Paper mill revival - how to break the cycle and extend value

advertisement

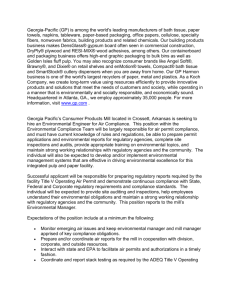

EXECUTIVE WIRE Paper mill revival how to break the cycle and extend value NORTH AMERICA / 2012 - 1.0 This issue’s hot topics • Paper mill closures will continue. • Old mills can find new life in adjacent grades and new industries. Each product or business model travels through the life cycle phases of introduction, growth, maturity and decline. Paper markets, in general, are in the maturity or decline phase in North America; demand is declining, price is often the key differentiator, and industry consolidation is rampant. Over the last five years, 81 mills have closed in North America. After its paper making days are over, what will your mill become? Many of the mills were closed by market leaders in the aftermath of industry consolidation or in efforts to match supply footprint with demand. The closures crossed companies, paper grades and geographies: • Size didn’t matter - Large industry leaders, such as International Paper, Resolute Forest Products and Domtar, accounted for half of the mills shut while smaller companies that owned and operated only one or two mills accounted for the other half of closures. • • Closures were across grades - No major paper grade was spared from the effects of the recession and decline in demand. Across all grades, newsprint fared the worst, with 18 mill closures since 2007, followed by uncoated freesheet (including specialties) with 15 mill closures. The U.S. was hardest hit - Of the 81 mills closed since 2007, 57 were in the U.S. However, in uncoated mechanical and newsprint, 12 of the 18 closures have been in Canada. Figure 1 CAPACITY HEALTH MAP - PULP AND PAPER Companies in distress 4.0 Asset Restructuring Index 3.5 “Healthy zone” 3.0 “Gray zone” 1.5 1.0 “Distressed zone” 0.5 0.0 MILL CLOSURES WILL CONTINUE - 38 AT RISK In contracting markets further consolidation and asset rationalization are required to protect value. More industry restructuring is needed both in terms of number of companies and mill closings. The Capacity Health map (Figure 1) plots total group pulp and paper capacity against a restructuring index, which is based on an adjusted Altman z-score combining five metrics for liquidity, profitability, leverage, solvency and activity, and can be used to assess a firm’s risk of restructuring. 2.5 2.0 Understanding the real life options for pulp and paper mill sites to either extend their life cycle in adjacent uses or to continue creating value for owners and communities in new ways, is critical. Like any life cycle phase, the business decisions around what to do with a closing mill must be carefully evaluated and planned. 0 5,000 10,000 15,000 20,000 25,000 30,000 Total Group Pulp and Paper Capacity (1000 metric t/a) Executive Wire USA 1 / 2010 35,000 40,000 An index score above 2.5 indicates a healthy firm while a score below 1.5 indicates a distressed firm. The Capacity Health map shows: • More than 20% of the publicly traded North American paper and board companies fall in the distressed zone. • 38 mills located in both Canada and the USA operate in the distressed zone. • The mills in the distressed zone produce both printing and writing and packaging paper grades. The owners of ailing mills should be focused on understanding the options for the mill to be revived and extend their life cycle with complementary or alternative future uses. Understanding the options Over half of the 81 mills closed since 2007 have yet to find a way to extend their life cycle in adjacent uses or to continue creating value for owners and communities in new sectors. Careful planning and developing a total life cycle management plan for pulp and paper mill assets and sites is required. The first step is to understand the range of options available for at risk or closed pulp and paper mills. Table 1 summarizes some options for mill life extensions being considered or already implemented. It is not an exhaustive list, and creative organizations are investigating and inventing new ones. Option 1 - pulp Conversion Some mills have found mill life cycle extensions in new paper grades or pulp markets. There have been 44 pulp and paper machines converted to new product grades since 2007, seven of which eventually failed. Some mills, such as Tembec’s former St. Francisville mill, which made the switch from coated paper to lightweight linerboard, changed ownership, while others continued to operate in the same hands but in new product markets. Pulp has been the “go to” market in many conversions. For example, IP is investing $83 million in its Franklin, VA mill to convert from kraft pulp and uncoated freesheet to fluff pulp and Domtar’s Plymouth, NC, mill was repositioned with $73.5 million investment on fluff in 2009. Executive Wire TABLE 1 Options for mill life cycle extensions Revival Option Opportunity Risks Who’s done it? 1. Pulp Global market pulp demand growth. Growth in specialty pulps. Price cycles. Cost competiveness against global capacity. IP Franklin, VA Domtar Plymouth, NC Fortress Paper, Thurso, QC 2. Other paper grades Tap into more steady markets. Create highly competitive entry. Conversion cost. Success difficult. Mature markets. Resolute (AbitibiBowater) Coosa Pines, AL IP, Pensacola, FL Verso, Sartell, MN 3. Specialty paper Pockets of growth. World of niche markets. Limited/small markets. Asset fit (scale). Wausau Paper Brainerd, MN NewPage, Escanaba, MI Verso, Bucksport, ME 4. Green energy - wood pellets, biofuels and bioenergy European demand for wood pellets. Asian markets growing. New technologies emerging quickly (e.g. torrefication.) Markets often driven by government energy regulations. Smurfit Stone sold mills to Green Investment Group Inc. Katahdin Paper’s Millinocket mills sold to Cate Street Capital. 