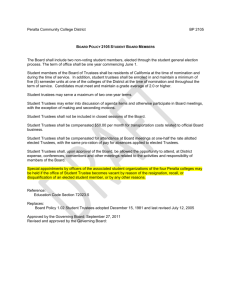

1334663910.42PF rules - India Trade Promotion Organisation

advertisement

INDIA TRADE PROMOTION ORGANISATION Employees Contributory Provident Fund Rules CONTENTS Rule No Description Page No. Chapter1:Preliminary…..…....……………………………….…………………………… 02 1 Definitions:……………………..………………………………………………………… …. 02 Chapter II: Membership and Contributions…………………………… …………… 04 2 Membership……………………………………………………………………….………… 04 3A Contributions………………………………………………………………………………… 05 3B Payment of Contributions:……………………………...……………………..…………… 05 Chapter III: Administration of the Fund:….………..……………………..….……… 06 4 Member’s “A” and “B” Accounts 06 5 Register and Accounts…………………………………..………………………………….. 06 6 Accounting Period and Valuation……….………………………………………………… 07 7 Expenses of the Fund……………………………………………………………………… 07 8 Auditors………………………………………………………………………….................. 07 9 Interest...…………………………………………………………………………………….. 07 10 Interest Suspense Account……………………………….……………………………….. 08 11 C.P.F. Reserve Account………………………………….……………………………….. 08 12 Investments…………………………………………………………………….................. 09 13 Restriction on the use of Fund……………………………..…….………………………. 09 AMENDMENT TO THE EX- TFAI CPF RULES CLAUSE 14.… ……………... …….. 09 ……………………………………………………….. TO 18 AS PER INCOME TAX RULES Chapter IV Circumstances in which with drawls may be permitted-14.…. …….. 09 14 Temporary Advances/withdrawls……………………………………………… ... …….. 09 15 Conditions for withdrawal for various purposes………………………… ……………… 11 16 Second Withdrawal…………………………………………………………………. ……… 14 17 Repayment of Amounts Withdrawn………………………………………….................... 15 18 Miscellaneous Provisions: …………………………………………..…………………….. 16 Chapter V: Transfer and payment of Accumulations:………………...…… ………. 17 19 Previous accumulations of members joining fund…………………………… … ………. 17 July 264Page 1 of 37 20 Transfer of accumulation where a member leaves the Organisation ………............. 18 21 Circumstances in which accumulations in the Fund are payable to a Member………. 18 22 Omitted ……………………………………………………………………………………… 19 23 Accumulation of a deceased Member to whom payable………………………………. 20 24 Nominations…………………………………………………………………………..…… 20 25 Deductions in case of dismissed Member……………………….................................. 21 26 Terms and Payment……………………………………………………………………….. 22 Chapter: VI: Miscellaneous:…………………………………………………………… 22 27 Protection against attachment……………………………………..…............................. 22 28 Information to Member…………………………………………………….... …………… 23 29 Saving right of the Employers…………………………………………………………..… 23 30 Settlement of difference………………………………………………………….. ………. 23 31 Alterations of Rules…………………………………………………………………........... 24 32 Termination of the Fund……………………………………………………….. ............. 24 33 Omitted …………………………………………………………………………………….. 24 34 Board of Trustees…………………………………………………………………….......... 24 35 Commencement.…………………………………………………………………………….. 27 July 264Page 2 of 37 INDIA TRADE PROMOTION ORGANISATION Employees Contributory Provident Fund Rules AMMENDED RULES Chapter1: Preliminary Title These Rules shall be called the TFA of India now ITPO Employees Contributory Provident Fund Rules. 1 Definitions: In these Rules, unless the context otherwise requires:- a) “The Trust Deed” means the Deed dated the and made between the Trustees of the one part and the TFAI now India Trade Promotion Organization of other part and shall include all Deeds amending or modifying the same in accordance with the provisions thereof. b) “The Rules” shall mean these Rules regulating the Fund. c) “The Fund” means the India Trade Promotion Organization Employees Provident Fund. d) “The Trustees” means the members of the Board of Trustees of the Fund for the time being. e) “The Authority” means Trade Fair Authority of India now Trade Promotion Organization whether under its present name, or any new name, and shall also include any other company with which the said India Trade Promotion Organization, here after may amaligamate or into which it may hereafter be reconstructed or to which the whole of its undertaking and business for the time being may there after be sold or otherwise transferred. f) “The Member” means any person in the employment of this Organization who has been admitted to membership of the Fund. July 264Page 3 of 37 g) “Employee” means any person who is employed for wages/salary in any kind of work. Manual or otherwise, in or in connection with the work of the Organization and who gets his wages directly or indirectly from the Organization and includes any person employed by or through a contractor in or/in connection with the work of the Organization. h) “Family” means the employees spouse, legitimate children, stepchildren and dependent parents, sisters and minor brothers. Provided that if a male subscriber proves that his wife has been judicially separate from him or has ceased under the customary law of the community to which she belongs to be entitled to maintenance, she shall no longer be deemed to be a member of the subscriber’s family for the purpose of these rules, unless the subscriber subsequently intimates in writing to the Trustees that she shall continue to be so regarded. Provided further that if a female subscriber by notice in writing to the Trustees expresses her desire to exclude her husband from the family, the husband shall no longer be deemed to be a member of the subscriber’s family in matters to which these rules relate unless the subscribers subsequently cancels such notice in writing. Explanations: I In either of the above cases, if the child of a Member has been adopted by another person and if, under the personal Law of the adopter, adoption is legally recognized, such a child shall be considered from the family of the Member. II An adopted child shall be considered to be a child when the trustees are satisfied that under the personal law of a Member, adoption is legally recognized as conferring this status of the natural child. III “Continues Service” means uninterrupted service and includes service which is interrupted by sickness, accident, authorized leave, strike which is not illegal or cessation of work not due to the employee’s fault. July 264Page 4 of 37 i) “ Contribution Salary” or emoluments means the pay, leave salary, subsistence grant and includes special pay, personal pay and dearness allowances including cash value of food concession, retaining allowance (if any) and leave encashment but does not include any other allowance overtime payment, bonus, commission, pensioner elements including portion of pension commuted or to her remuneration or profit what ever, derived by an employee by any means (outside his fixed ascertained basic salary). The currency in which the contribution is to be fixed in Indian Rupees. Notes:- In case of re-employed pensioners the Organization Contribution shall be based on the gross pay of the pensioners including pension. j) “The Act” shall mean the “ Employees Provident Fund Act 1952” as amended and/or supplemented from time to time or any re-enactment of that Act. k) “ The Statutory Scheme” shall mean the “Employee” Provident Fund Scheme, 1952” as amended and/or supplemented from time to time. l) “Exempted Provident Fund” shall mean a provident Fund Exempted from provisions of the statutory scheme pursuant to Section 17 of the Act. m) “Accounts Officer” means the Financial Adviser & Chief Accounts Officer of the Authority now Organization on behalf of the Trustees. n) “Year” means the Financial year of the Organization ending 31st March. In the Rules, where the context so admits the masculine gender shall singular the feminine and the singular number shall include the plural and vice versa. Chapter II: Membership and Contributions: Membership 2 i) Membership of the Fund shall be available to persons who, by their terms of service with the Organization or pursuant to the provisions of the Act are required to become Members of the Fund. July 264Page 5 of 37 Membership of the Fund shall commence from : the beginning of the month following the date on which the employee ii) a) The date of joining the establishment as an employeeHas joined as an employee or actual date of permanent absorption