FIR-Template-RF-2014_Layout 1.qxd

advertisement

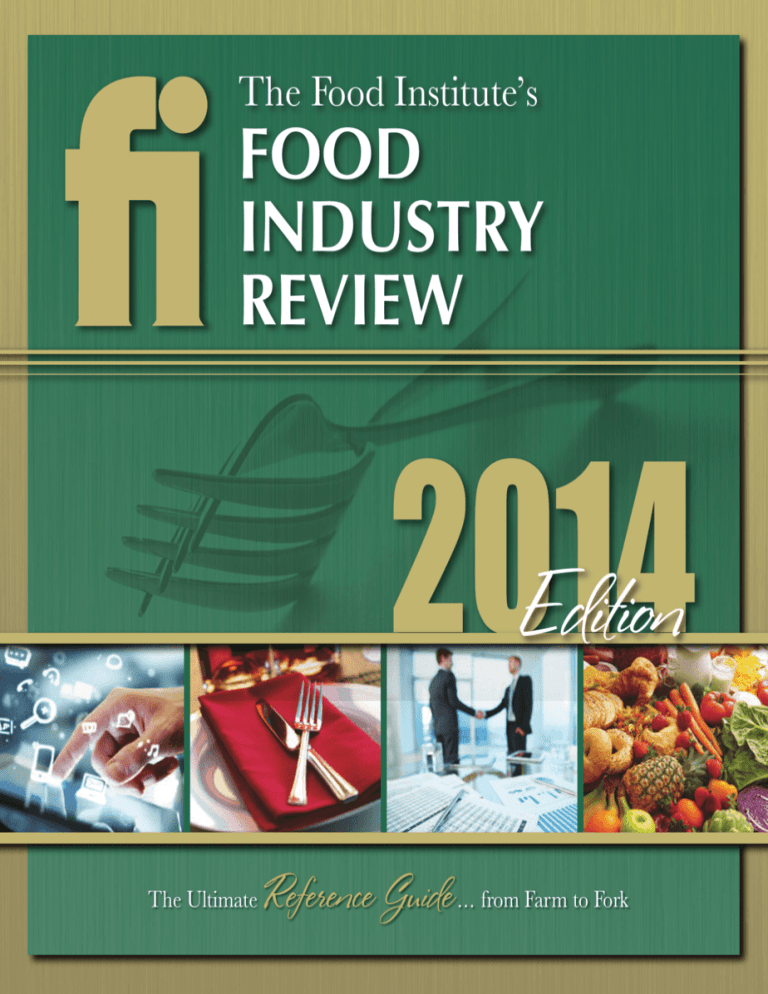

The Food Institute’s FOOD INDUSTRY REVIEW 2014 Edition The Ultimate Reference Guide ... from Farm to Fork The Food Institute’s Food Industry Review 2014 Edition The Food Institute 10 Mountainview Road Suite S125 Upper Saddle River, NJ 07458 Phone 201-791-5570 Fax 201-791-5222 www.foodinstitute.com • Prices: Binder & CD-ROM $425 Binder $350 CD-ROM or PDF $399 Copyright 2014 by The American Institute of Food Distribution Inc. Overview By 2018, the market share for traditional grocery will decrease 1.2 percentage points to 44.8%; while share for non-traditional grocery will increase to 40.1% and convenience stores share will increase to 15.1%, according to Willard Bishop’s Future of Food Retailing 2014 report. Market share will increase substantially for supercenters to 19.4% by 2018. Food Shopping Channels Used Regularly (Source: FMI Grocery Shopper Trends) Supermarket 85% 46% Supercenter Discount store 29% Warehouse clubstore 26% Low-price, no frills grocery store 16% Dollar store 15% Drug store 15% Natural or organic food store 11% Ethnic grocery 5% Convenience store 5% Online 3% Fresh Format stores are expected to continue their swift growth over the next five years at a rate of 12.1% annually. Limited-assortment will also experience strong growth of 5.9% by 2018. Small grocery will see a relatively low growth rate of 2.1%. Traditional supermarkets’ share is expected to continue to decline from 39.1% in 2013 to 36.2% by 2018. E-Commerce food and consumable sales will continue its substantial growth rate of 9.5% a year. According to Progressive Grocer’s 81st Annual Report of the Grocery Industry, retailers are more optimistic about 2014 than they have typically been about the coming year. Supermarket sales were $620 billion in 2013, an increase of 2.9%. Conventional supermarkets continue to hold the majority share of the industry at 65.8%, but also experienced a slight dip in units and modest sales gains. Supercenters represent just more than 25% of the industry but experienced increases of 4% in units and 4.7% in sales. Eight of the nation’s 10 largest retailers drive a significant portion of store traffic with groceries, according to STORES magazine. In all, 37 of the Top 100 retailers include groceries in their merchandise mixes; more than 20 can be classified as supermarkets. This is a good time to be a small-footprint or specialty grocery chain, whether national in scope or one with stores clustered in regional markets, according to the National Retail Federation. The rise of small and specialty grocery chains is enabled by the squeeze put on traditional supermarkets by discounters, drug stores and online purveyors of food and other consumables The proliferation of mergers and acquisitions in the supermarket industry indicate there are plenty of growth opportunities for smaller, regional and specialty grocers. Top Food Retailers (Source: STORES) Rank 1 2 3 4 6 7 9 10 11 15 16 17 Company Walmart Kroger Target Costco Walgreen CVS Caremark Safeway McDonald's Amazon.com Publix SUPERVALU Ahold USA/ Royal Ahold 18 22 24 26 27 28 30 32 2012 U.S. Retail Sales ($000) $328,704,000 $92,165,000 $71,960,000 $71,042,000 $65,014,000 $63,688,000 $37,532,000 $35,593,000 $34,416,000 $27,485,000 $27,457,000 WW Retail % Chg. '12 v '11 Sales ($000) 4.0% $467,896,000 6.6% $92,165,000 5.1% $71,960,000 10.6% $97,062,000 -1.2% $66,977,000 6.7% $63,863,000 1.6% $42,237,000 4.2% $88,290,000 30.4% $61,093,000 1.9% $27,485,000 -6.3% $27,457,000 U.S. % of WW Sales 70.3% 100.0% 100.0% 73.2% 97.1% 99.7% 88.9% 40.3% 56.3% 100.0% 100.0% 2012 Stores 4,570 3,538 1,778 435 7,821 7,472 1,418 14,146 --1,230 2,404 % Chg. '12 v '11 3.3% -1.0% 0.9% 2.4% 2.2% 1.7% -2.4% 0.4% na 2.7% -3 $25,845,000 3.1% $62,260,000 41.5% 772 2.1% Rite Aid $25,392,000 50.0% $25,392,000 100.0% 4,623 -0.9% Delhaize America YUM! Brands Dollar General Meijer Wakefern/ShopRite BJ's Wholesale Club Subway $18,800,000 $17,964,000 $16,022,000 $15,814,000 $13,656,000 $12,465,000 $12,237,000 -2.2% 5.1% 8.2% 2.8% 6.4% 6.0% 9.2% $29,212,000 $34,572,000 $16,022,000 $15,814,000 $13,656,000 $12,465,000 $18,417,000 64.4% 52.0% 100.0% 100.0% 100.0% 100.0% 66.4% 1,553 18,069 10,506 198 300 200 25,900 -5.9% 0.1% 5.7% 0.5% 3.1% 2.6% 3.5% Retail Segment Definitions (Source: Willard Bishop’s Future of Food Retailing Report) Traditional Grocery Traditional Supermarket – Stores offering a full line of groceries, meat, and produce with at least $2 million in annual sales and up to 15% of their sales in General Merchandise/Health and Beauty Care (GM/HBC). These stores typically carry anywhere from 15,000 to 60,000 SKUs (depending on the size of the store), and may offer a service deli, a service bakery, and/or a pharmacy. Fresh Format – Different from traditional supermarkets and traditional natural food stores, fresh stores emphasize perishables and offer center-store assortments that differ from those of traditional retailers—especially in the areas of ethnic, natural, and organic, e.g., Whole Foods Market, The Fresh Market, and some independents. Limited-Assortment Store – A low-priced grocery store that offers a limited assortment of centerstore and perishable items (fewer than 2,000), e.g., Aldi, Trader Joe’s and Save-A-Lot. Super Warehouse – A high-volume hybrid of a large traditional supermarket and a warehouse store. Super Warehouse stores typically offer a full range of