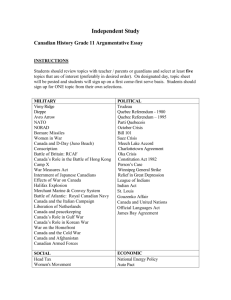

the Winter 2014 Edition

advertisement