dividend policy as an integral part of the decision

advertisement

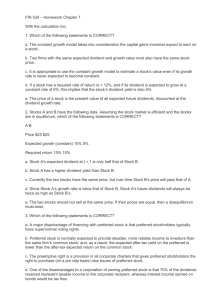

ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ DIVIDEND POLICY AS AN INTEGRAL PART OF THE DECISION-MAKING ON FINANCING OF THE COMPANIES Ismet DERDEMEZ1, Radoje CVEJIĆ2, Zoran KALIČANIN3 1 High Technical Mechanical School of Professional Studies, Trstenik, Serbia, e-mail: fakultet.tutin@live.com 2 Faculty for Strategic and Operational Management, Belgrade, Serbia, e-mail: radoje.cvejic@fsom.edu.rs 3 Faculty for Strategic and Operational Management, Belgrade, Serbia, e-mail: zoran.kalicanin@fsom.edu.rs those dividends are paid to shareholders. The procedure of dividend payments is different from country to country. Some of them pay dividends on a semi-annual or annual basis while enterprises in the US pay out quarterly. Dividends that are paid out to companies whose shares are publicly traded, usually are determined by the board of directors, and a few weeks later are paid out to shareholders (there are a few key dates from the time when the board of directors revealed the payment of dividends to the moment of payment of dividends). Announcement date of dividends (the first important date), then the Board of Directors announce a cash dividend that is paid out for that year (quarter). The importance of that date is reflected in a fact that with announcement of its intention to return, reduce or maintain the dividend at the same level, the company transmits the message to financial markets. If the company chooses its decision to change its dividend, this is the date when, realistically, will come to the market reaction. The date on which or after which the new owner of the shares shall not be entitled to the dividend (another important date) is a day without the right to collect dividends, respectively the time until when investors should buy the shares in order to receive the dividend paid by the company. The share price will generally decline on that day in order to maintain that loss, because the investor who bought shares after that date shall not be entitled to dividends. At the end of the working day, a few days after the date on which or after which the new owner of the shares shall not be entitled to the dividend, the company concludes its business books to transfer shares and prepare a list of shareholders as at the date by which the owner of shares can be registered in the list of shareholders entitled to dividend, actually the list of shareholders to receive dividends. And the last, no less important day, is the payment day of dividends. The practice is that dividends two or three weeks after the date by which the owner of shares can be registered in the Abstract— Strong by investment and strategically well-positioned companies at the end of the business year should make a decision in which amount will refund the amount of cash to its shareholders in the form of dividends or the decision on how they plan to withdraw funds from the business, and how much to invest. Decisions are similar and it is called the dividend resolutions. The main aspect of the dividend policy is to determine the appropriate allocation of profits between dividend payments and an increase in retained earnings of enterprises. Keywords— dividend policy, cash, profit, irrelevance, empirical testing. I. INTRODUCTION W hen making decision of a strategic nature, ie, decision on funding, a part of it is and the decision of dividend policy. The percentage of profit paid as dividend shows that which share of the profits of the enterprise may retain as a source of financing. Maintaining a large amount of current earnings in a company means lesser funds available for the current dividend payment. The main aspect of the dividend policy is to determine the appropriate allocation of profits between dividend payments and an increase in retained earnings of the company. Availability of information reaches the three aspects of dividend policy. The first is a procedural issue concerning the way in which dividends are determined and paid out to shareholders. The second is testing of widespread indicators of the amount of dividends. The third refers to the empirical testing of dividend policy. II. IMPORTANT INFORMATION REGARDING TO DIVIDEND POLICY Important information regarding the dividend policy contain answers to questions that are referred to how the company determines the amount of dividends, and one of the most important is how 44 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ list of shareholders. Although shareholders consider this day as an important, even that day should not occur an impact on the price. When the dividend policy is seen as merely a financial decision, payment of the dividend in cash is a passive rest. The percentage of earnings to be paid out as a dividend will vary from period to period, in accordance with changes in the amount of eligible investment opportunities that are available to the enterprise. If these opportunities are many, it is very likely that the estimates of paid earnings to be zero. On the other hand, if the company is unable to find profitable investment opportunities, dividend payments will amount to 100% of earnings. For situations that are between