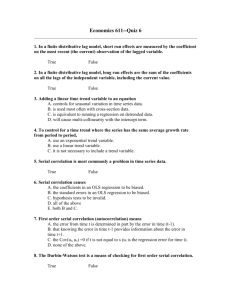

Econometrics lecture notes on Serial Correlation

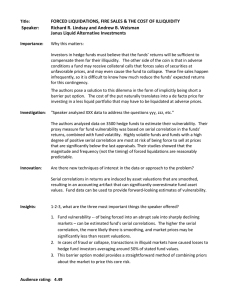

advertisement

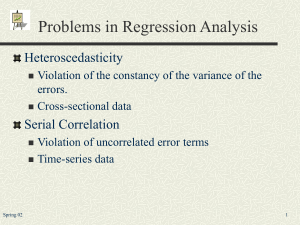

Econometrics lecture notes on Serial Correlation. You must know what positive and negative serial correlation are (Page 29) The implications for OLS estimates: They are in general unbiased when we have serially correlated error terms, except when we have a lagged dependent variable in which case they are biased. However the t statistics are biased upwards hence we are likely to accept as significant variables which in fact are not. Finally there is a better more efficient estimation technique. This is the method of generalised least squares (GLS) described in the notes. The GLS estimator is ΒGLS = (X'V-1X)-1X'V-1Y (1) For the general linear model: Y= XΒ + u You should know (1), but not to derive it. You should also know what V looks like when we have first order serial correlation of the form ut = ρut-1 + εt as defined half way down page one of your notes. V is given in (3) on page 30. You should also know (4) and (5) on page 31. But not the rest of page 31 or the first half of 32. You should know what the Durbin Watson statistic is and how to test for positive and negative serial correlation. You should also know that GLS when we have serial correlation is equivalent to the process described at the top of page 35. Heteroscedasticity The formula ΒGLS = (X'V-1X)-1X'V-1Y (1) Can also be used when we have heteroscedasticity. You should know what heteroscdestacity is and again what V is in the formula (1). It is defined at the bottom of page 35 (in fact it is σ2Ω). You should also understand page 36.