Lire l'étude

advertisement

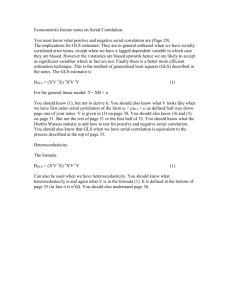

Returns Momentum, Returns Reversals and Earnings Surprises Leonard C. Soffer and Beverly R. Walther Kellogg Graduate School of Management Northwestern University 2001 Sheridan Road Evanston, IL 60208 January 2000 Email: L-Soffer@nwu.edu bwalther@nwu.edu Phone: 847-491-2672 847-467-1595 Fax: 847-467-1202 We thank Tom Fields, Bob Korajczyk, Bob Magee, and workshop participants at Northwestern University for helpful comments and suggestions. Financial support from the Accounting Research Center at the Kellogg Graduate School of Management, Northwestern University is gratefully acknowledged. ABSTRACT Returns Momentum, Returns Reversals and Earnings Surprises Abnormal stock returns measured over intervals of less than a year exhibit positive serial correlation, or returns momentum, while returns measured over longer periods exhibit negative serial correlation, or returns reversals. This paper examines if patterns in earnings surprises, together with investors’ inefficient reactions to those earnings surprises, account for the observed serial correlation in returns. Prior literature has documented that over periods of less than one year, earnings surprises are positively serially correlated. We document that over longer periods, they are negatively serially correlated. This pattern is strikingly similar to the pattern in returns. In addition to documenting these patterns across intervals, we also show that for any particular interval, the serial correlation of returns and the serial correlation of earnings surprises are related. Controlling for cross-sectional differences in firms’ serial correlations in earnings surprises, we are able to eliminate the serial correlation in returns at 3-, 24-, 36-, and 48-month intervals. We find some evidence of residual serial correlation in returns at 6-, 12-, and 60month intervals. Overall, our results suggest that the serial correlation in earnings surprises is an important factor in determining the sign and magnitude of the serial correlation in returns. 1. Introduction Researchers have documented that stock returns are serially correlated. If unexplained by risk, measurement error or chance, the existence of serially-correlated stock returns is a weakform inefficiency in the stock market. These predictable returns are anomalous, especially when they are based on such a simple and easily obtained predictor as prior returns. We consider two explanations for serially-correlated stock returns. The first explanation, which we label “induced” serial correlation, is that investors react inefficiently to some underlying information variable about firms. If investors initially under- or over-react to this information, and prices are later corrected, then we will observe serially-correlated returns. The inefficient pricing of the information variable and the subsequent correction induce the serial correlation in returns; there is no price reaction to prior stock returns per se. The second explanation, which we label “pure” serial correlation, is that price movements are the underlying cause of subsequent price movements. For example, when we observe positive serial correlation in quarterly returns, if it is pure serial correlation, then the predictable component of the returns is a reaction to prior returns, rather than to some underlying information variable. There are many potential sources of information that could induce serial correlation in returns. In fact, any information to which prices react will induce serial correlation in returns if the reaction is not unbiased and immediate. In order to distinguish between pure serial correlation in returns and induced serial correlation in returns, we must identify the information that could be causing the patterns in returns. Then, we must test whether, after controlling for the price reaction to that information, returns are still serially correlated. We label the extent to which returns are serially correlated after controlling for information that might induce that serial correlation as “residual” serial correlation. Any residual serial correlation that remains after 1 controlling for the underlying information we test could be pure serial correlation, or it could be induced by some other information variable for which we have not controlled. In this paper, we consider earnings information as a possible source of induced serial correlation in returns. We focus on earnings information because it, like lagged stock returns, has been shown to predict future stock returns. In addition, the predictability of stock returns based on prior earnings information appears to be due to an initial underreaction to the information in an earnings announcement, and a subsequent correction to that underreaction (e.g., Bernard and Thomas (1990); Soffer and Lys (1999)). Thus, the predictability of stock returns based on earnings information should induce serially-correlated returns. Further, the correlational structure of earnings surprises at various lags is similar to that of returns. We show empirically that when intervals of three and six months are examined, earnings surprises exhibit positive serial correlation. At one year or longer, earnings surprises are negatively serially correlated. This is not only a complicated pattern, but also one that is strikingly similar to the pattern in returns. Returns measured over intervals of less than a year exhibit positive serial correlation, or returns momentum, while returns measured over longer periods exhibit negative serial correlation, or returns reversals. Thus, earnings surprises and stock returns both exhibit momentum in the short run and reversals in the long run. This finding suggests that patterns in earnings surprises could simultaneously explain the existence of both returns momentum and returns reversals. We show that for any particular interval, the serial correlation of returns and the serial correlation of earnings surprises are related. Even though the average firm has positive serial correlation in both earnings surprises and returns measured over short intervals, the subset of firms with negatively serially-correlated earnings surprises have, on average, negatively serially- correlated returns. Similarly, over long intervals, firms with positively serially-correlated earnings surprises have, on average, positively serially-correlated returns, even though the average firm exhibits negative serial correlation in both variables over long intervals. These findings suggest that differences in the signs of the serial correlation in returns at various intervals are not due to the lengths of the intervals examined per se, but rather due to differences in the sign of the serial correlation of earnings surprises over varying intervals. They further support the possibility of induced serial correlation in returns. We directly investigate the extent to which the serial correlation in returns is induced by earnings