service departments, quality perishables, and reduced prices, e.g. Cub Foods, Shoppers Food & Pharmacy, and Smart & Final. Other (Small Grocery) – A small corner grocery store that carries a limited selection of staples and other convenience goods. These stores generate less than $2 million in business annually. Convenience Stores Convenience Store (w/gas) – A small, higher-margin store that offers an edited selection of staple groceries, non-foods, and other convenience food items, e.g., ready-to-heat and ready-to-eat foods. The Convenience Store with Gas format includes only Convenience Stores that sell gasoline, e.g., ExxonMobil (On the Run), AM/PM, etc. Convenience Store (w/o gas) – Small, higher-margin convenience stores that don’t sell gas and offer an edited selection of staple groceries, non-foods, and other convenience food items, e.g., readyto-heat and ready-to-eat foods. Stores such as 7-Eleven without gasoline pumps are included. Non-Traditional Grocery Wholesale Club – A membership retail/wholesale hybrid with a varied selection and limited variety of products presented in a warehouse-type environment. These ~120,000-sq. ft. stores have 60% to 70% GM/HBC and a grocery line dedicated to large sizes and bulk sales. Memberships include both business accounts and consumer groups, e.g., Sam’s Club, Costco and BJ’s. Supercenters – A hybrid of a large Traditional Supermarket and a Mass Merchandiser. Supercenters offer a wide variety of food, as well as non-food merchandise. These stores average more than 170,000-sq. ft. and typically devote as much as 40% of the space to grocery items, e.g., Walmart Supercenter, Super Target, Meijer and Kroger Marketplace stores. Dollar Stores – A small store format that traditionally sold staples and knickknacks, but now sells food and consumable items at aggressive price points that account for at least 20%, and up to 66%, of their volume, e.g., Dollar General, Dollar Tree and Family Dollar. Drug – A prescription-based drug store that generates 20% or more of its total sales from consumables, general merchandise and seasonal items. This channel includes major chain drug stores such as Walgreens and CVS, but does not include stores/chains, e.g., The Medicine Shoppe, that sell prescriptions almost exclusively. Mass – A large store selling primarily hardlines, clothing, electronics, and sporting goods but also carries grocery and non-edible grocery items. This channel includes traditional Walmart, Kmart, and Target stores. Military – A format that looks like a conventional grocery store carrying groceries and consumables, but is restricted to use by active or retired military personnel. Civilians may not shop at these stores (referred to as commissaries). E-Commerce (food and consumables) – Food and consumable products ordered using the internet via any device, regardless of the method of payment or fulfillment. This channel includes Amazon and Peapod as well as the E-Commerce business generated by traditional brick & mortar retailers, e.g., Coborns (Coborns Delivers) and ShopRite (ShopRite from Home and ShopRite Delivers). The other non-traditional retail segments above include their E-Commerce business. Supermarkets Shrink Just a few years ago, grocery stores averaged sizes around 46,000 square feet, 10,000 square feet larger than in the 1990s, reported TIME (June 2). Now in 2014, supermarkets have been shrinking to fit the needs of today’s modern consumer. Not only are traditionally smaller stores such as Aldi and Trader Joe’s thriving, both of which generally run under 20,000-sq. ft., but larger chains like Walmart, Publix and Kroger are exploring small format options. Planet Retail, a marketing research company, forecasts that the average store size across grocery formats is set to shrink from 25,500sq. ft. today to less than 24,000-sq. ft. by 2018. Publix is among the traditional supermarket retailers looking to scale down. The company is planning a prototype store for small urban communities and college campuses that will be 20,000 to 40,000 sq. ft. smaller than their typical stores, reported Orlando Business Journal (May 7). Stop & Shop is also opening condensed stores, shifting from their normal 75,000-sq. ft. to stores as small as 12,000 sq. ft. in New England, according to Boston Business Journal (June 4). The list doesn’t stop there. Kroger opened three 7,500-sq. ft. stores in Ohio, while Hy-Vee opened a 14,000-sq. ft. location called “Hy-Vee Mainstreet” in Iowa. Even Walmart, know for its gigantic supercenters, coming in at 182,000 sq. ft., has increased its number of Neighborhood Markets, 38,000 sq. ft., and Walmart Expresses, 12,000 sq. ft., and plans to open up to 300 of those concepts in 2014, reported The Dallas Morning News (June 5). The question is, what is causing this dramatic shift in store size? TIME states that part of the reason is the need to cater to Millennials, who are migrating more towards urban living and find large format stores to be overwhelming. It is also appealing to companies to have customers visit the store many times in one week, as opposed to the usual large shopping trip, that will only bring a customer in a few times a month. Urban markets are an important market for bigbox retailers such as Target and Walmart, reported Bloomberg (Jan. 9). Cities are growing faster than suburbs for the first time in decades, and they’re generally filled with younger, more free-spending residents, as well as college students and tourists. Target, for example, has opened eight CityTarget stores that are smaller, more urban and less uniform than their usual 135,000-sq. ft. suburban stores. 