ANTECEDENTS OF INTERNATIONAL PRICING ADAPTATION AND

advertisement

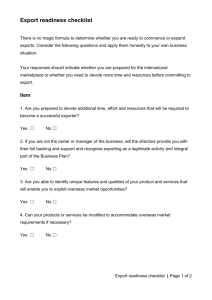

Forthcoming in the Journal of World Business ANTECEDENTS OF INTERNATIONAL PRICING ADAPTATION AND EXPORT PERFORMANCE Carlos M. P. Sousa and Frank Bradley University College Dublin Carlos M. P. Sousa Lecturer in Marketing UCD Michael Smurfit School of Business University College Dublin Blackrock, Co. Dublin Ireland Tel: + 353 1 716 8811 Fax: + 353 1 716 8019 Email: carlos.sousa@ucd.ie Frank Bradley R&A Bailey Professor of Marketing UCD Michael Smurfit School of Business University College Dublin Blackrock, Co. Dublin Ireland Tel: +353 1 716 8949 Fax: + 353 1 716 8977 Email: frank.bradley@ucd.ie Forthcoming in the Journal of World Business ANTECEDENTS OF INTERNATIONAL PRICING ADAPTATION AND EXPORT PERFORMANCE Abstract In this study, using data collected from over 300 firms price adaptation and export performance were measured at the export venture level and analyzed by way of structural equation modeling. The manager’s international experience and the characteristics of the foreign market were found to influence price adaptation and export performance, which itself was influenced by price adaptation. We concluded that international pricing strategies should reflect the environmental characteristics of the foreign market. A price standardization strategy had a positive impact on the export performance of the firm and, a surprising result, firms appeared to perform better in countries that were very different from their home country. 1 Forthcoming in the Journal of World Business 1. Introduction To overcome the difficulties experienced by firms in their attempt to expand beyond home markets, Samiee and Roth (1992) urge firms to develop effective global strategies in their endeavor to achieve sustainable competitive advantage in international markets. The focus of most studies in the literature, however, is on providing guidance on product, promotion, and distribution strategies but the central role of price decisions is ignored (Theodosiou & Katsikeas, 2001). Despite the calls for an increased research focus on export pricing, little tangible headway has been made (Myers, Cavusgil, & Diamantopoulos, 2002). Two possible reasons for this neglect are cited: the complex nature of international pricing and the reluctance of managers to discuss the issue (Myers & Cavusgil, 1996) and the second refers to the absence of suitable international pricing theories (Clark, Kotabe, & Rajaratnam, 1999). The absence of theoretical guidance may encourage managers to use domestic prices inappropriately as a basis for establishing international prices. The difficulty is exacerbated by the recognition that pricing in export ventures can play a key role in achieving superior performance (Stöttinger, 2001) and may be an essential ingredient in achieving sustainable competitive advantage in international markets. The purpose of this study is to identify the factors that influence a firm’s export price adaptation and export performance. Following Theodosiou and Katsikeas' (2001) argument, we consider international pricing strategy along the standardization-adaptation 2 Forthcoming in the Journal of World Business continuum. A major problem that limits existing research and its future development is the unit of analysis (Morgan, Kaleka, & Katsikeas, 2004). The fact that most studies adopt a firm-level unit of analysis and aggregate firms’ various product-market export ventures (Sousa, 2004) makes it difficult to identify and isolate specific antecedents of export performance (Morgan et al., 2004). To avoid this problem, we use the export venture, a particular product exported to a specific export market, as the primary unit of analysis. This approach is corroborated by Cavusgil, Zou, and Naidu (1993) who argue that any study of international marketing strategy standardization conducted at the overall firm level is likely to produce confounded, and thus unreliable, results. In the next section, the conceptual background to the research is presented, along with the development of specific research hypotheses. This is followed by a description of the research methodology. After presenting the results and a discussion of their implications, the paper concludes with limitations and suggestions for future research. 2. Theoretical background and research hypotheses Three literature streams provide the theoretical foundation for assessing the exporting behavior of firms (Francis & Collins-Dodd, 2000): the resource-based paradigm, the relational paradigm, and the contingency paradigm. The resource-based paradigm suggests that a firm’s export performance is based on firm-level activities such as size, 3 Forthcoming in the Journal of World Business firm experience, and competencies (Zou & Stan, 1998). As a result, little emphasis is placed on environmental factors as determinants of export performance and strategy. The relational paradigm focuses on the network of business interactions and views export expansion as the sequential development of relationships with foreign buyers (Styles & Ambler, 1994). Within this paradigm are a number of models such as IMP group interaction model (Turnbull & Valla, 1986), channel relationship models (Anderson & Narus, 1990), and buyer and seller relationships (Dwyer, Schurr, & Oh, 1987). The general aim of these models, however, is not to explain marketing performance but to analyze and predict relationship processes and outcomes. The theoretical perspective adopted in this study, the contingency paradigm, suggests that environmental factors influence the firm’s strategies and export performance. The effects of various firm characteristics on export performance are dependent on the specific context of the firm. According to Cavusgil and Zou (1994), this theory has its roots in the structure-conduct-performance framework of industrial organization and rests on two premises: (1) that organizations are dependent on their environments for resources (Pfeffer & Salancik, 1978), and (2) that organizations can manage this dependence by developing and maintaining strategies (Hofer & Schendel, 1978). Thus, in the contingency paradigm, exporting is considered as a firm’s strategic response to the interplay of internal as well as external factors (Robertson & Chetty, 2000). Universally valid prescriptions for firm success are unlikely to be found because the 4 Forthcoming in the Journal of World Business nature of the firm’s business position and the environmental context must be considered. Perspectives that emphasize the importance of the exporter’s contextual situation, therefore, offer a more fruitful approach in attempting to understand the determinants of export success (Walters & Samiee, 1990). A fundamental premise underlying this contingency theory is that no strategy can be effective in all contexts. Global marketing decisions regarding product, price, promotion, and distribution differ from those made in the home country since each country has a unique environment (Jain, 1989). The extent to which the elements of the marketing program should be standardized or adapted, however, is an ongoing debate. Proponents of standardization emphasize the homogenization of world markets and the associated cost savings. It is also argued that standardization facilitates economies of scale in all valueadding activities, and that this allows the firm to achieve a low-cost competitive position in global markets (Cavusgil et al., 1993). This standardization perspective has been criticized, however, as overly simplistic, myopic, and contrary to the marketing concept (Douglas & Wind, 1987; Wind, 1986). Advocates of the adaptation approach view markets as being heterogeneous, comprising consumers with different wants and needs. Standardization and adaptation, however, may be viewed as two extremes of the same continuum (Jain, 1989). The contingency perspective recognizes both advantages and disadvantages associated with each of the two extremes (Lages & Montgomery, 2004). No universal set of strategic choices can be considered optimal for all organizations and circumstances (Ginsberg & Venkatraman, 1985). This perspective is empirically 5 Forthcoming in the Journal of World Business supported by most of the recent literature and informs theory building in this paper (Theodosiou & Katsikeas, 2001; Sousa & Bradley, 2005; Özsomer & Prussia, 2000). 