Telemet Orion Custom Column Choices

advertisement

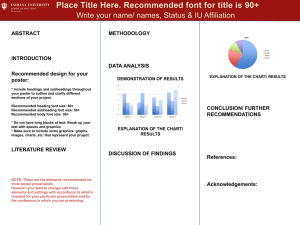

Telemet Orion Custom Columns Telemet America, Inc. Table of Contents A. B. C. D. E. F. G. H. I. J. K. L. M. N. O. P. Q. R. Descriptive - 27 Total Columns ............................................................................................... 2 Last Sale - 32 Total Columns ................................................................................................... 2 Bid / Ask - 17 Total Columns ................................................................................................... 3 Alerts - 26 Total Columns ......................................................................................................... 3 Dividend - 21 Total Columns .................................................................................................... 3 Earnings - 54 Total Columns ................................................................................................... 3 Earnings Estimates - 59 Total Columns ............................................................................... 4 Financials - 26 Total Columns ................................................................................................. 5 Holdings - 29 Total Columns ................................................................................................... 5 Prices / Period - 66 Total Columns ........................................................................................ 6 Statistical - 46 Total Columns .................................................................................................. 6 Industry / Sector / RS - 6 Total Columns .............................................................................. 7 Index Membership - 14 Total Columns ................................................................................. 7 Corporate Custom - 8 Total Columns .................................................................................... 7 As of date - 8 Total Columns ................................................................................................... 7 Financial Ratios - 220 Total Columns .................................................................................... 8 Sales Estimates - 6 Total Columns ...................................................................................... 10 User Formula - 65 Total Columns ......................................................................................... 10 Telemet Orion Custom Column Choices 730 Total Custom Columns To access the Telemet Orion columns modification window [from any custom pricing page] click Options > Columns… to get the window below: A. Descriptive - 27 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. B. Ticker Symbol Ticker Type Ticker Combo Ticker Combo Ext Company / Security CUSIP Listed Exchange SIC Code Quote Origin CIK Issue Type Issue Country Bond Type Last Sale - 32 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Blocks > 1K Blocks >5K Blocks >10K Blocks >20K Blocks >50K Blocks >100K Count – Trades Last Sale Date Last Sale Size Last Sale Time Last Sale $ Value Market/Exchange Net Change Net Change in 32nd 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. ADR Ratio GICS Code Root Maturity Date Maturity Month / Year Expiration Date Option Name Put / Call Strike Price Coupon Rate Note Coupon Decimal Document Web Address 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. Net Pct Change Open Interest Origin Price – Close Previous Day Price – IntraDay High Price – IntraDay Low Price – Last Sale Price – Open Price – VWA Sale Condition Seller’s Days Tick Trades – Total Number Trades – Total Value Trading Special Condition Trading Status 2 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 31. Volume – Cumulative C. Bid / Ask - 17 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. D. Ask Market Ask Price Ask Size Ask Time Ask Date Bid Market Bid Price Bid Size Alerts - 26 Total Columns News Time News Present Count – Broadtape Stories Today Count – Business News Stories Today Count – Research Direct Broker Est Today Count – Research Direct Consensus Est Today 7. Count – Research Direct Notes Today 8. Count – Market Scope Stories Today 9. Count – Press Wire Stories Today 10. Corporate Action 11. Div Alert 12. Edgar Alert 1. 