a discussion of beta – its limitations and usefulness

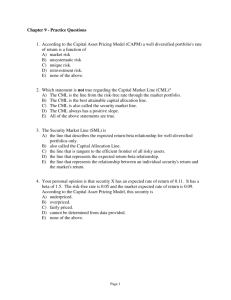

advertisement

2010: Fourth Third Quarter 2012: A DISCUSSION OF BETA – ITS LIMITATIONS AND USEFULNESS by Anish Ramachandran, CFA It’s been said that two things that you never want made are laws “May youtoliveseeinbeing interesting times.” and sausages. Luckily for the squeamish, Often thought be a as curse, all to portfolios aren’t to nearly messy of us have lived through some make. The way that we make them here interesting timesis-towecombine are atpretty Ken Stern & Associates living through a dynamic, parts of our Core Fixed Income, Core exciting, changing Equity, Tactical and environment. Uncorrelated / With that change comes Alternative sub-portfolios instress just the and weightings. a concern for thepart future right Thewhat tricky is in holds. Although this is a natural determining what those weights should reaction, thereisisdifferent also the– they have be. Every client possibility that such different objectives, uncertainty different time can create andrisk thattolerances we, as – horizons andvalue different investors, can capitalize on which means that every portfoliothis needs touncertainty. be different,When as well.pondering The way that changes what the future they are alland similar, though, is in the way holds, a simple that oneIofaskthemyself primary considerations – What do think a is in isquestion putting together any Iportfolio billionaire do?of that portfolio managing thewould exposure to the ups and downs of the equity Ten years the collective markets. Byago, working from the four market capitalization ofabove, all thewe at building blocks mentioned KS&A attempt to manage that market exposure, which is referred to by the Greek letter “Beta.” There is probably no concept in equity Pageand valuation that is more abused misinterpreted than beta.a The main What do you Think reason for the abuse is Billionaire Wouldbecause do? beta has become synonymous with the Capital AssetTax-Free Pricing Wealth Model (CAPM), which and states that the expected return of an Other Year-End asset is equal to a risk-free rate plus Opportunities the beta of the asset, multiplied by the expected market return, less the risk free rate. Complicated, right? Really, 1 2 it’s simpler than it sounds – it basically comes down in to the the idea that assets companies Standard & with betas willwas go up more than Poor’sabove 500 one Index the market when the market up approximately $12 trillion.is going Today and come at down more $10 thantrillion. the market it hovers roughly when it’s coming down. Assets with This contraction of market betas below oneover will go up less than an capitalization a ten-year up market and come down less than a period is not common. During down market.we have experienced that period management tool. What I intend to do in this article is to briefly discuss some opportunities that those challenges of CAPM and beta’s shortfalls and then created. show how, despite its shortcomings, we at KS&A use beta in portfolio Two years ago, could management and Ihow you not can, have too. written about electronic books or Criticismstablets of Beta electronic that surf the web. IOnce could not have written of the major criticismsabout of beta is genetically engineered fish or even the way in which it is calculated. This high and prolonged advanced green industries. Next technique is called regression, where unemployment, currency crises, year, I assume I’ll be able the returns of that a particular assettoare There is probably no concept wars, terrorism, health pandemics meet with my clients via compared to market returns over a equity of valuation that isand videoconferencing andin a myriad other worldon my specified period of time. Thetablet problem economy-shaping events. In each computer. Who could have with this is that there is little uniformity more abused and of the last ten speeches I have imagined five years ago?is. Most as to what that that period of time misinterpreted thana beta. given, I asked everyone simple Growth and innovation stop, practitioners suggest using never 5 years of question – What is going on in the they simply Thiswho monthly data,ebb but and thereflow. are some world today? Over 95% of the rapid, exciting, andperiods changing period think shorter time should be Unfortunately, finance literature is filled must responses were negative. Nobody a positive. If we used. be Theseen betaas estimate using these with studies that the inadequacies commented ondetail the low interest want to capitalize change,and we can approaches can be on different, if of CAPM a predictor of expected ask rates, low as inflation and potential a then beta ourselves, is used as “What a proxywould for risk, return. In had addition, many well- billionaire deals to be in various dothe with this one could depending on approach, known investors and Nobody professorstalked like information?” investment sectors. Or, perhaps a better get different results regarding the Seth Klarman and Stephen Penman, about the products from what I call question when with similar market riskis,of that faced investment. There respectively, have been that very open in challenges/opportunities “Happy Companies,” What did are good reasons for using or- not using their criticism of beta and CAPM and, consumers still love to buy, really smart people dobut during particular approaches, sometimes as a result,or many think that if recession not.people No one challenging to make their this confusionperiods is enough for investors the concept is not good enough for the commented on the growing fortunes? What we learn from to abandon the usecan of beta in valuation. pros, it’s notand good enough for them. how they built and retained their population commensurate The second criticism, which I believe to Granted, CAPM does No make some empires? growing the