these two extremes, the ratio of dividend payments will be some number between zero and one. Observation of dividend policy as a passive rest, which is determined only by existence of eligible investment projects, is leading to the conclusion that the dividends are not relevant. As for any companies, the dividend capacity is a major determinant of dividend policy for multinationals. Key factors can be seen on Fig. 1: Fig.1. Key factors of dividend policy Modigliani and Miller gave the most complete argument for the irrelevance of dividends [1]- [3]. They have proved that, with a given investment decisions of companies, the ratio of dividend payment is only a tiny detail. It does not affect shareholders' wealth. Enterprise value is determined only by the ability of earning assets of an enterprise or its investment policy and to the way in which the flow of earnings is divided between dividends and retained earnings do not affect that value. Viewpoint of Modigliani and Miller is that the effect payment of dividends to shareholders' wealth is compensated by other means of financing. We proceed from the sale of additional ordinary shares to collect the share capital instead of retained earnings. After the company made its investment decision, it must decide whether to: (1) keep the profits, (2) or to pay dividends and to sell new shares in the amount of such dividends in order to finance investments. An ordinary share is decreasing until market price due to dilution caused by extreme principal funding, actually is offset by the dividend payment. Therefore, it is said that the shareholder is indifferent between receiving earnings of dividends and receiving of retained profits of the enterprise. From Modigliani’s and Miller's assumptions about safety and perfection of capital market is followed the irrelevance of dividends. Investors can create cash flow of each dividend payment which would have to ensure the corporation but is not able to. If the dividends are less than desired, investors could sell part of their shares in order to get the desired part of the money. If the dividends are greater than desired, investors can use the dividends to purchase additional shares of the company. Investors are able to produce dividends from "homemade", if they are dissatisfied with the current capital structure of companies. For corporate decision on the value, company needs to do something for shareholders that they can not do for themselves. Since investors can produce dividends in homemade, which is perfect substitute for corporate dividends with previous assumptions that dividend policy is irrelevant. As a result of it, one dividend policy is good, as well as any other. The company can create value simply by changing a combination of dividends and retained earnings. As in the theory of capital structure, there is conservation of value, so that the sum of the parts is always the same. There are many arguments in favor of the opposite hypothesis - that dividends are relevant in terms of insecurity. Investors are not indifferent to whether to accept the offering in the form of income from dividends or in the form of share price appreciation. Dividends are received on an ongoing, permanent basis while the prospects for the realization of capital gains are somewhere in the future. Therefore, investors in the company that pays dividends immediately address their uncertainty with respect to those investors who have invested in a company that do not pay dividends. If investors prefer certainty, they will be willing to pay a higher price for a share that offers higher dividend, if all the other elements are unchanged. Only when the investors could create their own dividends, the listed preference would not be rational. Due to psychological reasons or due to 45 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ the need of sense of ease, investors prefer to obtain "a competitive thing," directly from the company, rather than to produce dividends on their own. The effective tax on capital gains (in present value terms) is less than the tax on income from dividends, even when the federal tax rate on the two types of income is equal. This would mean that the share which gives a dividend must have a higher expected return before tax then a share that does not pay dividend and has the same risk. In accordance with this fact, the higher is return of dividend on the share the required return before tax is higher, if all other elements are equal. The irrelevance of dividend payments is based on the idea that when there are good investment opportunities and when dividends are paid, the resources that the company pays have to be compensated by resources that are obtained with external funding. Introduction to the costs of emissions is associated with external financing, which favors the retention of earnings in the company. For every dollar that is paid as a dividend, company must recover every dollar of external financing including amounts of less than a dollar after the cost of emissions. Transaction costs involved in the sale of securities slow down the arbitration process in the same way as described for the debt. Shareholders who want current income must pay a brokerage commission on the sale of part