2.1. Development of hypotheses Contextual factors determine the appropriate degree of standardization/adaptation in contingency theory. Pricing decisions in international markets are influenced by internal and external factors (Theodosiou & Katsikeas, 2001). Internal factors are organizational characteristics such as the firm and the product, whereas external factors are usually the characteristics of the foreign market. The degree of co-alignment of these factors with the marketing strategy of the firm determines the level of export performance (Cavusgil & Zou, 1994). In the export literature it is argued that foreign markets pose both threats and opportunities for firms. Researchers report that environmental differences between markets are expected to affect the firm’s strategy and export performance (e.g. O'Cass & Julian, 2003). This argument might be further explored using an institutional theory perspective1. A key insight from this theory is the acknowledgment of the institutional environment (North, 1990). The institutional environment, defined as the socially constructed world that forces firms to conform to social rules and rituals (Orru, Biggart, & Hamilton, 1991), includes macro-level aspects of society including the regulatory system, cognitive beliefs and knowledge, and cultural norms (Carson, Devinney, Dowling, & John, 1999). Institutional theorists argue that differences in the institutional 1 We thank a reviewer for drawing this point to our attention. 6 Forthcoming in the Journal of World Business environment between countries are expected to affect the firm’s strategy and performance (Wan & Hoskisson, 2003). Foreign market characteristics, such as economic and industrial development, marketing and communications infrastructure, technical requirements, and legal regulations influence export performance (Balabanis & Katsikea, 2003; O'Cass & Julian, 2003; Baldauf, Cravens, & Wagner, 2000; White, Griffith, & Ryans, 1998). Furthermore, uncertainty arises when a firm attempts to export to countries not deemed similar to the home country (Erramilli & Rao, 1993) since the difficulty of obtaining and interpreting information increases (Boyacigiller, 1990). Without adequate information, many firms may encounter difficulties in predicting the consequences of their strategic decisions (Achrol & Stern, 1988). This uncertainty and lack of information about the foreign market may also increase the possibility of making wrong decisions and thereby reduce the performance of the firm abroad (Lee, 1998). Addressing this possibility, Johanson and Vahlne (1977, 1990) and Wiedersheim-Paul, Olson, and Welch (1978) suggest that, to enhance their chances of success, exporters should select countries that are perceived to be similar to the home market. The reasoning behind this advice is that similarities are easier to manage than dissimilarities, thereby making it more likely for the firm to succeed in similar markets. The following hypothesis is therefore suggested: H1: Environmental differences between the home and foreign markets negatively affect the export performance of the firm. 7 Forthcoming in the Journal of World Business Environmental differences influence the degree of price adaptation by firms in international markets (Myers et al., 2002). Market similarity between the home and foreign markets drives firms toward price standardization, whereas market diversity drives them toward price adaptation (Jain, 1989; Sousa & Bradley, 2005). An adaptation strategy is required when substantial differences exist in government regulations, communications and marketing infrastructure, and technical requirements (Douglas & Wind, 1987; Zou, Andrus, & Norvell, 1997; Chung, 2003). Furthermore, economic conditions prevailing in the foreign market can influence pricing decisions since the overall level of economic and industrial development of a country also influences the prices consumers are willing to pay for certain products (Theodosiou & Katsikeas, 2001). Lastly, firms are often required to adapt their pricing strategy abroad because of different regulations on tariffs, taxes, and resale price maintenance (Cavusgil et al., 1993; Jain, 1989). We therefore advance the following hypothesis: H2: Environmental differences between the home and foreign markets positively affect the degree of price adaptation. The number of countries to which a firm exports is another factor that influences the degree of price adaptation. Specifically, we suggest that the greater the number of countries to which the firm exports, the greater the pressure on the firm to standardize its pricing strategy because improved communications technologies among buyers make it increasingly difficult for exporters to maintain a differentiated pricing strategy in different markets for similar products (Doole & Lowe, 2004). Moreover, the maintenance 8 Forthcoming in the Journal of World Business of different price strategies in different markets gives rise to gray market activities (Antia, Bergen, & Dutta, 2004), and the larger the number of export markets served by the firm, the higher the risk of gray market activity (Myers, 1999). This problem of gray market activities is further exacerbated by the increased globalization of trade that leads Cavusgil, Chan, and Zhang (2003) to argue that globalization has made it more difficult for firms to use price discrimination strategies in different international markets. Price variations for the same product across markets are also likely to alienate distributors and customers when they discover these differences (Diller & Bukhari, 1994). Better information systems allow customers to observe when differential pricing exists. The introduction of the Euro and readily available information on worldwide prices through the Internet, have greatly increased price transparency. In these circumstances customers who pay different prices in different countries for essentially the same product can be expected to press for a uniform price, allowing for taxation differences (Terpstra & Sarathy, 2000). It is hypothesized, therefore, that: H3: The greater the number of countries to which the firm exports, the lower the degree of price adaptation. The manager’s international experience may influence the firm’s export pricing strategies (Myers et al., 2002). Ambiguity exists regarding the nature of the influence of experience. Some managers with substantial international experience are more willing to adapt their strategies to fit the idiosyncrasies of foreign markets (Cavusgil et al., 1993) than others who are more inclined to standardize (Cateora, 1996). However, in the past decade, 9 Forthcoming in the Journal of World Business managers with international experience report that it is increasingly difficult to follow a price adaptation strategy for similar products in international markets (Doole & Lowe, 2004). This leads Chung (2003) to conclude that firms with extensive export experience should consider standardizing prices. By standardizing, the manager is able to maintain consistent positioning, quality, and image in different markets while obtaining economies of scale in all value-adding activities (Whitelock, 1987). This leads to the fourth hypothesis: H4: The greater the manager’s export experience, the lower the degree of price adaptation. The manager’s export experience may also have a direct influence on the performance of the firm (Zou & Stan, 1998). The nature and direction of the impact is disputed however. Some studies reveal a positive relationship between export experience and export performance (Zou & Cavusgil, 2002; Madsen, 1989) whereas others discover a negative relationship between these two constructs (Baldauf et al., 2000; Cooper & Kleinschmidt, 1985). Most studies report a positive effect of export experience on export performance (Zou & Stan, 1998; Lages & Montgomery, 2005). Managers with more experience of international business perform better because of their access to international networks and a better understanding of foreign markets (Axinn, 1988). These managers are also more open to export opportunities and are less hesitant to operate abroad (White et al., 1998); this is in agreement with the finding of Dean, Menguç, and Myers (2000) and Madsen 10 Forthcoming in the Journal of World Business (1989) that the most important positive influence on export performance is export experience. Based on the above discussion, the following hypothesis is proposed: H5: The greater the manager’s export experience, the better the firm’s export performance. The degree of price adaptation is posited in our model as a key determinant of the export performance of the firm. In a review of the literature on standardization and adaptation, Shoham (1995) reports that the pattern of findings about pricing standardization and performance is mixed. Some studies, Kirpalani and Macintosh (1980) and Leonidou, Katsikeas, and Samiee (2002), for example, report that price adaptation positively influences export performance. Others have shown that price adaptation is negatively related to export performance (Shoham, 1999; Zou et al., 1997). Özsomer and Simonin (2004) agree with this view and postulate a positive relationship between price standardization and performance that concurs with Zou and Cavusgil (2002) who report a significant positive relationship between global marketing strategy and performance. Furthermore, as indicated previously, following a price adaptation strategy across markets is likely to alienate distributors and customers when they discover these differences (Diller & Bukhari, 1994) and thereby negatively influence the firm’s performance in those markets. The use of a price standardization could also eliminate parallel imports and the indirect cannibalization of the firm’s own product lines. 