consumption. one be more relevant and the main reason unrealistic assumptions – no transaction even mentioned the pace of why I personally take the beta quoted costs, all assets beingindustries tradable or and Consider John D. Rockefeller, innovation, the new on sites like Yahoo and Morningstar everyone having of access the same Andrew Carnegie and even Henry the proliferation new businesses with a grain of salt is something called information, which leads to everything Ford. Rockefeller started Standard that have resulted. Almost “standard error.” It’s a complicated way being fairly priced at all times.that However, universally, the attendees I Oil. He saw a new industry and the of saying that the way we measure beta is just because CAPM makes these asked saw challenges, but not the need for synergy and consolidation. imprecise and that it is so imprecise, that absurd assumptions, it doesn’t entirely negate the value of beta as a portfolio we can even measure that imprecision! (continued on next page) 2012: 2010: Fourth Third Quarter Page 2 For example, if a that regression It has been said he wasproduces able to abuild beta estimate of 1.5 with standard Standard Oil into a anearerror of 0.2,bythen we for can efficiency say with monopoly striving 95% confidence that the true beta of within his own model. that asset will be between 1.1 and 1.9 (two standard errors). Therefore,his it is Andrew Carnegie mortgaged incorrect assume that aa stock mother’stohouse during periodwith of beta of 1.5 will move 1.5 times the economic turmoil. He made a movement in the market it’s 10 more gutsy investment of $500– for accurate to say that there’s a 95% chance shares of the Adams Express that that asset between 1.1 Company andwill thatmove bet paid off well and 1.9 times the movement of the enough that he was given the market. To complicate this, every beta opportunity to make other gutsy regression produces a different standard moves – from steel to railroads. I error, so one could see Stock A with a believe he had an ability to search beta of 1.5 and a standard error of .05 and Stock B with a beta of 1.5 and a standard error of .3. Obviously, the beta of Stock A is a much more precise estimate, but, unless standardoferror The following is a the collection a of theofbeta reported tothat you, Iyou would few theis strategies believe never the difference in precision. couldknow potentially help our readers In true beta falls with toaddition, preservesince andthe protect their alegacies. range, using one estimate Nojust single strategytoisassess risk could lead errors in making appropriate fortoevery reader investment decisions. though, so be sure to consider, with yourfinal advisors, whether The knock against betathese comes from strategies are appropriate forlooking you. the fact that they are backward and don’t capture the risk characteristics of a company that is different today, or in the future, from what it was in the past. If the company’s profile has changed, then the risk implied in today’s price willI think be different from past prices When of billionaires, and using past prices to estimate beta vultures come to mind. could lead to errors in valuation. Many of us tend to be emotional Alternative Approaches investors - on the days when the Given criticisms, it should come marketthese is higher, we are happier as no surprise that many people and feel quite smug with our have tried to come On up days with when alternatives. investments. the Shannon Pratt’s Cost of Capital details market is lower, we second-guess the many ways people have tried to ourselves and wonder why we’re improve upon beta. I must say that, not making any money. It’s hard after reviewing alternatives, not to be on anvarious emotional roller I was more confused, since most of the coaster. approaches that were offered required proprietary data, and through were less the intuitive for opportunity compared to CAPM. I will mention adversity of others and used his twoshrewdness of the manyto different variations capitalize on it. of risk measures that have been proposed instead of the beta.it was popular to Do you think the idea in of the In convert 2003, anpeople article topublished driving automobiles? Ford Harvard Business Journal gotHenry significant didn’t because even invent automobile attention it usedthe option prices his greatest achievement was to –calculate a forward-looking beta. an assembly linevolatility to make In utilizing the approach, the implied process of building carsmajor more in the an option price (one of the efficient. of By bringing down the components option pricing) was price,out he made the invention backed of option prices and more accessible and created compared to the volatility of the bonds issued by the He company. option demand. was alsoSince a member market makers and traders are always forward-looking in their estimates of volatility (what they call the “implied” volatility), the estimate provided doesn’t I propose stepping back a bit suffer from the same “historical” bias from minute-by-minute or day-bythat the standard regression method day over-analysis. Instead, does. The nice thing about this method determine if you are emulating the is that the mathematics involved is very behavior of a vulture or of basic and all the data required could Roadkill is the investor be roadkill. obtained at no charge from public who gets run over by the market sites like Morningstar. But this method – buyworks whenfor thecompanies market is high onlythey really that and the other investors are excited have both traded options and bonds. In and they sellmeasure when the market is addition, the risk obtained using down and other investors are this method conveyed information on panicking. don’t capitalize total risk and notThey just market risk. Why on opportunities because they are is that significant? In valuation, we look responding to what has