2. 3. 4. 5. 6. E. Dividend - 21 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. F. X – Date Date – Pay Date – Record Dividend – Latest Dividend – Current Fiscal Year Dividend – Indicated * Dividend – Prior Fiscal Year Dividend – Trailing 4 Qtrs Dividend Coverage * Growth Rate 1 yr Earnings - 54 Total Columns 1. 2. Earnings – Current Fiscal Year Earnings – Prior Fiscal Year * 32. Yield – Bond 9. 10. 11. 12. 13. 14. 15. 16. 17. Bid Time Bid Date Bid x Ask Inside Bid Tick Financial Status Inside Status UPC Indicator Price/Yield Spread Count – Bid/Ask 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. Filing Date – Edgar Split Alert High/Low – Historical (7, 30, 90..Day) High/Low – IntraDay (7, 30, 90…Day) MvgAvg Cross – 7 x 30 MvgAvg Cross – 7 x 90 MvgAvg Cross – 7 x 180 MvgAvg Cross – 7 x 360 MvgAvg Cross – 30 x 90 MvgAvg Cross – 30 x 180 MvgAvg Cross – 30 x 360 MvgAvg Cross – 90 x 180 MvgAvg Cross – 90 x 360 MvgAvg Cross – 180 x 360 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. Growth Rate 3 yr Growth Rate 5 yr Growth Rate 10 yr Yield – Indicated * Yield – Trailing Div Yield Growth Direction Div Yield 1 Year Ago * Div Yield End Last Fiscal Year * Div Yield End Last Quarter * Div Yield End Next Last Quarter * Div Yield End 3 Quarters Back * 3. 4. 5. 6. Earnings – Prior Qtr * Earnings – Trailing 4 Qtrs * Earnings End Next Last Quarter * Earnings End 3Q back * 3 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. G. Earnings 5 yr hi * Earnings 5 yr lo * Earnings Yield * Earnings Yield Last FY * Earnings Release Date Earnings Release Date Flag Earnings Stability # of Consecutive Quarters of Positive Earnings Growth Earnings % Chg Last FY to Prev FY * Earnings % Chg Prev FY to FY Before That * Earnings % Chg Last FQ to Prev FQ * Earnings % Chg 1 Year Avg TTM Earnings % Chg 3 Year Avg Earnings % Chg 5 Year Avg Growth Rate 1 yr * Growth Rate 3 yr * Growth Rate 5 yr * Growth Rate 10 yr EPS – Prior Fiscal Year * EPS – Year Ago EPS – FY 2 YR Prior* EPS – Prior Qtr * EPS – 2 Qtr Prior * Earnings Estimates - 59 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 29. 30. 31. 32. 33. 34. 35. First Call EPS Est Fiscal Year * First Call EPS Est Qtr First Call EPS Est Next Fiscal Year * First Call EPS Est Next Qtr * First Call EPS % Change Estimate FY * First Call Est Fiscal Year End First Call Est Qtr End First Call Future Growth Rate * First Call Consensus Current Recommendation First Call PE Est Fiscal Year * First Call PE Est Next Fiscal Year * IBES EPS Est Fiscal Year IBES EPS Est Next FY Zacks Current FY Earnings Est.** Zacks Next FY Earnings Est. ** Zacks FY3 Earnings Estimate ** Zacks FY4 Earnings Estimate Zacks Current Qtr Earnings Est. ** Zacks Next Qtr Earnings Est. ** Zacks Q3 Earnings Estimate 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. EPS – 3 Qtr Prior * EPS – Trailing 4 Qtrs * EPS – Prior Trailing 4 Qtrs * EPS – FY % Change * EPS – Qtr % Change * EPS – Qtr % Last Yr * EPS – TTM % Change * EPS 5 yr hi * EPS 5 yr lo * PE – End Last FY * PE – Prior Fiscal Year* PE – End Last Qtr * PE – End Nxt Last Qtr* PE – End 3Q back * PE – Yr Ago * PE – Trailing 4 Qtrs * PE – 5 yr high * PE – 5 yr Low * EBIT EBIT TTM EBITDA MRA EBITDDA MRQ Date – Prior Quarter Date – 2 Qtr Prior Date – 3 Qtr Prior 14. 15. 16. 17. 