11 Forthcoming in the Journal of World Business In their study of the performance of Portuguese exporting firms, Lages and Montgomery (2005) report that price adaptation is negatively related to export performance. Their argument is that the Portuguese market, the location of their fieldwork, tends to have lower prices than most of the foreign markets targeted. These authors argue that the use of a standardized pricing strategy, by which they mean prices similar to those in the domestic market, helps to penetrate the export market and improve export performance. Low costs in the domestic market, achieved through scale economies or otherwise, may allow the firm to charge the same low prices abroad. These circumstances, combined with an elastic demand in the export market, permits the firm to price penetrate that market, thereby positively affecting export performance (Bradley, 2005). This explanation is consistent with Brouthers and Xu (2002), Julian (2003), and Christensen, da Rocha, and Gertner (1987) who report that low competitive prices tend to be positively associated with export performance. Furthermore, by pursuing such a price strategy, firms located in less developed markets are more likely to achieve success because it is compatible with consumer perceptions and expectations of products made in such countries (Aulakh, Kotabe, & Teegen, 2000). This leads to the following hypothesis: H6: The degree of price adaptation negatively affects the export performance of the firm. In summary, we propose that the degree of price adaptation is influenced positively by the differences in the market environments and negatively by the number of markets to which the firm exports. The export performance of the firm, we suggest, is affected 12 Forthcoming in the Journal of World Business positively by the international experience of the manager and negatively by differences in the market environments and the degree of price adaptation. An overview of the conceptual framework is presented in Figure 1. ******************************* Insert Figure 1 near here ******************************* 3. Methodology 3.1. Sample and data collection procedure The study was conducted using a sample of exporting firms based in Portugal. Portugal, a member of the European Union (EU) since 1986 but an open economy, has long depended on international trade because of the small size of the domestic market. Because of the openness of the economy a strong export orientation exists among Portuguese firms. We used a multi-industry sample to increase observed variance and to strengthen the generalizability of the results (Morgan et al., 2004). The sample comprised 874 exporting firms from all parts of the country. As the research base was located outside Portugal, questionnaires were sent with an international postage-paid business reply envelope that was followed by a reminder letter including a second reply envelope. The effective response rate, after two mail-waves, was 34.4 percent (301 usable questionnaires). This is a high response rate, considering that the 13 Forthcoming in the Journal of World Business average top management survey response rates are in the range of 15 to 20 percent (Menon, Bharadwaj, & Howell, 1996), and that collecting data from firms located in a foreign country is more difficult than collecting from a domestic population due to the numerous obstacles encountered. To explore the issue of non-response bias, we tested for differences between early and late respondents (Armstrong & Overton, 1977). As recommended by Weiss and Heide (1993), early responses were defined as the first 75 percent of returned questionnaires. The last 25 percent were considered late responses and representative of firms that did not respond to the survey. Using a t-test, early and late respondents were compared on all the variables and no significant differences were found; this suggests that non-response bias was not an issue. Moreover, since anonymity was guaranteed, bias associated with those who did not wish to respond for confidentiality reasons was also reduced (Bialaszewski & Giallourakis, 1985). Particular attention was paid to the identification and selection of the most appropriate person in each firm to participate in the study. Because of involvement and direct responsibility in decision making, the manager was considered to be a major force behind the initiation, development, sustenance, and success of a firm’s foreign activities. To ensure the reliability of the data, the respondents selected were senior managers with responsibility for foreign operations. The approach suggested by Huber and Power (1985) of using a single key informant was also adopted, with the view to minimizing the potential for systematic and random sources of error. In order to ensure that the most 14 Forthcoming in the Journal of World Business appropriate person would receive the questionnaire, each firm was contacted by telephone beforehand. 3.2. Measures The survey instrument used was developed following a comprehensive review of the relevant literature. It was written originally in English and translated into Portuguese by a bilingual expert. Four academic experts who were familiar with the topic under investigation assessed the content and face validity of the survey. To evaluate individual item content, clarity of instructions, and response format, we tested the questionnaire in a series of face-to-face settings with 15 managers involved in export operations. The questionnaire was then back-translated into English and checked for consistency with the original version. The items used to operationalize each construct were developed on the basis of existing literature (see Appendix). We operationalized export performance using five items: export sales growth, export profitability, export intensity, meeting expectations, and perceptions of how competitors rate the firm’s export performance. The first four items have been used frequently in previous studies (Zou, Taylor, & Osland, 1998; Brouthers & Xu, 2002; Katsikeas, Piercy, & Loannidis, 1996; Robertson & Chetty, 2000). The fifth item, based on Styles' (1998) work, asked respondents for their perception of how their 15 Forthcoming in the Journal of World Business competitors would rate the export venture’s performance. This item was assessed on a ten-point unsuccessful/successful scale. In relation to price we adopted the measures developed by Sousa and Bradley (2005). Price strategy was measured by the level of adaptation of price discounts, margins, credit, and payment security. The experience of the manager was measured by asking respondents to indicate their level of overseas experience in terms of living and working abroad and their degree of professional exporting experience (Das, 1994; Sousa & Bradley, 2006). Number of markets was measured by a single item; respondents were asked to indicate the number of countries to which they exported the product. Environmental characteristics were measured using items that focused on economic/industrial development, marketing infrastructure, communications infrastructure, technical requirements, and legal regulations (Theodosiou & Katsikeas, 2001; Shoham, 1999; Klein & Roth, 1990). In addition to the variables specified in our theoretical model, we included the size of the firm as a control variable. Previous research suggests that firm size has an influence on pricing strategies (Myers & Cavusgil, 1996; Chung, 2003) and on the export performance of the firm (Lado, Martinez-Ros, & Valenzuela, 2004; White et al., 1998). Myers (2004) reports that firm size, represented as the number of employees and company sales, affects the pricing decisions of the firm. As a result, we operationalized firm size using these two items. We also controlled for export destination. Because of possible foreign currency fluctuations, it was important to determine whether the firms were exporting to another 16 Forthcoming in the Journal of World Business EU country or if they were exporting to a non-EU country2. We, therefore, created the variable, export destination, as a dummy variable. 