Packaging Perspectives

JANUARY 2014

ELEVATE Your Experience.

FEATURE REPORT

2013: Year-End Review

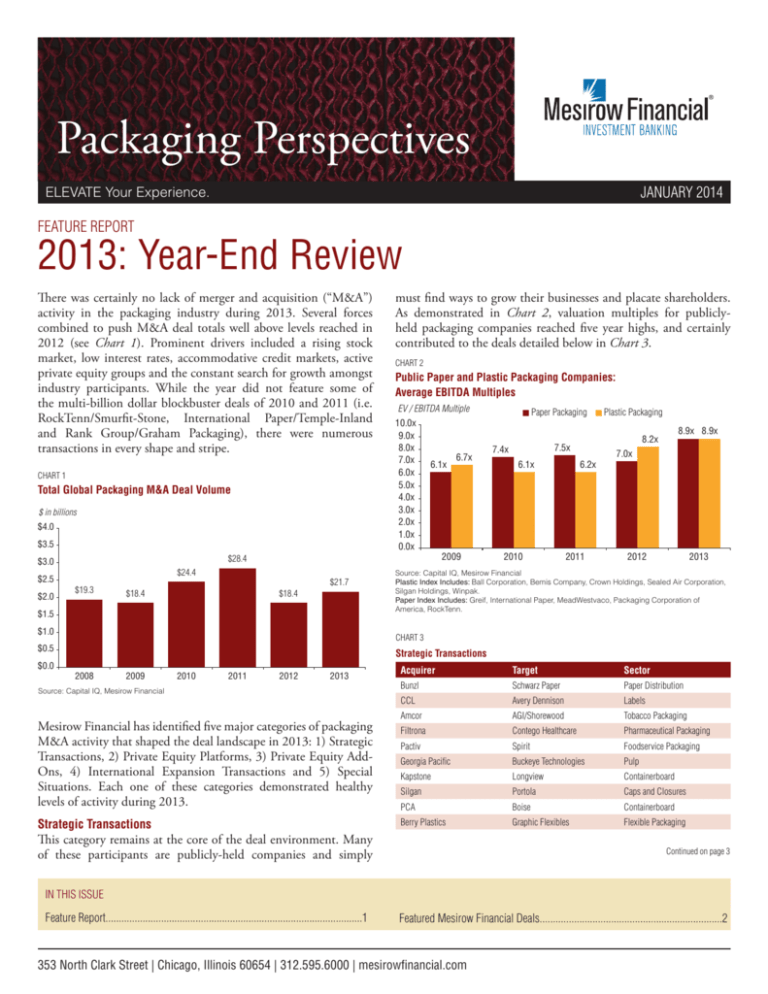

There was certainly no lack of merger and acquisition (“M&A”)

activity in the packaging industry during 2013. Several forces

combined to push M&A deal totals well above levels reached in

2012 (see Chart 1). Prominent drivers included a rising stock

market, low interest rates, accommodative credit markets, active

private equity groups and the constant search for growth amongst

industry participants. While the year did not feature some of

the multi-billion dollar blockbuster deals of 2010 and 2011 (i.e.

RockTenn/Smurfit-Stone, International Paper/Temple-Inland

and Rank Group/Graham Packaging), there were numerous

transactions in every shape and stripe.