surprise patterns. Controlling for the serial correlation in earnings surprises essentially eliminates the returns momentum we observe in quarterly returns. Thus, momentum in quarterly returns appears to be entirely induced by the pattern in earnings surprises, along with investors’ inefficient reactions to them. Our results at six- and 12-months intervals, however, suggest that returns momentum at these intervals is not entirely induced by earnings surprise patterns. Our mixed results at these shorter intervals suggest that more complex models than an AR1 may be necessary to understand the relationship between earnings surprise patterns and returns patterns. Our results are stronger in the longer intervals. Residual returns reversals are not statistically different from zero in the 24-month, 36-month, and 48-month intervals. We continue to find residual returns reversals at the 60-month interval, but the magnitude declines by approximately 25% after controlling for the serial correlation in earnings surprises. Overall, our results suggest that the serial correlation in earnings surprises is an important factor in determining the sign and magnitude of the serial correlation in returns. The remaining serial correlation in returns may be explained by other information variables, a more complete specification of the correlation structure in earnings surprises, or pure serial correlation in returns. The remainder of the paper proceeds as follows. Section 2 reviews the prior literature. Section 3 discusses our sample. The empirical results are presented in Section 4. Section 5 concludes the paper. 2. Prior Research and Motivation A substantial portion of the literature on the predictability of stock returns has focused on prior returns. These studies have documented both positive and negative serial correlation in returns, depending on the returns interval examined. Over shorter intervals (three to 12 months), the results generally support positive serial correlation, or returns momentum. (See, for example, Jegadeesh and Titman (1993) and Chan, Jegadeesh, and Lakonishok (1996).) Over a long interval (more than 12 months), returns typically exhibit negative serial correlation, or reversals. (See DeBondt and Thaler (1985, 1987).) In a single study, Poterba and Summers (1988) find evidence of both returns reversals and returns momentum depending on the length of the period over which returns are measured. Their variance ratio tests indicate that monthly returns exhibit momentum, while over periods of more than a year, returns exhibit reversals. This switch in the sign of the serial correlation in returns conditional on the length of interval examined is puzzling. Most researchers studying momentum or reversals model returns, either explicitly or implicitly, as an AR1 process with returns measured over some interval. If this is an accurate representation of the returns process for a short interval, say quarterly, and the coefficient of serial correlation is positive, then returns measured over any longer period and modeled as an AR1 will also exhibit positive serial correlation. Thus, the negative serial correlation exhibited at longer intervals suggests a more complex returns process than is captured by an AR1, and one that introduces some negative correlation at higher-order lags. It is unclear why the correlations at these higher-order lags would have a different sign. Because it is anomalous that returns would have any serial correlation structure at all, it is especially puzzling that returns would have a very complicated one. Another literature on the predictability of returns developed beginning with Ball and Brown (1968). This literature has documented that post-earnings announcement stock returns are related to the size and magnitude of the prior earnings surprises. (See also Foster, Olsen, and Shevlin (1984), Bernard and Thomas (1989), and Freeman and Tse (1989).) As a result, it is possible to earn abnormal returns of roughly 3-4% in the 60-day period following earnings announcements by going long (short) in firms with the most favorable (unfavorable) earnings surprises. Prior research has documented that quarterly earnings surprises are positively related to prior earnings surprises in the subsequent three quarters, and are negatively related in the fourth quarter following the earnings surprise (e.g., Bernard and Thomas (1990)). It has been shown that the predictability of returns based on prior earnings information, or post-earnings announcement drift, arises because of investors’ failure to assess this serial correlation in earnings surprises unbiasedly. 1 Bernard and Thomas (1990) show that the abnormal stock returns in the three quarters after an earnings surprise are positively related to the earnings surprise, while abnormal stock returns in the fourth quarter after an earnings surprise are negatively related to the surprise. Thus, both the serial correlation of the forecast error from a 1 Jacob, Lys, and Sabino (1999) show that the negative autocorrelation at the fourth lag in seasonally-differenced earnings may be a consequence of overdifferencing an already stationary series. As a result, it is difficult to infer how investors form expectations of quarterly earnings merely by looking at the correlation of abnormal returns with lagged unexpected earnings. seasonal random walk model and abnormal returns are positive (but declining) over the three quarters following a positive earnings surprise, and negative in the fourth quarter. Bernard and Thomas conclude that the predictable responses to subsequent earnings announcements occur because investors’ earnings expectations do not incorporate fully the serial correlation in seasonally-differenced earnings. As a result, investors’ forecast errors, and hence abnormal stock returns, are similar to the seasonal random walk forecast errors. Chan et al. (1996) examine whether post-earnings announcement drift accounts for returns momentum. Using six-month intervals, they find that both lagged earnings surprises and lagged returns explain returns, even in the presence of the other, and therefore rule out postearnings announcement drift as an explanation for momentum. In contrast, Kraft (1999) finds some evidence that prior returns have no explanatory power for future returns after controlling for both unexpected earnings and prior financial statement information. One possible explanation for the conflicting results in Chan et al. (1996) and Kraft (1999) is that these two studies use different windows to measure lagged returns. Chan et al. break their return periods at each month end. For their earnings information variable, they use the most recently released earnings announcement prior to the return period. The most recent earnings announcement will most likely be for the prior quarter, which may have ended one, two, or three months prior to the beginning of the returns period. Therefore, the earnings information is up to two and one-half months old, which biases Chan et al. against finding that prior earnings information explains returns momentum. In contrast, Kraft uses six-month returns for the period ending one month before portfolio formation. Thus, in his paper, lagged returns are a month old, which biases his tests against finding significant results for returns momentum, especially if it is short-lived. In contrast to most of the earlier work on momentum and reversals, we examine the serial correlation in returns at both short and long intervals. Further, we relate the sign and magnitude of the serial correlation in returns to that in earnings surprises. Our research is motivated by the different signs of serial correlation in returns depending on the interval examined. It brings together two literatures that have developed largely independent of one another. It also provides a framework for considering whether the remaining serial correlation in returns is induced by some other information variable. 