best Buy’s previous CEO, Brian Dunn, stepped down from office in April, causing confliction internally and externally throughout the company. Fortunately, Best Buy was proud to hire Hubert Joly, known as “Mr. Fix It,” in early September of 2012, and he remains in office today. He has impressive credentials and years of professional experience to contribute to the enhancement of the company. Originally, Joly grew up in France where he graduated from HEC Paris with a Business Administration degree, and then he pursued his Public Administration degree from Institut d’Etudes Politiques de Paris. Previously, Hubert Joly worked for Mckinsey (14 years), became president of EDS in France in 1996, and then became CEO of Vivendi Universal Games. Right before Best Buy, he worked for a hospitality company known as Carlson, based in Minnesota, where he held the CEO position. These credentials support is personal and professional success. Today, Best Buy has continued to improve since being under the head management of Hubert Joly. 3 IV. Michael Porter’s Five Forces Model The Michael E. Porter Model helps one to determine the strengths and weaknesses of any industry. This method narrows down different areas of the economy to help discover which ones are attractive and profitable, and also defines a company’s corporate strategy. Competition in the industry, potential of new entrants into industry, power of suppliers, power of customers, and threat of substitute products are all factors this model analyzes. Competition HIGH Online Retailers Digital Content Distributors Specialized Stores Big Box General Retail Stores Ex: Amazon, Walmart, eBay, Costco, Radio Shack, Game Stop, Target Potential of New Entrants into Industry Low Power of Suppliers Power of Customers Threat of Substitutes High Low Low New companies must have financial resources. Greatly influence price Competitive Pricing Searching Tools Carry Highest Quality Products Great influence product offerings. Online Shopping Loyal Customers Provide Price Match Guarantee Well-established Quality Brand Top 20 Retailers make up 60% or Profits Trusted by Customers Develops & Regulates Customer Base Sufficiently Differentiated Ex: Apple, Sony, Panasonic, Dell, and Toshiba Buy in Small Quantities Rely on Repeat Purchases Price Match Guarantee Work to Keep up with buying trends (digital downloads, online services) Provide Quality Products and SERVICES compared to others Best Buy’s direct competitors include Amazon, Walmart, eBay, Radio Shack, Game Stop, Target, and Costco. These are all retail companies that supply similar products to Best Buy. Some stores such as Walmart, Target, and Costco offer a variety of different products aside from electronics. Amazon and eBay are major e-commerce retailers, while Game Stop specializes in just video games, and Radio Shack focuses on small electronics. Best Buy has an advantage, because they are the largest big box store that specializes in the sale of electronics, and they also offer the greatest assortment. Compared to the other retailers, this tough, highly innovative industry can be just as difficult to enter as any other industry. On average, a big box electronic retailer will spend 15 million dollars as an initial investment to open a store. Since technology is rapidly changing, new markets are opening up when one least expects it, so in theory, there are not many barriers to enter and exit the market besides the financial component. The advantage Best Buy has is that it is one of the few physical stores that provide such a large variety of products. They rely heavily on suppliers such as Apple, Sony, Panasonic, Dell, and Toshiba. The top 20 suppliers make up about 60% of Best Buy’s merchandise. In order to provide top of the line products, the company must be on good terms with their suppliers, otherwise Best Buy could lose customer base. Suppliers do “call the shots” regarding price and product offerings. They provide Best Buy with the top of the line products, and all Best Buy has to do is make the purchase. This is one way to ensure that quality is taken care of, because the product liability is on the supplier. Along with supplier influence, comes the bargaining power of customers as well. 4 In recent years, online shopping has influenced customer purchasing power significantly. About 81% of customers research product prices online among competitors, especially for electronics, before making their purchase. Customers do not have a strong bargaining power, because most buy in small quantities. Also, Best Buy promises the best price and a price match guarantee. The final component of this analysis looks at the threat of substitutes. With this, Best Buy must deal with electronic/e-commerce retailers, digital content