2013 Market Share (Grocery & Consumables) (Source: Willard Bishop) Number of Stores Total Traditional Grocery Traditional Supermarkets Fresh Format Limited-Assortment Super Warehouse Other (Small Grocery) Total C-Stores Convenience (w/gas)* Convenience (w/o gas)* Total Non-Traditional Grocery Wholesale Club Supercenter Dollar Store Drug Mass Military Total All Formats 40,292 26,140 1,063 3,835 556 8,698 157,662 128,003 29,659 59,132 1,383 3,829 27,200 23,258 3,281 180 257,086 Dollar Share 46.0% 39.1% 1.2% 2.7% 1.8% 1.1% 15.0% 12.8% 2.2% 39.0% 8.7% 17.6% 2.5% 5.4% 4.3% 0.4% 100.0% Annual Sales (millions) $ 522,826.80 $ 444,210.80 $ 14,022.90 $ 31,069.10 $ 20,806.00 $ 12,718.00 $ 169,905.50 $ 145,265.90 $ 24,639.60 $ 442,072.00 $ 98,520.80 $ 200,281.80 $ 28,701.40 $ 61,294.80 $ 48,441.40 $ 4,831.70 $1,134,804.30 Thirty-nine percent of North American retail *Does not include gasoline sales. sales growth is coming from stores that are 35,000 sq. ft. or smaller, and more than a third of small-store growth is coming from stores that are 5,000 sq. ft. or smaller, according to RetailNet Group. “Small stores allow you to get into deep urban markets,” Dan O’Connor from RetailNet said. These high-density urban neighborhoods provide less flexibility for retail development so large retailers are using smaller stores. The small box trend is the logical extension of retailers’ growth plans following the consumer, reported CSNews Online (July 11). Studies also suggest that consumers want to shop in a smaller store, and will purchase more in a more manageable store format. An InContext Solutions study revealed that the quicker shoppers are able to find their first product, the more likely they are to linger in the category and purchase more. Additionally, every two extra minutes a shopper takes to make his or her first purchase in a category reduces the final basket size by one product. The study found that found the median time a shopper devotes to a single shopping mission is just over four minutes and less than 15% of shopping missions last more than 10 minutes. Digital media company, Catalina, also found that over the course of a year shoppers buy just 0.7% of all available products in the grocery store. Even those who account for 80% of all store purchases buy just 1% of all available products. The Shopper Experience Grocery shoppers are putting more weight on experience during their shopping trip. In a study conducted by Retail Feedback Group, shoppers who don’t believe their store provides a fun experience gave their store a satisfaction rating of only 3.95 out of 5. Only two out of 10 shoppers indicated that their primary store “absolutely” provides a fun and exciting environment, but those customers gave their store very high satisfaction marks of 4.78. Though supermarkets must focus on creating a more enjoyable experience at the store, companies cannot abandon efforts to keep prices affordable and transactions quick, as those are still the main factors in customer satisfaction at the grocery store. Omnico Group research found that more than 77% of Americans would be less likely to return to a store if they experienced long checkout lines. After eight minutes, customers are likely to abandon the checkout line and leave the store with no purchase and are likely to never return to that store as a result of the negative experience. The top three technologies that Omnico found will improve the average customer's in-store experience are self-checkout, free Wi-Fi and "click and collect" technology. 2013 Format Characteristics Many issues are (Grocery & Consumables) important to (Source: Willard Bishop) shoppers and contribute to their Total Store Avg. Total Avg. Weekly % of Total Area SKUs Store Sales Store Sales decision of where to Total Traditional Grocery $ 247,379 100% shop. The National Traditional Supermarkets 53,500 45,000 $ 324,171 100% Grocers Association Fresh Format 34,000 21,000 $ 253,180 100% (NGA) consumer Limited-Assortment 12,600 2,900 $ 152,144 100% survey unveiled that Super Warehouse 45,000 37,000 $ 702,950 100% some of the most Other (Small Grocery) 9,000 3,000 $ 27,452 100% critical attributes for Total C-Stores $ 20,518 81% costumers are Convenience (w/gas)* 2,800 3,100 $ 21,607 81% convenient location Convenience (w/o gas)* 3,000 3,700 $ 15,817 81% and access, Total Non-Traditional Grocery $ 143,852 navigable layouts Wholesale Club 132,400 4,900 $ 1,366,874 59% and checkout Supercenter 179,600 100,000 $ 998,206 60% processes that save Dollar Store 8,100 9,400 $ 19,594 66% time, the use of Drug 11,100 19,000 $ 50,759 34% technology to tailor Mass 62,400 95,000 $ 275,885 23% marketing messages Military 29,400 15,000 $ 547,479 100% and promotional *Does not include gasoline sales. offers, and caring about the customer. NGA President Peter J. Larkin stated, "The more personalized the shopping experience at friendly, nimble regional supermarkets, the greater their edge over retailers less connected to communities and less empowered to please people as personal situations arise." In a survey by Market Force Information, shoppers indicated that they prefer stores like Trader Joe’s and Publix because of their customer service and atmosphere. Trader Joe’s customers like its unconventional grocery shopping experience with