of the employee, by the Organization whichever is earliest. b) Being a deputation from a Govt. Department, has been absorbed permanently in the service of the Organization provided that persons who, at the time of becoming employees of the Organization and/or have become members of the Statutory Scheme or of Exempted Provident Fund shall become Members of the Fund iImmediately. iii) Re-employed employees shall also be eligible to become members of the fund from the date of re-employment and may be permitted to contribute from such date, provided that when the term of their re-employment is initially for a period of one year or less but is later extended as to exceed one year Organization contribution with interest shall be payable for the entire period for which such officers are allowed to contribute to the Fund. If the period exceeds one year. iv) If a member is transferred to foreign service or sent on deputation out of India, he shall remain subject to the Rule of that Fund in the same manner as if he was not so transferred or sent on deputation. v) A member of the Fund shall continue to be a Member until he with draws the amount standing to his credit in the Fund provided that a former employee who participates in the Fund but whose accounts has not been settled shall continue to be a member. If any question arises whether an employee is entitled or required to become or continue as a Member or as regard the date from which he is so entitled or required to become a members, the decision thereon of the Regional Commissioner appointed under the Act shall be final, provided that no decision shall be given unless both the Organisation and the employee have been heard. July 264Page 6 of 37 Contributions 3A i) The contribution payable to the fund both by a Mmember and by the Authority now organization shall be 12% of contribution salary as defined in rule1 (ij) Note 1 No contribution shall be payable during a period of suspension or during a period of leave without pay, or after death, retirement, resignation, or dismissal. 2 Contributions both of the subscriber and Employer should be rounded to the nearest rupee (50 pause or more being rounded to the nearest higher rupee). Payment of Contributions: 3B i) The employer shall in the first instance pay both the contribution payable by himself employer’s contribution and also on behalf of the member employed by him directly or by or through a contractor, the contribution payable by such member (members contribution). ii) In respect of employees employed by or through a contractor, the contractor shall recover the contribution payable by such employee and shall pay to the principal employee the amount of members’ contribution so deducted together with an equal amount of contribution so deducted (employees contribution) and also administrative charges/inspection charges. iii) It shall be the responsibility of the principal employer to pay both the contribution payable by himself in respect of the employees directly employed by him and also in respect of the employees employed by/or through a contractor and also administrative charges/inspection charges. Explanation For the purpose of this paragraph the expression “Administrative charges” means such percentage of the pay Basic wage, Dearness allowances etc. July 264Page 7 of 37 for the time being payable to the employees other than an excluded employee, and in respect of which P.F. Contribution are payable, as the Central Govt., may, in consultation with the Central Board and having regard to the resources of the fund for the meeting its normal administrative expenses fix. iv) The amount of member’s contribution and installments on accounts of principal and interest on withdrawal from the Fund shall, notwithstanding any provision to the contrary in the Rules or any contract or any law for the time being in force, be recovered by means of deduction from the salary of the Member. The recovery shall be supported by a schedule in the prescribed form. v) Such deduction shall be made only from the salary paid in respect of the period or part of the period for which the contribution is payable. Provided that the Organization shall be initialed to recovered number contributions from a salary paid in respect of another period where the Member at the time of joining service with Authority/Organization has in writing given a false declaration concealing that he was already a member of t he Statutory Scheme, and provided further that where no deduction has been made on account of accident mistake or a clerical error., s Such deduction may, with the consent in writing of the Inspector under Section 13 of the Act, be made from the subsequent salary. vi) Any sum deducted by the Organization from the salary of a Member under this Rule shall be deemed to have been entrust ed to the Organization for the purpose of paying the contribution in respect of which it was deducted. vii) Not with standing any contract to the contrary the Organization shall not be entitled to deduct the Organization contribution from the wage of a member or otherwise to recover it from him. Chapter III: Administration of the Fund: 4 Member’s “A” and “B” Accounts The Accounts Officer on behalf of the Trustees shall keep an “A Account (Member Account) and a “B” Account (Organizations Account) in respect of each Member. There shall be entered in the “A” Account the Member’s contribution and in the “B” Account” the Organization contribution, and interest as provided under these Rules shall be entered pro-rate in both “A” July 264Page 8 of 37 and “B” Accounts. All the accounts of the Members shall be maintained at the Head Quarter of the Authority/Organization at New Delhi. Persons who shall become members of the Fund up to 1.3.77, after having been members of a statutory scheme or of an exempted provident fund shall have the option to have the amount standing to their credit in the previous fund transferred to the Fund and credited separately to the Member’s “A” account and ‘B’ account, However, they will be allowed continuity of membership of the fund from the date of joining of the fund. Register and Accounts 5 The trustees shall cause to be kept a Register of Members of the Fund in which shall be entered the name of every Member and particulars of the date of his joining and leaving the service of the Organization and other necessary particulars. The Trustees shall cause to be kept full Books and Accounts of the Fund. The Register and Accounts and Records of the Fund may be kept at the Head Quarter of the Authority (Organization) The Register and the Accounts shall at all times during office hours be opened to the inspection of the Trustees and Provident Fund Authorities or anyone appointed by them for the purpose. Accounting Period and Valuation 6 The accounts of the Fund shall be closed on the 31st day of March of each year or (if they deem it necessary) at such intermediate dates as the Trustees shall decide. At the end of each Accounts period a Balance Sheet shall be drawn up. For this purpose the investment shall be valued at cost prices adjusted at the discretion of the Trustees in the case of remember securities in accordance with the redemption value. Any appreciation or depreciation disclosed by such valuation shall be carried to the “C.P.F. Reserve Amount” mentioned in rule 11. Expenses of the Fund 7 i) The Organization shall bear all the expenses relating to the administration of the Fund including fees and allowances of the Trustees if any, traveling July 264Page 9 of 37 and compensatory allowance, if any clerical assistance, cost of books and stationary, auditors and other incidental charges. ii) The Organization shall also contribute the difference if any, between the amounts of interest credited to the accounts of the members under rule 9 and the amount accrued as interest on investment reduced by any surplus in previous years. Auditors 8 The accounts of the Fund shall be examined and the correctness of the Revenue Accounts and Balance Sheets ascertained by the Auditors appointed by the Trustees. A copy of the audited Balance sheet shall be forwarded to the Regional Provident Fund Commissioner. Interest 9 i) The Trustees shall