3. Sample 3.1 Data Requirements We obtain quarterly earnings and returns data for every firm appearing on both Compustat and CRSP. For every holding period interval in our study, we use the data to construct abnormal earnings and earnings surprises. We break all of our holding periods based on earnings announcement dates. All of our holding periods begin at day +2 relative to a quarterly earnings announcement and end at day +1 relative to another quarterly earnings announcement. For example, one six-month holding period would be from two days after the first quarter earnings announcement to one day after the third quarter earnings announcement. We break all holding periods just after an earnings announcement so that when we test whether either lagged returns or lagged earnings surprises subsumes the other in predicting returns, we are using the most recent information available for both. Therefore, prior returns and prior earnings surprises are equally timely. To compute holding period abnormal returns, we first compute abnormal returns for every firm-day in our sample as the firm's stock return on that day, less the return on the value- weighted market index on the same day. We then aggregate abnormal returns (geometrically) over the entire holding period. For all seven of our intervals, which range from three months to 60 months, we have a separate holding period abnormal return for each firm-quarter for which there is sufficient data. Thus, our observations overlap for all intervals longer than three months. We refer to firm i’s abnormal returns for the holding period ending with quarter t as Ri,t, and the lagged abnormal return, lagged by one holding period, as Ri,t-1. Although our observations for a given firm overlap when we use six-month intervals or longer, our current abnormal returns and lagged abnormal returns for a given observation (i.e., Ri,t and Ri,t-1) do not overlap. We compute earnings surprise for a given holding period as actual earnings for the entire period less the seasonal random walk expectation for the holding-period earnings as of the beginning of the holding period, normalized on stock price at the beginning of the holding period. This model implies slightly different computations of the surprise for intervals of one year or less and longer than one year. For intervals of one year or less, the earnings surprise is holding-period earnings less earnings for the same quarter(s) of the previous year, normalized on beginning-of-period stock price. For example, one six-month earnings surprise would be earnings from the first quarter of year t plus earnings from the second quarter of year t, minus earnings from the first quarter of year t-1 plus earnings from the second quarter of year t-1, deflated by price at the beginning of the first quarter of year t. The computation of earnings surprise for intervals of more than one year is more complicated. At the beginning of a holding period of n quarters, where n is an integer multiple of 4, the expected holding period earnings is n/4 times the immediately preceding four quarters earnings. We subtract this amount from actual holding period earnings and normalize on beginning of period stock price to obtain the earnings surprise amounts for these intervals. For example, one two-year earnings surprise would be the sum of earnings from the first quarter of year y through the fourth quarter of year y+1, minus two times the sum of earnings from the first quarter of year y-1 through earnings from the fourth quarter of year y-1, deflated by price at the beginning of the first quarter of year y. The following equations illustrate the computation of the earnings surprise at all intervals: 1 n−1 P ⋅ ∑ ( X i,t−v − X i,t −4−v ) t−n v=0 Si,t = 1 n−1 n / 4 n+3 ⋅ ∑ X i,t−v − ⋅ ∑ X i,t− v Pt −n P t− n v=0 v= n for n ≤ 4. for n > 4. Once we computed abnormal returns and earnings surprises for every possible firmquarter for all seven holding period intervals, we created our data sets by finding all observations for which we had abnormal returns, earnings surprise, and lagged values of both. We then excluded all firm-quarters relating to any firm for which we did not have at least ten observations, in order to facilitate the computation of individual firm estimates of the serial correlation of earnings surprises. We also excluded all firm-quarters relating to any quarter for which we did not have at least 100 observations, so that we could reliably run cross-sectional regressions. We refer to each of the seven resulting samples as the three-month sample, the sixmonth sample, and so on. Our sample sizes are as follows: Interval (Number of Months) 3 6 12 24 36 48 60 Number of Firm-Quarter Observations 301,395 272,410 223,623 158,647 115,818 84,877 61,575 The sample size falls as the interval length increases because at longer intervals, more quarters are required to have a valid observation. For example, in the three-month sample, two quarters of surprises and returns are required to create an observation. However, in the 60-month sample, 40 quarters are required for an observation. Table 1 provides descriptive statistics for the three-month sample. Panel A shows the years to which our observations pertain. Although there is a slight skewness toward more recent years, our sample is not clustered in any particular time period. Panel B shows summary statistics for our two variables, earnings surprise and abnormal returns. The mean (median) quarterly abnormal return is 0.00003 (-0.0136). The mean (median) quarterly earnings surprise is 0.0036 (0.0021), indicating the typical surprise is about one-third of one percent of stock price. The descriptive statistics for the longer interval samples are similar to the descriptive statistics for the three-month sample and are not reported. 