already at things from the perspective of the happened. marginal investor who is diversified and only has exposure to the market risk. The vulture, sits onwill his Therefore, using ahowever, total risk measure perch, watching the action. After most likely lead to more conservative patiently he feeds estimates of waiting, value and result when in an the folly is over and the emotional investor rejecting significantly more animal has been caught in the investment opportunities. headlights and been run over by Another alternative to beta that gets the markets. When he sees attention is one that does not relyoff on distress, he swoops in, tears market all, gets but relies instead someprices lunchatand out before on he, company fundamentals. This beta himself, becomes lunch, too. is either referred to as accounting betaInorAugust fundamental beta. wateredof 2010 the Amarket sold down version of this method would relate the committee earnings change of a stock of the that pushed to through that of the broad market, but in one the first paved road canthe addworld variables such as debt ratios, – Woodward Avenue cash balances, dividend payouts, etc., in Detroit – knowing that his to make it morewould complex presumably, product beand, more valuable more useful. On the surface, the process as roads got better. looks promising but the biggest issue is that accounting numbers are at The the common lesson of all three most four timesfigures a year. isMarket of released these historical that prices, on the other hand, are available they were not only visionaries but daily data from public sites. Also, unemotional through economic it is not uncommon for companies adversity and in their steadfast to attempt to “smooth” accounting climb. numbers by accelerating or decelerating the recognition of revenues or expenses, which means that the figures may not reflect the “true” risk. Is there hope? Asoff. we can see, it is hard to argue flows, against According to money these critiques, but it is also evident investors sold equities and thatbought the proposed bonds.alternatives Why did also theyhave sell shortfalls of their own. Just because those equities? One of the of primary these limitations, though, reasons was fearit–doesn’t media mean that the concept of beta has noa reports had them worried about value. Keeping all these issues mind, double dip-recession. Yetinthe beta can still be used as a risk measure. stock market rallied in Let’s see how. In fact, the rally September. looks like it will yield one of the best Septembers since 1939. Beta more can beinvestors used Why didn’t to see shifts riskacting like participate? Theyin were roadkill - already wounded and across the market. afraid to take advantage of the opportunity that August created. Beta can be used to see shifts in risk across the market. If one sector of the market becomes riskier, then its How many of youSince havethe been told beta should increase. overall to diversify placingmust various market beta by by definition remain in different asset sector’s classes at amounts 1, this implies that another - small cap stocks, large cap beta must go down to balance out. One estate, international canstocks, see thisreal post-2007, when the beta etc.? Thewas idea behind of equities, the financial sector 1.13 and the this that these asset classes beta foristhe technology sector was 1.25. don’t move in tandem with one Since then, the financial sector another – when (continued one zigs, the on next page) 2012: 2010: Fourth Third Quarter Page 23 It has been said that he was able to has become significantly build Standard Oil into amore near-risky, due to all ofbythe questions monopoly striving for remaining efficiency regarding the underlying assets of the within his own model. financial firms, pending government regulation and manymortgaged more. Thathisrisk Andrew Carnegie ismother’s reflected house in the increase the sector during ainperiod of beta to 1.63. In contrast, the beta economic turmoil. He made a of the technology sector gutsy investment of has $500gone for down 10 to 0.97 during that period, reflecting shares of the Adams Express the lower “relative” Company andrisk. that bet paid off well for opportunity through the adversity of others and used his Conclusion capitalize on ait.bit As shrewdness one can see,tothere is quite of controversy regarding beta, its Do you think to shortcomings andit was its popular uses. The convert people idea of not discussion above toistheclearly driving automobiles? Henry Ford exhaustive or mathematically detailed. therecommend automobile Fordidn’t more even detail,invent I would – his greatest achievement was looking at Pratt’s book, Cost of Capital. an assembly linecriticisms to make In utilizing my opinion, the common the process of building cars levied against regression beta more are enough that he was given the efficient. By bringing down the Beta at the portfolio level conveys justified, however the alternatives that opportunity to make gutsy at have price, made the invention more information thanother it does beenhe proposed are also lacking. As moves – from steel to railroads. I more accessible and created the individual stock level. If one has I have said before, in order to use a tool he with had an abilityofto1.5, search demand. was also a member abelieve portfolio a beta then effectively, oneHe must also understand its that portfolio is thought to be 1.5 limitations. Beta at the stock level has times more exposed macro-economic problems, but works much better at the variables than the overall market and portfolio level and can also be used to will relatively more volatile overoftime seeIshifts in risk across sectors. propose stepping back a Finally, bit Thebefollowing is a collection a than a portfolio that has a beta of 1.1. one has to remember that valuation is from minute-by-minute or day-byfew of the strategies that I believe