18. IBES EPS Est Qtr IBES EPS Est Next Qtr IBES % Chg EPS Est Cur FY IBES % Chg EPS Next FY IBES Current FY 3 Month % Earnings Revision IBES # of Next FY EPS Est IBES # of Current FY EPS Est IBES Next FY 3 Month % Earnings Revision IBES # of Current Qtr EPS Est IBES # of Next Qtr Est IBES Est Fiscal Year End IBES Est Qtr End IBES Future Growth Rate IBES PE Est Fiscal Year IBES PE Est Next Fiscal Year Zacks Q4 Earnings Estimate Zacks Q5 Earnings Estimate Zacks Current FY Expected Report Date Zacks Next FY Expected Report Date Zacks Current Qtr Expected Report Date Zacks Next Qtr Expected Report Date 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 36. 37. 38. 39. 40. 41. 4 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 42. Zacks Number of Current Fiscal Year Estimates 43. Zacks Number of Next Fiscal Year Estimates 44. Zacks Nu mber of FY3 Estimates 45. Zacks Number of FY4 Estimates 46. Zacks Number of Current Quarter Estimates 47. Zacks Number of Next Quarter Estimates 48. Zacks Number of Q3 Estimates 49. Zacks Number of Q4 Estimates 50. Zacks Number of Q5 Estimates 51. Zacks Long Term Growth Rate H. Financials - 26 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. I. Shares Outstanding – Prior Fiscal Year Shares Outstanding – Prior Qtr * Market Capitalization* Institutional Ownership Pct Preferred Stock Revenue – Current Fiscal Year Revenue – Prior Fiscal Year * Revenue – FY 2 YR Prior * Revenue – Prior Qtr * Revenue – 2 Qtr Prior* Revenue Year Ago Revenue – Trailing 4 Qtrs * Revenue – Prior Trailing 4 Qtr * Holdings - 29 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Basis Basis Value Basis Net Change Basis Net Pct Change Commission Date Shares Gain / Loss Gain/Loss – Day to Date Gain/Loss – Week To Date Gain/Loss – Month To Date Gain/Loss – Quarter To Date Gain/Loss – Year To Date Market Value 52. Zacks Current Fiscal Year P/E Estimates ** 53. Zacks Next Fiscal Year P/E Estimates ** 54. Zacks FY3 P/E Estimate 55. Zacks FY4 P/E Estimate 56. Zacks Current Consensus Recommendation 57. Zacks Current FY 1 Month % Earnings Revision 58. Zacks Next FY 1 Month % Earnings Revision 59. Zacks Target Price 14. Revenue – FY % Change * 15. Revenue - % Chg Prev FY to FY Before That * 16. Revenue – Qtr % Change * 17. Revenue – TTM % Change * 18. Revenue – Growth Rate 1 yr * 19. Revenue – Growth Rate 3 yr * 20. Revenue – Growth Rate 5 yr * 21. Revenue – Growth Rate 10 yr 22. Revenue – 3 yr Average * 23. Revenue – 5 Year Avg * 24. Debt to Equity 25. Debt – Long Term 26. Cash & Equivalents 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. Market Value – End Last Week Market Value – End Last Month Market Value – End Last Qtr Market Value – End Last Year Impact DTD Impact WTD Impact MTD Impact QTD Impact YTD Weight in Portfolio % Over / Under SPX Dividend Income $ Weight Manager Account 5 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns J. Prices / Period - 66 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. K. Date – Prior Qtr End Date – Prior Fiscal Year End Date – 1st Qtr CY End * Date – 2nd Qtr CY End * Date – 3rd Qtr CY End * Date – 4th Qtr CY End * Close – 1st Qtr CY End * Close – 2nd Qtr CY End * Close – 3rd Qtr CY End * Close – 4th Qtr CY End * Close – 7 day * Close – 30 day * Close – 90 day * Close – 180 day * Close – 360 day * High – 7 day * High – 30 day * High – 90 day * High – 180 day * High – 360 day * Low – 7 day * Low – 30 day * Low – 90 day * Low – 180 day * Low – 360 day * Net Change – 7 day * Net Change – 30 day * Net Change – 90 day * Net Change – 180 day * Net Change – 360 day * Net Pct Change – 7 day * Net Pct Change – 30 day * Statistical - 46 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Avg Volume – 7 day Avg Volume – 30 day Avg Volume – 90 day Avg Volume – 180 day Avg Volume – 360 day Moving Avg – 7 day Moving Avg – 30 day Moving Avg – 90 day Moving Avg – 180 day Moving Avg – 360 day Alpha Alpha – 1 year 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. Net