distributors, and other big box general retailers. Electronic/e-commerce retailers provide a convenient shopping experience, offering consumers a large variety of products, a low price, and home delivery. Digital content distributors such as Netflix, Xbox, and iTunes offer a unique way for customers to purchase their products. Lastly, big box retailers offer a vast diversity of products from food to apparel to electronics. These do not create a major threat regarding substituting products, but substituting brand names. People may chose to buy the same products at one of Best Buy’s competitors, because that competitor might satisfy the consumers particular shopping needs. V. Strengths, Weaknesses, Opportunities, and Threats (S.W.O.T. analysis) Strengths of Best Buy include the size, quality services, product offerings, inventory management, niche marketing, and reputation development. They have done an outstanding job developing brand recognition, especially with their large domestic and global distribution channels. Their brand name itself makes it easy to increase profit margins. Unique services, such as the Geek Squad and providing installations, have contributed to their differentiation from other retail electronic stores. Separate services such as these give them opportunity for specialized stores under their brand name (basically another way to make money.) Along with this, Best Buy has continued to perform excellent services that exceed customer expectations. This is what they are known for. Another strength is inventory management, because this company is able locate niche markets at various locations, and they always have products on their shelves that customers demand. This contributes to a stable increase in sales overall. All these strengths lead to the development of Best Buy’s positive and notable reputation. Weaknesses are present in any company. For Best Buy, they struggle with senior leadership turnover, weakening finances, global expansion, competition, new technology and innovation, and too many brands. Top management for the company has changed more rapidly than ideal. Chief Executive Officer (CEO) Brian Dunn, stepped down in April, and then Hubert Joly replaced him. Issues in authority and leadership caused problems with the infrastructure of the company. Although Best Buy appears to be successful, on paper they are struggling financially. Strategic marketing and planning in international markets has continued to be an area Best Buy lacks in. Domestic purchases make up a major portion of their sales, but they are sacrificing this ratio so that they can continue to compete globally. Continuing to increase profits domestically is the only aspect that is keeping the company afloat in foreign markets. Competition continues to increase as new technology and innovative products are developed. E-commerce retailing has transformed the industry, and as Amazon’s sales continue to grow, Best Buy’s continue to decrease. In regards to brands, the company focuses too heavily on niche marketing, creating affordable products, and needs to bring attention to the market they could take advantage of for higher end items. 5 Opportunities arise in the mist of these strengths and weaknesses. Changes in economic and lifestyle trends in today’s society are key areas Best Buy could take advantage of. Some of these trends include emerging global markets, growth of mobile technology, increased need for IT support, and the increase in online shopping. The world is “becoming smaller,” as more trade barriers come tumbling down, allowing companies to join global markets. Best Buy has already jumped the gun on this opportunity, but potential markets arise everywhere, every day, all over the world. The growth of mobile technology and smart phones has allowed communication to be performed instantaneously, at a greater convenience, and more efficiently. An increasing need for IT support is also present today, because as technology continues to advance it becomes more difficult for the “average Joe” to conduct repairs alone. One of this company’s major competitors is Amazon, but Best Buy is not just competing with them as a company, but the entire online shopping industry. Amazon has become a competitor with all major retail stores, but if Best Buy can create their own advantage and efficient process to online shopping for their store, it could create success for them. Threats are the final area of this analysis, in which it seems Best Buy has had many in recent years. Some topics include shareholder lawsuits, limited suppliers, wholesalers becoming competitors, online retailers taking over market, and other competitors entering the markets. They have experienced lawsuits with their shareholders, causing