4. Analysis and results 4.1. Reliability and validity Content validity was established through the literature review and by consulting experienced researchers and managers. On the basis of these procedures, it was concluded that the measures had content validity. Discriminant validity, convergent validity, and scale reliability were assessed by confirmatory factor analysis in line with the paradigm advocated by Gerbing and Anderson (1988). Tables 1 and 2 show the results obtained from the estimation of the CFA model. The overall chi-square for this model was 270.955 (p < 0.00) with 98 degrees of freedom (df). Four measures of fit were examined: the comparative fit index (CFI = 0.986), Tucker-Lewis fit index (TLI = 0.981), incremental fit index (IFI = 0.986), and the root mean square error of approximation (RMSEA = 0.077). The results suggest that the scale measures were internally consistent, able to discriminate, and provided a good fit of the factor model to the data. An inspection of these results shows that the items employed to measure the constructs were both valid (convergent validity and discriminant validity) and reliable (composite reliability, variance extracted, and internal reliability). More specifically, convergent validity is evidenced by the large and significant standardized loadings (t > 1.96, p < .05) of the items on the respective constructs. Discriminant validity, on the other hand, was 2 We thank a reviewer for drawing this point to our attention. 17 Forthcoming in the Journal of World Business assessed by observing the construct intercorrelations. These were significantly different from 1, and the shared variance between any two constructs (i.e. the square of their intercorrelation) was less than the average variance explained in the items by the construct (Fornell & Larcker, 1981). The correlation matrix for the constructs is shown in Table 2. Adequate discriminant validity is evident for all constructs since their diagonal elements are greater than the off-diagonal elements in their corresponding rows and columns in the upper triangle. In regard to the reliability of the constructs, Table 1 presents the results of composite reliability, and variance extracted. The values for composite reliability, ranging from 0.74 for experience to 0.85 for environment, considerably exceed Bagozzi and Yi's (1988) recommended minimum level of 0.60. In terms of variance extracted, only export performance fell slightly short of the 0.50 guideline, while all the others exceeded the recommended level. We conclude, therefore, that for all constructs the indicators were sufficient and adequate in terms of how the measurement model was specified. ******************************* Insert Table 1 & Table 2 near here ******************************* 18 Forthcoming in the Journal of World Business 4.2. Testing of hypotheses Because of the complexity of the model and the need to test the relationships between the constructs simultaneously, structural equations were used by applying the maximum likelihood (ML) method (Amos version 4.0). The overall chi-square for the model in Figure 2 was significant (chi-square = 335.323, df = 153, p < 0.001), as might be expected given the size of the sample (Bagozzi & Yi, 1988). Several researchers note the sensitivity of this statistic to the size of the sample, such that tests involving large samples generally lead to the rejection of the model even if it is appropriate (Bagozzi & Baumgartner, 1994). To address this issue, we examined the structural diagnostics for relative global fit suggested by Bollen (1989). As with the CFA model, the other measures of fit were: comparative fit index (CFI = 0.987), Tucker-Lewis fit index (TLI = 0.982), incremental fit index (IFI = 0.987), and the root mean square error of approximation (RMSEA = 0.063). Given that all the fit indices were inside conventional cut-off values, the model was deemed acceptable (Browne & Cudeck, 1993; Vandenberg & Lance, 2000). The relationships proposed in the model were examined next (Figure 2). ****************************** Insert Figure 2 near here ****************************** Contrary to the expectations in H1, our findings suggested that the greater the environmental differences between the home and the foreign market, the better the export 19 Forthcoming in the Journal of World Business performance of the firm (path coefficient = 0.222; p < 0.05). In relation to H2, the results indicated that the greater the environmental differences, the more likely was the manager to follow a price adaptation strategy in that foreign market (path coefficient = 0.581; p < 0.001). Supportive findings for H3 (path coefficient = -0.181; p < 0.05) indicated that the number of markets affected price adaptation negatively. The results for H4 (path coefficient = -0.141; p < 0.05) supported the notion that the manager’s international experience was negatively related to price adaptation. Furthermore, the relationship between the manager’s international experience and export performance was found to be significant and positive (path coefficient = 0.170; p < 0.05), thus supporting H5. Finally, in relation to H6, the results supported our contention that the degree of price adaptation negatively affects the performance of the firm (path coefficient = -0.196; p < 0.05). In sum, the findings show that all six hypotheses tested significantly, five hypotheses were supported (H2-H6), while hypothesis (H1) was not. 4.3. Tests of competing models Although our model represented a good fit to the data, it is possible that there are better models. To assess the quality of our model relative to other theoretically based models, tests of competing nested models were conducted (see Anderson & Gerbing, 1988). We compared the nested models using the sequential chi-square difference test (SCDT). The occurrence of a significant chi-square difference value when a path is constrained to zero would indicate a significant loss of fit, in which case the path should be retained in the 20 Forthcoming in the Journal of World Business model. In contrast, a non-significant value would indicate acceptance of the more parsimonious of the nested models (James, Mulaik, & Brett, 1982). The first alternative to be tested was a model in which experience of the manager and environmental characteristics were constrained to have no effect on the export performance of the firm. The chi-square value for this model was 349.650 and the degrees of freedom were 155. The results, however, indicated that there was a significant loss of fit between this model and the theoretical model, with a chi-square diff of 14.327 (df = 2, p < 0.001). This difference indicates that the paths from experience of the manager and environmental characteristics to export performance should remain in the model. The second alternative was a model that constrained to zero the paths to price from experience of the manager and from environmental characteristics. The chi-square for this model was 409.704 (df = 155). The SCDT again indicated a significant loss of fit (chi-square diff = 74.381, df = 2, p < 0.001); this shows that these paths too should remain in the model. The final alternative was to test a model that included a direct path between the number of markets and export performance. The chi-square for this model was 335.322 (df = 152). This model yielded an insignificant chi-square difference when compared to the theoretical model (chi-square diff = 0.001, df = 1, p > 0.1). The insignificant SCDT suggests that the more parsimonious model, the theoretical model, should be retained. Overall, these results indicate that our hypothesized model explained the data better than these three alternative models. 