of their shares if they consider that dividend payments is not satisfactory with regard to their current preference for income. Due to these benefits, the shareholders who have a higher demand compared to the current dividends will prefer that the company pay additional dividends. Perfect capital markets also assume that the securities are infinitely divisible. The fact that the smallest unit of share capital is one share, it may result in "inadequacy of scale" when the shares are marketable. It also acts as a barrier to the sale of shares instead of dividends. The share price can positively react to this increase in dividends. The idea is that the company's accounting earnings from financial statements may not reflect the true reflection of economic profit of the company. The share price will respond to an extent that dividends provide information about the economic profits. In other words, dividends in cash are used to investors as indicators of future business. Dividends reflect management expectations in the future. The company should be aimed to establish a dividend policy that will maximize shareholders' wealth. Almost everyone agrees that the corporation would provide to its shareholders the surplus funds in the absence of profitable investment opportunities. The company does not have to pay the total amount of unused earnings in each period. In fact, it can seek the stabilization of the absolute amount of dividends paid from one to period. In the long term, total retained earnings and additional old securities, factors that increase the share capital, will match the amount of new profitable investments. Dividend policy would still be a passive rest, which is determined by the amount of investment. In order the company had justification for the payment of dividends which are higher than the amount of retained earnings, although have been taken all reasonable investments, there must be a net preference for dividends on the market. It is very difficult to "ignore" the arguments that we have just discussed to get to the basics. In support of the dividends go only investment restrictions and some preferences for investors. III. SECURITY AND STABILITY OF DIVIDENTS AND FACTORS THAT AFFECT THEM Dividend policy is becoming a critical weapon, although sometimes neglected, in the fight to reduce agency costs. Agency costs arise when the interests of managers and shareholders disagree. This tension can be increased when it comes to ranking on the nature and level of compensation for executive directors and up to the rate at which the executive directors will reinvest profits. Returning of funds to shareholders, dividend rightfully increases responsibility of decisions on reinvestment that is in the hands of the owner of the company. Dividend policy represents only one group of tools - as well as a well-designed system of compensation - to manage the agency's problems. If management and the board of directors review their management policies, they will see that the dividend should be placed on top of the list. It will always be difficult to make such a system, which will cause the executive authority to act as well as the owners in every way. Instead of wondering why to pay more, executive directors and board of directors should ask themselves whether it is really in the best interest of company not to do so. Though the laws in the countries differ significantly, most states prohibit the payment of dividends, if such dividends decrease the capital. Capital, in some countries, is defined as the total Alpari value of common shares. Other countries define capital so that it includes not only the overall Alpari value of ordinary shares, but also the premiums paid in capital. In addition to these state regulations, dividends can be paid only "up to the amount of retained earnings". The company pays out a dividend "from the money", while the corresponding reduction is recorded in the account of retained earnings. It is interesting that in some countries dividend not only can not exceed the bookkeeping amount of the retained earnings of companies, but also the overall book-keeping value of share capital. Some countries prohibit the 46 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ payment of dividends in cash if the company is insolvent. Since the company's ability to pay its obligations depends more on its liquidity than of capital, restriction of technical insolvency provides the creditors good protection. When money is limited, the company is not allowed to elect the shareholders to the detriment of creditors. When establishing the legal limit to the dividend policy of companies, the next step is the evaluation of resources needed to company. The key is to determine the possible cash flows and cash position of the company if there are no changes in the dividend policy. Except that we must consider the expected results, we should anticipate and the business risk so that we get a number of possible cash flows. When taking decisions on dividends, primarily is considering the liquidity of the company. Since the dividends are cash outlay, the greater is the cash position and overall liquidity of the company, the greater is the ability to pay dividends. A company that is growing and