credit to the Accounts of each Member interest at such rate as, be determined by the Trustees, which shall however not be lower than that declared by the Central Government for the members of the Statutory Scheme. ii) Interest shall be credited with effect from 31st March of each year in the member’s account in the following manner; a) On the amount to the credit of a subscriber on the 31st March of the preceding year, less any sums withdrawn during the current year of interest for 12 months. b) On sums withdrawn during the current year interest from 1st April of the current year up to the last date of the month preceding the month of withdrawal. c) On all sums credited to the Member’s account after the 31st March of the preceding year interest from the month of credit up to the march of the current year. In the case of cash deposit by a member towards repayment of advance, interest will be allowed from the month following that in which the deposit is made. July 264Page 10 of 37 iii) Total amount of interest shall be rounded to the nearest rupee , 50 paiuse or above being rounded to the nearest higher rupee and any sum less than 50 paiuse being ignored. iv) In addition to the amount payable under Rule 26, interest there on up to the end of the month preceding that in which the payment is made up to the end of the sixth month after the month in which such amount become payable, whichever of these period be less, shall be payable to the person to whom such amount is to be paid. Interest Suspense Account 10 All interest, rent and other income realized by the Fund including net profits or losses, if any from the sale of investments shall be credited or debited, as the case may be to an Account called the “Interest Suspense Account”. C.P.F. Reserve Account 11 A.C.P.F. Reserve Account shall be maintained to which shall be credited the entire amount for-feited from the individual accounts under the Rules, The amount at the credit of C.P.F. Reserve Account shall be available for the following purposes at the discretion of the Board of Trustees:- i) aAd-hoc payment of RS. 30.00 to the heirs of a deceased member as an aid for procuring a succession of a guardianship certificate for getting the provident fund dues if such a certificate is necessary. ii) payment of a sum of the nominee/heirs of a deceased member provided that the total amount including the sum proposed to be paid does not exceed Rs. 1000.00 ( The intention that a sum of Rs. 1000.00 should be assured to such nominees/heirs). iii) For meeting money order commission on remittances from the provident Fund to outgoing members/their heirs. Formatted: Bullets and Numbering 1.3. July 264Page 11 of 37 iv) For declaring the rate of interest so that it is not lower than fixed under the Employees Provident Fund Scheme. v) For making good the capital loss on the conversion of securities and other instruments. This should however, be limited to cases of absolute necessity. Investments 12 All moneys contributed to the Fund (whether by the employer or by the employees) or transferred from the individual account of an employee in any recognized provident fund maintained by his former employer or accruing by way of interest or other wise to the Fund may be deposited in a current account with any scheduled Bank and to the extent such moneys as are not so deposited (such moneys as are not so deposited being here after in this Rule referred to as investible moneys) shall be invested in Govt. Securities as per pattern of investment laid down by Govt. of India(Ministry of Labour ) from time to time. Restriction on the use of Fund 13 Subject to the provisions of the Act and the Rules the Fund shall not, except with the previous sanction of the Central Government, be expended for any purpose other than for the payment of sums standing to the credit of individual. Members or to their nominees or heirs or legal representatives in accordance with the provisions of the Rules. Chapter IV :. Circumstances in which advances/ with drawals may be permitted-14. Temporary Advances / WithdrawlsWithdrawals 14 Advances/ Withdrawals by a Member may be allowed by the The Trustees may at their discretion and subject to limitationsed laid down in the Indian Income Tax (P.F. in force allows withdrawals by a Member for in the following purpose: circumstances : a) tTo pay expenses incurred including hospitalization in connection with the illness of the employee or a member of his family including hospitalization and where necessary, traveling expenses. illness including any hospitalization resulting from such an illness of the employee or a member of his family actually dependent on him. The traveling expenses arising as a result of such an illness or hospitalization July 264Page 12 of 37 shall also be covered. aa) to pay expenses in connection with the serious or prolonged illness or a disability, including where necessary, the traveling expenses of the member or any person actually dependent on him as a temporary advance. b) Meeting the cost of higher education, including where necessary, the travelling expenses of any child of the employee actually dependent on him in the following cases, namely:- i) eEducation outside India for academic technical, professional or vocational courses beyond the matriculation stage, and ii) aAny medical, engineering or other technical or specialized course in India of an employee or any member of his family. c) tTo pay for the cost of passage to a place out of India of an employee or any member of his family as a temporary advance.. d) tTo pay expenses in connection with marriage of self, daughter, son, sister or brother, funerals or ceremonies which by the religion of the employee it is incumbent upon him to perform. e) tTo pay premium on policies of insurance on the life of the employee or of his wife provided that the policy is assigned to the trustees of the funds or at their discretion deposited with them and that the receipts granted by the insurance company for the premium are from time to time handed over to the trustees for inspection. f) f) tTo meet the coast of the legal proceedings instituted by the employee for vindication of his position in regard to any allegations made against him in respect off any Act done or [purporting to be done by him in the discharge of his official duty or to meet the coast of his deference when he is prosecuted by the employer in any court of law in respect of any official misconduct on his part. July 264Page 13 of 37 Provided that the advance under this clause shall not be admissible to an employee who institutes legal proceedings in any court of law either in respect of any matter unconnected with his official duty or against the employer in respect of any condition of service on penalty imposed on him; g)1 to meet the expenditure on building a house, or purchasing a site or a house or a house and site. Provided that the employee furnishes an undertaking to the trustees not to encumber or alienate such house or site or house and site or as the case may be, Provided that the employee furnishes an undertaking to the trustees not to encumber or alienable such house or site such house and site or as the case may be, Provided further such house or site or such house and site shall not be deemed to be an encumbered property merely because such house or site or such house and site is: i) mortgaged, solely for having obtained funds for the purchase of the said house or site or the said house and site or for the building of such house to any of the following agencies, namely (a) the Central Government, (b) a State Government (c) a cooperative societies, being a society registered or deemed to be registered under the cooperative Societies Act, 1912, or under any other law for the time being in force in any State relating to cooperative societies, (d) an institution (e) trust, (f) a local body, or (g) a housing finance corp., or Mortgaged, solely for having obtained fund for the purchase of the said house or site or the said house and site or for the building of such house to any of the following ageneses, namely (a) the Central Government, (b) a State Government (c) a Cooperative Societies, being a society