21 Forthcoming in the Journal of World Business 5. Discussion and implications Despite the number of calls for a greater focus on export pricing research, little tangible headway has been made. To contribute toward filling this void in the literature, we identify factors that drive the export performance of the firm, with special emphasis on the influence of price adaptation. The results indicate that the degree of price adaptation is positively influenced by environmental characteristics of the foreign market and negatively associated with the managers’ international experience and the number of markets, thus providing support for H2-H4. These findings are consistent with earlier research that has examined the antecedents of marketing strategy adaptation and standardization. Contrary to expectations, however, we discover that the relationship between the foreign environment and export performance (H1) is positive and significant, indicating that firms perform better in countries that are viewed as different from the home country. Although surprising, O'Grady and Lane (1996), Morosini, Shane, and Singh (1998), and Evans and Mavondo (2002) suggest that the belief that countries that are similar to the home country are more easily understood and managed than distant ones may not necessarily be true. In their study of 32 Canadian companies exporting to the United States, O'Grady and Lane (1996) report that only seven were successful. These authors argue that perceived similarity can cause decision makers to fail because they do not prepare for the differences. As a result, perceived similarity may lead to managerial carelessness and 22 Forthcoming in the Journal of World Business failure. Thus, the intuitively appealing assumption that firms perform better in similar markets than in distant ones should be questioned and is an issue that warrants further empirical investigation. As expected, managers with greater international experience positively influence the performance of the firm in foreign markets. This supports H5 and is corroborated by the findings of da Rocha, Christensen and da Cunha (1990) that international experience enriches managerial expertise and increases the firm’s performance in overseas markets. This finding is also supportive of the Zou and Stan (1998) view that the manager’s international experience helps a firm to identify and leverage international opportunities while avoiding international threats. Furthermore, our results provide evidence that there is a negative relationship between price adaptation and export performance (H6), that is, the smaller the degree of price adaptation, the higher the export performance of the firm. This result is also in line with previous research findings (e.g. Zou et al., 1997; Shoham, 1999; Lages & Montgomery, 2005) and demonstrates that the presentation of a consistent price image across markets leads to superior performance. In addition to the relationships discussed above, it is noteworthy to mention that both control variables display a significant influence on price adaptation and export performance. The size of the firm positively influences price adaptation and export performance. Since an adaptation strategy often requires a greater financial resource commitment from the firm (Whitelock & Pimblett, 1997), it is expected that larger firms tend to adapt their strategies more because they possess more resources. Examining the 23 Forthcoming in the Journal of World Business relationship between the size of the firm and export performance, we find that the larger the firm, the higher the export performance. The reason for better performance among larger firms than small firms derives from factors such as scale economies, production capacity, R&D expenditure, and the ability and willingness to take risks. It may also be argued that larger firms possess more unused and/or underutilized resources and, therefore, are able to direct more efforts to export activities (Baldauf et al., 2000). Export destination, on the other hand, was found to have a negative effect on the price adaptation strategy of the firm, indicating that firms that export to an EU country follow a more standardized price strategy, whereas firms that export to a non-EU country adapt their price strategy. Firms that export to non-EU countries, in addition, have to deal with different regulations on tariffs, taxes, technical requirements as well as foreign currency fluctuations that often force them to adapt their price strategy. 5.1. Managerial implications In addition to providing useful insights into the literature, our research has implications for managers. Specifically, our results indicate that decisions regarding price standardization or adaptation should be based on the environmental characteristics of the foreign market. A thorough analysis of the foreign market is necessary in order to be able to develop appropriate export pricing strategies. This is not a novel recommendation for managers, since previous research (e.g. Theodosiou & Katsikeas, 2001; Myers et al., 2002) repeatedly stresses the importance of this factor in developing the firm’s international pricing strategies. A surprising and interesting result in this study is that 24 Forthcoming in the Journal of World Business firms appear to perform better in countries that are very different from their home country. When exporting to similar countries, some firms often fall into the trap of ignoring small but important differences that exist between them. Advice for managers, based on our results, is that in order to be more successful, they should consider exporting to countries that are not very similar to their own country. Our findings further indicate that the manager’s international experience is important in explaining pricing decisions as well as explaining the export performance of the firm. Managers that have considerable international experience are more likely to follow a standardization approach in setting prices in foreign markets since, as we have seen, a standardized strategy permits scale economies, synergies, and efficiencies (Hamel & Prahalad, 1985; Levitt, 1983; Yip, 1995), simplifies planning, and provides the firm’s brand with a consistent image (Zou & Cavusgil, 2002). Managers that have more international experience are also more likely to perform better than less experienced managers. Hence, firms should place considerable effort in increasing the export experience of their managers. Moreover, the fact that managers’ skills and knowledge are resources that are difficult to imitate can create a competitive advantage for the firm. In the case of managers that are already working in the company, the firm should encourage further training in coping with international issues. Frequent participation in either government sponsored exhibitions or industry-specific international trade fairs, for instance, can be a reasonably cost effective means of giving managers greater overseas experience. Managers can also be exposed to other managers and experts who may be able to coach them on doing business in foreign markets, thus avoiding the delay of 25 Forthcoming in the Journal of World Business normal learning over time. Another alternative that firms should consider is to hire managers with experience of international markets rather than attempting to build up the entire body of experience in-house. This may be difficult, however, as poaching managers in this way is increasingly difficult. A key determinant of export performance and a vital issue for managers is to determine whether to adapt or standardize their pricing strategies in foreign markets. Managers with more international experience perform better by choosing to standardize prices. Our results also indicate that price standardization has a positive impact on the export performance of the firm. As a general rule, however, following a standardized low price strategy in international markets is something to be discouraged. In the case of the firms in the sample, low price strategies may become increasingly less viable for Portuguese firms in the international arena. Competitive advantages based on low prices are not sustainable over time as other low cost countries, China for example, can be significantly more price competitive. Ultimately, in order to be able to survive in the long term, Portuguese exporters that compete on low price are likely to be forced to develop alternative strategies as their price advantage erodes. We encourage these exporters, therefore, to develop strategies where quality and brand image and other non-price issues may be more important than price in the eyes of the customer. 