CHART 1

Total Global Packaging M&A Deal Volume

$ in billions

$4.0

$3.5

$2.0

$24.4

$19.3

$18.4

$18.4

$21.7

$1.5

$1.0

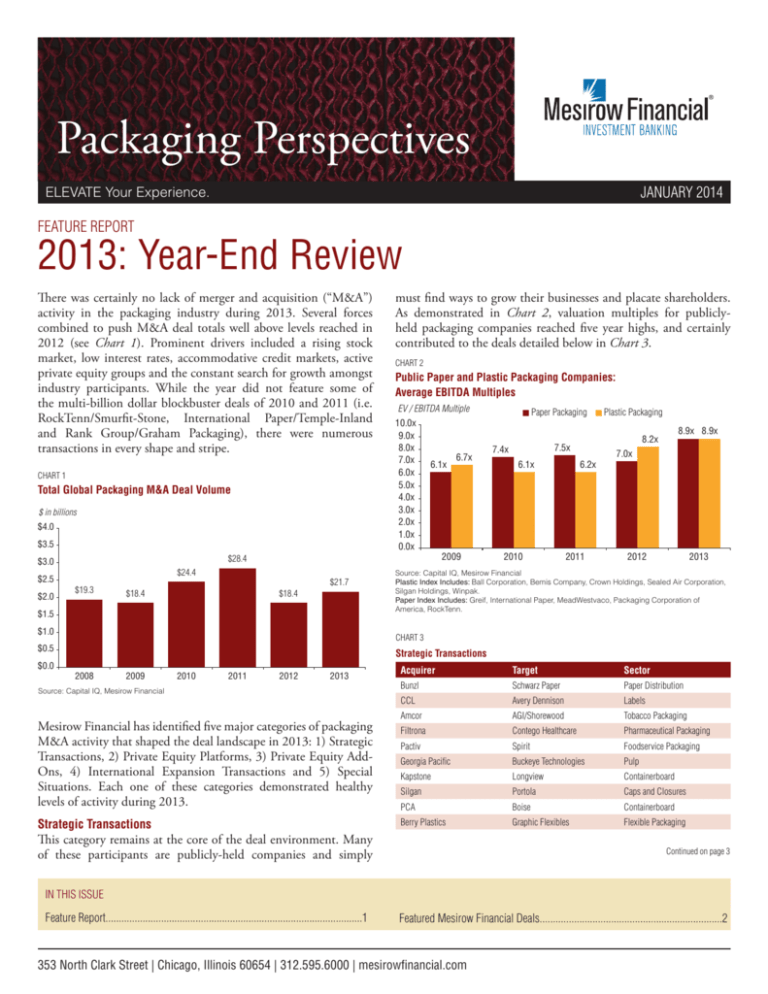

Public Paper and Plastic Packaging Companies:

Average EBITDA Multiples

EV / EBITDA Multiple

10.0x

9.0x

8.0x

7.0x

6.0x

5.0x

4.0x

3.0x

2.0x

1.0x

0.0x

6.1x

6.7x

2009

Paper Packaging

6.1x

2010

8.9x 8.9x

8.2x

7.5x

7.4x

Plastic Packaging

6.2x

2011

7.0x

2012

2013

Source: Capital IQ, Mesirow Financial

Plastic Index Includes: Ball Corporation, Bemis Company, Crown Holdings, Sealed Air Corporation,

Silgan Holdings, Winpak.

Paper Index Includes: Greif, International Paper, MeadWestvaco, Packaging Corporation of

America, RockTenn.

CHART 3

$0.5

$0.0

CHART 2

$28.4

$3.0

$2.5

must find ways to grow their businesses and placate shareholders.

As demonstrated in Chart 2, valuation multiples for publiclyheld packaging companies reached five year highs, and certainly

contributed to the deals detailed below in Chart 3.

Strategic Transactions

2008

2009

2010

2011

2012

2013

Source: Capital IQ, Mesirow Financial

Mesirow Financial has identified five major categories of packaging

M&A activity that shaped the deal landscape in 2013: 1) Strategic

Transactions, 2) Private Equity Platforms, 3) Private Equity AddOns, 4) International Expansion Transactions and 5) Special

Situations. Each one of these categories demonstrated healthy

levels of activity during 2013.

Strategic Transactions

Acquirer

Target

Sector

Bunzl

Schwarz Paper

Paper Distribution

CCL

Avery Dennison

Labels

Amcor

AGI/Shorewood

Tobacco Packaging

Filtrona

Contego Healthcare

Pharmaceutical Packaging

Pactiv

Spirit

Foodservice Packaging

Georgia Pacific

Buckeye Technologies

Pulp

Kapstone

Longview

Containerboard

Silgan

Portola

Caps and Closures

PCA

Boise

Containerboard

Berry Plastics

Graphic Flexibles

Flexible Packaging

This category remains at the core of the deal environment. Many

of these participants are publicly-held companies and simply

Continued on page 3

IN THIS ISSUE

Feature Report.................................................................................................1

Featured Mesirow Financial Deals.....................................................................2

353 North Clark Street | Chicago, Illinois 60654 | 312.595.6000 | mesirowfinancial.com

2

January 2014

FEATURED MESIROW FINANCIAL DEALS

Expera Specialty Solutions, LLC Acquires Wausau Paper Corp. Specialty Paper Business

•n

Mesirow Financial, Inc. acted as the exclusive financial advisor to Wausau Paper Corp.

(“Wausau”) in the sale of its specialty paper business (“WPM”) to Expera Specialty

Solutions, LLC (“Expera Specialty Solutions”), a newly formed company sponsored by

KPS Capital Partners, LP, a New York-based private equity firm.