that is profitable, may not be liquid because its funds can go into fixed assets and permanent working capital. Since the management of such companies often wants to maintain a certain level of liquidity due to the financial flexibility and protection in the event of uncertainty, it does not want to jeopardize that position by paying huge dividends. Liquid position is not the only way to ensure financial flexibility and protection against uncertainty. If the company is able to borrow funds in a relatively short period of time, it may be in the form of lines of credit or revolving loan agreement with the bank or simply informal willingness of financial institutions to extend credit. Financial flexibility may result from the ability of the companies to appear in the capital market with bond issue. As the company is larger and better known, its entry in the capital market is easier. What is the ability to rent the company greater, the greater is its financial flexibility, and therefore its ability of dividend payments in cash. With the current borrowing capacity, management should be less concerned about the effect that the dividends have in cash on liquidity. If a company pays huge dividends later may need to raise capital by selling the shares in order to finance profitable investment projects. In addition to these circumstances, a controlling interest of the company may be reduced if shareholders who possess a controlling package of shares are not willing or able to enroll additional shares. These shareholders may choose the payment of less dividends and financing of investment needs by means of retained earnings. Such dividend policy does not have a maximum increase of shareholders' wealth, but it can still be in the interests of those who have a control package. Control can be implemented in a different, a completely various way. When the company is considered by other companies or individuals to acquire, low dividend payments may act as advantage for those outside of companies who want the control package. They are able to convince the shareholders that the company does not act in order to maximize shareholder wealth and they (outsiders) can do it better. Companies that are at risk of takeover can determine the high dividend payments to please the shareholders. The stability of dividend payments is an attractive feature for many investors. If all the other elements are unchanged, the share can has the higher price if during the time pay a stable dividend instead of paying a fixed percentage of earnings. Investors may be willing to pay a premium for a stable dividend for information content of dividends, due to their demand for current income and certain institutional constraints. When profits fall, and the company does not reduce its dividends, the market may have more confidence in share than the company reduced the dividend. Stable dividend could mean that the expectations of management with respect to future are better than it currently shows a decline in earnings. So management can influence the expectations of investors through informative content of dividends. However, management cannot constantly keep cheating on market. If there is a declining trend in earnings, stable dividend will forever leave an impression of bright future. Moreover, if a company is in an unstable job with strong fluctuations in earnings, stable dividend can not ensure the fundamental illusion of stability operations. It appears that most companies follow a long-term policy of targeted relationship on dividend payments. It appears that most companies follow a long-term policy of targeted relationships of dividend payments. When profits rise to a new level, the company is increasing the dividend only if it considers that the increased profits will be held. Companies are also very reluctant to reduce the absolute amount of their dividends in cash. Both of these factors explain why changes in dividends often lag behind changes in earnings. In the ascendant period of economic growth, the gap between dividends and earnings becomes visible when retained earnings grow in relation to dividends. On the contrary, the retained earnings will decrease in relation to dividends. One of the way that the company to increase the distribution of money to its shareholders during the period of prosperity is a voting of extraordinary dividend along with the ordinary dividends that are usually paid out on a quarterly or semi-annual basis. 47 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ After voting for the extraordinary dividend the company warns the investors that this dividend is not an increase of the established rate of dividends. Vote of extraordinary dividends is particularly suitable for companies that have fluctuating profits. Using of extraordinary dividends allows the company to maintain a steady flow of regular dividends, while also distributing a certain premium achieved due to progress. If the company continuously pays extraordinary dividends, it denies their purpose. Extraordinary dividend becomes expected. When is properly set, an extraordinary or special dividend always provides a market the positive information about the current and future business operations. main purpose of fragmentation is