a neighborhood feel, along with a level of service and customer satisfaction that exceeds expectations. Courteous service, fast checkouts and inviting atmosphere are just as important to shoppers as low prices and promotions, according to the survey. The respondents who reported having an unpleasant shopping experience cited long checkout times, inability to find the products they want, lacking produce quality, poor service by floor associates and poor service by cashier as the main reasons for their dissatisfaction. Many supermarkets are changing the types of amenities they offer, as well, to improve the customer experience and keep shoppers lingering in the store. Hy-Vee added a 11,000-sq. ft. wing to its Omaha, NE location with a full-service restaurant and bar with wait-staff, and a Shoprite in New Jersey added an oyster bar, a wellness center with registered dietitians, a yoga studio and child-care center. Publix opened a store with a 1,500-sq. ft. cooking school, including wine pairings and classes on basic knife skills, condiments, French pastry and Italian cuisine, reported Orlando Sentinel (Dec. 10, 2013). Future of Grocery While technology will be more important than ever for groceries, it is just one aspect in a variety of considerations required to run a successful grocery store, according to PWC’s Front of the Line: How Grocers can get Ahead for the Future. A survey of over 1,000 shoppers found four broad categories, each with its own particular preference. PwC found that most customers still prefer brick-and-mortar grocery stores to online shopping, with only 1% of respondents primarily using online services despite 92% having access to them. The most common concern was the inability to touch and check products before purchase. At the same time there is room for improvement among traditional grocers, with the most common customer complaints being long lines, crowded aisles and parking lots and unhelpful staff. 2013 Industry Consumer Experience Benchmarks - Supermarkets (Source: ACSI Retail Report) Convenience of Store Location and Hours 86 Ability to provide brand names 81 Availability of merchandise (inventory stocks) 81 Quality and freshness of meat and produce 81 Layout and cleanliness of store 80 Courtesy and helpfulness of staff 80 Variety and selection of merchandise 80 Quality of pharmacy services 80 Website satisfaction 79 Frequency of sales and promotions 79 Call center satisfaction Speed of checkout process 77 73 Most shoppers cited traditional grocery stores as their primary source of food, with 83% putting them in their top three shopping spots. While prices remained an important factor, researchers found customers were willing to pay more for an improved in-store experience, including benefits such as education and quality products. An easy to navigate store with new merchandise displays, clear signage and knowledgeable staff could make could take advantage of the desire for an improved shopping experience, leading to additional visits and more purchases at each visit. Personalization is Key Eighty-five percent of consumers prefer personalized offers reflecting their past shopping behavior, according to a survey by Synqera. Almost 90% of respondents said they would have purchased an item that was similar in look and quality, but less expensive, than one that they were originally looking for, if only they had been made aware of it. Both brick-and-mortar and online retailers can learn from the targeted shopping experience of e- commerce companies such as Amazon.com, who suggests items based on past purchases. Online discounts and mobile apps are replacing print coupons, and many retailers, like Kroger and Metro, are offering mobile apps that deliver weekly coupons sorted by relevance to each shopper. About 45% of Safeway’s sales now come from shoppers who get special offers online or from mobile apps, up from almost zero in 2011, when their program “Just for U” rolled out nationally, reported Bloomberg (Nov. 14, 2013). Simon Hay, CEO of Dunnhumby, says that although fewer than 5% of offers consumers receive today are individualized, that number should rise to more than 30% within eight years. The mobile apps could eventually let supermarkets send personalized offers in real time by tracking shoppers lists and location inside the store, with users consent. Mobile and Online Shopping Experiences It is increasingly important that retailers match their in-store shopping experience to their online and mobile shopping experiences. Forty-eight percent of smartphone shoppers and 50% of tablet shoppers will abandon a retail brand altogether if it has a poor mobile shopping experience, according to research by Mobiquity. The research found that Target is now the most-browsed mobile app and website, which takes WalMart's prior top position in previous studies. Some 50% of shoppers complained that shopping on retailers' tablet apps involves too many steps, while 49% said they couldn't find the products they were looking for on retailers' tablet sites. The study also found that 35% of consumers went on to complete their purchase in-store. Members of the food Consumer Satisfaction Scores - Supermarkets industry know that online (Source: American Consumer Satisfaction Index) purchases of food will increase in the coming Company 2012 2013 % Change years, but we can never Supermarkets 77 78 1.3% know how much. According Publix 86 86 0.0% to a study by Deloitte, food All Others 