Equities Commentary - Cantor Fitzgerald Ireland

advertisement

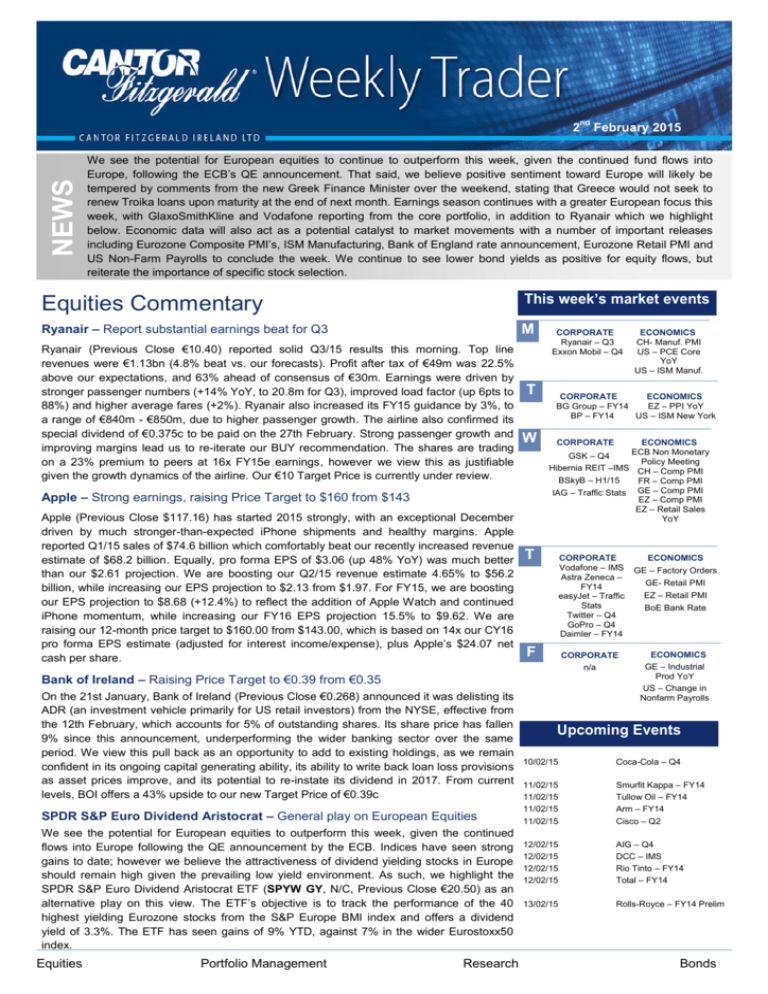

NEWS nd MONTH2015 2014 200th February We see the potential for European equities to continue to outperform this week, given the continued fund flows into Europe, following the ECB’s QE announcement. That said, we believe positive sentiment toward Europe will likely be tempered by comments from the new Greek Finance Minister over the weekend, stating that Greece would not seek to renew Troika loans upon maturity at the end of next month. Earnings season continues with a greater European focus this week, with GlaxoSmithKline and Vodafone reporting from the core portfolio, in addition to Ryanair which we highlight below. Economic data will also act as a potential catalyst to market movements with a number of important releases including Eurozone Composite PMI’s, ISM Manufacturing, Bank of England rate announcement, Eurozone Retail PMI and US Non-Farm Payrolls to conclude the week. We continue to see lower bond yields as positive for equity flows, but reiterate the importance of specific stock selection. Equities Commentary This week’s market events Ryanair – Report substantial earnings beat for Q3 M Ryanair (Previous Close €10.40) reported solid Q3/15 results this morning. Top line revenues were €1.13bn (4.8% beat vs. our forecasts). Profit after tax of €49m was 22.5% above our expectations, and 63% ahead of consensus of €30m. Earnings were driven by stronger passenger numbers (+14% YoY, to 20.8m for Q3), improved load factor (up 6pts to 88%) and higher average fares (+2%). Ryanair also increased its FY15 guidance by 3%, to a range of €840m - €850m, due to higher passenger growth. The airline also confirmed its special dividend of €0.375c to be paid on the 27th February. Strong passenger growth and improving margins lead us to re-iterate our BUY recommendation. The shares are trading on a 23% premium to peers at 16x FY15e earnings, however we view this as justifiable given the growth dynamics of the airline. Our €10 Target Price is currently under review. T W CORPORATE ECONOMICS BG Group – FY14 EZ – PPI YoY BP – FY14 US – ISM New York CORPORATE ECONOMICS ECB Non Monetary Policy Meeting Hibernia REIT –IMS CH – Comp PMI BSkyB – H1/15 FR – Comp PMI IAG – Traffic Stats GE – Comp PMI EZ – Comp PMI EZ – Retail Sales YoY T CORPORATE Vodafone – IMS Astra Zeneca – FY14 easyJet – Traffic Stats Twitter – Q4 GoPro – Q4 Daimler – FY14 F CORPORATE n/a Bank of Ireland – Raising Price Target to €0.39 from €0.35 On the 21st January, Bank of Ireland (Previous Close €0.268) announced it was delisting its ADR (an investment vehicle primarily for US retail investors) from the NYSE, effective from the 12th February, which accounts for 5% of outstanding shares. Its share price has fallen 9% since this announcement, underperforming the wider banking sector over the same period. We view this pull back as an opportunity to add to existing holdings, as we remain confident in its ongoing capital generating ability, its ability to write back loan loss provisions as asset prices improve, and its potential to re-instate its dividend in 2017. From current levels, BOI offers a 43% upside to our new Target Price of €0.39c SPDR S&P Euro Dividend Aristocrat – General play on European Equities We see the potential for European equities to outperform this week, given the continued flows into Europe following the QE announcement by the ECB. Indices have seen strong gains to date; however we believe the attractiveness of dividend yielding stocks in Europe should remain high given the prevailing low yield environment. As such, we highlight the SPDR S&P Euro Dividend Aristocrat ETF (SPYW GY, N/C, Previous Close €20.50) as an alternative play on this view. The ETF’s objective is to track the performance of the 40 highest yielding Eurozone stocks from the S&P Europe BMI index and offers a dividend yield of 3.3%. The ETF has seen gains of 9% YTD, against 7% in the wider Eurostoxx50 index. Equities Portfolio Management Research ECONOMICS CH- Manuf. PMI US – PCE Core YoY US – ISM Manuf. GSK – Q4 Apple – Strong earnings, raising Price Target to $160 from $143 Apple (Previous Close $117.16) has