registered or deemed to be registered under the cooperative society, 1912,or under any other law for the time being in force in any state relating to cooperative societies, (d) an institution (e) trust, (f) a local body, or (g) a housing finance corp., or (h) ITPO or under any other ii) hHeld in the name of any of the aforesaid agencies and the employee is precluded from transferring or otherwise disposing of that house orn site or that house and site without the prior approval of such agency. July 264Page 14 of 37 iii) Land acquired on a perpetual lease or on lease for a period of not less than 30 years for constructing a dwelling house/flat or a house/flat built on such a leased land, shall also not be deemed to be an encumbered property. for not less than thirty years of Property lease g)1A To meet the expenditure on any additions, substantial alterations or improvements necessary to a house. g)2 For payment of loan previously raised for the purpose of construction or purchase of a house,. Explanation: For the purpose of this clause, “pay” shall have the meaning assigned to it in the explanation to Rule 15.7(1) & 15.7(2). In the case of an employee who needs: h) i) tTo meet his household expenses if a factory or their establishment, when he is working is locked up or closed down for more than fifteen days for reasons other than a strike rendering him unemployed without any compensation or if he is not in receipt of wages for a continuous period or two months or more.. ii) tTo meet his house hold expenses if he factory or other establishment where in he is working, suffers cut in supply of electricity resulting in a loss of one-forth or more of the total wages of the employee. iii) tTo meet the cost of purchasing an equipment required by a physically handicapped employee which will minimize his hardship on account of the handicap. iv) tTo meet his house hold expenses where the employee is discharged or dismissed or retrenched by the employer and such discharge, dismissal, or retrenchment as the case may be, isn challenged by the employee in any court or tribunal and the case is pending in that court or tribunal. July 264Page 15 of 37 v) tTo meet the expenses of the damage caused to the movable or immovable property of the employee as a direct result of-: ia) fFlood, cyclone, earthquake other convulsion of nature, or iib) rRiots. Explanation :EXPLANATIONS: For the purpose of this clause, “ pay” shall have the meaning assigned to it in the explanation to sub-rules 2(i) and 2(ii) of 15. For the purpose of this clause, “ Pay” shall have the meaning assigned to it in the explanation to sub-rules 2(i) and 2(ii) of 15. i) In any other case wherein the Chairman of Board of Trustees is satisfied that considering the peculiar circumstances temporary advance withdrawal is justified. Conditions for withdrawal for various purposes 15 The withdrawals below may be refundable or non refundable as per the request of the employee unless specified in the Rules.: except for passage abroad as specified in clause ( c) of rule 14 and any other case as specified clause ( i) of rule 14 which shall only be refundable advances. 15.1 The withdrawal in connection with expenses on illness as specified in clause (a) of rule 14 shall not exceed the member’s basic wages and the dearness allowance for six months or his own share of contribution with interest in the Fund, which ever is less. 15.2 The withdrawal in connection with the cost of higher education as specified in clause (b)(i) & (b)(ii) of rule 14, by an employeer. (i) Non-refundable advance shall not exceed 50% of the employee’s share of contribution to the Fund with interest thereon, standing to his/her credit on the date of such authorization. (ii) Refundable advance shall not exceed three months Basic pay and July 264Page 16 of 37 Dearness Allowance or half of the member’s total contribution with interest thereon whichever is less 15.3 The withdrawal for purpose of passage abroad as referred to in clause (c) of rule 14 shall not exceed three month’s pay or the total of the accumulation of exempted contributions and of exempted interest lying to the credit of the employee, which ever is less. 15.4 The withdrawal for purpose of marriage, funeral or religious ceremonies as referred to in clause (d) of rule 14, from his or her Provident Fund account, shall not exceed six months pay or the total of the accumulation of exempted contributions and exempted interest lying to the credit of the employee, which ever is less. 15.5 The withdrawal for purpose of LIC premium as referred to in clause (e) of rule 14 shall not exceed three month’s pay or the total of the accumulation of exempted contributions and of exempted interest lying to the credit of the employee, which ever is less. 15.6 The withdrawal for the purpose of legal proceedings specified in clause (f) of rule 14, shall not exceed three months pay or Rs. 500/- whichever is greater, but shall in no case exceed half the amount to the credit of the employee. 15.7 1 The withdrawal for the purpose of dwelling house as specified in clause (g.1) and clause (g.2) of rule 14 by any employee shall be subject to the following conditions:- i) The amount of withdrawal shall not exceed the member’s basic wages and dearness allowance for thirty six months or the member’s own share of contributions, together with the employer’s share of contributions with interest thereon in his account in the Fund or the actual cost towards the acquisition of the dwelling site (together with the cost of construction thereon) or the purchase of the dwelling house/flat or the construction of the dwelling house, whichever is the least. Explanation: The actual cost towards the acquisition of the dwelling site or the purchase of the dwelling house/flat shall include the charges payable July 264Page 17 of 37 towards registration of such site, house or flat.The amount of withdrawal shall not exceed member’s basic wages and dearness allowance for thirty six months or the member’s own share of contributions, together with the employer’s share of contributions with interest thereon in his account in the Fund thirty-six months pay including basic salary and dearness allowance, of the employee or the actual cost of the house and/ or of the site, whichever is less. ii) The employee shall have completed five years of service or in is due to retire within the next ten years. iii) The construction of the house should be commenced within six months of the withdrawal and should be completed within one year from the date of ht the commencement of the construction. iv) If the withdrawal is made for the purchase of a house and/or a site for a house the purchase should be made within six months of the withdrawal. v) If the withdrawal is made for the repayment of loan previously raised for the purpose of construction or purchase of a house, the repayment of the loan should be made within three months of the withdrawal vi) Where the withdrawal is for the construction of a house it shall be permitted in two or more equal installments (not exceeding four), a later installment being permitted only after verification by the trustees about the actual utilization of the earlier withdrawal vii) The withdrawal shall be permitted only if the house and/or site is free from encumbrances and no withdrawal shall be permitted for purchasing a share in a joint property or building or house or land whose ownership is divided. However, the The withdrawal shall be permitted for purchasing a flat or house and/ or site whose ownership is in the name of the employee or the spouse or is jointly owned by the employee and the spouse. July 264Page 18 of 37 viii ) 15.7 2 If the amount withdrawn exceeds the actual cost of the purchase or construction of the house and/or site, or if the amount is not utilized for the purpose for which it is withdrawn, the excess or the whole amount, as the case may be, shall be refunded to the trustees forthwith in one lump sum together with interest from the month of such withdrawal at the rate prescribed in sub-rule (4) of rule 17. The amount refunded shall be credited to the employers account in the Provident Fund. A withdrawal for additions, substantial