26 Forthcoming in the Journal of World Business 5.2. Limitations and directions for further research There are a number of research limitations in this paper. First, the research instrument used may have created common method variance that could have inflated the construct relationships. This could be particularly worrisome if the respondents were aware of the underlying conceptual framework. Respondents were not informed of the specific purpose of the study, however, and all construct items were separated and mixed so that no respondent should have been able to detect which items were associated with which factors (Jap, 2001). Moreover, allowing respondents’ answers to be anonymous and assuring them that there were no right or wrong answers should have further reduced method biases (Podsakoff, MacKenzie, Lee, & Podsakoff, 2003). Hence, the possibility of introducing bias through common method variance was minimized. Nevertheless, two statistical tests were conducted to determine the extent of possible method variance in the data. The Harman one-factor test (Podsakoff & Organ, 1986) demonstrated that the risk of common method variance was unlikely to be significant in this case because the exploratory factor analytic results showed that a single general factor did not account for most of the variance. To confirm these results, additional analyses were performed to test for common method variance following the procedure recommended by Podsakoff et al. (2003) and used by Conger, Kanungo, and Menon (2000). In this approach, we reestimated the model with all the indicator variables loading on a general method factor. The goodness-of-fit indices (CFI=0.922; TLI=0.904; IFI=0.922; RMSEA=0.145) indicate a poor fit; this suggests that bias arising from common method variance was unlikely. 27 Forthcoming in the Journal of World Business Finally, a test of discriminant analysis in the confirmatory factor analysis also provided evidence that the constructs were distinct. The somewhat high RMSEA reported in this study may represent another potential limitation. It should be noted, however, that the interpretation of any fit index in isolation, the RMSEA included, can be problematic because of trade-offs between Type I and Type II errors. To address this issue, McQuitty (2004) uses the concept of statistical power. Therefore, “recommendations regarding the relationship between model fit and goodnessof-fit-statistics must be considered in light of statistical power and should not be absolute, because “… the conclusions one draws regarding the adequacy of one’s model for explaining a phenomenon are dependent on statistical power (Kaplan, 1995: 117). Situations in which power is overly great (i.e. π>0.90) may require a more relaxed interpretation of fit than is typical. Conversely, a more stringent interpretation of fit statistics is required when power is low, especially when goodness-of-fit statistics are not exemplary” (McQuitty, 2004: 182). To address this issue we analyzed the statistical power in our study and it was well above 0.9. Therefore, the high statistical power and the exemplary values for the CFI, IFI, and TLI in both cases appear to mitigate the somewhat high RMSEA value. Another possible limitation is that, since only firms based in Portugal were surveyed, caution should be exercised in generalizing our findings too broadly. Future work should, therefore, test this framework in other countries to provide a more generalizable foundation for understanding these relationships. Nonetheless, generalizations of the 28 Forthcoming in the Journal of World Business findings may be applicable in countries that are in a similar stage of development and experience structural characteristics and export contingencies comparable to those in Portugal. Additionally, the study employed a cross-sectional research design, an approach that cannot capture the dynamic aspects of the determinants of price adaptation and export performance. Future work should, therefore, consider adopting a longitudinal design to shed light on these relationships over time. The institutional environment has been extensively studied in law and institutional economics but its impact is largely unexplored in the international marketing and business literature, with a few exceptions (e.g. Chelariu, Bello, & Gilliland, 2006; Kim & Oh, 2002). Although we address the concept of institutional environment briefly in our paper, we believe that future research should consider developing frameworks that incorporate the institutional environment into the export literature. It is hoped that this study will contribute toward a better understanding of price adaptation in international markets and will encourage fellow researchers to continue investigating this important topic. 29 Forthcoming in the Journal of World Business REFERENCES Achrol, R. S. & Stern, L. W. (1988). Environmental Determinants of Decision-Making Uncertainty in Marketing Channels. Journal of Marketing Research, 25 (February): 36-50. Anderson, J. C. & Gerbing, D. W. (1988). Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach. Psychological Bulletin, 103 (3): 411-423. Anderson, J. C. & Narus, J. A. (1990). A Model of Manufacturer Firm and Distributor Firm Working Partnerships. Journal of Marketing, 54 (1): 42-58. Antia, K. D., Bergen, M. & Dutta, S. (2004). Competing with Gray Markets. Sloan Management Review, 46 (1): 63-69. Armstrong, J. S. & Overton, T. S. (1977). Estimating Nonresponse Bias in Mail Surveys. Journal of Marketing Research, 14 (August): 396-402. Aulakh, P. S., Kotabe, M. & Teegen, H. (2000). Export Strategies and Performance of Firms from Emerging Economies: Evidence from Brazil, Chile, and Mexico. Academy of Management Journal, 43 (3): 342-361. Axinn, C. N. (1988). Export Performance: Do Managerial Perceptions Make a Difference. International Marketing Review, 5 (2): 61-71. Bagozzi, R. P. (1980). Causal Models in Marketing. New York: John Wiley & Sons, Inc. Bagozzi, R. P. & Baumgartner, H. (1994). The Evaluation of Structural Equation Models and Hypothesis Testing. Pp. 386-422 in R. P. Bagozzi (Ed.) Principles of Marketing Research, Cambridge, MA: Basil Blackwell. Bagozzi, R. P. & Yi, Y. (1988). On the Evaluation of Structural Equation Models. Journal of Academy of Marketing Sciences, 16 (Spring): 74-94. Balabanis, G. I. & Katsikea, E. S. (2003). Being an Entrepreneurial Exporter: Does it Pay? International Business Review, 12 (2): 233-252. Baldauf, A., Cravens, D. W. & Wagner, U. (2000). Examining Determinants of Export Performance in Small Open Economies. Journal of World Business, 35 (1): 61-79. Bialaszewski, D. & Giallourakis, M. (1985). Perceived Communication Skills and Resultant Trust Perceptions Within the Channel of Distribution. Journal of Academy of Marketing Science, 13 (2): 206-217. Bollen, K. A. (1989). Structural Equations with Latent Variables. New York: Wiley and Sons. Boyacigiller, N. (1990). The Role of Expatriates in the Management of Interdependence, Complexity and Risk in Multinational Corporations. Journal of International Business Studies, 21 (3): 357-381. Bradley, F. (2005). International Marketing Strategy. Harlow, England: Prentice-Hall Financial Times. Brouthers, L. E. & Xu, K. (2002). Product Stereotypes, Strategy and Performance Satisfaction: The Case of Chinese Exporters. Journal of International Business Studies, 33 (4): 657-677. Browne, M. W. & Cudeck, R. (1993). Alternative Ways of Assessing Model Fit. Pp. 136162 in K. A. Bollen & J. S. Long (Eds.), Testing Structural Equation Models, Newbury Park, CA: Sage. 30 Forthcoming in the Journal of World Business Carson, S. J., Devinney, T. M., Dowling, G. R. & John, G. (1999). Understanding Institutional Designs Within Marketing Value Systems. Journal of Marketing, 63 (Special Issue): 115-130. Cateora, P. R. (1996). International Marketing. Chicago: Irwin. Cavusgil, S. T., Chan, K. & Zhang, C. (2003). Strategic Orientations in Export Pricing: A Clustering Approach to Create Firm Taxonomies. Journal of International Marketing, 11 (1): 47-72. Cavusgil, S. T. & Zou, S. (1994). Marketing strategy - performance relationship: An investigation of the empirical link in export market ventures. Journal of Marketing, 58 (January): 1-21. Cavusgil, S. T., Zou, S. & Naidu, G. M. (1993). Product and Promotion Adaptation in Export Ventures: An Empirical Investigation. Journal of International Business Studies, 24 (3): 479-506. Chelariu, C., Bello, D. C. & Gilliland, D. I. (2006). Institutional Antecedents and Performance Consequences of Influence Strategies in Export Channels to Eastern European Transitional Economies. Journal