78 81 4.0% business executives only 79 80 1.0% Kroger expect 35% growth of Whole Foods 80 78 -3.0% online CPG purchases in the 78 77 -1.0% next year and 76% growth Winn-Dixie Supervalu 76 77 -1.0% in three years. In contrast, Safeway 75 76 1.0% consumers expect their 72 72 0.0% online purchases to Wal-Mart increase by 67% in the next year and 158% in three years. Consumers prefer to use online retailers to purchase their food for a variety of reasons, including free at-home delivery, pricing similar to or less than traditional physical stores, and free in-store pickup. Some retailers are responding to these results and improving their online experiences for shoppers. Whole Foods Market adopted a “click and collect” program where customers can choose their products online, and then go to their designated store and pick up the items that are there waiting for them. Walmart has also tested online ordering options, delivering their grocery products directly to consumers’ homes, for a small fee. H-E-B has also expressed plans to begin an online shopping experience for customers, while Roche Brothers, Costco, and Fairway all currently offer online ordering and home delivery in select areas. Some retailers are not concerned about online retailing and are not focusing their attention on it. For example, Kroger’s CEO, David Dillon stated that he believes shoppers like making a connection with their community and neighbors by going to the grocery store, which is one reason why Kroger’s digital strategy doesn’t focus on e-commerce, reported The Wall Street Journal (Oct. 30, 2013). Studies show that consumers are making the switch to online shopping, though, provided retailers make a few changes. Nineteen percent of shoppers said they are using “click and collect” more often than in the previous year, according to a survey by Accenture. The survey showed that the ability to check product availability online before traveling to a store is the service that would most improve the shopping experience for 31% of U.S. shoppers, and the vast majority of respondents said they would either travel to a store to make a purchase or buy online if retailers offered real-time information on product availability. The study also found that shoppers expect a retailer’s product offerings to be the same across different shopping channels, and more than half also expect promotions and prices to be the same. Percentage of U.S. Store Expansion in the Top 20 Expansion Chains: 2013 vs. 2007 (Source: Nielsen ) Mass Merchandisers 5.0% Grocery 6.9% Dollar Stores 35.6% Drug Stores 20.8% C-Stores 31.7% Intent among consumers to buy groceries online rose from 22% in 2011 to 27% in 2014, according to Nielsen. This increase gets even higher in the Asia-Pacific region, especially in China and South Korea, where purchase intentions exceed the global average by about 20% each. Also, eMarketer forecasts that business-to-consumer e-commerce sales worldwide will rise 20% from 2013 to $1.5 trillion in 2014. John Burbank, president of strategic initiatives at Nielsen stated, "Finding the right balance between meeting shopper needs for assortment and value, while also building trust and overcoming negative perceptions, such as high costs and shipment fees, is vital for continued and sustainable growth." Amazon Moves Further into Food Industry Amazon is always a frontrunner when it comes to e-commerce, and their grocery business is no different. It unveiled Amazon Pantry in April, which looks to rival such warehouse clubs as Costco and Sam’s Club. With Pantry, customers are able to load a box with household items and groceries (non-perishable), and have it shipped directly to their home for a flat fee . The company has also started a program called Prime Fresh, a same-day grocery delivery service in California and Seattle. The service also includes a device called Amazon Dash, a remote-like wand that can be used to scan products customers would like to order with Amazon Fresh, or users can speak the name of a product into the device and it will be added to their shopping list. Amazon’s founder and CEO, Jeff Bezos, shows no signs of slowing down the company’s grocery business. He told shareholders, “We’ll continue our methodical approach – measuring and refining AmazonFresh – with the goal of bringing this incredible service to more cities over time." Amazon was placed at number nine on STORES magazine’s Top 100 Retailers list for 2014, after not making the Top 100 at all last year. Amazon added nearly $10 billion in Internet retail sales last year, which effectively matched Walmart’s total web sales. Online Grocery Delivery Grocery delivery services are poised to grow but have a lot to learn, according to Wells Fargo Securities LLC and Fluid Inc.’s research Online Grocery: Is Anyone Doing It Right? The study focused on how each service engaged and interacted with customers and found that there’s still room for improvement, especially in user experience, online features and content, and making the services more grocery centric. Fresh Direct was found to have the best combination of grocery centered service with a digital mindset, but lacked national products. Peapod, the digital extension of Stop & Shop and Giant, did have the selection of national products, but lacked fresh produce availability. Amazon Fresh and Google Shopping achieved what they are best known for: powerful mobile websites, and detailed product information and search. Amazon