alternations or improvements necessary as specified in clause (g.1A) of Rule 14 to the house owned by the employee or spouse or spouse or jointly owned by the employee and the spouse, may be granted once and in one installment only upto and shall not exceed twelve months basic wages and dearness allowance: or the employeers own contribution with interest thereon or the amount standing to his credit in the Fund, whichever is less: Provided that the said withdrawal shall be admissible only after a period of five years from the date of purchase or completion of the house: Provided that a further second withdrawal shall be admissible only after a period of ten years from the date of first repair advanced and not exceed twelve months basic wages and dearness allowanceProvided that aA further withdrawal up to twelve months basic wages and dearness allowance or member's own share of contribution with interest thereon in his account, whichever is the least may be granted for addition, alteration, improvement or repair of the dwelling house owned by the member or by the spouse or jointly by the member and the spouse, after ten years of withdrawal, mentioned above. Provided further that where the amount withdrawn is not utilized in whole or in part for the purpose for which it was withdrawn, the excess or the whole amount, as the case may be, shall be refunded to the trustees forthwith in one lump sum together with interest from the month of such withdrawal at the rate prescribed in sub-rule (4) of rule17 and the amount so refunded shall be credit ed to the employees account in the fund. Explanation: For the purpose of sub-rules 15.7(1) and 15.7 (2) “Pay” includes basic July 264Page 19 of 37 wages with dearness allowance, retaining allowance (if any), cash value of food concession admissible there onto which the employee is entitled at the time when the withdrawal is granted 15.8 The withdrawal for any other purpose referred to in clause (h) of rule 14 shall not exceed three month’s pay or the total of the accumulation of exempted contributions and of exempted interest lying to the credit of the employee, which ever is less. For the purpose of physical handicap as referred to in clause (h)(iii) of rule 14 : (i) No advance shall be paid unless the member produces a medical certificate from a competent medical practitioner to the satisfaction of the Board of Trustees to the effect that he is physically handicapped. (ii) The amount advanced under this rule shall not exceed the member’s basic wages and dearness allowance for six months or his own share of contributions with interest thereon or the cost of the equipment, whichever is least ExplanationFor the purpose of this rule except sub-rule 15.7 “Pay” means the pay to which the employee is entitled at the time when the withdrawals is granted. 15.9 Second With Drawl 16 1 Save as in sub-rule (2) and sub-rule (3) a second temporary advance/ withdrawal shall not be permitted until the temporary advance first withdrawn has been fully repaid. 2 A withdrawal may be permitted:- a) For a non refundable withdrawal specified in rule 14 not withstanding that the sum withdrawn earlier for any purpose has not been repaid; b) For any other purpose specified in rule 14 not with standing that any sum withdrawn earlier as a non refundable withdrawal specified in rule 14 has not been repaid. July 264Page 20 of 37 3 A withdrawal referred to in clause (a) of sub-rule (2) of an amount equal to the difference between the amount of withdrawal admissible under sub-rule 15.7 (1) of Rule 15 as on the date of application and the amount actually withdrawn by the employee for the purpose specified in clause (g)(1) and (g)(2) of rule 14 any time during six years preceding the 3rd day of October 1981 may be permitted to the employee, subject to the following conditions, namely:- i) The employee had availed of the first withdrawal for purchase of a site and now proposes to construct a house on the so purchased: or ii) The employee had availed the first withdrawal foro making initial payment towards allotment or purchase of a house from any of the agencies referred to in the second provision to clause (g) (1)of rule 14 and now proposes to withdraw the amount for completing the transaction and for acquiring ownership of the house so purchased : or iii) The employee had availed of the first withdrawal for construction of a house but the said construction could not be completed due to shortage of funds. Repayment of Amounts Withdrawn 17 1 Where a withdrawal is allowed as `other than refundable advance, the amount withdrawn need not be repaid. 2 Where a refundable withdrawal advance is allowed in connection with marriage as specified in clause (d) of rule 14, the amount withdrawn shall be repaid ins not more than forty-eight equal installments. 3 Where a withdrawal refundable advance is allowed for any other purpose, the amount withdrawn shall be repaid in not more than twenty-four equal monthly installments 4 In respect of temporary advance / withdrawals : a) referred to in clause (viii) of sub-rule 15.7 ; or b) where amount withdrawn is not utilized for the intended purpose ; or July 264Page 21 of 37 c) whole of the amount is not utilized for the said purpose Interest shall be paid in accordance with the following table:- TABLE Where the amount is repaid in not One additional installments of 4% more than 12 monthly installments on the amount withdrawn. Where the amount is repaid in more Two additional installments of 4% than 12 monthly installments but not on the amount withdrawn. more than 24 monthly installments. Where the amount is repaid in more Three additional installments of than 24 monthly installments but not 4% on the amount withdrawn more than 36 monthly installments Where the amount is repaid in more than 36 monthly installments but not more than 48 monthly installments Where the amount is refunded under clause(viii) of sub-rule (2) of rule 15. ThreeFour additional installments of 4% on the amount withdrawn. 4% of the refundable. amount which is Provided that at the description of the trustees of the fund, interest, may be recovered on the amount aforesaid or the balance thereof outstanding from time to time at one per cent above the rate which is payable for the time being on the balance in the fund at the credit of the employee. July 264Page 22 of 37 The employer shall deduct the installments aforesaid from the employer’s salary, and pay them to the trustees of the fund. These deductions shall commence from the second monthly payment of salary made after the with drawal or, in the case of an employee on leave without pay, from the second monthly payment, of salary made after his return to Duty. Miscellaneous Provisions: 18 a) Amount withdrawn but not repaid may be deemed as income In case of default of repayment of installments due under sub-rule (2) or sub-rule (3) on sub-rule (4) of rule 17 or where the amount withdrawn is not uutilised litired for the purpose for which it is with drawn , the Chief Commissioner or Commissioner may at its discretion order that the amount of the withdrawal or the amount outstanding shall be added to the total income of the employee for the year in which the default occurs or the withdrawn amount is finally held not have been utilized for the purpose for which it is withdrawn, and Assessing officer shall assess the employee accourdingly. b) With drawl on leave preparatory to retirement. Withdrawal within one year before the retirement: The Board of Trustees may on an application from a member in such form as may be prescribed, permit withdrawal of upto 90 percent of the amount standing at his credit at any time after attainment of the age of 54 years by the member or within one year before his actual retirement on superannuation whichever is later. Not with standing anything contained in rules 14 to 17 , it shall be open to the trustee s of a provident fund to permit the withdrawal it shall be open to the trustees of a provident fund to permit the withdrawal of ninety percent of the amount standing at the credit of any employee if the employee takes leave preparatory to retirement provided that if he rejoins duty on the expiry of his leave he shall