•n

Based in Mosinee, Wisconsin, WPM provides a range of highly specialized paper

products to the food, industrial & tape and coated & liner markets across a broad range

of product categories and specific end-use applications.

•n

a portfolio company of

Simultaneously, Expera Specialty Solutions acquired Packaging Dynamics’ Thilmany

Papers business unit, including manufacturing facilities in Kaukana and De Pere,

Wisconsin.

•n

Expera Specialty Solutions is the leading North American manufacturer of specialty

paper products for use in the tape, pressure-sensitive release liner, industrial and food

packaging segments. Expera Specialty Solutions’ manufacturing platform includes

machines at four mills located in Rhinelander, Mosinee, Kaukauna and De Pere,

Wisconsin.

— Sell-side Advisor —

•n

The sale of WPM demonstrates Mesirow Financial Investment Banking’s deep

understanding of the specialty paper market and ability to facilitate a complex transaction

with a financial sponsor.

SPECIALTY PAPER BUSINESS

has been acquired by

MEI Labels Holdings, LLC Acquires The Venture Corporation

•n

Mesirow Financial acted as the exclusive financial advisor to The Venture Corporation

(“TVC”) on its partnership with MEI Labels Holdings, LLC (“MEI Labels”), a portfolio

company of Svoboda Capital Partners LLC, a Chicago-based private equity firm.

•n

Based in Lewisville, Texas, TVC is a full-service manufacturer and premier provider of

print, label and packaging solutions for customers in the health and beauty, consumer

goods and pet care end markets, among others.

•n

MEI Labels is a leading provider of pressure sensitive label products, inserts, tags,

banners and other products, including silk screening and embroidery. Located in

Catoosa, Oklahoma, MEI Labels has grown significantly since its inception, becoming

a national label printing platform, serving a diverse set of customers across the United

States, including many in the food / grocery, industrial, packaging and retail markets.

•n

This transaction highlights Mesirow Financial Investment Banking’s ability to position

middle market clients as attractive tuck-in acquisition candidates for private equityowned strategic buyers.

has been acquired by

a portfolio company of

— Sell-side Advisor —

CONTACT US

William Hornell

Managing Director

Direct–312.595.6176

bhornell@mesirowfinancial.com

Rocky Pontikes

Managing Director

Direct–312.595.6821

rpontikes@mesirowfinancial.com

Sarah Baker

Vice President

Direct–312.595.7159

spbaker@mesirowfinancial.com

Louis Mitchell

Managing Director

Direct–312.595.6025

lmitchell@mesirowfinancial.com

Rick Weil

Managing Director

Direct–312.595.6131

raweil@mesirowfinancial.com

Adam Oakley

Vice President

Direct–312.595.6692

aoakley@mesirowfinancial.com

Brian Price

Vice President and

Chief Operating Officer

Direct–312.595.6545

bprice@mesirowfinancial.com

January 2014

3

2013: YEAR-END REVIEW continued from page 1

Private Equity Platforms

CHART 6

The transactions listed in Chart 4 represent new platforms for

private equity sponsors. The fund raising market improved in 2013

and it is estimated that private equity groups now have record levels

of cash available for investment. The packaging industry remains

very attractive for private equity given the industry’s stability,

growth prospects and profitability.

International Expansion Transactions

Acquirer

Target

Location

Amcor

Shenda Enterprise

China

Amcor

Tuflex

India

Bemis

Foshan

China

Multi-Color

LabelMakers

Australia

CHART 4

Multi-Color

John Watson

Scotland

Private Equity Platform Transactions

Multi-Color

Gern & Cie

Switzerland

Domtar

Indas

Spain

Scholle

Flexpack

Brazil

Graphic Packaging

Contego Beverage

Europe

Acquirer

Target

Sector

H.I.G.

Caraustar

Paperboard

Blue Wolf / Atlas Holdings

Twin Rivers Paper

Tissue

Peak Rock

Atlas Tissue Mills

Tissue

KPS

Expera

Specialty Paper

Cove Point

Bemis Clysar

Specialty Films

Arbor Investments

Keyes Packaging

Food Packaging

Carlyle

Chesapeake

Cartons/Specialty

Madison Dearborn

Multi Packaging Solutions

Cartons/Specialty

Graham Partners

Comar

Healthcare Packaging

Mason Wells

Sealed Air Medical

Medical Packaging

American Securities

Tekni-Plex

Specialty Films

Jordan Co.

Transilwrap

Specialty Coatings

Private Equity Add-Ons

Once these platforms have been acquired, it is not uncommon to

see the new private equity-owned businesses make acquisitions.

