January 2013

Quarterly Investment Perspective

The Table Is Set

Rebecca H. Patterson, Chief Investment Officer

As we move beyond the holiday season, many of our fondest memories come from time spent

around the table — sharing good food, conversation and laughter with friends and family.

From an investment perspective as well, a table was set in 2012 — for a stronger economy and

returns (though perhaps not a feast) in the year ahead. If last year focused on the sometimes

unpleasant negotiations around whom to invite and what to serve, this year could bring

together the critical economic players and forces needed to create less volatile markets

and more sustainable, albeit still lackluster, growth at the global table.

Setting the Table in 2012

How did policymakers set an economic table in

2012? It was a worldwide effort. In the U.S., the

November election and subsequent fiscal cliff

negotiations, as well as policy shifts by the Federal

Reserve (including unprecedented numerical targets

for monetary policy), all were intended to create a

backdrop to support longer-term economic growth

and put debt levels on a more sustainable path.

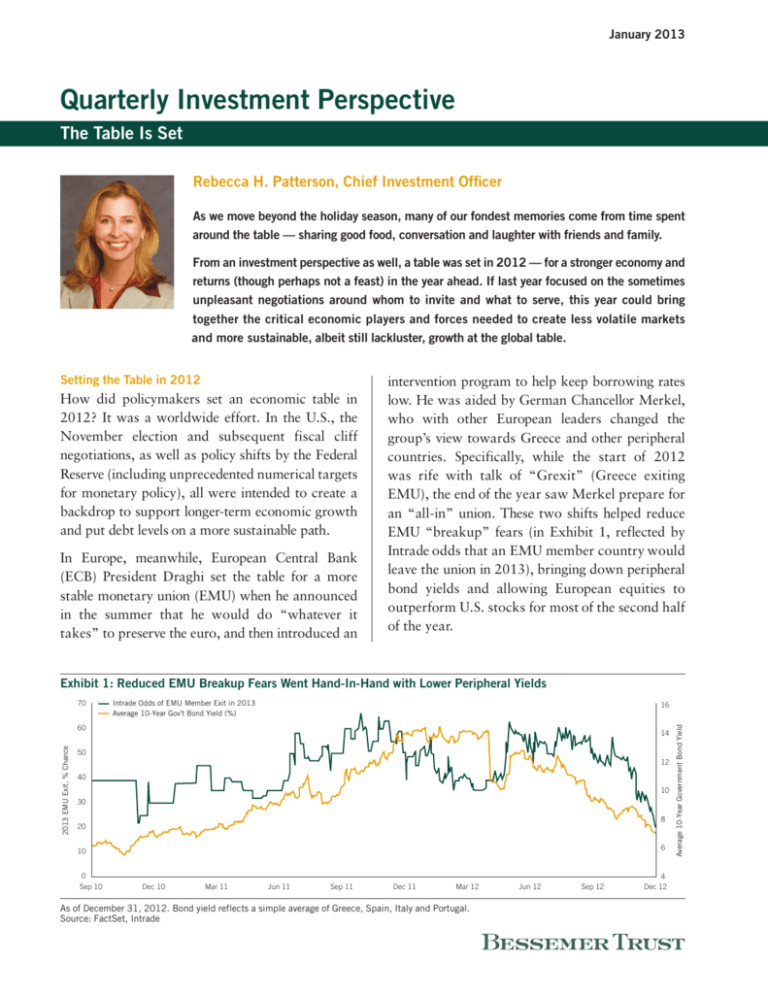

In Europe, meanwhile, European Central Bank

(ECB) President Draghi set the table for a more

stable monetary union (EMU) when he announced

in the summer that he would do “whatever it

takes” to preserve the euro, and then introduced an

intervention program to help keep borrowing rates

low. He was aided by German Chancellor Merkel,

who with other European leaders changed the

group’s view towards Greece and other peripheral

countries. Specifically, while the start of 2012

was rife with talk of “Grexit” (Greece exiting

EMU), the end of the year saw Merkel prepare for

an “all-in” union. These two shifts helped reduce

EMU “breakup” fears (in Exhibit 1, reflected by

Intrade odds that an EMU member country would

leave the union in 2013), bringing down peripheral

bond yields and allowing European equities to

outperform U.S. stocks for most of the second half

of the year.

Exhibit 1: Reduced EMU Breakup Fears Went Hand-In-Hand with Lower Peripheral Yields

Intrade Odds of EMU Member Exit in 2013

Average 10-Year Gov't Bond Yield (%)

16

2013 EMU Exit, % Chance

60

14

50

12

40

10

30

8

20

6

10

0

Sep 10

Dec 10

Mar 11

Jun 11

Sep 11

Dec 11

Mar 12

As of December 31, 2012. Bond yield reflects a simple average of Greece, Spain, Italy and Portugal.