3.2 Existence of Returns Momentum/Reversals and Drift In Table 2, we examine if our samples exhibit returns momentum, returns reversals, and post-earnings announcement drift, as documented by prior researchers. For each interval, we estimate three cross-sectional regressions for each quarter of our data: abnormal returns on an intercept and lagged abnormal returns; abnormal returns on an intercept and lagged earnings surprise; and abnormal returns on an intercept and both lagged abnormal returns and lagged earnings surprise. We report the average coefficients of these regressions, as in Fama and MacBeth (1973). We also report the t-statistics for the hypotheses that the mean coefficients are zero, as well as the number of regressions for which the coefficient is negative or positive. The t-statistics are based on the aggregated standard errors, which are computed as follows: SE( COEFk ) = T 1 ⋅ ∑ SE2 ( COEFk ,t ) T t=1 (1) where T is the number of cross-sectional regressions, SE( COEFk ,t ) is the standard error of the estimate of the k-th coefficient in the quarter t regression. 2 Before reporting the t-statistics, we correct for the effect of overlapping periods that arises for periods longer than three months. 3 Short Intervals Panel A of Table 2 reports the results for the short intervals. Consistent with prior studies, we find evidence of both returns momentum and post-earnings announcement drift in the short intervals. The estimated coefficient on lagged returns in the first column is significant and positive for three months, six months, and 12 months, confirming returns momentum. For the three-month interval, for example, the mean coefficient is 0.0176, with a t-statistic of 11.20. Seventy-one of the 107 cross-sectional regressions have positive coefficients, while only 36 have negative coefficients. The coefficient on lagged earnings surprise in the second column is also significant and positive in the three short intervals, confirming the existence of post-earnings announcement drift. Again using the three-month interval as an example, the mean coefficient is reliably positive, with a t-statistic of 22.93. Ninety of the 107 cross-sectional coefficients are positive. 2 Our results are similar to those reported if we assume that the standard errors are identically distributed. For example, our six-month regressions include one where the independent variable is third quarter 1996 returns plus fourth quarter 1996 returns, and another where the independent variable is fourth quarter 1996 plus first quarter 1997. While using all such regressions is more efficient than reducing the number to eliminate any overlapping, the coefficient estimates from these regressions are correlated. Thus, we divide the t-statistics by a factor to correct for the bias in the standard errors, and report the corrected values. 3 The final two columns report the results of cross-sectional regressions of abnormal returns on an intercept, lagged abnormal returns, and lagged earnings surprise. In each of the three short intervals, the mean coefficient on lagged returns is reduced when lagged earnings surprise is added to the specification, but the t-statistic remains significantly positive. For example, in the three-month interval, the average estimated coefficient on Ri,t-1 drops about 30%, from 0.0176 to 0.0122, when Xi,t-1 is included as another independent variable. Consistent with Chan et al.’s (1996) finding for six-month intervals, we continue to find evidence of returns momentum after controlling for prior earnings surprises at all short intervals examined; the majority of the cross-sectional regressions yield positive coefficients on lagged returns. Thus, the Chan et al. conclusion is not sensitive to the returns interval used. Overall, our results indicate that in the short intervals, prior earnings surprises explain some, but not all, of the returns momentum. 4 Long Intervals Panel B of Table 2 presents the results from estimating the three cross-sectional regressions for the longer intervals, which range from 24 to 60 months. In contrast to the results for the shorter intervals, but consistent with prior research, we find evidence of returns reversals at the longer intervals. Although the coefficient on lagged returns is insignificantly different from zero in the 24-month case, it is reliably negative for the other three intervals. For example, for the 60-month interval, the average cross-sectional coefficient on Ri,t-1 is -0.0326 (t-statistic = -4.83, two-tailed probability < 0.01). 4 We find that earnings surprises explain more of the returns momentum if we break returns intervals at month-end, as Chan et al. (1996) did, rather than at earnings announcement dates, or if we use rank regression techniques, as Chan et al. did. Using either one of those approaches, we find evidence of reversals at short intervals, controlling for the effects of earnings surprises on the serial correlation in returns. Prior research has not examined the extent to which long-run returns reversals are related to earnings surprises. We find mixed results regarding the predictability of returns using lagged earnings surprises at longer intervals. The coefficient on lagged earnings surprise is insignificant in the 60-month interval, but reliably negative in the 24- and 36-month intervals and reliably positive in the 48-month interval. 5 When both lagged returns and lagged earnings surprises are included in the specification, the coefficient on lagged returns becomes more negative at all four intervals, although it is only in the 48- and 60-month intervals that the increase in the magnitude of the coefficient is very substantial. Consistent with the short-interval results, we find evidence of residual serial correlation in returns after controlling for lagged earnings surprises. Thus, lagged earnings information, even at longer intervals, does not account for all of the serial correlation in returns. However, the results are in contrast to the shorter intervals, where controlling for earnings information dampened the effect of lagged returns. The regression results in Table 2, while consistent with prior research, are biased. Specifically, when observations from firms with different serial correlation coefficients are pooled, the resulting estimates are biased. In the next section, we control for cross-sectional differences in serial correlation to determine whether these biases lead to incorrect inferences. 