Fresh’s delivery was not always available for the same day, while Google Shopping was. Both services lacked the grocery-centric features. Safeway.com and Walmart To Go have delivery services in some areas. Both companies offered the same products and quality as its stores, but lagged in website layout and features. Wells Fargo analysts believe that brick-and-mortar grocery retailers could lose market share as grocery delivery continues to grow, especially conventional grocery stores. Natural and organic grocers such as Whole Foods Market and Trader Joe’s could hold their market share. Grocery Delivery Availability and Features Company Availability Price Minimum Order Delivery Time Usually not until next day Fresh Direct New York City area, New Jersey, Connecticut, Philadelphia, Delaware $5.99/one-time delivery, $12.99/one month, $69/six months, $119/year $30 Google Shopping Express Manhattan, San Jose, San Francisco, Los Angeles Free trial with membership n/a Amazon Fresh S. California, San Francisco, Seattle $299/year n/a Peapod Chicago, Milwaukee, S.E. WI, Indianapolis, S. NH, RI, CT, NY, NJ, MD, VA, DC, Philadelphia, S.E. PA Between $6.95 and $9.95 $60 Same-day Safeway.com AZ, CA, DC, MD, OR, VA, WA Between $9.95 and $12.95, plus a fuel surcharge $49 8-12 hours after ordering Walmart To Go San Jose, San Francisco, Denver Free with $30 minimum order n/a Next day Harris Teeter (only pickup) 160 Southeast locations n/a n/a n/a n/a One-hour delivery Same-day for evening delivery Same-day or next-day Whole Shopper (only pickupPylmouth Meeting, PA $4.95/one-time delivery, $16.95/moth $5 for orders under $100 Munchery San Francisco $2.95 n/a Instacart Atlanta, Austin, Boston, Chicago, Denver, Los Angeles, New York City, Philadelphia, San Francisco, Seattle, DC $3.99 n/a 1-2 hours Postmates San Francisco, Seattle, New York City, DC $5 minimum and 9% added to each item n/a Under an hour Relay Foods Nine VA towns; Williamsburg, Brooklyn, NY; DC; Baltimore/Annapolis, MD n/a n/a However, the playing field for grocery delivery is still uncluttered and the category is somewhat underdeveloped. Existing grocery stores have the knowledge needed to improve grocery delivery. They have the network of stores, the workforce and in some cases online loyalty programs that could create a better model with working features, such as same-day delivery. Some grocers are choosing to start with online ordering to then pick up in store or using delivery companies like SHUTL to offset the delivery costs. Whole Foods is testing online ordering with Whole Shopper in its Plymouth Meeting, PA store with benefits such as same prices online as in store and wireless payment. Harris Teeter offers in-store pick up as well in 160 stores. Online grocery delivery services need to engage consumers with the imagery, design and information on their websites to continue its growth. The websites should be more user friendly with features such as multi-item search, quick lists, and mobile apps. These mobile apps or websites should also have its own features like easy list making for the shopper’s convenience. Shoppers looking for convenience also want more communication with drivers, via text messages, and a personalized experience, with ready-made meals, shoppable recipes, and product history. Customers also look to each other for help with customer reviews or popular products lists. There is also much to learn from start-ups, according to Wells Fargo. Munchery offers searchers by diet restrictions on its website and communication with drivers via text. The company, which services San Francisco, also promotes social sharing by giving discounts when friends sign up. Instacart offers same-day delivery in 11 cities and plans to expand to 20 by the end of 2014. Although this service is pricier, their delivery options are within an hour or two and it offers a shop with a friend feature. Postmates delivers anything from food to electronics in under an hour. Distance to Primary Store and Presence of Closer Alternatives (Source: FMI Grocery Shopper Trends) 89% 80% 74% 65% 60% 50% Total Supermarket 69% 71% 73% 52% Club Store Supercenter Others Primary store located within five miles Other stores are located closer to home than Primary store Relay Foods, which services some East Coast markets, delivers items from local farms, stores and restaurants. The user has options to save recurring orders and to either pick up at a location or have the products delivered. Relay Foods has plans to go national. According to Fluid, if the startups were put against the larger companies, they would be strong contenders, due to the better features and online experience. They are making online grocery services fun, like Whole Foods and Trader Joe’s did with grocery shopping. The goal is to make the consumer not think of it as a chore, but as an enjoyable experience. Costco Continues Growth Costco is not the only warehouse club on the market, but it continues to see comparable store sales rising, keeping its edge over similar chains. Within the first seven months of 2014, samestore sales saw an average growth of approximately 4.7%, reported Zack’s Investment Research. A differentiated product range enables Costco to provide an upscale shopping experience to its members, resulting in market share gains and higher sales per square foot. The company also continues to maintain a healthy membership renewal rate and is committed to opening new clubs in domestic and