Many significant industry participants in the packaging industry

have been built by this approach (Paperworks, Exopack, Berry

Plastics, Clondalkin, Ampac, Fort Dearborn, WS Packaging).

Given the accommodative credit markets available during 2013,

it was not surprising to see several add-on transactions as well (see

Chart 5).

CHART 5

Private Equity Add-On Transactions

Sponsor

Acquirer

Target

Frazier Healthcare

Packaging Coordinators

Anderson Brecon

One Equity

Constantia

Spear

Wind Point Partners

Hilex Poly

Clondalkin Flexibles

Olympus

Waddington

Par Pak

Svoboda Capital

MEI Labels

TVC One

KRG

Fort Dearborn

AC Label

Metalmark

Hoffmaster

Graphic Management

Special Situations

There were also several unique packaging transactions in 2013 that

added to the deal landscape. Sun Capital Partners is merging five of

its specialty packaging businesses together under the Coveris name

to form the sixth largest plastics packaging business in the world.

Multi Packaging Solutions and Chesapeake have announced their

merger which will form a $1.4 billion global specialty packaging

business. Additionally, International Paper has indicated that

progress is continuing on the merger of xpedx and Unisource.

Valuations

Not surprisingly, it was another strong year for deal valuations in

2013. Given the deal drivers discussed in this article, sellers were

able to obtain valuations consistent with the high levels obtained

in 2011 and 2012 (see Chart 7). There was a slight dip in 2013

financial buyer multiples due to an increase in specialty paper

transactions relative to 2011 and 2012.

CHART 7

Average EV / EBITDA Multiples for Packaging M&A Transactions

EV / EBITDA Multiple

10.0x

8.7x

9.0x

8.0x 7.2x 7.5x 7.4x

7.0x

6.0x

5.0x

4.0x

3.0x

2.0x

1.0x

0.0x

2006

2007

Financial

6.6x

7.2x

6.5x

Strategic

6.2x

6.8x

6.5x

7.2x

6.8x

7.2x

6.5x

7.1x

5.3x

2008

2009

2010

2011

2012

2013

Source: Capital IQ, Mesirow Financial

International Expansion

Since the financial crisis, there has been an increase in the use of

M&A to accomplish international growth objectives (see Chart 6).

Companies such as International Paper, MeadWestvaco, Graphic

Packaging, CCL, Amcor, Bemis and Smurfit Kappa have all

been consistent acquirers of international businesses. This is not

surprising given the divergence in economic growth rates around

the world.

Outlook for 2014

It is difficult to imagine a better environment for packaging M&A

transactions. Between high stock prices, high public company

valuation multiples, record levels of private equity to invest,

encouraging economic growth forecasts and low interest rates,

there is no reason to anticipate a slowdown in activity. In addition

to the current deal environment, many of these transactions are

creating value for the purchasers. Companies like RockTenn,

Kapstone, Amcor, Bemis, Graphic Packaging, Multi-Color and

Berry Plastics are all using M&A to drive their business models.

We expect this trend to continue.

353 North Clark Street Chicago, Illinois 60654

MESIROW FINANCIAL INVESTMENT BANKING

MESIROW FINANCIAL

Our Investment Banking professionals focus exclusively on

middle-market transactions and serve established middlemarket companies and large corporations, both public and

private, in merger & acquisition advisory, capital markets

advisory, restructuring and special situations, fairness and

solvency opinions, board of directors advisory and special

committee representation. Headquartered in Chicago, we are a

national firm with a global reach.

Mesirow Financial is a diversified financial services firm

headquartered in Chicago. Founded in 1937, it is an

independent, employee-owned firm with approximately 1,200

employees globally. With expertise in Investment Management,

Global Markets, Insurance Services and Consulting, Mesirow

Financial strives to meet the financial needs of institutions,

public sector entities, corporations and individuals. For more

information, visit mesirowfinancial.com.

Mesirow Financial continues to be a leader in assisting

paper, plastics, packaging and specialty printing companies

with merger and acquisition transactions. Our experienced

professionals have completed nearly 100 packaging transactions

in recent years, and we are consistently focused on elevating the

experience for our clients.

Mesirow Financial refers to Mesirow Financial Holdings, Inc. and its divisions, subsidiaries and affiliates. The Mesirow Financial name and logo are registered service marks

of Mesirow Financial Holdings, Inc. © 2014, Mesirow Financial Holdings, Inc. All rights reserved.