5. Other industrial use New business entry. New business joint venture. Real estate value. Community employment. Partner selection and fit. Can be a lengthy process. IP’s Terre Haute, IN mill sold to the City. Neenah Paper’s Ripon, CA mill sold to pet food processor. Eurocan Pulp & Paper site sold to Kitimat LNG, wharf sold to Rio Tinto Alcan. Option 2 - OtHEr paper grade conversion Opportunities to add capacity in printing and writing grades is limited, and conversions in packaging grades have proved to be challenging. Market leaders such as Resolute Forest Products have struggled with paper grade conversions and failed in their attempt to convert the Coosa Pines newsprint mill to lightweight linerboard. Conversions to adjacent paper grades, especially packaging grades is on the rise. Sales and marketing are key to entry into these markets. Establishing new channels of distribution and having the right sales people and programs in place is critical to success. Forward integration into converting may be an option to consider. Partnership opportunities and off-take contracts can make or break the project. Option 3 –Specialty paper conversion Conversions in various specialty papers have extended some ex-commodity paper mills’ life cycle. Wausau Paper recently invested $27 million in its Brainerd, MN, mill to produce tape base stock. Also, NewPage converted PM 3 at its Escanaba, MI, mill from coated freesheet to produce specialty papers. These opportunities are inherently limited by the small market sizes and the challenge of converting commodity scale machines to fit niche specialty market demands. However, these specialty markets can provide a strategic platform for growth if the company can redefine itself for a new mission. There is a lack of strong global specialty paper players in most market segments. Option 4 – Green energy One tenth of closed mills have found life cycle extensions in the green energy space, with mill sites acquired by alternative energy investors, such as Green Investment Group Inc. (GIGI). GIGI has worked with local and regional government entities to help attract wood pellet manufacturer Trebio to invest $19 million in a 130,000 ton per year pellet plant at the former Smurfit Stone mill in Portage-du-Fort, QC. Katahdin’s East Millinocket and Millinocket mills were sold by Brookfield Asset Management to Cate Street Capital in 2011, with a plan to produce torrefied wood at both sites within two years. Not all green energy related initiatives with old mill sites have been successful. UPM’s Miramichi, NB, mill was sold to Umoe Solar (solar & bioethanol) for $26.3mm. Citing competition from China, Umoe Solar cancelled the project and the New Brunswick government was forced to buy the site back for $11 million. Fiber availability, long term supply contracts and technology advancements are all key considerations for organizations considering green energy options. Coordination and collaboration with state/provincial and local government agencies are critical to success. Option 5 – OTHER INDUSTRIAL OR COMMERCIAL USE Many other types of organizations including municipalities and manufacturers outside the forest industry see value in pulp and paper mill sites. M.O.P. Environmental Solutions worked with numerous state and regional government agencies to purchase Wausau Paper’s former Groveton, NH mill, and reconfigure it for the commercial manufacture of oil absorbent products. M.O.P. was interested in the mill site for its existing assets – including infrastructure (rail, power, etc.), waste water and sewage, and its proximity to market. Part of IP’s Terre Haute, IN mill site was sold to the city, who hopes to use the site’s existing wastewater treatment pond to store combined storm water and wastewater, and the rest of the site to provide open green space for future development. Many mills have not been re-purposed and the only source of value has been spare parts or scrap metal. Resolute Forest Products sold four of its paper mills (Fort William, Beaupre, Donnacona, Dalhousie) to American Iron & Metal Company for scrap for C$8.7 million (plus 40% of any proceeds from the sale of paper machines on the site) in 2010. Smurfit-Stone’s Ontonagon mill and Sappi’s Muskegon mill were sold to American Iron & Metal Company and Melching Inc. (respectively) for scrap metal in 2011. Fraser