Source: FactSet, Intrade

Jun 12

Sep 12

4

Dec 12

Average 10-Year Government Bond Yield

70

The Table Is Set

Feast or Famine in 2013?

As 2013 begins, we are asking ourselves what

happens now that the global table has been set.

Taking the analogy a step further, will investors be

more likely to find a feast or famine in the year ahead?

Looking at the U.S., we sadly do not expect a feast for

investors, at least early in the year. Fiscal tightening in

2013 will weigh on growth — probably taking about

1% from GDP. Further, while the U.S. avoided the

full “fiscal cliff,” the deal struck suggests that any

agreement on spending (likely including entitlement

reform) will be tied to a needed increase in the debt

ceiling. The potential for another government

showdown — even more dramatic than those seen

in July 2011 or December 2012 — could turn the

market’s stomach, so to speak, at least for a while.

(Recall that in the aftermath of the 2011 U.S.

sovereign credit downgrade, the S&P 500 fell 17%

in just 12 trading days.)

That said, our caution towards Washington should

be taken in context — we would highlight two

factors in particular that leave our macro view

2

Second, we believe consumers may continue to find

at least a partial offset to higher taxes (Exhibit 2)

from both lower gasoline prices (down more than

16% between September and end-December,

helped by better supply expectations, in turn tied in

part to advances in U.S. drilling technology) and

improving home prices (home values comprise a

major portion of the average American’s net worth).

Assuming these trends continue (our base case)

and that consumers are willing to dip into savings

somewhat, we could see retail sales hold up better

than expected in the year ahead.

Exhibit 2: Tighter U.S. Fiscal Policy Offset to a Degree

from Housing and Gasoline Prices

50

Housing

Gas Prices

4.00

3.80

40

3.60

30

3.40

20

3.20

10

0

Dec 11

Median Gas Price ($)

During the second half of 2012, our portfolios

benefited both from the relative improvement in

sentiment towards Europe and parts of Asia, as

well as from a search for yield heightened by

central bank efforts. The latter led to continued

strong performance in high-yield corporate debt,

emerging-market debt and mortgage-backed securities, while the former supported non-U.S. equities.

more balanced for the year overall. First, a lackluster

pace of growth is already a consensus view on

Wall Street (as of year-end, consensus estimates

put 2013 U.S. GDP growth at 2%). We believe

U.S. asset prices already reflect at least some of

this growth outlook. In fact, we’d highlight that,

historically, sub-trend U.S. growth did not correlate

well with equity returns — while such periods

have seen more volatility in equity performance,

on average, the S&P 500 has still risen in such

environments (including a 16% gain in 2012 despite

GDP growth around 2.2%).

NAHB Housing Market Index

In Asia, table setting was especially pronounced

in China and Japan — both countries saw new

leaders outline their respective economic goals. In

Japan’s case, that meant more stimulus and a

weaker yen. Indeed, the Japanese TOPIX index

surged nearly 20% just between mid-November

and year-end, largely on expectations for such policy

action. In China’s case, new leaders reinforced dual

goals — sufficient growth but controlled inflation,

and a relative rebalancing toward domestic demand

at the expense of exports.

3.00

Feb 12

Apr 12

Jun 12

Aug 12

Oct 12

2.80

Dec 12

As of December 31, 2012.

Source: National Association of Realtors, U.S. Department of Energy

One wild card for the U.S. this year is corporate

behavior. Last year saw business sentiment improving, but CEOs still reluctant to spend; indeed,

cash as a percentage of total assets remained near

Bessemer Trust Quarterly Investment Perspective

The Table Is Set

Exhibit 3: For Now, Corporate Spending Looks Unlikely to Boost U.S. Growth

Estimated Capital Expenditures for the Next Six Months

40

30

Index

20

10

0

(10)

Philly Fed

Empire State

Recessions

(20)

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

As of December 31, 2012.

Source: Federal Reserve

multi-decade highs (around 11%). While the fiscal

cliff resolution may set the table for slightly less

corporate angst, we have yet to see evidence that

U.S. firms are about to ramp up hiring and/or capital expenditures — especially given still-uncertain

outlooks for corporate tax policy. As of December,

business sentiment surveys showed that corporate

spending plans over the coming six months

remained near cyclical lows, a view likely to be

reflected in the coming earnings season as well

(Exhibit 3).