bad publicity for the company. This has affected the price of their stock. Also, Best Buy has limited suppliers and sources to obtain inventory at a consistent price. Since there is a high bargaining power of suppliers, they must be in constant negotiation with them, since they “call the shots” in regards to product price and product offering. Some suppliers are even becoming wholesalers such as Apple. This takes away business and sales from Best Buy. As online retailing continues to grow, the threat of this taking over the industry is high. Rumors have even leaked that Amazon has debated buying Best Buy out. As with any other industry, there is always the threat of new competitors entering the market. This is often difficult to predict. Overall, this S.W.O.T. paints a sufficient image of the strengths, weaknesses, opportunities, and threats for the company so they can strategically plan and prepare for the future. VI. Strategy for Rate of Expansion Best Buy plans to continue to grow in global markets. Most of their revenues are obtained domestically, and foreign markets are very expensive to transition into. In order to expand globally, they must raise capital and focus their growth here in the U.S. Traditionally, Best Buy has been known to provide cutting edge consumer electronics. When their largest competitor, Circuit City, went out of business, Best Buy obtained leverage of the market. They plan to take advantage of opportunities in cloud computing, virtual sales, and affiliate marketing. Since Best Buy has already developed a highly recognizable brand and infrastructure, they plan to utilize this advantage, and continue to push for growth. The goal is to increase sales to small and medium size businesses and to increase the sale of their goods and service through e-commerce, so that they can be offered worldwide. When more capital is obtained domestically, Best Buy will continue to channel more funds to grow business on an international scale to countries such as Canada, Mexico, and China. 6 VII. Store Demographics Most Best Buy stores are located in suburban areas in shopping outlet strips. Locations are free and stand-alone, as one can depict from their storefront design, and they are a destination store. A unique component of their distribution is the availability of products in Kiosks such as in airports. In plain terms, this is basically a Best Buy vending machine for consumers to conveniently purchase products. This mechanism creates a higher elasticity for the price of these products at this location, because the demand will be higher, and there is a higher chance of an impulse purchase decision. Most stores are full-sized retail stores, but there are also specific stores that segment their brand such as Best Buy Mobile. This brand focuses specifically on mobile phones. Best Buy Mobile stores are mostly located in malls. In terms of size and number, in 2013 Best Buy had 1,990 stores operating with a total square footage of 55,785,000, making the average size 28,032 square feet. VIII. Sustainability “Going Green” is a strong initiative for society to be more aware of the environment and their footprint they leave behind. Best Buy has taken strong initiatives to become more sustainable. Their goal can be divided into a couple different areas: grow our green business, recycling efforts, carbon footprint reduction, and innovative green solutions. Energy Star is a part of their appliance and electronic product line, which allows them to use less energy to operate. Also, items are packaged in non-toxic materials. For recycling efforts, stores recycle internally and provide end of life solutions for one’s old electronics. Leed and green building standards and efficient lighting in stores is part of carbon footprint reduction. Finally, Best Buy ensures a diverse network of contributors and new green customer solutions. Becoming eco-friendly is becoming a more important part of the company’s brand. As an electronic company, consumers are setting expectations for Best Buy to be very social responsible, which includes following the major trend of worldwide sustainability and conservation efforts. IX. Recent News “Best Buy Thinks Television is the Future of its Business.” September 29, 2014. Best Buy believes that its new televisions will be a hit in the next few years. They are working with Samsung and Sony to show case new televisions that are said to have a display four times better than high definition. “The iPhone 6 is a Gift for Best Buy.” September 22, 2014. History has shown that the release if a new iPhone creates a sufficient boost, anywhere from 2%-2.5%, to mobile revenue. “Should Amazon Acquire Best Buy or Radio Shack?” September 15, 2014. Amazon reports having about 8 billion dollars in cash. This arises a controversial decision, as Amazon debates the pros and cons of buying Best Buy or Radio Shack. 