that the share looks like more attractive for the purchase, and with that (with any luck) attract more customers. To company will be very difficult to maintain the same dividend in cash per share before and after the fragmentation of shares. But it can increase the effective dividend for shareholders. Theoretically, the dividends in shares or fragmentation of the shares for the investor have no value. They get into the ownership additional shares, but their ownership share in the company remains unchanged. The market price per share should be reduced proportionally, so that the total value of the ownership share remains unchanged. In theory, the dividend in shares or fragmentation of the shares is purely cosmetic changes. If an investor wants to sell a number of shares in order to achieve the income that can be facilitated by the dividends in shares/fragmented shares. Of course, and without dividends in shares/fragmented shares, shareholders may also sell a number of their original shares in order to obtain income. In any case, the sale of shares is the sale of principal and is subject to capital gains tax. It is certain that some investors do not consider the sale of additional shares resulting from the dividend in shares/fragmented shares as a sale of principal. For them, the dividend in shares/fragmented shares are additional benefit. They can sell the additional shares and still retain their original shares. For such shareholders dividends in shares/fragmented shares can have a positive psychological effect. Sometimes the dividends in shares are used in order to preserve cash. Instead of increasing the dividend in cash when rising earnings, the company can keep much of its earnings and votes for less dividends in shares. That decision effectively results in lowering relationship of dividend payment: when earnings increase, but dividend still remains approximately the same, the ratio of the dividend payment will be cut down. Will this share increase shareholders' wealth depends on the matters we have previously discussed. The decision to retain a larger portion of earnings, of course, can be made without a dividend in shares. Although the dividends in shares can satisfy some investors because of their psychological effect, the substitution of cash dividends for common shares involves fairly large administrative costs. Dividends paid in shares are more expensive to administrative processing rather than dividends in cash, ie. cash outlay is the lack of dividend in shares. Fragmentation of shares and to some extent the dividends in shares are used to make shares more attractive for sale in a way that to attract more customers and influence to the structure of shareholders when increasing shares of individual shareholders and reducing shares of institutional IV. DIVIDENTS IN SHARES, FRAGMENTATION OF SHARES AND MERGER OF SHARES The dividend in shares is the payment of the additional common shares to shareholders. It does not constitute an accounting change within the account in the share capital in the balance sheet of the company. The ownership share of shareholders in the company remains unchanged. Accounting makes the difference between a small percentage of dividends in shares and the high percentage of dividends in shares [4], [5], [6], [7]. A large percentage of dividends in shares (usually 25% or more of the previously issued ordinary shares) must be seen differently. While for a small percentage is not expected to have a major effect on the market value of shares, for a large percentage of dividends in shares are expected to significantly reduce the market price of shares. Therefore, in the case of a large percentage of dividends in shares, the conservative view advocates the re-classification of amount limited to Alpari value of additional shares rather than the amount that relates to the market value of a dividend in shares. In case of fragmentation of the shares, the number of shares increases with the proportional decrease in alpri values of shares. On dividends in shares, an alpari value of common shares is not reduced, while in the fragmentation of the shares it reduces. From this it follows that the fragmentation of the shares, account of ordinary shares, premium on additional paid-in capital and retained earnings remain unchanged. Total share capital, of course, remains the same. Total share capital, of course, remains the same. The only change is happening in Alpari value of ordinary shares, which is now based on the value per share half of earlier values. In addition to the accounting monitoring, dividends in shares and fragmentation of the shares is very similar. Fragmentation of the shares (or, alternatively, a large percentage of the dividend in shares) is usually reserved for occasions when a company wants to achieve a significant reduction in the market price of common shares. The 48 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ shareholders. Rather than to increase, the company can reduce the number of ordinary shares in circulation. This can be achieved by summing up the shares. Summing up of shares are applied to increase the market share price, when is consider that the share is sold at too low price. In some cases, it is an attempt to remain on