We would expect that a material improvement in

corporate behavior, if and when it emerges, will be

well telegraphed through sentiment surveys and

corporate guidance. We would see any such shift

by corporate America as key for a faster, broader

U.S. economic recovery, and in turn upside potential

for related equities.

What about Europe? The table may look more

attractive now, but in our view, investors still need to

be careful not to overindulge. While the European

political elite and ECB seem intent on limiting

downside risk (in our view, at least until the autumn

German elections), the region still faces stagnant

(and in some cases, negative) growth and mountains

of debt. Indeed, the European Commission last

month estimated that EMU debt, at 92.8% of GDP

in 2012, would only fall to 88.6% in 2020 — the

January 2013

commission’s outlook suggested a euro area with

at least 20 years of debt/GDP well above the

Maastricht Treaty guideline of 60%.

A continued, needed focus on reducing debt seems

likely to prevent a stronger growth recovery anytime

soon. Fragile growth and high unemployment rates

(the EMU jobless rate reached a record 11.8% in

November 2012) will keep EMU vulnerable to

shocks — be they external (such as a renewed

bout of Middle East stress that suddenly lifts oil

prices) or internal (possible uncertainty around

Italy’s upcoming election).

A potentially more stable, even stronger, U.S.

economy, at the margin, could help Europe, both via

general risk appetite as well as trade. So too would

an improving Asia. In Asia’s case, we expect both

China and Japan (the region’s largest economies) to

post improving economic numbers in the months

ahead, albeit relative to a soft 2012. Indeed, such an

improvement in China is already starting to be

reflected in business sentiment surveys and industrial

production (Exhibit 4).

In China, we believe leaders will pursue both policy

stability and sustainable growth, while in Japan,

the new Liberal Democratic-led government seems

likely to take more steps to extinguish deflation

once and for all, in part by actively encouraging a

weaker yen.

3

The Table Is Set

Exhibit 4: Improving Industrial Production Bodes Well

for Chinese GDP

China GDP YoY %

China Industrial Production

22

12

20

11

18

16

10

14

9

12

8

10

7

8

6

5

2006

China Industrial Production Growth

China GDP Growth (% YoY)

13

6

4

2007

2008

2009

2010

2011

2012

As of November 30, 2012.

Source: Bloomberg, Federal Reserve

What’s on the Menu? Portfolio Implications

As we consider our 2013 macroeconomic views, the

table laid before us, so to speak, at least five key

portfolio implications emerge.

• Remain underweight traditional fixed income,

and consider hedge funds a complement to bonds

as a way to manage volatility.

• Stay overweight in credit and extended fixed

income — “yield-focused investments.”

• Preserve global equity exposure — with a tilt

towards non-U.S. large cap firms.

• Where appropriate, use private equity and real

estate to capture specific investment opportunities

and portfolio diversification.

• Don’t overlook inflation and event-risk hedges.

To be frank, we do not see much value in traditional,

developed-market government bonds. The Federal

Reserve, ECB and Bank of Japan may be working

hard to keep bond yields from rising, but a further

decline in yields (and support for prices) seems very

limited simply given current valuations. We maintain

a maximum underweight here in our Balanced

Growth portfolio. That said, we would be reluctant

to get rid of bonds — historically, and in our view,

for the foreseeable future, they effectively cushion

losses from falling equity markets as investors seek

liquidity and safety. Over time, that balance helps

manage portfolio volatility.

4

But what happens when these markets see yields rise

on a more sustained basis, optimistically if growth

gains more traction? While such a shift does not feel

likely near-term, with continued fiscal tightening

weighing on growth, we know such a day is coming.

With that in mind, and looking around the investment

universe for other assets with low volatility, we

consider hedge funds. Certainly they do not offer

the same liquidity or cost as government bonds, but

at least at Bessemer, a well-designed hedge fund portfolio has helped reduce volatility with respectable

returns. We would not consider hedge funds a

replacement in any way for bonds, but they can

serve as a complement.

Beyond hedge funds, we also believe that we can

continue to find attractive opportunities and more

muted volatility through a number of other investments. Specifically, we remain overweight extended

fixed income and credit, including local-currency

emerging-market debt, high-yield U.S. corporate

debt and mortgage-backed securities. Given how

much these investments have gained in recent years

(emerging-market spreads over U.S. Treasuries have

narrowed 160 basis points since the beginning of

2012), we expect returns in 2013 to be more

modest (Exhibit 5). That said, with central banks

determined to keep monetary policy extremely

easy and investors searching for yield, we believe

demand will still outstrip supply once again to keep

prices supported.