international markets. Costco’s CEO stated that it plans to open 30 stores a year, which will double its business in about 15 years. The company has also seen a positive response to its organic offerings, which provides higher margins, and also attracts younger customers, reported Bloomberg Businessweek (March 6). Costco specifically mentions its “giant bags of kale” as a popular product that has been bringing in a new customer base. The Growth of the Dollar Store The possibility of a large dollar store merger is bringing up questions of why dollar stores are in such high demand. At the time of publication, Dollar Tree is speeding up its acquisition of Family Dollar Stores, amid increasing bids from Dollar General. After the Great Recession in the early 2000s, consumers were looking for ways to stretch their dollars, and one way to do that was with the dollar store. Now that shoppers are returning to prerecession cash flows, dollar stores have retained their following by changing their image to a place that can offer high quality foods and products that rival supermarkets and drug stores, reported TIME (Aug 18). These discount retailers aim to become a one-stop shop for customers that is more manageable and smaller than traditional mass retailers. Since customer finances are improving and dollar stores are selling higher quality items, they need to find ways to cut prices further, reported The New York Times (Aug 18). One way is to merge with the competition, which is what Dollar Tree and Dollar General aim to do. The fight over Family Dollar “confirms that small-box retailing is the fastest-growing segment of an otherwise slow-growth/no-growth retail store environment,” stated Craig Johnson, president of the consulting firm Customer Growth Partners. 2014 Top Alternative Formats (Source: Supermarket News) Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Company Wal-Mart Stores Costco Wholesale Corp. Target Corp. 7-Eleven Dollar General Corp. Meijer Inc. Whole Foods Market BJ's Wholesale Club Trader Joe's Co. Family Dollar Stores Aldi Smart & Final Sprouts Farmers Market 99 Cents Only Stores The Fresh Market Corporate/ Franchise Stores 5,166 539 1,921 8,285 11,100 204 367 201 415 7,915 1,227 240 167 350 149 Sales in $ Billions Top 75 Ranking 374.4e 90.5a 73.6e 25.3e 17.8e 15.0e 12.9a 11.8e 11.3e 10.4a 8.0e 2.4e 2.4e 1.8e 1.5e 1 3 4 9 15 17 19 20 21 23 26 49 50 57 65 e: estimated sales a: actual sales Dollar Stores Expand Food Offerings Dollar stores are increasingly adding to their food offerings, becoming more like a small grocery store. Family Dollar added 400 food items to its stores in 2014, including national brands such as Hellman’s and Ragu. Dollar stores aim to appeal to the smaller family consumer, one who is not looking to buy in bulk. These may be single or older consumers who are shopping for only one or two people. Companies have begun to design products specifically for this purpose, such as General Mills, who created their FiberOne bars in smaller packages to sell specifically in dollar outlets, reported Bloomberg Businessweek (July 15). Dollar Tree installed more freezers and coolers in their stores, offering frozen and refrigerated product in 3,115 stores. One of their top performing categories in the third quarter of 2013 was frozen and refrigerated products. Dollar stores are also rivaling convenience stores, becoming another quick food option that does not involve a long trip to the grocery store. According to studies by Nielsen, more consumers are going food shopping in dollar stores for immediate needs, not to stock up on items. The large amount of dollar stores in the U.S. makes them a more convenient alternative to traditional supermarkets. Dollar General opened their 11,000th store in 2013, and spans 40 states. Additionally, Nielsen found that not just families with smaller incomes shop at dollar stores for food, but 20% of their sales come from households making over $70,000. Drug Stores Aim to Offer Fresher, Healthier Options Drug stores are attempting to improve their customer experience, adding more food options and creating an inviting feel. Rite Aid updated its store concepts to include a café that serves coffee, tea, baked goods and ice cream, as well as offering more packaged gluten-free and organic items. Top 10 Drug Chains by Dollar Volume (Source: Racher Press research, Chain Drug Review) Rank 1 2 3 4 5 6 7 8 9 10 Company Walgreens CVS Caremark* Rite Aid Shoppers Drug Mart Health Mart Jean Coutu Group London Drugs Rexall Pharma Plus McKesson Canada Medicine Shoppe *Retail Sales only Sales (in billions) $72.22 $65.62 $25.53 $10.08 $7.40 $3.68 $2.19 $2.16 $2.14 $1.90 Walgreens also updated some of its stores with fresher options and healthier fare. Its Manhattan flagship store features fresh sushi, sandwiches, wraps and ready-to-eat cut fruits and vegetables. It also carries a wider range of frozen foods and entrees as well as expanded deli dairy items for a more complete range of options. Additionally, the chain opened a new flagship in Chicago that boasts even more offerings such as: made-to-order juice, a smoothie and milkshake bar; sushi and sashimi; produce; on-the-go meal options such as wraps, soup, sandwiches and salads; and a self-serve frozen yogurt and Icee station. The store also features a walk-in cooler with craft beers and wines, with an assortment of cheese and crackers. CVS/pharmacy launched Gold Emblem Abound, a new brand of snack products