Paper’s mill in Berlin, NH, was first sold to North American Dismantling (NAD), which demolished and sold for scrap all nonessential assets on the site. Laidlaw Energy Group purchased the site from NAD to develop a 75MW biomass-energy power plant. Laidlaw has since secured a 20 year power purchase agreement valued at $1.3 billion. Laidlaw plans to be operational in 2013 after an investment of about $67 million. Pöyry is a global consulting and engineering company dedicated to balanced sustainability. We offer management consulting, total solutions for complex projects, and design and supervision. Our expertise extends to the fields of energy, industry, urban & mobility and water & environment. Pöyry has 7000 experts operating in about 50 countries, locally and globally. Finding a new potential industrial use for a mill site requires coordination and collaboration with state/provincial and local government agencies. Compare the real life examples with your current situation, in terms of both the assets and hosting conditions. Are there any obvious fits unique to your mill site, such as the expansion of a neighboring business or a desirable wharf or waterfront? The workshop should provide you with a roughly defined set of new options for the site and assets. Screen options – Conduct fatal flaw analysis of your options based on a set of viability criteria, such as investment need, strategic fit with the (old or new) owner’s goals, access to market, and availability of inputs. The screening process will yield a short list of initiatives for life cycle extension with strong sense of their relative probability of success. Finding the RIGHT OPTION Life cycle planning and understanding opportunities for extension are as important for industrial assets as they are for consumer goods. At the end of every life cycle is the opportunity for reinvention with a new path forward, as proven by the hyper-speed life cycles of the consumer electronics industry. From VCRs to DVDs to BlueRays to 3Ds, reinventing is both possible and profitable. Based on Pöyry’s experience, the most successful reinventions are guided by a structured approach to planning. The following key steps are necessary for revival planning of a pulp and paper mill asset. Take inventory – Assess what your location and what you have inside the mill fence has to offer for businesses – both incumbent or new ventures. Establish agreement on the resources and investment available. Key technical dimensions include: • Asset and site condition. • Scale and infrastructure. • Location (market access, input availability). Measure local and regional government agency support for redevelopment. This process enables you to focus on realistic options for asset revival. Generate ideas – A proven approach is to start with an idea generation workshop. Explore local, regional and global ideas and solutions for pulp and paper mill asset and site reinvention. Understand what the key success factors in previous mill revivals were and learn from your peers’ failures. Build a transition plan – Develop a road map for your transition. The road map should include specific actions, such as a blueprint for asset conversion or re-purposing in new markets (engineering plan, market strategy, financial forecast, resource planning) or asset divestiture (marketing plan, negotiations). These steps will identify the opportunities and construct an actionable plan for your mill revival to extend value beyond the final days of its current life cycle. How Pöyry can help Pöyry Management Consulting helps you make informed strategic decision, including planning for the full mill life cycle and identifying extension opportunities. Pöyry’s experts can effectively and efficiently identify alternative site uses and highlight the key success factors and possible challenges. Pöyry’s extensive global experience, industry databases, case study library and deep industry knowledge provide our clients with decision making support services including: • • • • Idea generation workshops, assessments and screenings. Business case evaluation, feasibility studies and market sizing reports. Divestiture plan development, marketing planning, and transaction support services. Conversion plan development, marketing planning and implementation support services. Pöyry is a global consulting and engineering company dedicated to balanced sustainability and responsible business. With quality and integrity at our core, we deliver best-in-class management consulting, total solutions, and design and supervision. Our in-depth expertise extends to the fields of energy, industry, urban & mobility and water & environment. Pöyry has 7,000 experts and a local office network in about 50 countries. Pöyry’s net sales in 2010 were EUR 682 million and the company’s shares are quoted on NASDAQ OMX Helsinki. (Pöyry PLC: POY1V). Soile Kilpi, Director tel. 646-651-1547 soile.kilpi@poyry.com Sanna Kallioranta, Senior Consultant tel. 646-651-1549 sanna.kallioranta@poyry.com Pöyry Management Consulting 52 Vanderbilt Avenue, Suite 1005 New York, NY 10017, USA www.poyry.us