So, if someone wants to make their not a science and that models are only day over-analysis. Instead, could potentially help our readers portfolio less exposed to broad macro as good as the assumptions that go into determine if you are emulating the to preserve and protect their variables, then one place to start would them. Therefore, one should behavior of a vulture or of always legacies. No single strategy is be to replace their higher reader beta positions have a marginRoadkill of safetyisand on the roadkill. theerr investor appropriate for every with lower ones. One might ask how side of caution, because chances are – who gets run over by the market though, so be sure to consider, with could a measure whether that works so poorly thatthey whichever valuation measures you buy when the market is high your advisors, these at the stock level become relevant at useand will the haveother some investors standard error. are excited strategies are appropriate for you. the portfolio level, since betas of all and sellmanagement, when the market is a toolthey for risk portfolio firms in the portfolio are obtained As down and other investors are is an invaluable tool. We often from a regression where the estimates betapanicking. They don’t capitalize see portfolios that are built around have standard errors. The answer lies on opportunities because they are stock selection, without in averaging. When we average multiple individual responding to what has already to how this addition affects the stock betas, the resulting average has regard happened. think of billionaires, aWhen muchI lower standard error, which overall risk of the portfolio. In our at KS&A, this is a mistake – vultures tobeta mind. means thecome average is closer to the opinion The vulture, however, sits on his true beta. Mathematically, it amounts to when choosing components to fit into perch, watching theitaction. After your portfolio, we find much more Many of usbelow: tend to be emotional the equation patiently waiting, heeach feeds when valuable to look at how piece fits investors - on the days when the the folly is over and the emotional Standard Error of Portfolio Beta = into the portfolio as a whole, so that we market is higher, we are happier animal has been caught in the Average standard error portfolio / √n, can manage the overall market exposure and feel quite smug with our and been run over by where n is the number of stocks to headlights the level that is appropriate for the investments. On days when the the markets. he sees individual investor.When Although we may market is lower, we second-guess distress, he swoops in, tears off see great opportunities in a particular ourselves and wonder why we’re some and gets out before sector or lunch asset class or even security, not making any money. It’s hard he, himself, becomes lunch, too. that doesn’t necessarily mean that asset not to be on an emotional roller is appropriate for all of our clients. coaster. In August of 2010 the market sold of the committee that pushed through the first paved road in the world – Woodward Avenue One should always have a in Detroit – knowing that his margin safetybeand errvaluable on the productofwould more as roads got better. side of caution, because chances are that whichever The common lessonvaluation of all three ofmeasures these historical figures is that you use will have they were not only visionaries but some standard unemotional througherror. economic adversity and in their steadfast climb. Portfolio management isn’t solely a question of chasing returns – it is more a question of seeking out risk-adjusted returns, which means knowing both what your risk tolerance is and how well your portfolio suits that tolerance. off. According to money flows, and about If investors you need sold moreequities information bought bonds. Why did they and sell how our portfolios are structured those equities? One of the managed to an appropriate risk level primary reasons was fear –Advisor media for each investor, your KS&A reports hadtothem worried about a looks forward hearing from you. double dip-recession. Yet the stock market rallied in September. In fact, the rally looks like it will yield one of the best Septembers since 1939. Why didn’t more investors participate? They were acting like roadkill - already wounded and afraid to take advantage of the opportunity that August created. How many of you have been told to diversify by placing various amounts in different asset classes - small cap stocks, large cap stocks, real estate, international equities, etc.? The idea behind this is that these asset classes don’t move in tandem with one another – when one zigs, the Ken Stern is a registered principal with, and offers securities through First Allied Securities, Inc., a Registered Broker/Dealer, Member FINRA/SIPC. Asset Planning Solutions is a Licensed Insurance Agency, #OB95262. Ken Stern & Associates (KS&A) is a Registered Investment Advisor, not a tax or estate planning firm. KS&A recommends that you consult a tax or an estate planning professional if you feel that these services are necessary for your situation. There is no certainty that any investment will be profitable or successful in achieving investment goals. The S&P 500 Index is an unmanaged index that is generally considered representative of the U.S. stock market. The performance of an unmanaged index is not indicative of the performance of any particular investment. Investments offering the potential for a higher rate of return also involve a higher degree of risk. Actual results will vary. Investments in foreign securities may be affected by currency fluctuations, differences in accounting standards and political instability. These risks are more significant in emerging markets (or concentrations within a single country) and are subject to greater risk of loss and volatility and may not be suitable for all investors.