4. Empirical Results 4.1 Motivation for the Relationship between Serial Correlation of Earnings Surprises and Returns To motivate our empirical tests, we outline the relation between the sign of the serial correlation in earnings surprises and the sign of the serial correlation in returns. We first show 5 One reason for these weak results is the inclusion of firms in the sample which have positive serial correlation in earnings surprises at long intervals. If we eliminate these firms and re-estimate the cross-sectional regressions of current returns on lagged earnings surprises, we find that the average estimated coefficient on Xi,t -1 is statistically positive in all long intervals. that, in the absence of any source of predictable returns other than lagged earnings information, a firm would, in certain circumstances, exhibit serial correlation in returns. Consider the following earnings surprise process: X t = β0 + β1 ⋅ X t −1 + ε t (2) Investors’ expectations of the period t earnings surprise as of t-1, which may not be efficient, are Et−1( X t ) = β*0 + β*1 ⋅ X t−1 (3) β1* represents the degree to which the serial correlation in earnings surprises is considered by investors when they form their earnings expectations. A value of zero indicates that investors completely ignore serial correlation. A value of β1 indicates that they efficiently incorporate serial correlation into their earnings expectations. Let abnormal returns from t-1 to t depend on the extent to which investors are actually surprised by the earnings information that arrives during period t, but not depend directly on lagged returns, Rt-1: Rt = α0 + α 1 ⋅ [ X t − Et −1( X t )] + Ωt (4) Given these assumptions, 2 Cov( Rt ,Rt−1 ) = α1 ⋅ ( β1 − β*1 )⋅ ( 1− β1 ⋅ β1* )⋅ Var( X t ) Assuming | β1 | < 1 and | β1* | < 1, the sign of Cov(Rt, Rt-1) will depend solely on the sign of β1 − β1* . Returns will be serially uncorrelated only if investors’ earnings expectations are (5) efficient, i.e. β1* = β1 . However, inefficient expectations will induce serial correlation in returns. If investors underestimate the serial correlation in earnings surprises (0 < β1* < β1 or 0 > β1* > β1 ), then the serial correlation in returns will have the same sign as the serial correlation in earnings surprises. Thus, earnings surprise patterns whose coefficient of serial correlation depends on the interval, together with inefficient earnings expectations, could explain both returns momentum and returns reversals. 4.2 Empirical Tests of the Relation between Serial Correlation of Earnings Surprises and Returns To examine the extent to which the serial correlation in returns relate to the serial correlation in earnings surprises, Table 3 presents estimates of both at each interval. We obtain the serial correlation in earnings surprises by estimating cross-sectional regressions of the current earnings surprise (Xi,t) on an intercept and the lagged earnings surprise (Xi,t-1) for each quarter. We report the average coefficient on Xi,t-1 from these regressions (see Fama and MacBeth (1973)). The estimates for the serial correlation in returns are repeated from Table 2. The serial correlation in earnings surprises is positive in the three- and six-month intervals. Beginning at 12 months, the serial correlation in earnings surprises is negative. This switch in the sign of the serial correlation at 12 months undoubtedly occurs because when the interval exceeds six months, the same fiscal quarter of adjacent years appears in both the dependent variable, current earnings surprise, and the independent variable, lagged earnings surprise. And, earnings surprises from one quarter to the same quarter of the next year will be negatively serially correlated as long as earnings surprises are not completely permanent. With the exception of the 12-month interval, the sign of the serial correlation in returns is identical to that of the earnings surprise. To more directly determine the association between the sign of the serial correlation in returns and the sign of the serial correlation in earnings surprises at each interval, we estimate the serial correlation in returns and earnings surprises at each interval for each firm in the sample. 6 This approach relaxes the assumption that the serial correlation is cross-sectionally constant for all firms within a given interval, but assumes that the serial correlation is a time-series constant for each firm. We construct contingency tables for the signs of the firm-specific serial correlations in earnings surprises and returns. Table 4 provides these contingency tables. For every interval, the serial correlations of earnings surprises and returns are related. In other words, it is not just that across intervals the cross-sectional serial correlation coefficients show similar patterns, as in Table 3. For any given interval, the pattern in earnings surprises and the pattern in returns for a firm are related. In every one of the contingency tables, the null hypothesis of independence is rejected, with χ2 (1) statistics ranging from 8.38 to 230.71. In all seven contingency tables, the upper-left and lowerright cells have a greater proportion of the observations than they would under the null hypothesis of independence. These are the two cells where the serial correlation of returns and the serial correlation of earnings surprises have the same sign. To determine the extent to which the variation in returns across intervals depends on the earnings surprise pattern for that interval, we divide firms into deciles based on the firm-specific estimates of the serial correlation in their earnings surprises for each interval. For each decile, we estimate the average serial correlation in returns using cross-sectional regressions of Ri,t on an intercept and Ri,t-1 (as in Table 2). This approach also mitigates the bias induced by pooling across observations with different serial correlations, as discussed in the prior section. 6 To determine the serial correlation in earnings surprises (returns) for a firm, we separately regress Xi,t (Ri,t ) on an intercept and Xi,t -1 (R i,t -1) for each firm in the sample. Table 5 reports the results on the average serial correlation in returns for each decile and each returns interval. The first row in each panel reports the average, firm-specific serial correlation in earnings surprises for that decile. The outlined cell is the one that contains observations corresponding to both negative and positive earnings surprise serial correlation firms. Note that at the shorter (longer) intervals, the majority of firms exhibit positive (negative) serial correlation in earnings surprises. For example, in the three-month regressions, it is in the second decile that serial correlation becomes positive, while in the 60-month regressions, it is in the eighth decile. However, while the average serial correlation in earnings surprise across all firms is positive at short intervals and negative at long intervals, there are some firms for which the earnings process does not follow that of the average firm. Within each interval examined, the estimated serial correlation in returns is increasing in the earnings surprise serial correlation decile. Further, the serial correlation in returns tends to be positive (negative) for firms with positive (negative) serial correlation in earnings surprises regardless of the interval. Therefore, momentum (reversals) is not confined to short (long) intervals, but appears to be related to whether the firm has positive (negative) serial correlation in earnings surprises. In Figure 1, we present graphs of the serial correlation in returns against the serial correlation in earnings surprises by deciles formed on the serial correlation