Pct Change – 90 day * Net Pct Change – 180 day * Net Pct Change – 360 day * Close – Year To Date * Close – Quarter To Date * Close – Month To Date * Close – Week To Date * Net Change – Year To Date * Net Change – Quarter To Date * Net Change – Month To Date * Net Change – Week To Date * Net Pct Change – Year To Date * Net Pct Change – Quarter To Date * Net Pct Change – Month To Date * Net Pct Change – Week To Date * Date of YTD * Date of QTD * Date of MTD * Date of WTD * Close – 3 Year * High – 3 year * Low – 3 years * Net change – 3 years * Net pct change – 3 years * Close – 5 years * High – 5 years * Low – 5 years * Net change – 5 years * Net percent change – 5 years * Close – 10 years * High – 10 years * Low – 10 years * Net change – 10 years * Net percent change – 10 years * 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. Alpha – Russell 1000 Growth * Alpha – Russell MidCap * Beta Beta – 1 year Beta – Russell 1000 Growth * Beta – Russell MidCap * R-square R-squared – 1 year R-Squared – Russell 1000 Growth * R-Squared – Russell MidCap * Relative Strength Relative Strength Stat. Number Total Return 7 Days * Total Return 30 Days * 6 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. L. Total Return 90 Days * Total Return 180 Days * Total Return 360 Days * Total Return WTD * Total Return MTD * Total Return QTD * Total Return YTD * Total Return Last Calendar Year Total Return 3 Years Total Return 5 Years Industry / Sector / RS - 6 Total Columns 1. 2. M. S&P Sector Name S&P Industry Group Name Index Membership - 14 Total Columns 1. 2. 3. 4. 5. 6. N. DJ 30 DJ Composite DJ Transportation DJ Utilities F40 NASDAQ 100 Corporate Custom - 8 Total Columns 1. 2. 3. O. Alpha 1 Alpha 2 Numeric 1 As of date - 8 Total Columns 1. 2. 3. 4. New… Price @ 12/31/2005 Price @ 03/31/2006 Price @ 06/30/2006 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. Volatility – 7 day Volatility – 30 day Volatility – 90 day Volatility – 180 day Volatility – 360 day Volume – Pct of 7 Day Avg Volume – Pct of 30 Day Avg Volume – Pct of 90 Day Avg Volume – Pct of 180 Day Avg Volume – Pct of 360 Day Avg 3. 4. 5. 6. S&P Industry Name S&P Subindustry Name Russell Sector Russell Industry 7. 8. 9. 10. 11. 12. 13. 14. Russell 1000 Russell 2000 Russell 3000 S&P 100 S&P 500 S&P 500 Weight SP400 SP600 4. 5. 6. 7. 8. Numeric 2 Numeric 3 Numeric 4 Industry Sector 5. 6. 7. 8. Price @ 09/30/2006 Price @ 12/31/2006 Price @ 03/31/2007 Price @ 06/30/2007 7 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns P. Financial Ratios - 220 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. Accts Payable Days – MRA Acct Payable Days – G1yr Accts Payable Turnover – MRA Accts Payable Turnover – G1yr Accts Rec. Turnover – MRA Accts Rec. Turnover G1yr Acid Test – MRQ Acid Test – G1yr Assets / Equity – MRQ * Average Collection Period – TTM Average Collection Period – G1yr Bk Value / Assets – MRQ Bk Value / Assets – G1yr Book Value – MRQ * Book Value – G1yr Book Value / Share End Last FY * Book Value / Share End Nxt Last Qtr * Book Value / Share Current Book Value / Share - MRQ * Book Value / Share End 3Q Back * Book Value / Share Yr Ago * Book Value / Share – G1yr Book Value / Share 5 yr High * Book Value / Share 5 yr Low * Capital Structure Leverage – MRQ Capital Structure Leverage – G1yr Cash / Share – MRQ Cash / Share – G1yr Cash Turnover – TTM Cash Turnover – G1yr Cash Turnover Days – TTM Cash Turnover Days – G1yr CF / Share – Last FY * CF / Share - MRQ * CF / Share – End Next Last Qtr * CF / Share – End 3Q Back * CF / Share – Year Ago * CF / Share TTM * CF / Share – 5 yr High * CF / Share – 5 yr Low * CFO / Total Debt – TTM CFO / Total Debt – G1yr Current Ratio – MRQ Current Ratio – G1yr Debt – Short Term Debt / Assets – MRQ Debt / Assets – G1yr Debt / Bk Value – MRQ Debt / Bk Value – G1yr Debt / Equity – MRQ Debt / Equity – G1yr Debt Coverage – TTM Debt Coverage – G1yr Diluted EPS TTM Diluted Shares – MRQ * Dividend Payout – TTM Dividend Payout – G1yr EBITDA – TTM EBITDA Margins – Last FY * EBITDA Margins - MRQ * EBITDA Margins - TTM * EBITDA Margins – 3 yr Avg * EBITDA Margins – 5 yr Avg * Effective Tax Rate – TTM Effective Tax Rate – G1yr Enterprise Value – MRQ * Enterprise Value / EBITDA Enterprise Value / Shares – MRQ * Fixed Assets Turnover – TTM Fixed Assets Turnover – G1yr Free Cash Flow – TTM Free Cash Flow / Share – Last FY * Free Cash Flow / Share - MRQ * Free Cash Flow / Share – End Next Last Qtr * 75. Free Cash Flow/Share – End 3Q Back * 76. Free Cash Flow / Share – Year Ago * 77. Free Cash Flow / Share – TTM * 78. Free Cash Flow / Share – 5 yr High * 79. Free Cash Flow / Share – 5 yr Low * 80. Gross Profit – TTM 81. Gross Profit – G1yr 82. Gross Profit Margin – Last FY * 83. Gross Profit Margin – MRQ * 84. Gross Profit Margin – TTM * 85. Gross Profit Margin – G1yr 86. Gross Profit Margin – 3 yr Avg * 87. Gross Profit Margin – 5 yr Avg * 88. Interest Coverage – TTM 89. Interest Coverage – G1yr 90. Inventory Days – TTM 91. Inventory Days – G1yr 92. Inventory to Working Cap – MRQ 93. Inventory to Working Cap – G1yr 94. Inventory Turnover – TTM 95. Inventory Turnover – G1yr 96. LT Debt / Assets – MRQ 97. LT Debt / Assets – G1yr 98. LT Debt / Bk Value – MRQ 99. LT Debt / Bk Value – G1yr 100. LT Debt / Total Capital – Last FY * 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74. 8 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 101. LT Debt / Total Capital – MRQ * 102. LT Debt / Total Capital – TTM * 103. LT Debt / Total Capital – 3 yr Avg * 104. LT Debt / Total Capital – 5 yr Avg * 105. LT Debt / Working Cap – MRQ 106. LT Debt / Working Cap – G1yr 107. Most Recent Year Date 108. Most Recent Quarter Date 109. Operating Cash Flow – TTM 110. Operating Cycle – MRQ 111. Operating Cycle – G1yr 112. Operating Income / Gross Profit - TTM 113. Operating Income / Gross Profit – G1yr 114. Operating Income / Share – TTM 115. Operating Income / Share – G1yr 116. Operating Profit Margin - TTM 117. Operating Profit Margin - G1yr 118. P / Book * 119. P / Book End LFY * 120. P / Book End Nxt Last Q * 121. P / Book End 3Q Back * 122. P / Book Year Ago * 123. P / Book 5 yr hi * 124. P / Book 5 yr lo * 125. Price/Book – 5 years average 126. Price/Book to 5 years average 127. P / Cash Flow * 128. P / Cash Flow – End Last FY * 129. P / Cash Flow – 5 yr hi * 130. P / Cash Flow – 5 yr lo * 131. Price/Cash Flow – 5 years average 132. Price/Cash Flow to P/CF 5 yr Avg 133. P / FCF * 134. P / FCF – End Last FY * 135. P / FCF – 5 yr High * 136. P / FCF – 5 yr Low * 137. P / Rev * 138. PEG End Last FY * 139. PEG Current * 140. PEG End Last Qtr * 141. PEG End Next Last Qtr * 142. PEG End 3Q Back * 143. PEG Year Ago * 144. PEG 5 yr High * 145. PEG 5 yr Low * 146. Pre-Tax Profit Margin – Last FY * 147. Pre-Tax Profit Margin - MRQ * 148. Pre-Tax Profit Margin – TTM * 149. Pre-Tax Profit Margin – G1yr 150. Pre-Tax Profit Margin – 3 yr Avg * 151. Pre-Tax Profit Margin – 5 yr Avg * 152. Pre-Tax ROA – TTM 153. Pre-Tax ROA – G1yr 154. Pre-Tax ROCE – TTM 155. Pre-Tax ROCE – G1yr 156. Pre-Tax ROE – TTM 157. Pre-Tax ROE – G1yr 158. Pre-Tax ROI – TTM 159. Pre-Tax ROI – G1yr 160. Price / Sales - Last FY 161. Price / Sales - Current 162. Price / Sales – 5 yr Avg 163. Price / Sales to P/S 5 yr Avg 164. Price / Earnings – 5 yr Avg 165. Price / Earnings to P/E 5 yr Avg 166. Profit Margin – Last FY * 167. Profit Margin - MRQ * 168. Profit Margin – TTM * 169. Profit Margin – G1yr 170. Profit Margin – 3 yr Avg * 171. Profit Margin – 5 yr Avg * 172. Property, Plant, & Equipment – MRQ 173. Reinvestment Rate - TTM 174. Return on Assets – Last FY * 175. Return on Assets – TTM * 176. Return on Assets – G1yr 177. Return on Assets – 3 yr Avg * 178. Return on