7 “Best Buy Sees Revenue Shrink as Shoppers Shift Online.” August 26, 2014. Amazon has continued to rapidly increase profits while Best Buy’s are falling. Today, they have to not only compete with Amazon, but the entire e-commerce industry to stay afloat. X. Target Market Best Buy’s target market consists of small sized businesses, medium sized businesses, software companies, game developers, and small music and movie producers. In regarding people and demographics, their market has more recently targeted wealthy suburban families, trendy urban residents, and close-knit families of Middle Americans. Best Buy customers do not tend to buy a large quantity of products. Most buy a small quantity, in which they purchase a high quality product at a low cost. This means that the company relies heavily on repeat buyers. XI. Company Life Cycle The company appears to be entering the end of its life cycle. With sales moving online, they are having a hard time competing with the e-commerce industry. Even with strong strategic differentiation efforts and quality perception of products/services, Best Buy is still struggling. In today’s society, the norm of purchasing electronics is moving from physical full-service stores like Best Buy to e-commerce. They are stuck with high overhead costs, expensive employee training, and too much space for inventory, unlike their competitor, Amazon. There have been rumors that Amazon is considering the possibility of buying Best Buy. Even a rumor such as this indicates that this company is nearing the end of its life cycle. XII. Pricing Policies and Product Offerings Best Buy Inc. is a company that focuses on selling electronics. Their main departments include consumer electronics, computing and mobile devices, entertainment, appliances, services, and other. Each of these makes up a certain percentage of the total revenue. Consumer electronics make up 20%, computing and mobile phones 55%, entertainment 5%, appliances 10%, services 9%, and other <1%. Best Buy relies on increasing the gross margin on products that are sold in their major departments (consumer electronics and computing/mobile phones), which helps contribute to profit maximization. This is their pricing strategy. Other pricing policies include their promise to match competitors and any price on the market for the same product. Price matching is a growing trend continuing to reshape the retail industry. Due to the massive increase in instantaneous multimedia communication, such as mobile applications, finding the lowest price is essential to consumers. This created highly competitive prices. Best Buy is said to be in a constant “price war” with Walmart. Some of their service components that set them apart include their popular Geek Squad brand, installations, and free “haul away.” Best Buy also offers special product services and replacement plans. These are all advantages the company relies on to keep themselves differentiated in today’s market. 8 XIII. Competition, Marketing Strategies, and Business Strategies Competition for Best Buy has been significantly increasing in recent years. In the past, competition was not as fierce, especially with the closing of competitors such as Circuit City and CompUSA. Today, the growth of online consumer shopping has created competition in all industries. With a rise in price matching and trade-in programs, Best Buy has been forced to step up their game. Best Buy is a physical store and requires a heavy investment in inventory, overhead, property, and employees to operate, where as major competitors such as Amazon and eBay are fully online retailers that are changing the industry, and they do not require these investments. In order to make up for the changing industry, Best Buy uses specific marketing and business strategies. In order to compete, their strategy must change from differentiation to specifically a focused differentiation. They can achieve this by limiting the variety of their products. Instead of carrying a large variety, Best Buy will chose to carry leading consumer electronics, and not products that are saturated in the market. In each of the departments previously discussed, they will simply carry the most current product in each department, which takes advantage of public interest and allows for greater expertise. Their new strategy will create an alternation in internal systems, location, sales (transition to online shopping), and customer services. XIV. Social Media Marketing Social Media continues to grow in popularity as an inexpensive, yet effective marketing tool. Brad Smith is the Director of Interactive Marketing & Emerging Media