in earnings surprises. The serial correlation in returns (represented by the dark solid line in Figure 1) is increasing as the serial correlation in earnings surprises increases in all returns intervals. We also graph the residual serial correlation in returns after controlling for lagged earnings (results not tabulated). The dark dotted line provides the estimated coefficient on lagged returns from a regression of current returns on lagged returns and lagged earnings by deciles formed on the basis of the serial correlation in earnings. Consistent with Table 2, the magnitude of the serial correlation in returns after controlling for lagged earnings is reduced. Further, consistent with the conjecture that the serial correlation in earnings is driving the observed returns momentum/reversals, the dotted line is closer to zero, regardless of whether the serial correlation in earnings is positive or negative. The horizontal lines in each graph represent the serial correlation in returns when the regressions are estimated on the entire sample (i.e., the coefficient estimates from Table 2). Our results suggest that the dichotomy found in the momentum/reversals literature, whereby returns exhibit momentum at short intervals and reversals at long intervals, may not be due to the time interval per se. Rather, at short intervals, most firms exhibit positively seriallycorrelated earnings surprises, as well as returns. However, for those firms whose earnings surprises are negatively serially correlated, so are returns. Similarly, at long intervals, most firms exhibit negatively serially-correlated earnings surprises and returns. But, for those firms whose earnings surprises are positively correlated, so are returns. Finally, we examine whether returns are serially correlated after controlling for the serial correlation in earnings surprises. In the following equation, ρ1,i represents firm i’s serial correlation in returns: Ri,t = ρ 0 + ρ1,i Ri,t −1 + υ i,t (6) Modeling the serial correlation in returns as a function of the serial correlation in earnings surprises, ρ1,i = λ0 + λ1SC_ EARNi +ζ i we can rewrite equation (6) as: (7) Ri,t = ρ 0 + λ0 Ri,t −1 + λ1 Ri,t −1 ∗ SC_ EARNi +ψ i,t (8) where ψ i,t = Ri,t−1 ∗ζ i,t + υ i,t . If the serial correlation in returns is associated with the serial correlation in returns, then the estimated coefficient on the interaction term, Ri,t-1*SC_EARN i, will be significant and positive. Equation (8) also allows us to determine if there is residual serial correlation in returns after controlling for the serial correlation in earnings surprises by testing whether the estimated coefficient on Ri,t-1 is significantly different from zero. Table 6 provides the averaged results from cross-sectional estimations of equation (8) for each interval. In all seven intervals, the coefficient on the interaction term is positive and significant. For example, in the three-month interval, the average coefficient on Ri,t-1*SC_EARN i is 0.0729 (t-statistic = 12.66, two-tailed probability < 0.01), while in the sixty-month interval the average coefficient is 0.0551 (t-statistic = 4.38, two-tailed probability < 0.01). Regardless of whether returns on average exhibit momentum, as in the short intervals, or reversals, as in the long ones, serial correlation in returns is positively associated with serial correlation in earnings surprises. The magnitudes of the coefficients on lagged returns in these regressions, relative to the values when the interaction terms are not included (Table 2), indicate that the serial correlation in earnings surprises explains much of the patterns in returns. In the three-month, 24-month, 36month, and 48-month regressions, the estimated coefficient on Ri,t-1 becomes insignificant once the interaction term is included. While still significant, the residual returns reversal is much lower in the 60-month regression (-0.0326 in Table 2 versus -0.0245 in Table 6). In the 12month regressions, we find evidence of returns momentum, instead of reversals, once the interaction term is included (-0.0048 in Table 2 versus 0.0562 in Table 6). It is only in the sixmonth regression that the degree of returns momentum is not substantially affected by the inclusion of the interaction term (0.0674 in Table 2 versus 0.0502 in Table 6). Overall, the results in Table 6 indicate that the serial correlation in returns is related to the serial correlation earnings surprises. Further, the serial correlation in earnings surprises is a dominant (although not the only) factor leading to serial correlation in returns. 5. Conclusion In an efficient stock market, abnormal returns should not be predictable based on any information, whether it be prior returns, prior earnings information, or any other information that is known before the returns accumulation window. However, the finance and accounting literatures have documented predictable abnormal returns based on both past returns and past earnings information. The former has shown that when returns are measured over short (long) intervals, they exhibit momentum (reversals). The latter has shown that prices react slowly to quarterly earnings announcements, resulting in predictable returns for up to a year after an earnings announcement. This paper has examined the relation between these two sets of findings. Our research was motivated by two facts. First, the dichotomy of results in the finance literature (short-term momentum versus long-term reversals) suggests that some underlying information that follows a similar pattern might explain the anomalous behavior. Second, we find empirical evidence that serial correlations in earnings surprises are positive at short intervals and negative at long intervals, just as the serial correlations in returns are. This suggests that inefficient price responses to earnings information could explain both the positive serial correlation in returns at short intervals and the negative serial correlation of returns at long intervals. We examine empirically the extent to which earnings information explains the serial correlation in returns. We find that at any returns interval, firms with positive (negative) serial correlation in earnings surprises tend to have positive (negative) serial correlation in returns. So, at short intervals, where we observe momentum on average, we observe reversals for the subset of firms that have negatively correlated earnings surprises. Similarly, at long intervals, we observe momentum in the subset of firms having positively correlated earnings surprises, even though the average firm has returns reversals. The finding of positive (negative) serial correlation in returns at short (long) intervals on average occurs because most firms have positive (negative) serial correlation of earnings surprises. Further, at three- and six-month intervals, when we include an interaction term between firm-specific serial correlation in earnings surprise and lagged returns in a regression of returns on lagged