which includes more than 40 items that are free from artificial flavors and preservatives. The chain also began an in-store tagging program called Fit Choices, which makes it easier for customer to find healthy food options. The new Fit Choices tags are focused around four categories: "Heart Healthy," "Sugar Free," "Gluten Free" and "Organic." Drug Stores Face New Challenges, Competition Amid new competition from convenience and dollar stores, drug stores need to differentiate themselves to stand out, according to Chain Drug Review’s State of the Industry report. Drug stores that focus on health and wellness can gain an edge over dollar stores that do not offer those services. Smaller stores that do not have the same presence as chains need to rely on customer service and special offerings to keep from losing customers. CVS led the sector by adding 202 stores in 2013, followed by Health Mart at 169 and Walgreens with 144 stores. Rite Aid continued to close underperforming stores and locations coming off lease, while also pushing ahead with conversions to its "wellness store" format. More than a quarter of Rite Aid's store base now has the wellness concept, and plans call for 450 more locations to adopt the format in the retailer's current fiscal year, reported Chain Drug Review (May 1). Top 10 Drug Chains by Store Count (Source: Chain Drug Review) Rank 1 2 3 4 5 6 7 8 9 10 Company Walgreens CVS Caremark Rite Aid Health Mart McKesson Canada Shoppers Drug Mart Medicine Shoppe Pharmasave Rexall Pharma Plus Jean Coutu Group Stores 8,221 7,660 4,587 3,246 1,650 1,309 570* 500 454 407 *U.S. stores only Convenience Stores Growing The U.S. convenience store count increased to 151,282 stores as of December 31, 2013, a 1.4% increase from the year prior, according to the 2014 NACS/Nielsen Convenience Industry Store Count. Convenience stores account for 34.3% of all retail outlets in the U.S., according to Nielsen, which is significantly higher than the U.S. total of other retail channels including drug stores, supermarket/supercenter and dollar stores. NACS Chairman Brad Call attributes the change to the need for convenience in today’s world, with customers strapped for time and looking for a quick way to access food, fuel and beverages. More retail companies are picking up on this trend and entering into the convenience store arena. Walmart built its first convenience store in 2014 and Big Y partnered with F.L. Roberts & Co. Inc. to open its first c-store in December 2013. Convenience Stores Appeal to Urban Millennials Convenience store operators are finding that in order to appeal to urban consumers and Millennials, they must adapt their offerings. Almost three-quarters of Millennials shop at a convenience store at least once a week, according to Convenience Store News' 2014 Realities of the Aisle study. More Millennials also indicated they shop at c-stores almost every day, 15% vs. 11% for total respondents. Millennials tend to shop at traditional supermarkets less, and convenience store and supercenters more, possibly representing their need to multitask and purchase many types of products at once. Foodservice is a growing category in c-stores, with more retailers adding fresh and prepared foods to their locations to cater to younger, urban consumers. In its New York City stores, 7-Eleven began experimenting with healthier food options and more unique choices such as craft beers, fresh salads and specialty coffee drinks that are employee-served, reported Crain’s New York Business (Jan. 27). QuikTrip also added more foodservice options, creating a new concept called QT Kitchens. The company added a series of made-to-order food counters to their stores serving flatbreads, toasted sandwiches, pizza, breakfast sandwiches, smoothies and specialty coffee drinks, reported Arizona Daily Star (Apr. 7). Eighty one percent of c-store operators predict an increase in their foodservice sales, according to Convenience Store News’ 2014 Foodservice Study. Additionally, 63.5% of all respondents anticipate that their foodservice profits will grow in 2014 compared to 2013. Two thirds of participants said that lunch is still the most popular time for foodservice sales at 30.3%, but breakfast is quickly catching up at 26.4%. 2014 Top 20 C-Store Chains by Total Growth (Source: Convenience Store News) Rank 1 2 3 4 5 6 7 Company Name 1 7-Eleven Inc. Military Tesoro Corp. Alimentation Couche-Tard Inc. Fikes Wholesale Inc. QuikTrip Corp. Casey's General Stores Inc. 8 Valero Corner Store 9 10 Murphy Oil Corp.3 Sunoco Inc. 2 RaceTrac Petroleum Inc. Pilot Flying J Sheetz Inc. Susser Holdings Corp. Maverik Inc. Shell Oil Co. Hy-Vee Inc. Victory Marketing LLC Wawa Inc. Western Refining Inc. Love's Travel Stops & 20 (tie) Country Stores 11 12 (tie) 12 (tie) 14 15 (tie) 15 (tie) 17 (tie) 17 (tie) 17 (tie) 20 (tie) Total Store Total Store Count Jan. Count Dec. 2013 2013 Stores Added Increase 6,680 503 225 7,641 636 345 961 133 120 14.39% 26.44% 53.33% 3,585 194 587 3,659 255 641 74 61 54 2.06% 31.44% 9.20% 1,686 1,728 42 2.49% 996 1,030 34 3.41% 124 1,978 152 2,004 28 26 22.58% 1.31% 633 513 411 541 234 4,933 97 70 596 210 650 536 434 559 249 4,948 110 83 609 222 25 23 23 18 15 15 13 13 13 12 3.95% 4.48% 5.60% 3.33% 6.41% 0.30% 13.40% 18.57% 2.18% 5.71% 287 299 12 4.18% 1) 7-Eleven's numbers include U.S. stores only. 2) Valero's numbers include corporate stores only. 3) Murphy's numbers include Murphy Express locations only.