refund the amount drawn together with interest at the rate allowed by the fund July 264Page 23 of 37 c) In computing the period of membership of the Fund of a Member Rule 15 , his total service with the authority now organization (exclusive of periods of breaks) as well as the periods . Oof his membership of any private provident Funds of exempted Corporation of other establishments of exempted provident Fund immediately preceding the current membership of the Fund shall be included , provided that the member has not severed his memberships by withdrawal of his provident fund during such period. Chapter V: Transfer and payment of Accumulations: 19 Previous accumulations of members joining fund In the event of a transfer of the service of an employee (otherwise qualified for the membership under Rule2) without any break in service who is either a member of the Provident Fund established under the provisions of the employees Provident Fund Act 1952, or whose services are transferred to the Organization from any other Corporation Company or association of persons which maintains a Provident Fund recognized under the Indian Income Tax Act,1922, 1922(XI of 1922) or to which the Provident Fund Act, 1925(XIV) OF 1925) applies the entire amount standing to the credit of such employee in the Provident Fund with such other Corporation, Company or Association or persons (including the employers contributions and interest t hereon) shall be accepted by the trustees for credit to the provident Fund established under these rules and the employee shall be become a member of this Fund from the date of his joining this Organization after Transfer. In such case his previous membership of the Provident Fund falling within the purview of the E.P.F. Act shall be taken into account for paying him employees share under Rule 22. Nothing in this rule shall, however, be deemed to provide that thethat the amount of such transferred balance shall be taken into account in enter mining the contributions to be made by the Organization to the Fund under Rules (3)_ here of so that the Organization shall be under no liability what so ever when such payment or transfer is made to this provident Fund to make equivalent contribution to the fund. Subject as aforesaid any such transferred balance She has credited to the account of such joining member and be subject to the provisions of the rules for the time being in force. 20 Transfer of accumulation where a member leaves the Organisation July 264Page 24 of 37 When a Member leaves the service of the Organization and joins another establishment covered by the Act, or recognized under Indian Income Tax Act, 1922 (XI of 1922) or to which the Provident Fund Act 1925 (XIV of 1925) applies he may apply ,apply, for the transfer of his accounts. The amount standing to the credit of the members’ “ A” And “B” Accounts together with interest thereon up to the end of the month proceeding the month of transfer of such balance, shall thereupon be transferred direct to the new establishment (if the said establishment is an exempted one) or if the new establishment is an un exempted one to the Regional Provident Fund Commissioner in whose jurisdiction the new establishment is located ,located, or to the new Provident Fund Account in the Govt. Department . Provided such transfer is otherwise permissible under the C.P.F. Rules of such undertakings or Govt. departments etc. Explanation So far as transfer from and to Central Government/ State Govt. corporate bodies owned by the government is concerned the transfer shall include cases of resignation from service in order to take up appointment under a body corporate owned or controlled by Government without any break and with proper permission of the Government and the Corporation as the case may be. The time taken to join the new post shall not be treated as a break in service if it does not exceed the joining time admissible to a Government servant on transfer from one post to another. Resignation from service in order to take up appointment in another Department of the Central Government or under the State Government or under a body corporate owned or controlled by Govt. without any break and with proper permission of the Govt. Corporate/Organization concerned shall not be treated as resignation form Govt. service /Corporation Circumstances in which accumulations in the Fund are payable to a Member 21 I a) Subject to the provisions of paragraph 69(i) of the Statutory Scheme, a Member may withdraw the full amount standing to him credit in the Fund. On retirement from service on Superannuating July 264Page 25 of 37 b) On retirement on account of permanent and total incapacity for work due to bodily or mental infirmity duly certified by a Medical Officer designated by the Organization(Organization (A memberA member suffering from tuber closes or leprosy even if contracted after leaving the service of the Organization grounds of illness but before the payment has been authorized, shall be deemed to have been permanently and totally in capacity for work) c) On termination of the service in the case of mass or individual retirement as the result of reduction by the Organization of its establishments provided that in the case of mass retrenchment the payment shall be made immediately and in the case of individual retrenchment payment shall be made if the member has not been employed in any other establishment to which the act applies continuousapplies continuous period of not less than six months immediately proceeding the date on which the member makes the application for the date on which the Member makes the application for withdrawal, Provided further that in the case of an individual retrenchment pending final withdrawal, the member may at his option, be paid for the period during which we member is out of employment monthly withdrawal not exceeding six, of a non refundable advance from the Fund of an amount equal to: i) The pay (including dearness allowance, cash value of any food concession and retaining allowance) drawn by him in the month immediately preceding the month in which he was retrenched, or ii) One–sixth of the amount standing to his credit (including interest) in the Fund whichever is less and on the expiry of the period of six months referred to in the foregoing proviso the balance amount, if any shall: 1 In any case where the members secures employment in any establishment to which the Act applies, be transferred to the new provident fund account of that establishment. July 264Page 26 of 37 II 2 In any case where the Member secures employment in an establishment not covered by the Act, be paid in cash to him after the expiration of the said period of six months or be transferred under Section 17-A to the credit of the account of such Member in the provident Fund of the establishment in which he is re-employed provided that it shall be so done only if the Member so desires and such transfer is permissible under the rules of that provident fund: 3 In any case where the member does not secure employment be paid in cash. On the death of the member while in the service of Organization (before the amount standing to his credit has become payable) the Full amount standing to the credit of his account shall be paid in accordance with Rule 23. 