of the company. He manages all the social media marketing. He believes that when using social media, Best Buy must focus on making the customer the priority and providing communication. Brad aims to engage and influence customers. Their Social Media Marketing Mission Statement reads: “To connect customers and employees with the Best Buy brand and each other through the right tools, platforms, and collaboration delivered when, where and how they want.” The channels Best Buy utilizes are their community forum, Best Buy IdeaX, Facebook Fan page, and Twitter page. Brad Smith understands that people are bombarded with marketing messages every day that they tend to tune them out. Customers simply do not listen to marketers and advertisers today. Best Buy has guidelines with their social media that include making it social, being authentic, keeping it simple, easily accessible, about the people, and transparent. 9 XV. Stock Pricing XVI. Financial Ratios SIC Code: 5731 Quick Ratio Upper Quartile 2.4 Solvency Middle 1.1 Lower Quartile 0.4 Best Buy 0.5 Current Ratio 3.4 2.0 1.2 1.47 Current Liabilities to Net Worth Current Liabilities to Inventory Total Liabilities to Net Worth Fixed Assets to 22.6 47.5 117.4 156 62.7 130.5 218.4 131 24.5 71.4 147.2 156 10.8 21.3 58.6 57 10 Net Worth Collection Period Sales to Inventory Assets to Sales Sales to Net Working Capital Accounts Payable to Sales Return on Sales Return on Assets Return on Net Worth Upper Quartile 7.7 19 Efficiency Middle 23.7 9.4 Lower Quartile 42.7 5.6 Best Buy 0.96 1.31 22.5 13.8 36.9 7.3 53.1 4.1 30.18 .14 3.3 5.6 8.8 10.74 Lower Quartile 0.3 0.8 2.2 Best Buy 100.4 3.3 10.5 Upper Quartile 5 15.5 29.9 Profitability Middle 2.2 4.6 9.7 XVII. Financial Ratio Analysis Financial ratios paint a picture of how a company is doing and can be compared to other companies in their industry. The ratios for Best Buy are listed above. In the solvency section, ratios are evaluated to determine how well the company can “pay its debts.” The quick ratio, current ratio, and fixed assets to net worth fall between the lower and middle quartile. Current liabilities to net worth and total liabilities to net worth both fall below the lower quartile, while current liabilities to inventory falls in the upper quartile. These numbers indicate the Best Buy has more liabilities than assets and does a poor job paying off their debts compared to other companies in their industry. In the efficiency section, it indicates the company’s ability to achieve maximum productivity with minimal waste. Best Buy’s collection period falls above the upper quartile, while the assets to sales ratio falls in the upper quartile. Sales to inventory, sales to net working capital, and accounts payable to sales all fall below the lower quartile. These ratios indicate that Best Buy does a below average job being efficient in their operations. The final section is profitability, which shows the businesses ability to obtain a financial gain. Return on sales falls above the upper quartile, return on net worth falls in the upper quartile, and return on assets is close to the middle quartile. These ratios indicate that the company does on decent job turning over profits compared to other companies in their industry. Overall, most of Best Buy’s financial ratios fall in the lower quartiles, supporting the previous statement that the company is reaching the end of its life cycle. XVIII. Cash Flow Analysis 11 SCF- Question 1 Is the SCF dated in the title for a period of time similar to the income statement or for a point in time similar to the balance sheet? Why? The cash flow statement is dated similar to the income statement (both show may of 2013 and May of 2014) while the balance sheet is different (shows May 2014, February 2014, and May 2013.) The cash flow statement is dated similar to the income statement, because both of these statements provide the necessary information to form the balance sheet (cash amount and net income.) SCF- Question 2 Identify the following sections of the SCF and record the amounts. Check the math by summing to the cash balance at the end of year. Verify that the ending cash balance reported on the SCF is the same as reported on the balance sheet. Section Net operating cash flows Net investing cash flows Net financing cash flows Net increase (decrease) in cash flows Cash balance at beginning of year Cash balance at end of year Does the total match balance sheet cash? Current Year 308 -362 -53 -109 2678 -5 -116 -641 -755 1826 2569 1071 Yes/No Prior Year Second Prior Year Yes/No SCF- Question 3 12 Record net sales, net income and net operating cash flows below. All three should be trending in approximately the same direction. If so, this is a sign of well-run business. If