the lists of the greatest stock market shares, because a big drop in prices could lead to removal from the list. Many companies do not like the price of their shares fall significantly below $ 10, per share. As with dividends in shares and ordinary shares of fragmentation, it is very likely that will appear information or effect signaling that is associated with the announcement of the return merger of shares. Usually, that signal is negative, as is negative and the signal that occurs when a company admits to having financial difficulties. However, financial difficulties do not have to be the main motive for the merger. Maybe the company simply wants to raise the share price to a higher level of trade, where the overall trading costs and services are lower. Still, information from practice suggest consistency of statistically significant decline in the share price about the date of publication on merger of shares, assuming that all other factors are unchanged [8][11]. The fall can be reduced by past successful operations of the company, but a good company would nevertheless think twice before it implements the merger of shares. There are too bad apples in the barrel that could spoil everything. funds of increased dividends. When there is no personal incomes tax and transaction costs, these two alternatives theoretically should not represent a difference for shareholders. In the case of redemption, the fewer the number of shares that remain in circulation earnings per share and the dividend per share should rise, which would also cause the growth of the market price share. In theory, the capital gain arising from the purchase should be equal with the dividend that would otherwise be paid. Purchase of shares takes precedence over payment of dividends in cash in terms of taxation of investors to that extent that the tax rate on capital gains is lower than rates on income from dividends. Capital gains tax is paid only when the shares are sold, while the dividend tax must be paid immediately. Repurchase of shares is particularly appropriate in situations when a company has a very large surplus of money for distribution. If these funds are paid to shareholders through an extra dividend, they would immediately have to pay taxes. The company must closely acts that do not develop a permanent program to buy back shares in lieu of payment of dividends. Some under the redemption of shares considered decision about investing, and not on financing. In fact, in the narrow sense, repurchase in fact it is, although shares held as purchased own shares does not provide the expected return as is the case with other investments. No company can take if you "invest" only in their actions. No company can last long if "invest" only in its shares. The decision to repurchase shares should include the distribution of surplus funds when investment opportunities of companies are not attractive enough to justify the investment of these funds now or in the foreseeable future. Therefore, the repurchase of shares cannot really be seen as an investment decision in terms of its definition. Repurchase of shares is best viewed as a kind of a decision on financing for the motive which has a capital structure and dividend policy [16]- [20]. Many large companies have plans for the reinvestment of dividends (DRIP). Within these plans, shareholders have the opportunity to reinvest their dividends in cash in additional shares of the company. There are two basic types DRIP, which vary according to whether additional shares come from existing ordinary shares or new cash issue. If you use the existing shares, the company transfers the dividend in cash of all shareholders who wish to reinvest in the bank acting as trustee. Then the bank buys shares of companies on the open market. Some companies even bear all brokerage costs that arise when purchasing shares during the reinvestment. But in the DRIP, in which shareholders alone bear the brokerage costs, these costs are relatively low V. REPURCHASE OF SHARES AND REINVESTMENT OF DIVIDENTS The three most common of repurchase, [12]- [16], are independent public offers of fixed prices, the Dutch auction of self-public offer and repurchase on the open market. On an independent offer of fixed price, the company provides a formal offer to shareholders to purchase a certain number of shares, usually at a specific price. The offer price is above the current market price. Shareholders may choose to sell their shares at a specific price or they still hold them. Period offer usually takes two to three weeks. If shareholders offer more shares than the company originally wanted to repurchase, the company may choose to redeem all or part of the surplus. However, it is under no obligation to do so. As a rule, the costs of transactions are higher for a company that makes an offer higher than those incurred by purchasing shares on the open market. If a company has excess cash and insufficiently profitable investment opportunities to justify the use of these funds, the distribution of these funds may be in the interests of shareholders. Distribution can be in the form of redemption of shares or payment of 49 ANNALS OF THE UNIVERSITY OF ORADEA Fascicle of Management and Technological Engineering