22 Omitted 23 Accumulation of a deceased Member to whom payable On the death of member before the amount standing to his credit has become payable or where the amount has become payable, before payment has been made, the amount due vide Rules 21 and 22 shall be paid to the claimants in accordance with the following provisions a) If a nomination made by the member in accordance with Rule 24 subsist, the amount or the part thereof to which the nomination relates shall become payable to his nominee or nominees in accordance with such nominations or. b) If a nomination made by the member in accordance relates only to a part of the amount the whole amount or the part thereof to which nomination does not relate, as the case may be shall become. July 264Page 27 of 37 Payable to the Members of his family in equal shares: PROVIDED that no share shall be payable to: a) Sons who have attained majority b) Sons of a deceased son who have attained majority: c) Married daughters whose husbands are alive: d) Married daughters of a deceased son whose husbands are alive As long as there is any member of the family other than those specified under (A), (b) ,), (C) and (d) above and PROVIDED further that the widow or widows and the child or children of a deceased son shall receive between them in equal parts only the share which that son would have received if he had survived the Member and had not attained the age of majority at the time of the Member’s death. c) in any case to which the provisions of paragraphs (a) (b) do not apply the whole amount shall be payable to the person legally entitled to receive it on production of probate or letters of administration to the estate of the deceased or a succession certificate. The Trustees may, if the amount payable does not exceed Rs. 5000/- and if they are satisfied after enquiry about the title and bonafidre ofe of the claimant, waive the production of probate or letters of administration or succession certificate For the purpose of this Rule a Member’s posthumous child if born alive, shall be treated in the same way as a surviving child born before the Member’s death. 24 Nominations Each Member shall immediately after having been admitted to membership of the Fund, sign a declaration (in such form as may from time to time be prescribed by the Trustees) nominating) nominating the person or persons who will in the event of his death be entitled to receive payment of the amount standing to his credit in the fund. July 264Page 28 of 37 A member may, in his nomination, distribute the available amount amongst his nominees at his own desecration, in which case he will have to specify the share payable to each one of the nominees. If a member has a family at the time of making the nomination, the nomination shall be in favour of one or more persons belonging to his family. Any nomination made previously by such a Member in favour of a person not belonging to his family shall be void. If at the time of making nomination the Member has no family, the nomination may be in favour of any person or persons but if the Member subsequently acquires a family such nomination shall forthwith be deemed to be invalid and the Member shall make a fresh nomination in favour of one or more persons belonging to his family. A nomination made under this Rule may at any time be modified by the Member by making a fresh nomination canceling the previous one. If the nominee predeceases the Member, the interest of the nominee shall revert to the Member, who shall make a fresh nomination in respect of such interest. A nomination or its modification or notice, of cancellation shall take effect, to the extent that it is valid, on the date of its receipt by the Accounts Officer on behalf of the Trustees. 25 Deductions in case of dismissed Member Not with standing anything contained in Rule 22 if a Member is dismissed by the Organization for serious and willful misconduct, the Organization may send intimation thereof to the Trustees and the Trustees shall have thehave the power to forfeit the Organization contribution up to a maximum of the Organization contribution in the last two complete years and that of the present period. Before exercising the power of forfeiture conferred by the Rule, the Member concerned shall be called upon by notice in writing to show cause why the forfeiture should not be made and Trustees shall decide the amount of forfeiture should not be made and Trustees shall decide the amount of forfeiture after taking into account any representation made by the Member. July 264Page 29 of 37 A forfeiture made under this rule may be reviewed by the Trustees either of their own notion or at the request of the Organization of the Member. Any amount forfeited from the “B Account of a member under this rule shall not be returned to the Organization but shall be credited to the C.P.F. reserve account of the Fund. 26 Terms and Payment. When the amount standing to the credit of Member or the balance there of after any deduction under Rules 21, 22, and 25 becomes payable, it shall be the duty of the Trustees to make prompt payment as provided in the Rules, They shall close the accounts of the Member and give notice in writing to the person to whom the amount is payable, specifying the amount and tendering payment If any portion of the amount which has become payable is in dispute or doubt, the Trustees shall make prompt payment of that portion which is not in dispute or doubt, the balance being adjusted as soon as possible. If the person to whom any amount is to be paid under the Rules as a minor or lunatic for whose estate a guardian under the Guardians and Wards Act, 1990(8 of 1990) or a manager under the Indian Lunacy ActLunacy Act 1912 (4 of 1912) as the case may be has been appointed, the payment shall be made to such guardian or manager. In case no such payment or manager has been appointed and the amount does not exceed Rs. 2000/the payment shall be made to such person as the Trustees consider to be the proper person representing the minor or lunatic and the receipt of such person for the amount paid shall be a sufficient discharge there of. In any other case the amount shall be paid to the person authorized by law to receive the payment on behalf of the minor or the lunatic July 264Page 30 of 37 If it is brought to the notice of the Trustees that a posthumous child is to be born to the deceased Member they shall retain the amount which will be due to the child in the event of its being born alive, and distribute the balance. If subsequently no child is born or the child is still born, the amount retained shall be distributed in accordance with the provisions of Rule 23. Chapter: VI: Miscellaneous: Protection against attachment 27 (1) The amount standing to the credit of any member in the Fund shall not in any way be capable of being assigned or charged and shall not be liable to attachment under any decree or order of any court in respect of any debt or liability incurred by the member and neither the Official Assignees appointed under the Presidency Towns Insolvency Act, 1909 nor any Receiver appointed under the Provincial Insolvency Act, 1920 shall be entitled to, or have any claim on any such amount; The amount standing to the credit of any member in the Fund shall not in any way be capable of being assigned or charged and shall not be liable to attachment under anyunder any decree or order of any court in respect of any debt or liability incurred by the deceased or the nominee before the death of the member. (2) 28 Any amount standing to the credit of a member in the Fund at the time of his death and payable to his nominee under these rules shall, subject to any deduction authorized by the said rules, vest in the nominee and shall be free from any debt or other liability incurred by the deceased or the nominee before the death of the member and shall also not be liable to attachment under any decree or order of any court. Information to Member July 264Page 31 of 37 Each Member shall receive a copy of the Rules and any alteration there in, a copy of the Annual Report, Annual Balance sheet and Revenue Account of the Fund and a statement of his “A” & “B” Accounts in thein the Fund showing the opening balances at the beginning of the period ,period, the amount contributed during the year, the total amount of interest credited at the end of the period or debited in the period or debited in the period and the closing balance at the end of the period. The member shall be deemed to have accepted the statement as correct unless be sends written objection to the Trustees within 6 months of the statement being issued In all cases where in a certificate shall be required of the amount of the balance standing to the credit of a deceased Member in the books of the Fund for the purpose of obtaining free of duty a grant of probate or letters of Administration or Succession Certificate or for any other purpose such a certificate shall be in such form as may from time to time be prescribed by the trustees 29 Saving right of the Employers Nothing in the Trust Deed or in the Rules shall in