Agostini-Favero_paper

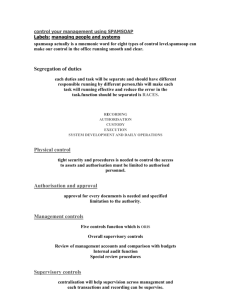

advertisement