CS 661: System Simulation

advertisement

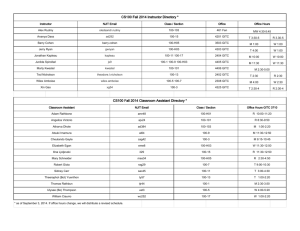

CS 661: System Simulation Spring Semester at NJIT Tuesday Evenings, 6:00 - 9:05pm Instructor Prof. Jim Calvin Office: 4409 GITC Phone: (973) 596-3378 e-mail: calvin@njit.edu URL: web.njit.edu/∼calvin Description Simulation is one of the most widely used tools for analyzing complex processes and systems. Its use in engineering and business has increased dramatically in recent years, in part because of the increased power of personal computers and workstations, on which the vast majority of simulations are carried out. Examples of the use of simulation in engineering include the design and analysis of computer systems, networking, web-based systems, and fault-tolerant computing. The uses of simulation in a business environment include evaluating alternative operational policies, viewing the impact of changes in personnel or equipment on business performance, assessing the capabilities of a proposed factory, performing risk analysis of a proposed business plan, and pricing financial instruments. This course covers the use of simulation as a tool for analyzing engineering and business problems. The two primary goals of the course are to learn how to plan, build and use simulation models and to develop an understanding of when simulation is an appropriate tool for analysis. Much of the work in the course will involve learning the mathematical and software tools for building simulation models, performing experiments with them, and interpreting the results. Although the focus of the course is on general simulation concepts and techniques, independent of a simulation package, we will also illustrate some of the material using the software package ARENA, a popular simulation package. ARENA is well suited for creating large and detailed discrete-event simulation models. We will also use Excel to carry out some Monte Carlo simulations. The course will cover many applications of simulation, including computer-performance modeling, manufacturing, and finance. Prerequisites An undergraduate or graduate calculus-based course in probability and statistics at the level of Math 244 or Math 333, and working knowledge of at least one higher-level programming language (e.g., C or Java). 1 Tentative Course Outline 1. Introduction to simulation modeling, and review of basic probability and statistics (2 weeks) 2. Fundamental simulation concepts (1 week) 3. Probability distributions and input modeling (2 weeks) 4. Generating uniform and non-uniform random variates (2 weeks) 5. Building simulation models using Arena (2 weeks) 6. Output data analysis for simulations (1 week) 7. Monte Carlo simulation, including project management and finance (2 weeks) 8. Variance-reduction techniques (2 weeks) Throughout the course, we will cover many topics in finance, including stochastic models for risky asset prices (geometric Brownian motion, jump-diffusion models, Markov regime-switching models), interest-rate models, portfolio valuation, pricing options (including exotic path-dependent options), estimating value-at-risk, and variance-reduction techniques for pricing path-dependent options. Textbook There are two alternate texts for the course: • A. M. Law, Simulation Modeling and Analysis, 4th Edition, McGraw-Hill, 2007, ISBN: 0073294411. • P. Glasserman, Monte Carlo Methods in Financial Engineering, Springer, 2003, ISBN: 0387004513. Students interested in finance should buy the Glasserman book. All other students should buy the Law book. Students only need to buy one of the books. 2 CS704: Scheduling Spring Semester at NJIT Instructor Prof. Joseph Leung Office: 4202 GITC Phone: (973) 596-3387 e-mail: leung@oak.njit.edu URL: web.njit.edu/∼leung WeeklyListing of Topics 1. Overview of Scheduling. The 3-field Notation. Tutorial on Complexity Theory. 2. Tutorial on Complexity Theory. 3. The Makespan Criteria. UET Task Systems. The Coffman-Graham Algorithm. 4. Hu’s Algorithm. The LPT Rule. Preemptive Scheduling. McNaughton’s Rule. MuntzCoffman Algorithm. 5. List Scheduling. Anomaly of List Scheduling. Comparison of List, Nonpreemptive and Preemptive Scheduling. 6. Optimal Online Scheduling. Heuristics. Competitive Ratios. 7. Midterm Exam. 8. Mean Weighted Flow Time. SPT Rule. Bicriteria Scheduling: (1) Minimzing Makespan Subject to Minimum Mean Flow Time. 9. Bicriteria Scheduling (2) Minimizing Mean Flow Time Subject to Minimum Makespan. Minimizing Mean Flow Time Subject to Release Time and Deadline Constraint. 10. Maximum Lateness Objective. Lawler’s Algorithm. Sahni’s Algorithm. Horn’s Network Flow Algorithm. 11. Hodgson-Moore Algorithm. Tardiness Objective. Lawler’s Pseudo-Polynomial Time Algorithm. 12. Midterm Exam. 13. Open Shop, Flow Shop and Job Shop 14. Review 3 CS: Optimization Fall 2011 at NJIT Instructor Prof. Jim Calvin Office: 4409 GITC Phone: (973) 596-3378 e-mail: calvin@njit.edu URL: web.njit.edu/∼calvin Description A survey of methods and applications of global optimization. Prerequisites An undergraduate or graduate calculus-based course in probability and statistics at the level of Math 244 or Math 333, and working knowledge of at least one higher-level programming language (e.g., C or Java). Main Topics 1. Global optimization, randomized algorithms; simulated annealing; evolutionary algorithms. 2. Methods based on stochastic models; average-case analysis. 3. Complexity of global optimization. 4. Optimization with noise-corrupted function evaluations. 5. Simulation-based optimization. Textbook A. Zhigljavsky and A. Z̆ilinskas, Stochastic Global Optimization, Springer, 2008. 4