any way restrict the right of the Organization of terminate the employment of a Member The benefits to which a Member may claim to be entitled under the provisions of the Trust deed and the Rules shall not be used as a ground for increasing damages in any action brought by a member against the Organization in respect of dismissal. No member or any other person entitled to any payment shall have any claim to such payment except out of the Fund and he shall not in any case have any claim against the Trustees personally or against the Organization 30 Settlement of difference July 264Page 32 of 37 Not withstanding the provisions of the Act and of the Stationary Scheme, all questions not provided for under the Rules and/or differences arising in regard to the meaning or application of the Rules and/or rights and obligations by the parties concerned will be decided by the Trustees and their decision shall ( subject(subject to the powers and discretion of the competent Courts and subject further if such a decision should amount to an alteration of the Rules both to the approval from the competent Provident Fund Commissioner and from the competent Commissioner of Income- Tax, (New-Delhi) be conclusive and binding on all concerned. 31 Alterations of Rules The Trustees shall have the right at any time with the written consent of the Organization to alter, cancel or add to the Rules or any of them with effect from the date of the Resolution by the Trustee (or such other date, the Resolution shall determine) PROVIDED that previous intimation of the proposed change shall have been given to and the approval there of obtained from both the competent Provident Fund Commissioner appointed under the Statutory Scheme of the competent Commissioner of Income Tax PROVIDED also that any such change shall not have the effect of diminishing the right of member accrued up to the time of the change, Particulars of every such change shall be notified to the Member forthwith after the making there of. 32 Termination of the Fund The fund shall not be revocable save with the consent of all the beneficiaries. 33 Omitted 34 Board of Trustees The Board of Trustees shall be constituted in the manner here in after provided: July 264Page 33 of 37 1 Number of members: The Board shall consist of an equal number of representatives of the employees and the employees. The number of trustees on the Board shall be so fixed as to afford as far as possible representation to workers in various branches/departments of the establishments. Provided that the number of trustees on the Board shall neither be less than six nor more than twelve (2) in the case of common Provident Fund for a group of two or more establishments under the same employer one Board may be constituted for all such establishments. Provided that the employees of each such establishment shall be entitled to elect a trustee on the Board. 2 Employers representatives: The employer shall nominate his representatives from amongst the officers employed in managerial or administrative capacity y in the establishment. 3 Election of Employees representatives: The representatives of the employees shall be elected by the members of the Fund in an election to be held for the purpose on any working day Provided that whenever there is a recognized Unionrecognized Union under the code of Discipline or under any State Act, Union shall nominate the employees representative Provided further that wherever there is no recognized Union, the representative Union, if any existing under any law regulating the recognition of workers Union shall nominate the employers representatives. July 264Page 34 of 37 Provided also that wherever there is neither a recognized Union nor a representative Union of workers, any union existing in the establishment and qualified for recognition by the employer, shall nominate the employees, representative. Where there is more than one such Union, the procedure laid down in the Industrial Dispute (Central) Rules, 1957, for the elections of the workers representative on the works committee shall be followed with such modifications if any as may be considered necessary by the Regional State Provident Fund Commissioner Qualifications of candidates for elections: 4 i) Any member of the Fund who is not less than 21 years of age, may if nominated as here in after provided, be a candidate for election as employees’ representative. ii) An outgoing trustee shall be eligible for re-election re-nomination as the case may be. 5 Procedure for election: The employer shall fix a date for receiving the nomination from candidates for election as employee’s representative. He shall also fix a date for the withdrawal of nomination and the date of election whichelection, which shall not be earlier than three days or later than ten days after the closing date for withdrawal of nominations. The dates so fixed shall be notified to the members least seven days in advance. The notice shall be affixed on the notice Board of the establishment. A copy of such notice shall also be sent to the recognized trade union or the UNIONS concerned, in the establishment and o the Regional/State Provident Fund Commissioner. 6 Nomination of candidates for election: Every nomination shall be made in the form annexed to these rules, catch nomination paper shall be signed by the candidate to whom it relates and attested by at least two members of the Fund other than the proposer and shall be delivered to the employer before or on the closing date fixed for receiving the nomination: July 264Page 35 of 37 7 Scrutiny of Nomination papers: The employer shall scrutinize the nomination papers received under rule 6 on the days, following the last date fixed for withdrawing the nomination papers. The candidate or his nominee, the proposer of the attesting members may be present, if they so desire. The invalid nominations papers shall be rejected. 8 Voting in election: i) If the number of candidates who have be4en validly nominated is equal to the number of seats the candidates shall forthwith be declared duly elected. ii) If the number of candidates is more than the number of seats, voting shall take place on the date fixed for election. iii) The election shall be conducted by the employer. iv) Every member of the Fund shall have as many votes as there are seats to be filed on the Board Provided that each such member shall be entitled to cast only one vote in favour of any one candidate v) The voting shall be by secret Ballot. Disqualification of a Trustee: A person shall be disqualified for being a Trustee of the Board 9 If he is declared to be of unsound mind by a Competent Authority :or i) If the is an is charged insolvent, or July 264Page 36 of 37 ii) 35 Do not has been convicted of an offense-involving moral purported. 10 Chairman of the Board: The employer shall nominate one of his representatives on the Board to be Chairman thereof. In the event of an equality of votes, the Chairman shall exercise casting vote. 11 Filling of causal vacancies: In the event of a trustee elected or nominated ceasing to be trustee during the tenure of the Board, his successor shall be elected or nominated, as the case may be, in the manner here before provided for election or nomination. The person elected or nominated to a casual vacancy shall be a trustee for the due of the term for which the person whose place he fills would have been trustee. The funds shall ipso facto vast and continue to be vested in the new trustee or trustees. 12 Meeting of Trustees and Quorum: At any meeting of the trustees, two trustees shall constituted a quorum provided one of them is a representative of the employee. Any decision of a meeting of the trustees and shall be final and binding on them. The chairman of the Board of Trustees shall have a casting vote in addition to and not instead of his won vote as a Trustee. The Decision of the majority shall be final and binding . binding. In case of dispute ,dispute, the matter shall be referred to the Regional Provident Fund Commissioner whose decision in the matter shall be final and binding. Commencement These rules shall come into force with effect from the 1st March ,March, 1977. July 264Page 37 of 37