Assets – 5 yr Avg * 179. Return on Capital – Last FY 180. Return on Capital – TTM 181. Return on Capital – 3 yr Avg 182. Return on Capital – 5 yr Avg 183. Return on Equity – Last FY * 184. Return on Equity – TTM * 185. Return on Equity – G1yr 186. Return on Equity – 3 yr Avg * 187. Return on Equity – 5 yr Avg * 188. Return on Investment – TTM 189. Return on Investment – G1yr 190. Revenue / Share – Last FY * 191. Revenue / Share – TTM * 192. Revenue / Share – 3 yr Avg * 193. Revenue / Share – 5 yr Avg * 194. ROCE – TTM 195. ROCE – G1yr 196. Sales / Assets – TTM 197. Sales / Assets – G1yr 198. Sales / Share – TTM 199. Sales / Share – G1yr 200. Tangible Book Value – MRQ 201. Tangible Book Value – G1yr 202. Tangible Book Value / Share – MRQ 203. Tangible Book Value / Share – G1yr 204. Total Asset Turnover – TTM 9 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078 Telemet Orion Custom Column Choices 730 Total Custom Columns 205. Total Asset Turnover – G1yr 206. Total Cost and Expenses – Last FY * 207. Total Cost and Expenses – MRQ * 208. Total Cost and Expenses – TTM * 209. Total Cost and Expenses – YTD 210. Total Cost and Expenses – 3 yr Avg * 211. Total Cost and Expenses – 5 yr Avg * 212. Total Receivables Turnover – TTM 213. Total Receivables Turnover – G1yr 214. Total Stockholders Equity – MRQ 215. Working Capital – MRQ 216. Working Capital – G1yr 217. Working Capital / Share – MRQ 218. Working Capital / Share – G1yr 219. Working Capital Turnover – TTM 220. Working Capital Turnover – G1yr Q. 3. 4. 5. Sales Estimates - 6 Total Columns 1. 2. R. Zacks Current Quarter Sales Mean Estimate Zacks Next Quarter Sales Mean Estimate User Formula - 65 Total Columns 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. New… $ Chg vs. 360 Day High * $ Chg vs. 360 Day Low * % Chg FC EPS Est Current FY * % Chg FC EPS Est Current Qtr % Chg FC EPS Est Next Qtr * % Chg IBES EPS Est Cur Qtr % Chg IBES EPS Est Next Qtr % Chg IBES EPS Est Next FY % Chg Net for 1Q 2006 * % Chg Net for 1Q 2007 * % Chg Net for 2006 * % Chg Net for 2Q 2006 * % Chg Net for 2Q 2007 * % Chg Net for 3Q 2006 * % Chg Net for 4Q 2006 * % Chg S&P500 30 day * % Chg S&P500 360 day * % Chg S&P500 for Today * % Chg S&P500 YTD * % Chg vs. 180 day MA % Chg vs. 30 day MA % Chg vs. 360 day High * % Chg vs. 360 day Low * % Chg Zacks EPS Est Cur FY ** % Chg Zacks EPS Est Cur Qtr ** % Chg Zacks EPS Est Nxt FY ** % Chg Zacks EPS Est Nxt Qtr ** % Chg Zacks Rev Est 3Q Fwd % Chg Zacks Rev Est 4Q Fwd % Chg Zacks Rev Est Cur FY % Chg Zacks Rev Est Next FY 6. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. Zacks 3rd Quarter Sales Mean Estimate Zacks 4th Quarter Sales Mean Estimate Zacks Current Fiscal Year Sales Mean Est Zacks Next Fiscal Year Sales Mean Est % Chg Zacks Rev Est Next Qtr 30 day Relative to 180 day MA Div Yld Rel to S&P500 – Indic * Dividend Plowback Ratio EBIT Per Share EBITDA Margin Enterprise Value/Mkt Cap Estimated FC Long Term PEG * Estimated FC PEG * Estimated FC PEG w/ Div Yield * Estimated IBES PE Next FY Estimated IBES PEG Estimated IBES PEG w/ Div Yield Estimated Zacks Long Term PEG ** Estimated Zacks Long Term PEG w/ Div Yield ** Estimated Zacks P/S Cur FY Estimated Zacks P/S Next FY Estimated Zacks PEG ** Estimated Zacks PEG w/ Div Yield ** P/E relative to S&P P/E * Portfolio Mkt Value Prev Day Pre/Post Mkt Indication $ Chg Pre/Post Mkt Indication % Chg Return vs. S&P500 for 1 Year * Return vs. S&P500 for 30 days * Return vs. S&P500 for Today * Return vs. S&P500 YTD * S&P500 Div Yield – Indicated * S&P500 P/E * Total Enterprise Value TTM PEG * TTM PEG with Dividend Yield TTM Revenue per Share * 10 of 10 * = Field will also populate data for SPX-I and S500 sectors & industries . ** = Field will also populate data for only S500 sectors & industries. © 2008, Telemet America, Inc. | 325 First Street, Alexandria, VA 22314 | 1-800-368-2078