started 2015 strongly, with an exceptional December driven by much stronger-than-expected iPhone shipments and healthy margins. Apple reported Q1/15 sales of $74.6 billion which comfortably beat our recently increased revenue estimate of $68.2 billion. Equally, pro forma EPS of $3.06 (up 48% YoY) was much better than our $2.61 projection. We are boosting our Q2/15 revenue estimate 4.65% to $56.2 billion, while increasing our EPS projection to $2.13 from $1.97. For FY15, we are boosting our EPS projection to $8.68 (+12.4%) to reflect the addition of Apple Watch and continued iPhone momentum, while increasing our FY16 EPS projection 15.5% to $9.62. We are raising our 12-month price target to $160.00 from $143.00, which is based on 14x our CY16 pro forma EPS estimate (adjusted for interest income/expense), plus Apple’s $24.07 net cash per share. CORPORATE Ryanair – Q3 Exxon Mobil – Q4 ECONOMICS GE – Factory Orders GE- Retail PMI EZ – Retail PMI BoE Bank Rate ECONOMICS GE – Industrial Prod YoY US – Change in Nonfarm Payrolls Upcoming Events 10/02/15 Coca-Cola – Q4 11/02/15 11/02/15 11/02/15 11/02/15 Smurfit Kappa – FY14 Tullow Oil – FY14 Arm – FY14 Cisco – Q2 12/02/15 12/02/15 12/02/15 12/02/15 AIG – Q4 DCC – IMS Rio Tinto – FY14 Total – FY14 13/02/15 Rolls-Royce – FY14 Prelim Bonds Regulatory Information This material is approved for distribution in Ireland by Cantor Fitzgerald Ireland Ltd. Cantor Fitzgerald Ireland Ltd (“CFIL”) is regulated by the Central Bank of Ireland. Cantor Fitzgerald Ireland Ltd is a member firm of the Irish Stock Exchange and the London Stock Exchange. Where CFIL wishes to make this and other Cantor Fitzgerald research available to Retail clients, such information is provided without liability and in accordance with our terms and conditions that are available on the CFIL website. No report is intended to and does not constitute a personal recommendations or investment advice nor does it provide the sole basis for any evaluation of the securities that may be the subject matter of the report. Specifically, the information contained in this report should not be taken as an offer or solicitation of investment advice, or to encourage the purchased or sale of any particular security. Not all recommendations are necessarily suitable for all investors and CFIL recommend that specific advice should always be sought prior to investment, based on the particular circumstances of the investor either from your CFIL investment adviser or another investment adviser. CFIL takes all responsibility to ensure that reasonable efforts are made to present accurate information but CFIL gives no warranty or guarantee as to, and do not accept responsibility for, the correctness, completeness, timeliness or accuracy of the information provided or its transmission. This is entirely at the risk of the recipient of the report. Nor shall CFIL, its subsidiaries, affiliates or parent company or any of their employees, directors or agents, be liable to for any losses, damages, costs, claims, demands or expenses of any kind whatsoever, whether direct or indirect, suffered or incurred in consequence of any use of, or reliance upon, the information. Any person acting on the information contained in this report does so entirely at his or her own risk All estimates, views and opinions included in this research note constitute CANTOR IRELAND’s judgment as of the date of the note but may be subject to change without notice. Changes to assumptions may have a material impact on any recommendations made herein. Unless specifically indicated to the contrary this research note has not been disclosed to the covered issuer(s) in advance of publication. Past performance is not a reliable guide to future performance. The value of your investment may go down as well as up. Investments denominated in foreign currencies are subject to fluctuations in exchange rates, which may have an adverse affect on the value of the investments, sale proceeds, and on dividend or interest income. The income you get from your investment may go down as well as up. Figures quoted are estimates only; they are not a reliable guide to the future performance of this investment. Conflicts