of Business Research, 59 (5): 525-534. Christensen, C. H., da Rocha, A. & Gertner, R. K. (1987). An Empirical Investigation of the Factors Influencing the Export Success of Brazilian Firms. Journal of International Business Studies, 18 (Fall): 61-77. Chung, H. F. L. (2003). International Standardization Strategies: The Experiences of Australian and New Zealand Firms Operating in the Greater China Markets. Journal of International Marketing, 11 (3): 48-82. Clark, T., Kotabe, M. & Rajaratnam, D. (1999). Exchange Rate Pass-Through and International Pricing Strategy: A Conceptual Framework and Research Propositions. Journal of International Business Studies, 30 (2): 249-268. Conger, J. A., Kanungo, R. N. & Menon, S. T. (2000). Charismatic Leadership and Follower Effects. Journal of Organizational Behavior, 21 (7): 747-767. Cooper, R. G. & Kleinschmidt, E. J. (1985). The Impact of Export Strategy on Export Sales Performance. Journal of International Business Studies, 16 (Spring): 37-55. da Rocha, A., Christensen, C. H. & Cunha, C. E. d. (1990). Aggressive and Passive Exporters: A Study in the Brazilian Furniture Industry. International Marketing Review, 7 (5): 6-15. Das, M. (1994). Successful and Unsuccessful Exporters from Developing Countries: Some Preliminary Findings. European Journal of Marketing, 28 (12): 19-33. Dean, D. L., Menguç, B. & Myers, C. P. (2000). Revisiting Firm Characteristics, Strategy, and Export Performance Relationship: A Survey of the Literature and an Investigation of New Zealand Small Manufacturing Firms. Industrial Marketing Management, 29 (5): 461-477. Diller, H. & Bukhari, I. (1994). Pricing Conditions in the European Common Market. European Management Journal, 12 (2): 163-170. Doole, I. & Lowe, R. (2004). International Marketing Strategy: Analysis, Development and Implementation. London: Thomson Learning. Douglas, S. P. & Wind, Y. (1987). The Myth of Globalization. Columbia Journal of World Business, 22 (4): 19-29. Dwyer, F. R., Schurr, P. H. & Oh, S. (1987). Developing Buyer-Seller Relationships. Journal of Marketing, 51 (2): 11-27. 31 Forthcoming in the Journal of World Business Erramilli, M. K. & Rao, C. P. (1993). Service Firms' International Entry Mode Choice: A Modified Transaction Cost Approach. Journal of Marketing, 57 (July): 19-38. Evans, J. & Mavondo, F. T. (2002). Psychic Distance and Organizational Performance: An Empirical Examination of International Retailing Operations. Journal of International Business Studies, 33 (3): 515-532. Fornell, C. & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18 (February): 39-50. Francis, J. & Collins-Dodd, C. (2000). The impact of firms' export orientation on the export performance of high-tech small and medium-sized enterprises. Journal of International Marketing, 8 (3): 84-103. Gerbing, D. W. & Anderson, J. C. (1988). An Updated Paradigm for Scale Development Incorporating Unidimensionality and Its Assessment. Journal of Marketing Research, 25 (May): 186-192. Ginsberg, A. & Venkatraman, N. (1985). Contingency Perspective of Organizational Strategy: A Critical Review of the Empirical Research. Academy of Management Review, 10 (3): 421-434. Hamel, G. & Prahalad, C. K. (1985). Do You Really Have a Global Strategy? Harvard Business Review, 63 (July/August): 139-148. Hofer, C. W. & Schendel, D. (1978). Strategy Formulation: Analytical Concepts. St. Paul: West Publishing Company. Huber, G. P. & Power, D. J. (1985). Retrospective Reports of Strategic-level Managers: Guidelines for Increasing their Accuracy. Strategic Management Journal, 6 (2): 171180. Jain, S. C. (1989). Standardization of International Marketing Strategy: Some Research Hypotheses. Journal of Marketing, 53 (January): 70-79. James, L. R., Mulaik, S. A. & Brett, J. M. (1982). Causal Analysis: Assumptions, Models and Data. London: Sage. Jap, S. D. (2001). "Pie Sharing" in Complex Collaboration Contexts. Journal of Marketing Research, 38 (February): 86-99. Johanson, J. & Vahlne, J.-E. (1977). The internationalization process of the firm - A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, 8 (1): 23-32. Johanson, J. & Vahlne, J.-E. (1990). The mechanism of internationalization. International Marketing Review, 7 (4): 11-24. Julian, C. (2003). Export Marketing Performance: A Study of Thailand Firms. Journal of Small Business Management, 41 (2): 213-221. Kaplan, D. (1995). Statistical Power in Structural Equation Modeling. Pp. 100-117 in R. H. Hoyle (Ed.) Structural Equation Modeling: Concepts, Issues, and Applications, London: Sage Publications Inc. Katsikeas, C. S., Piercy, N. F. & Loannidis, C. (1996). Determinants of export performance in a European context. European Journal of Marketing, 30 (6): 6-35. Kim, K. & Oh, C. (2002). On Distributor Commitment in Marketing Channels for Industrial Products: Contrast Between the United States and Japan. Journal of International Marketing, 10 (1): 72-97. 32 Forthcoming in the Journal of World Business Kirpalani, V. H. & Macintosh, N. B. (1980). International Marketing Effectiveness of Technology-Oriented Small Firms. Journal of International Business Studies, 11 (Winter): 81-90. Klein, S. & Roth, V. J. (1990). Determinants of Export Channel Structure: The Effects of Experience and Psychic Distance Reconsidered. International Marketing Review, 7 (5): 27-38. Lado, N., Martinez-Ros, E. & Valenzuela, A. (2004). Identifying Successful Marketing Strategies by Export Regional Destination. International Marketing Review, 21 (6): 573-597. Lages, L. F. & Montgomery, D. B. (2004). Export Performance as an Antecedent of Export Commitment and Marketing Strategy Adaptation: Evidence from Small and Medium Sized Exporters. European Journal of Marketing, 38 (9/10): 1186-1214. Lages, L. F. & Montgomery, D. B. (2005). The Relationship Between Export Assistance and Performance Improvement in Portuguese Export Ventures: An Empirical Test of the Mediating Role of Pricing Strategy Adaptation. European Journal of Marketing, 39 (7/8): 755-784. Lee, D.-J. (1998). The Effect of Cultural Distance on the Relational Exchange Between Exporters and Importers: The Case of Australian Exporters. Journal of Global Marketing, 11 (4): 7-22. Leonidou, L. C., Katsikeas, C. S. & Samiee, S. (2002). Marketing Strategy Determinants of Export Performance: A Meta-Analysis. Journal of Business Research, 55 (1): 5167. Levitt, T. (1983). The Globalization of Markets. Harvard Business Review, 61 (MayJune): 92-102. Madsen, T. K. (1989). Successful Export Marketing Management: Some Empirical Evidence. International Marketing Review, 6 (4): 41-57. McQuitty, S. (2004). Statistical Power and Structural Equation Models in Business Research. Journal of Business Research, 57 (2): 175-183. Menon, A., Bharadwaj, S. G. & Howell, R. D. (1996). The Quality and Effectiveness of Marketing Strategy: Effect of Functional and Dysfunctional Conflict in Intraorganizational Relationships. Journal of Academy of Marketing Sciences, 24 (4): 299-313. Morgan, N. A., Kaleka, A. & Katsikeas, C. S. (2004). Antecedents of Export Venture Performance: A Theoretical Model and Empirical Assessment. Journal of Marketing, 68 (January): 90-108. Morosini, P., Shane, S. & Singh, H. (1998). National Cultural Distance and Cross-Border Acquisition Performance. Journal of International Business Studies, 29 (1): 137-158. Myers, M. B. (1999). Incidents of Gray Market Activity Among U.S. Exporters: Occurrences, Characteristics, and Consequences. Journal of International Business Studies, 30 (1): 105-126. Myers, M. B. (2004). Implications of Pricing Strategy-Venture Strategy Congruence: An Application Using Optimal Models in an International Context. Journal of Business Research, 57 (6): 591-600. Myers, M. B. & Cavusgil, S. T. (1996). Export Pricing Strategy - Performance Relationship: A Conceptual Framework. Pp. 159-178 in S. T. Cavusgil & T. K. Madsen (Eds.), Advances in International Marketing, London: JAI Press. 33 Forthcoming in the Journal of World Business Myers, M. B., Cavusgil, S. T. & Diamantopoulos, A. (2002). Antecedents and Actions of Export Pricing Strategy: A Conceptual Framework and Research Propositions. European Journal of Marketing, 36 (1/2): 159-188. North, D. (1990). Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press. O'Cass, A. & Julian, C. (2003). Examining Firm and Environmental Influences on Export Marketing Mix Strategy and Export Performance of Australian Exporters. European Journal of Marketing, 37 (3/4): 366-384. O'Grady, S. & Lane, H. W. (1996). The psychic distance paradox. Journal of International Business Studies, 27 (2): 309-333. Orru, M., Biggart, N. W. & Hamilton, G. G. (1991). Organizational Isomorphism in East Asia, in W. W. Powell & P. J. DiMaggio (Eds.), The New Institutionalism in Organizational Analysis, Chicago: The University of Chicago Press. 