The Fraud Triangle April 2011

advertisement

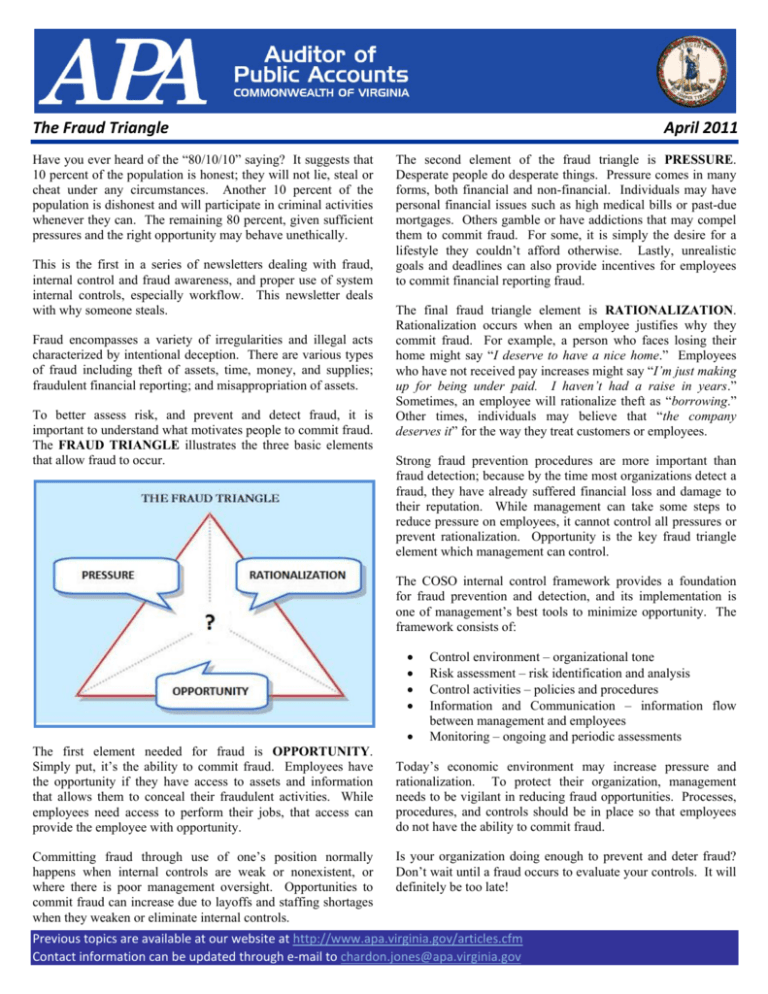

The Fraud Triangle Have you ever heard of the “80/10/10” saying? It suggests that 10 percent of the population is honest; they will not lie, steal or cheat under any circumstances. Another 10 percent of the population is dishonest and will participate in criminal activities whenever they can. The remaining 80 percent, given sufficient pressures and the right opportunity may behave unethically. This is the first in a series of newsletters dealing with fraud, internal control and fraud awareness, and proper use of system internal controls, especially workflow. This newsletter deals with why someone steals. Fraud encompasses a variety of irregularities and illegal acts characterized by intentional deception. There are various types of fraud including theft of assets, time, money, and supplies; fraudulent financial reporting; and misappropriation of assets. To better assess risk, and prevent and detect fraud, it is important to understand what motivates people to commit fraud. The FRAUD TRIANGLE illustrates the three basic elements that allow fraud to occur. April 2011 The second element of the fraud triangle is PRESSURE. Desperate people do desperate things. Pressure comes in many forms, both financial and non-financial. Individuals may have personal financial issues such as high medical bills or past-due mortgages. Others gamble or have addictions that may compel them to commit fraud. For some, it is simply the desire for a lifestyle they couldn’t afford otherwise. Lastly, unrealistic goals and deadlines can also provide incentives for employees to commit financial reporting fraud. The final fraud triangle element is RATIONALIZATION. Rationalization occurs when an employee justifies why they commit fraud. For example, a person who faces losing their home might say “I deserve to have a nice home.” Employees who have not received pay increases might say “I’m just making up for being under paid. I haven’t had a raise in years.” Sometimes, an employee will rationalize theft as “borrowing.” Other times, individuals may believe that “the company deserves it” for the way they treat customers or employees. Strong fraud prevention procedures are more important than fraud detection; because by the time most organizations detect a fraud, they have already suffered financial loss and damage to their reputation. While management can take some steps to reduce pressure on employees, it cannot control all pressures or prevent rationalization. Opportunity is the key fraud triangle element which management can control. The COSO internal control framework provides a foundation for fraud prevention and detection, and its implementation is one of management’s best tools to minimize opportunity. The framework consists of: The first element needed for fraud is OPPORTUNITY. Simply put, it’s the ability to commit fraud. Employees have the opportunity if they have access to assets and information that allows them to conceal their fraudulent activities. While employees need access to perform their jobs, that access can provide the employee with opportunity. Committing fraud through use of one’s position normally happens when internal controls are weak or nonexistent, or where there is poor management oversight. Opportunities to commit fraud can increase due to layoffs and staffing shortages when they weaken or eliminate internal controls. Control environment – organizational tone Risk assessment – risk identification and analysis Control activities – policies and procedures Information and Communication – information flow between management and employees Monitoring – ongoing and periodic assessments Today’s economic environment may increase pressure and rationalization. To protect their organization, management needs to be vigilant in reducing fraud opportunities. Processes, procedures, and controls should be in place so that employees do not have the ability to commit fraud. Is your organization doing enough to prevent and deter fraud? Don’t wait until a fraud occurs to evaluate your controls. It will definitely be too late! Previous topics are available at our website at http://www.apa.virginia.gov/articles.cfm Contact information can be updated through e-mail to chardon.jones@apa.virginia.gov