Yield is a factor that also should help equities in

2013. Equity dividend yields have now surpassed

10-year government bond yields in a number of

developed markets (in the U.S., the S&P’s 2.6%

yield in early January dwarfed a 10-year bond yield

around 1.85%). Further, many firms with excess

cash are growing dividends faster (in the U.S., at

the fastest pace in six decades). Indeed, for 2012,

S&P 500 cash dividends are estimated to have

been 13% above the previous record set in 2008,

even without counting dividends paid in December

for tax reasons.

Bessemer Trust Quarterly Investment Perspective

The Table Is Set

Exhibit 5: Strong Recent Returns from Yield-Focused Investments

Post Financial Crisis (Since 2009)

Asset Class

Global Equities

U.S. Treasuries

High-Yield Bonds

Convertible Bonds

Emerging-Market Bonds

Hedge Funds of Funds

Annualized Return

Annualized Volatility

14.4%

3.9

21.7

13.5

16.6

2.1

19.5%

8.1

9.9

12.0

6.8

4.1

As of December 31, 2012.

Source: HedgeFund.net, J.P. Morgan, Merrill Lynch, Standard & Poor’s, UBS, United States Department of the Treasury

Beyond growing dividends, corporations are helping

the stock market in another way: share buybacks.

With cash levels high and risk appetite low, both

dividend and buyback trends are likely to continue.

While these factors may help equity returns in

2013, we still expect bouts of indigestion during

the year — in the U.S., for instance, anxiety about

the debt-ceiling and spending debates this quarter

could limit S&P gains. With that in mind, we

continue to keep a slight tilt towards non-U.S.

stocks, including emerging-market equities that

we expect to benefit from improving growth

trends and still-attractive valuations.

We see value this year not only in public equity but

also in private equity, especially for investors with

longer time horizons and relatively modest liquidity

needs. In particular, we believe that certain investment themes are more effectively accessed via private

equity — including structural growth in the emergingmarket consumer, early-stage tech companies and,

in some cases, real assets.

Finally, as we look across asset classes, we continue

to think about and position for “what ifs”: What

if Washington gridlock worsens? What if tensions

in the Middle East rise? What if weather wreaks

havoc with global crops? As we begin 2013, we

continue to look for opportunities to protect

January 2013

portfolios, in part via equity and commodity derivative positions (Exhibit 6). If recent years have taught

us anything, it’s that we should expect surprises.

We are doing what we can within the investment

team to make sure any “flies in the soup” do not

ruin what otherwise should be a good meal.

Exhibit 6: Combining Growth and Protection

Balanced Growth Portfolio Asset Allocation

Growth

Defensive Growth

Bonds

22%

Protective

Large Cap Equities

23%

Cash

2%

Hedge Funds

12%

Small & Mid

Cap Equities

13%

Credit

9%

Private Equity

10%

Commodities Real Estate

4%

5%

As of December 31, 2012.

This model displays Bessemer’s suggested model portfolio allocation

guidelines. Each client situation is unique and may be subject to special

circumstances, including but not limited to greater or less risk tolerance,

classes and concentrations of assets not managed by Bessemer, investment

limitations imposed under applicable governing documents, and other

limitations that may require adjustments to the suggested allocations.

Model asset allocation guidelines may be adjusted from time to time on

the basis of the foregoing or other factors.

Alternative investments, including Bessemer private equity, real estate,

and hedge funds of funds, are not suitable for all clients and are available

only to qualified investors.

5

THIS PAGE INTENTIONALLY LEFT BLANK

THIS PAGE INTENTIONALLY LEFT BLANK

This material is for your general information. It does not take into account the particular investment objectives, financial situation, or needs of individual

clients. This material is based upon information obtained from various sources that Bessemer Trust believes to be reliable, but Bessemer makes no

representation or warranty with respect to the accuracy or completeness of such information. Views expressed herein are current only as of the date

indicated, and are subject to change without notice. Forecasts may not be realized due to a variety of factors, including changes in economic growth,

corporate profitability, geopolitical conditions, and inflation. The mention of a particular security or asset class is not intended to represent a specific

recommendation, and our views may change at any time based on price movements, new research conclusions, or changes in risk preference.

Atlanta • Boston • Chicago • Dallas • Denver • Los Angeles • Miami

New York • Palm Beach • San Francisco • Washington, D.C. • Wilmington

Cayman Islands • New Zealand • United Kingdom

Visit us at www.bessemer.com.

Copyright © Bessemer Trust Company, N.A. All rights reserved.

•

•

Naples

Woodbridge