one or more are going in a different direction, or random, then you must keep an eye open for an explanation why. Item Current Year Prior Year Net Sales 461 -73 Net Income 463 -111 Net Operating Cash Flows 308 -5 Second Prior Year Explain why net sales, net income and net operating cash flows are trending together or differently. (Hint: Look at depreciation expense and substantial changes in inventory, accounts receivable and accounts payable balances. Explaining why is a key learning point.) Net operating cash flows occur internally. If net operating income is going well, it will allow for an increase in net income overall and an increase in sales. If cash flow is not operating well internally, neither will net sales or net income. SCF- Question 4 Identify the primary cash outflows and inflows from investing activities. Description of Activity Cash outflow: Purchase of Investments Cash inflow: Sales of Investments Amount -496 224 Consider three key issues at this point. Is the company adding assets? This is a sign of growth. Is the company replacing assets? This is a sign of growth and stability. Is the company only selling assets? This is a sign of retrenchment. Best Buy has bought over 496 million dollars worth of investment and has sold 224 millions dollars worth. This indicates that the company is purchasing more assets than it is selling, which means that they are expanding/growing. 13 SCF- Question 5 Identify the primary cash inflow and outflow from financing activities. Description of Activity Amount Cash inflow: Issuance of Common Stock 9 Cash outflow: (Note: cash dividends paid are reported here.) Repayment of Debt -59 Consider two key issues at this point. How is the company being financed, through debt or equity? Can you determine which is growing faster and why? A sound corporate strategy is to finance a company with debt during stable times, because this demands regular payment of principal and interest, and to finance a company with equity during unstable times, because leadership can elect to pay or not pay dividends. Best Buy has a negative cash flow of -59 and a cash inflow of 9. Since there outflow is drastically less than the inflow and it is negative, the company is being financed by debt. Also, since the ratio is so unbalanced, this indicates that cash outflow is growing faster since the economy is becoming more stable. From this cash flow statement, one can see that Best Buy’s ending cash flow does match the amount on the balance sheet. Their cash flow and income statement are both released together, before the balance sheet. Net sales, net income and net operating cash flows are trending together. Best Buy’s purchase of investments exceeds their sale of investments, meaning that they are expanding. Finally, the company uses debt financing to operate. 14 XIX. Appendix Financial Ratios Current Ratio Total Current Assets ÷ Total Current Liabilities 10,118 / 6880 = 1.47 Quick (Acid Test) Ratio (Cash + Net Receivables) ÷ Total Current Liabilities (2569=871) / 6880 = 0.5 Current Liabilities to Net Worth Total Current Liabilities ÷ Net Worth 6880 / 4421 = 1.56 Current Liabilities to Inventory Total Current Liabilities ÷ Inventory 6880 / 5255 = 1.31 Total Liabilities to Net Worth Total Liabilities ÷ Net Worth 6880 / 4421 = 1.56 Fixed Assets to Net Worth Fixed Assets ÷ Net Worth 2525 / 4421 = 0.57 Collection Period (Net Receivables ÷ Net Sales) * 365 (871 / 9035) * 365 = 0.096 Sales to Inventory Net Sales ÷ Inventory 9035 / 6880 = 1.31 Assets to Sales Total Assets ÷ Net Sales 13911 / 461 = 30.18 Sales to Net Working Capital Net Sales ÷ (Current Assets - Current Liabilities) 461 / (10118 – 6880) = 0.14 Accounts Payable to Sales Accounts Payable ÷ Net Sales 4952 / 461 = 10.74 Return on Sales (Profit Margin) Net Profit ÷ Net Sales 463 / 461 = 1.004 Return on Assets Net Profit ÷ Total Assets 463 / 13911 = 0.033 15 Works Cited Bensen, S., A. El Haddi, K.Fitzsimmons, A. Hussein, H. Marotske. “Best Buy Corporation: Strategic Management Analysis.” Academia. 05 Nov 2012. Web. 02 Oct 2014. “Best Buy Co. Inc.” Reuters. 08 Oct 2014. Web. 04 Oct 2014. “Best Buy Inc (NYS: BBY). Mergent Online. Web. 28 Sept 2014. Carlson, Thad. “Influencing the Customer: Retailers and ENERGY STAR Qualified electronics.” 2008. PowerPoint Document. Dutta-Roy, Taposh. “Best Buy Strategic Analysis.” 17 Apr 2013. PowerPoint Document. Kaparuwan, Sanchit, Sumit Kumar, Prateek Mishra, Hitesh Sharma, Yash dev Sharma. “Porter’s Five Forces Analysis for Best Buy Co. Inc.” 13 Jun 2013. PowerPoint Document. Odden, Lee. “Social Media Marketing Practices from Best Buy.” TopRank Online Marketing. Web. 04 Oct 2014. Peisenieks, Kaspars. “Best Buy: Monetization of Square Footage.” Seeking Alpha. 08 Jul 2013. Web. 04 Oct 2014. 16