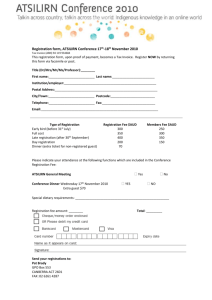

Price List

advertisement