returns, we find that the coefficient on lagged returns declines and, in the three-month case, becomes insignificant. For intervals of 36 months and longer, the negative coefficient on lagged returns declines in magnitude, becoming insignificant in all but the longest (60-month) interval examined. Our results suggest that some, but not all, of the patterns we observe in returns are induced by slow reactions to earnings information. The fact that lagged returns still have some ability to predict returns even controlling for earnings information suggests that there may be other sources of information that are both serially correlated and not completely reflected in stock prices. REFERENCES Ball, R. and P. Brown. “An Empirical Evaluation of Accounting Income Numbers.” Journal of Accounting Research (Autumn 1968): 159-178. Bernard, V., and J. Thomas. “Post-Earnings-Announcement Drift: Delayed Price Response or Risk Premium?” Journal of Accounting Research (Supplement 1989): 1-36. Bernard, V., and J. Thomas. “Evidence that Stock Prices Do Not Fully Reflect the Implications of Current Earnings for Future Earnings.” Journal of Accounting and Economics (December 1990): 305-340. Chan, L., N. Jegadeesh, and J. Lakonishok. “Momentum Strategies.” The Journal of Finance (December 1996): 1681-1713. DeBondt, W., and R. Thaler. “Does the Stock Market Overreact?” The Journal of Finance (July 1985): 793-808. DeBondt, W., and R. Thaler. “Further Evidence on Investor Overreaction and Stock Market Seasonality.” The Journal of Finance (July 1987): 557-581. Fama, E. and J. MacBeth. “Risk, Return and Equilibrium: Empirical Tests.” Journal of Political Economy (May/June 1973): 607-636. Foster, G., C. Olsen, and T. Shevlin. “Earnings Releases, Anomalies, and the Behavior of Security Returns.” The Accounting Review (October 1984): 574-603. Freeman, R. and S. Tse. “The Multiperiod Information Content of Accounting Earnings: Confirmations and Contradictions of Previous Earnings Reports.” Journal of Accounting Research (Supplement 1989): 49-84. Jacob, J., T. Lys, and J. Sabino. “Autocorrelation Structure of Forecast Errors from Time-Series Models: Implications for Post-Earnings Announcement Drift Studies.” Working Paper, University of Colorado at Denver, Northwestern University, and Massachusetts Institute of Technology, 1999. Kraft, A. “Accounting-Based and Market-Based Trading Rules.” Working Paper, University of Chicago, 1999. Jegadeesh, N. and S. Titman. “Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency.” The Journal of Finance (March 1993): 65-91. Poterba, J. and L. Summers. “Mean Reversion in Stock Prices: Evidence and Implications.” Journal of Financial Economics (October 1988): 27-59. Soffer, L. and T. Lys. “Post-Earnings Announcement Drift and the Dissemination of Predictable Information.” Contemporary Accounting Research (Summer 1999): 305-331. Table 1 Descriptive Statistics – 3 Month Sample A. Frequency of Observations by Year Year 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 Percent 1.7% 2.1% 2.6% 2.8% 2.8% 2.8% 2.8% 2.7% 2.6% 2.6% 2.6% 3.1% 3.5% 3.7% Year 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 Percent 3.7% 4.0% 4.1% 4.2% 4.3% 4.4% 4.7% 5.1% 5.6% 6.0% 6.0% 5.6% 3.9% B. Univariate Statistics Ri,t Mean 0.00003 Median -0.0136 Std. Dev. 0.2129 N 301,395 Xi,t 0.0036 0.0021 0.4367 301,395 __________________ This table provides descriptive statistics on the three-month sample used in this study. In Panel A, the frequency of sample observations by year is provided. Panel B presents univariate statistics on the main variables examined in this paper, abnormal returns (Ri,t ) and the earnings surprise (Xi,t ). The earnings surprise is calculated as actual earnings at quarter t minus actual earnings at quarter t-4, deflated by stock price at t-1. We compute abnormal returns (Ri,t ) relative to the value-weighted index for the period from day +2 relative to the quarter t-1 earnings announcement through day +1 relative the quarter t earnings announcement. Table 2 The Association of Returns with Prior Returns and Prior Earnings Surprises Mean Regression Coefficients from Overlapping Period Cross-Sectional Regressions Interval Rt-1 A. Short Intervals 3 month 0.0176 Xt-1 Rt-1 Xt-1 0.0914 0.0122 0.0864 (11.20) 36/71 (22.93) 17/90 (7.67) 38/69 (22.06) 18/89 1.02% 0.46% 0.0674 0.0751 0.0615 0.0520 (31.67) 31/74 (16.05) 23/82 (28.37) 34/81 (11.03) 25/80 2.06% 0.48% 0.0464 0.0324 0.0441 0.0158 (18.11) 37/64 (5.69) 42/59 (16.56) 35/66 (2.70) 51/50 1.98% 0.29% 6 month 12 month B. Long Intervals 24 month -0.0048 36 month 48 month 60 month 1.45% 2.39% 2.21% -0.0115 -0.0044 0.0043 (-1.32) 49/44 (-1.87) 53/40 (-1.16) 48/45 (0.65) 54/39 1.50% 0.37% -0.0270 -0.0196 -0.0281 0.0101 (-5.75) 49/36 (-2.83) 50/35 (-5.50) 44/36 (1.36) 42/43 2.13% 0.28% -0.0165 0.0159 -0.0284 0.0408 (-2.78) 46/31 (2.00) 26/51 (-4.31) 49/28 (4.49) 31/46 1.69% 0.46% -0.0326 0.0069 -0.0437 0.0322 (-4.83) 40/39 (0.83) 38/31 (-5.71) 45/24 (3.28) 25/44 1.56% 0.40% 1.69% 2.20% 2.28% 2.16% ______________________ This table provides the mean coefficients from cross-sectional regressions of current returns (Ri,t ) on lagged returns (Ri,t -1), lagged earnings surprises (Xi,t -1), and both lagged returns and lagged earnings surprises. The estimated intercepts from these regressions are not reported. The t-statistic adjusted for overlapping periods is provided in parentheses below the mean coefficient. The number of negative coefficients and the number of positive coefficients from the cross-sectional regressions are provided below the t-statistic, followed by the mean adjusted R2 of the cross-sectional regressions Table 3 The Serial Correlation in Returns and Earnings Surprises Mean Regression Coefficients from Overlapping Period Cross-Sectional Regressions Interval 3 month 6 month 12 month 24 month 36 month 48 month 60 month Serial Correlation in Returns 0.0176 Serial Correlation in Earnings Surprises 0.1961 (11.20) 36/71 (161.78) 4/103 0.0674 0.1520 (31.67) 31/74 (89.67) 4/101 0.0464 -0.1785 (18.11) 37/64 (-68.05) 9/92 -0.0048 -0.1850 (-1.32) 49/44 (-42.32) 90/3 -0.0270 -0.1745 (-5.75) 49/36 (-30.66) 84/1 -0.0165 -0.1445 (-2.78) 46/31 (-21.06) 77/0 -0.0326 -0.0975 (-4.83) 40/39 (-11.83) 59/10 __________________ This table provides the mean serial correlation in returns and serial correlation in earnings surprises for various intervals. The serial correlation in returns is the mean coefficient from cross-sectional regressions of current returns (Ri,t ) on lagged returns (Ri,t -1). The serial correlation in earnings surprises is the mean coefficient from crosssectional regressions of current earnings surprises (Xi,t ) on lagged earnings surprises (Xi,t-1 ). The estimated intercepts from these regressions are not reported. The t-statistic adjusted for overlapping periods is provided in parentheses below the mean coefficient. The number of negative coefficients and the number of positive coefficients from the cross-sectional regressions are provided