361-379. Özsomer, A. & Prussia, G. E. (2000). Competing Perspectives in International Marketing Strategy: Contingency and Process Models. Journal of International Marketing, 8 (1): 27-50. Özsomer, A. & Simonin, B. L. (2004). Marketing Program Standardization: A Crosscountry Exploration. International Journal of Research in Marketing, 21 (4): 397419. Pfeffer, J. & Salancik, G. R. (1978). The External Control of Organizations: A Resource Dependence Perspective. New York: Harper & Row. Podsakoff, P. M., MacKenzie, S. B., Lee, J.-Y. & Podsakoff, N. P. (2003). Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. Journal of Applied Psychology, 88 (5): 879-903. Podsakoff, P. M. & Organ, D. W. (1986). Self-Reports in Organizational Research: Problems and Prospects. Journal of Management, 12 (4): 531-544. Robertson, C. & Chetty, S. K. (2000). A Contingency-Based Approach to Understanding Export Performance. International Business Review, 9 (2): 211-235. Samiee, S. & Roth, K. (1992). The Influence of Global Marketing Standardization on Performance. Journal of Marketing, 56 (April): 1-17. Shoham, A. (1995). Global Marketing Standardization. Journal of Global Marketing, 9 (1/2): 91-119. Shoham, A. (1999). Bounded Rationality, Planning, Standardization of International Strategy, and Export Performance: A Structural Model Examination. Journal of International Marketing, 7 (2): 24-50. Sousa, C. M. P. (2004). Export Performance Measurement: An Evaluation of the Empirical Research in the Literature. Academy of Marketing Science Review, 4 (9): Available: http://www.amsreview.org/articles/sousa09-2004.pdf. Sousa, C. M. P. & Bradley, F. (2005). Global Markets: Does Psychic Distance Matter? Journal of Strategic Marketing, 13 (1): 43-59. Sousa, C. M. P. & Bradley, F. (2006). Cultural Distance and Psychic Distance: Two Peas in a Pod? Journal of International Marketing, 14 (1): 49-70. Stöttinger, B. (2001). Strategic Export Pricing: A Long and Winding Road. Journal of International Marketing, 9 (1): 40-63. Styles, C. (1998). Export performance measures in Australia and the United Kingdom. Journal of International Marketing, 6 (3): 12-36. 34 Forthcoming in the Journal of World Business Styles, C. & Ambler, T. (1994). Successful Export Practice: The UK Experience. International Marketing Review, 11 (6): 23-47. Terpstra, V. & Sarathy, R. (2000). International Marketing. Forth Worth: The Dryden Press. Theodosiou, M. & Katsikeas, C. S. (2001). Factors Influencing the Degree of International Pricing Strategy Standardization of Multinational Corporations. Journal of International Marketing, 9 (3): 1-18. Turnbull, P. W. & Valla, J.-P. (1986). Strategies for International Industrial Marketing: The Management of Customer Relationships in European Industrial Markets. London: Croom Helm. Vandenberg, R. J. & Lance, C. E. (2000). A Review and Synthesis of the Measurement Invariance Literature: Suggestions, Practices, and Recommendations for Organizational Research. Organizational Research Methods, 3 (1): 4-70. Walters, P. G. P. & Samiee, S. (1990). A Model for Assessing Performance in Small US Exporting Firms. Entrepreneurship Theory and Practice, 15 (Winter): 33-50. Wan, W. P. & Hoskisson, R. E. (2003). Home Country Environments, Corporate Diversification Strategies, and Firm Performance. Academy of Management Journal, 46 (1): 27-45. Weiss, A. M. & Heide, J. B. (1993). The Nature of Organizational Search in High Technology Markets. Journal of Marketing Research, 30 (May): 220-233. White, D. S., Griffith, D. A. & Ryans, J. K. (1998). Measuring Export Performance in Service Industries. International Marketing Review, 15 (3): 188-204. Whitelock, J. M. (1987). Global Marketing and the Case for International Product Standardization. European Journal of Marketing, 21 (9): 32-44. Whitelock, J. M. & Pimblett, C. (1997). The Standardization Debate in International Marketing. Journal of Global Marketing, 10 (3): 45-66. Wiedersheim-Paul, F., Olson, H. C. & Welch, L. S. (1978). Pre-export Activity: The First Step in Internationalization. Journal of International Business Studies, 9 (Spring/Summer): 47-58. Wind, Y. (1986). The Myth of Globalization. Journal of Consumer Marketing, 3 (Spring): 23-26. Yip, G. S. (1995). Total Global Strategy: Managing for Worldwide Competitive Advantage. Englewood Cliffs, NJ: Prentice Hall. Zou, S., Andrus, D. M. & Norvell, D. W. (1997). Standardization of International Marketing Strategy by Firms from a Developing Country. International Marketing Review, 14 (2): 107-123. Zou, S. & Cavusgil, S. T. (2002). The GMS: A Broad Conceptualization of Global Marketing Strategy and Its Effect on Firm Performance. Journal of Marketing, 66 (October): 40-56. Zou, S. & Stan, S. (1998). The determinants of export performance: A review of the empirical literature between 1987 and 1997. International Marketing Review, 15 (5): 333-356. Zou, S., Taylor, C. R. & Osland, G. E. (1998). The EXPERF scale: A cross-national generalized export performance measure. Journal of International Marketing, 6 (3): 37-58. 35 Forthcoming in the Journal of World Business Figure 1: The Conceptual Model H1 (-) Environment H2 (+) Number of markets H3 (-) Price adaptation H6 (-) Export performance H4 (-) Experience H5 (+) Control variable: Control variable: Export destination Size 36 Forthcoming in the Journal of World Business Table 1: Confirmatory Factor Analysis and Constructs Reliability Constructs and items Regression Standardized Weights Loadings t-value Export Performance (CR* = .80; VE** = .46) Meeting expectations How competitors rate firm’s export performance Export intensity Export profitability Export sales growth 0.944 1.347 0.752 0.609 (set to 1) 0.795 0.570 0.596 0.610 0.774 12.220 9.032 9.505 9.746 Price (CR* = .83; VE** = .56) Price discount policy Margins Credit concession Payment security 0.825 0.843 0.934 (set to 1) 0.701 0.743 0.786 0.756 10.812 11.624 12.097 Environment (CR* = .85; VE** = .54) Economic/industrial development Marketing infrastructure Communications infrastructure Technical requirements Legal regulations 0.784 1.046 1.002 0.976 (set to 1) 0.698 0.838 0.757 0.702 0.668 10.439 11.990 11.148 10.473 Experience (CR* = .74; VE** = .59) Overseas experience Export experience 1.349 (set to 1) 0.832 0.703 3.969 Model fit indices are as follows: chi-square = 270.955; df = 98 (p = 0.000); CFI=0.986; TLI=0.981; IFI=0.986; RMSEA=0.077 Note: *Composite reliability (CR) (Bagozzi, 1980) **Variance extracted (VE) (Fornell & Larcker, 1981) 37 Forthcoming in the Journal of World Business Table 2: Correlation between Constructs Construct 1 2 3 4 0.46 0.004 0.011 0.074 2. Price -0.066 0.56 0.353 0.007 3. Environment 0.103 0.594 0.54 0.008 4. Experience 0.272 -0.084 0.091 0.59 1. Export performance Note: Correlations in the lower triangle, shared variance in upper triangle and average variance extracted on the diagonal 38 Forthcoming in the Journal of World Business Figure 2: Final Model Control variable: Size 0.222 Environment 2.303 -0.181 -2.554 -0.141 2.621 2.366 7.266 Number of markets 0.237 0.222 0.581 Price adaptation -0.123 -2.118 -0.196 -2.003 Export performance -2.003 0.170 Experience 2.217 Control variable: Export destination Chi-square=335.323, df=153 CFI=0.987; TLI=0.982; IFI=0.987; RMSEA=0.063 Note: Standardized parameter estimate above the lines and t-values below the lines 39 Forthcoming in the Journal of World Business APPENDIX: Constructs and Measures ENVIRONMENT Scale: 1 (very similar) to 5 (very different) • Communication infrastructure • Marketing infrastructure • Technical requirements • Legal regulations • Economic/industrial development PRICE ADAPTATION Scale: 1 (very similar) to 5 (very different) • Price discount policy • Margins • Credit concession • Payment security EXPORT PERFORMANCE Scale: 1 (very unsatisfied) to 5 (very satisfied) • Export sales growth • Export profitability • Export intensity • Degree of meeting expectations Scale: 1 (unsuccessful) to 10 (successful) • How competitors rate firm’s export performance EXPERIENCE Scale: 1 (none) to 5 (substantial) • Degree of professional exporting experience • Degree of overseas experience: living/working abroad NUMBER OF MARKETS • Number of countries to which they export the product SIZE OF THE FIRM • Number of employees • Company sales EXPORT DESTINATION • Country to which they export the product 40