of Interest & Share Ownership Policy It is noted that research analysts' compensation is impacted upon by overall firm profitability and accordingly may be affected to some extent by revenues arising other CANTOR IRELAND business units including Fund Management and Stock broking. Revenues in these business units may derive in part from the recommendations or views in this report. Notwithstanding, CANTOR IRELAND is satisfied that the objectivity of views and recommendations contained in this note has not been compromised. Nonetheless CANTOR IRELAND is satisfied that the impartiality of research, views and recommendations remains assured. Our conflicts of interest management policy is available at the following link; http://www.cantorfitzgerald.ie/regulation_mifld.shtml Analyst Certification Each research analyst responsible for the content of this research note, in whole or in part, certifies that: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in the research note. US distribution This research note is being distributed by (CF Ireland / CF Europe / CF US / CF Canada / CF Hong Kong) in the United States and is intended for distribution in the United States solely to “major U.S. institutional investors” (as such term is defined in Rule15a-6 of the U.S. Securities Exchange Act of 1934 and applicable interpretations relating thereto) and is not intended for the use of any person or entity that is not a major institutional investor. This material is intended solely for institutional investors and investors who Cantor reasonably believes are institutional investors. It is prohibited for distribution to non-institutional clients including retail clients, private clients and individual investors. Major Institutional Investors receiving this research note should effect transactions in securities discussed in this research note through Cantor Fitzgerald & Co. This research note has been prepared in whole or in part by research analysts employed by non-US affiliates of Cantor Fitzgerald & Co that are not registered as broker-dealers in the United States. These non-US research analysts are not registered as associated persons of Cantor Fitzgerald & Co. and are not licensed or qualified as research analysts with FINRA or any other US regulatory authority and, accordingly, may not be subject (among other things) to FINRA’s restrictions regarding communications by a research analyst with a subject company, public appearances by research analysts, and trading securities held by a research analyst account. UK distribution This research note is approved for distribution in the United Kingdom by Cantor Fitzgerald Europe (“CFE”). CFE is authorised and regulated by the Financial Conduct Authority (“FCA”). While we believe this information and the materials upon which this information was based is accurate, except for any obligations under the rules of the FCA, we do not guarantee its accuracy. This material is only intended for use by eligible counterparties or professional clients who fall within articles 19 or 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 and not the general investing public. None of the investments or investment services mentioned or described herein are available to other persons in the U.K and in particular are not available to "retail clients” as defined by the rules of the FCA. Other important disclosures Prices quoted in this research note, unless otherwise indicated, are as of close on the previous trading day. The distribution of this research note in other jurisdictions may be restricted by law and persons into whose possession this specialist sales market commentary publication comes should inform themselves about and observe any such restrictions. By accepting this research note you agree to be bound by the foregoing instructions. Sources: CANTOR IRELAND Research, Bloomberg Dublin: 75 St. Stephen’s Green, Dublin 2, Ireland. Tel : +353 1 633 3800. Fax : +353 1 633 3856/+353 1 633 3857 CORK: Dolmen House, 45 South Mall, Cork. Tel: +353 21 422 2122. LIMERICK: Theatre Court, Lower Mallow Street, Limerick. Tel: +353 61 436500. Email : ireland@cantor.com web : www.cantorfitzgerald.ie Equities Portfolio Management Research Bonds