below the t-statistic. Table 4 The Association between the Firm-Specific Serial Correlation in Earnings Surprises and the Sign of the Firm-Specific Serial Correlation in Returns A. Short Intervals 3 month Sign of SC in Earnings Sign of SC in Returns Negative Positive Negative 8.30% 6.01% Positive 45.60% 40.08% 6 month Sign of SC in Earnings Negative Positive Negative 13.93% 8.94% Positive 39.46% χ = 8.38 Sign of SC in Earnings 37.68% χ = 46.51 2 12 month Sign of SC in Returns 2 Sign of SC in Returns Negative Positive Negative 47.30% 22.89% Positive 13.93% 15.87% χ = 210.82 2 B. Long Intervals 24 month Sign of SC in Earnings Sign of SC in Returns 36 month Negative Positive Sign of SC in Earnings Negative 59.03% 14.66% Positive 14.76% 11.55% Negative Positive Negative 62.08% 11.49% Positive 16.15% 10.28% χ = 230.71 χ = 184.85 2 48 month Sign of SC in Earnings Sign of SC in Returns 2 60 month Negative Positive Sign of SC in Earnings Negative 60.34% 10.39% Positive 19.01% 10.26% χ = 118.46 2 Sign of SC in Returns Sign of SC in Returns Negative Positive Negative 59.44% 9.05% Positive 20.79% 10.72% χ = 98.90 2 ______________________ This table provides separate contingency tables for each interval for the sign of the firm’s serial correlation in returns and the sign of the firm’s serial correlation in earnings surprises. Within each interval, current returns (Ri,t ) are regressed on lagged returns (Ri,t -1) by firm to obtain the firm’s serial correlation in returns. Similarly, for each interval, current earnings surprises (Xi,t ) are regressed on lagged earnings surprises (Xi,t -1) to obtain the firm’s serial correlation in earnings surprises. For each interval, the χ2 statistic to test for independence between the sign of the firm’s serial correlation in returns and the sign of the firm’s serial correlation in earnings surprises is provided. Table 5 Serial Correlation in Returns for Deciles Formed on the Serial Correlation in Earnings Surprise Panel A: 3 Months Decile 1 Mean SC -0.189 in Earnings Mean SC -0.0120 in Returns (-1.75) Panel B: 6 Months Decile 1 Mean SC -0.282 in Earnings Mean SC 0.0612 in Returns (5.96) Panel C: 12 Months Decile 1 Mean SC -1.145 in Earnings Mean SC 0.0123 in Returns (0.59) Panel D: 24 Months Decile 1 Mean SC -1.920 in Earnings Mean SC -0.0438 in Returns (-1.14) Panel E: 36 Months Decile 1 Mean SC -2.275 in Earnings Mean SC -0.1198 in Returns (-1.89) Panel F: 48 Months Decile 1 Mean SC -3.839 in Earnings Mean SC -0.0989 in Returns (-1.06) Panel G: 60 Months Decile 1 Mean SC -3.043 in Earnings Mean SC -0.1369 in Returns (-1.16) 2 0.002 3 0.068 4 0.138 5 0.218 6 0.300 7 0.384 8 0.477 9 0.589 10 0.834 -0.0007 (-0.14) -0.0027 (-0.55) -0.0015 (-0.33) 0.0208 (4.30) 0.0104 (2.22) 0.0206 (4.06) 0.0346 (7.18) 0.0486 (9.87) 0.0737 (12.86) 2 -0.059 3 0.011 4 0.069 5 0.128 6 0.192 7 0.260 8 0.341 9 0.444 10 0.767 0.0531 (6.57) 0.0368 (5.42) 0.0561 (8.64) 0.0479 (7.36) 0.0638 (9.74) 0.0630 (9.95) 0.0812 (12.92) 0.0931 (14.57) 0.1348 (18.40) 2 -0.561 3 -0.444 4 -0.348 5 -0.256 6 -0.161 7 -0.063 8 0.038 9 0.172 10 0.886 -0.0258 (-1.63) -0.0080 (-0.62) 0.0077 (0.60) 0.0326 (2.63) 0.0533 (4.13) 0.0483 (3.94) 0.0588 (5.09) 0.0901 (7.70) 0.1684 (12.36) 2 -0.771 3 -0.581 4 -0.463 5 -0.373 6 -0.284 7 -0.184 8 -0.052 9 0.108 10 1.290 -0.0739 (-2.24) -0.0905 (-3.49) -0.0365 (-1.58) -0.0367 (-1.66) -0.0246 (-1.17) 0.0095 (0.43) 0.0033 (0.15) 0.0559 (2.60) 0.1527 (5.58) 2 -0.913 3 -0.685 4 -0.546 5 -0.442 6 -0.347 7 -0.227 8 -0.085 9 0.094 10 1.386 -0.0889 (-1.88) -0.1296 (-3.05) -0.1318 (-3.28) -0.0682 (-2.01) -0.0523 (-1.56) -0.0116 (-0.35) -0.0142 (-0.43) 0.0460 (1.47) 0.1317 (3.15) 2 -0.994 3 -0.752 4 -0.597 5 -0.472 6 -0.352 7 -0.215 8 -0.067 9 0.141 10 1.860 -0.1093 (-1.36) -0.1477 (-2.44) -0.0593 (-1.15) -0.0738 (-1.51) -0.0463 (-0.87) -0.0304 (-0.71) 0.0065 (0.14) 0.0025 (0.05) 0.0887 (1.82) 2 -1.012 3 -0.778 4 -0.614 5 -0.492 6 -0.344 7 -0.206 8 -0.059 9 0.132 10 3.277 -0.0920 (-0.91) -0.1382 (-2.04) -0.0881 (-1.33) -0.1290 (-1.71) -0.0766 (-1.20) -0.0472 (-0.77) -0.0153 (-0.28) -0.0063 (-0.11) 0.0878 (1.34) This table provides the mean coefficients from cross-sectional regressions of current returns (Ri,t ) on lagged returns (Ri,t -1) for deciles of firm observations. Within each panel, the deciles are formed on the basis of the firm’s serial correlation in earnings surprises. The mean serial correlation in earnings surprises is provided for each decile. The estimated intercepts from these regressions are not reported. The t-statistic adjusted for overlapping periods is provided in parentheses below the mean coefficient. Table 6 The Association of Returns with Prior Returns and the Serial Correlation in Earnings Surprises Mean Regression Coefficients from Overlapping Period Cross-Sectional Regressions Interval 3 month 6 month 12 month 24 month 36 month 48 month 60 month Rt-1 -0.0037 Rt-1*SC_EARN 0.0729 (-1.59) 50/57 (12.66) 19/88 0.0502 0.0835 (18.16) 37/68 (10.15) 20/85 0.0562 0.0838 (21.05) 31/70 (13.31) 18/83 0.0065 0.0793 (1.70) 45/48 (10.21) 12/81 -0.0069 0.1225 (-1.38) 45/40 (12.14) 11/74 -0.0031 0.0873 (-0.50) 42/35 (7.58) 11/66 -0.0245 0.0551 (-3.48) 39/30 (4.38) 18/51 Mean Adjusted R2 1.18% 2.23% 2.33% 1.85% 3.12% 2.43% 2.07% This table provides the mean coefficients from cross-sectional regressions of current returns (Ri,t ) on lagged returns (Ri,t -1) and the interaction of lagged returns on the serial correlation in earnings surprises (SC_EARN). The estimated intercepts from these regressions are not reported. The t-statistic adjusted for overlapping periods is provided in parentheses below the mean coefficient. The number of negative coefficients out of the total number of cross-sectional regressions is provided below the t-statistic. The mean adjusted R2 of the cross-sectional regressions is provided in the final column. Figure 1 Serial Correlation in Returns by Deciles SC in Returns for Decile SC in Returns for Decile 0.16 0.08 0.07 0.14 0.06 0.12 0.05 0.1 0.04 0.03 0.08 0.02 0.06 0.01 0 -0.4 -0.2 0 0.2 0.4 0.6 0.8 -0.01 SC in Earnings for Decile 0.04 1Surprise 0.02 -0.02 0 -0.03 -0.4 3 Month -0.2 0 0.2 0.4 0.6 6 Month SC in Returns for Decile 0.2 0.15 Serial Correlation in Returns Serial Correlation in Returns Controlling for Lagged Earnings 0.1 0.05 0 -1.5 -1 -0.5 0 -0.05 12 Month 0.5 SC in Earnings Surprise for Decile 1 0.8 SC in Earnings Surprise for 1 Decile Figure 1, Continued Serial Correlation in Returns by Decile SC in Returns for Decile SC in Returns for Decile 0.2 0.2 0.15 0.15 0.1 0.1 0.05 0.05 SC in Earnings Surprise for 1.5 Decile 0 -2 -1.5 -1 -0.5 SC in Earnings Surprise for 1 Decile 0 0 0.5 1 -0.05 -2.5 -2 -1.5 -1 -0.5 0 0.5 -0.05 -0.1 -0.15 -0.1 -0.2 -0.15 -0.25 24 Month 36 Month SC in Returns for Decile SC in Returns for Decile 0.15 0.1 0.1 0.05 0.05 0 0 -2.5 -2 -1.5 -1 -0.5 0 0.5 1 SC in Earnings Surprise for 1.5 Decile -3 -2.5 -2 -1.5 -1 -0.5 0 -0.05 -0.05 -0.1 -0.1 -0.15 -0.2 48 Month -0.15 -0.2 60 Month 0.5 1 SC in Earnings Surprise for Decile 1.5