ISSUE #3, 2015, http://www.imtuoradea.ro/auo.fmte/ because the trustees buy shares in large quantities. Another form of invested plan relates to the issuance of new shares. The company just with this method really can gather new assets. This kind of plan has proven to be particularly popular for those companies that need fresh capital for the construction and improvement. Effectively, such a plan reduces the payment of dividends in cash in the company. shareholders. In many other situations, the shares are redeemed with the right intention to be withdrawn. If you look at the total money that corporations distributed to shareholders in cash dividends, repurchase of shares and the takeover bid - dividends are only one (but not always the primary) mechanism for allocation of money. Dividend reinvestment plans (DRIP) allow shareholders to automatically reinvest the paid dividends in additional shares of the company. VI. CONCLUSION REFERENCES Access to the irrelevance of dividends simply affirms that the present value of future dividends remain unapplied even if the dividend policy changes in the schedule and size of dividends. Ie does not say that the dividends, including and the liquidation dividends never be paid out. On the contrary, it says that the postponement of dividends (but only in a case when is expected growth of future dividends) has no effect on the market price of shares. The vote of dividend in shares or fragmentation of shares can provide information to investors. As we have already said, in certain situations, management may have better information about the company than investors. Instead of that information to the media, management could use the dividend in shares or fragmentation of shares that would convincingly demonstrated its confidence in the positive outlook of the company. Does that signal a positive effect on the share price, is an empirical question. The evidence is abundant. There is a statistically significant positive stock price reaction to the announcement of dividends in shares and fragmentation of shares. Information has the effect of the fact that the stock is undervalued and should have a higher value. But we should be careful in interpreting these results. As it turned out, the dividend in shares and fragmentation of shares typically come before dividends in cash and increase of profits. Market observers dividends in shares and fragmented shares as leading indicators of larger dividends in cash and increased earning capacity. So, not only the dividends in shares or fragmented shares those which condition the positive reaction of the share price, but good information indicates these signals. Also, the company must pay a higher dividend and earnings, if it wants the share price to is higher. Some companies repurchase their shares in order to have stimulation by management. In this way it does not increase the total number of shares. Another reason for the repurchase of shares is that their shares to be available for the acquisition of other companies. In certain cases, companies that no longer want to be in the public ownership "become private-owned" by repurchase of all shares of foreign [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11] [12] [13] [14] [15] [16] [17] [18] [19] [20] 50 P. Asquith, and D.W. Mullins, “The Impact of Initiating Dividend Payments on Shareholders' Wealth,” Journal of Busines, vol. 56 1983, pp. 77-96. L.S. Bagwell, “Dutch Auction Repurchases: An Analysis of Shareholder Heterogeneity,” Journal of Finance, vol. 47 1992, pp. 71-105. H.K. Baker, A.L. Phillips, and G.E. Powell, “The Stock Distribution Puzzle: A Synthesis of the Literature on Stock Splits and Stock Dividends“, Financial Practice and Education, vol. 5 1995, pp. 24-37. H.K. Baker, and E.G. Powell, “Determinants of Corporate Dividend Policy: A Survey of NYSE Firms. Financial Practice and Education, 10 (Spring/Summer 2000), 29-40. D.M. Bliine, and C.P Cullinan, “Distributions to Stockholders: Legal Distinctions and Accounting Implications for Classroom Discussion,“ Issues in Accounting Education, vol. 10 1995, pp. 307-316. M.S. Grinblatt, W.R. Masulis, and S. Titman, “The Valuation Effects of Stock Splits and Stock Dividends,“ Journal of Financial Economics, vol. 13 1984, pp. 461-490. J. Lintner, “Distribution of Income of Corporations Among Dividends, Retained Earnings, and Taxes,“ American Economic Review, vol. 46, 1956, pp. 97-113. R.H. Litzenberger, and K. Ramiswamy, “Dividends, Short Selling Restrictions, Tax-Induced Investor Clienteles and Market Equilibrium,“ Journal of Finance, vol. 35, 1980 pp. 469-482. R.F.L. Litzenberger, and C.J. Van Horne, “Elimination of the Double Taxation of Dividends and Corporate Financial Policy,“ Journal of Finance, vol. 33 1978, pp. 737-749. J. Markese, “Common Stock Dividends: What Are They Worth?“ AAII Journal, vol. 11, 1989, pp. 29-33. M. McNichols, and D. Ajay “Stock Dividends, Stock Splits, and Signaling,“ Journal of Finance, vol. 45, 1990, pp. 857-879. M.H. Miller, “Behavioral Rationality in Finance: The Case of Dividends,“ Midland Corporate Finance Journal, vol. 4, 1987, pp. 6-15. F.L. Merton, and K. Rock. “Dividend Policy under Asymmetric Information,“ Journal of Finance, Vol. 40 1985, pp. 1031-1051. S.F. O'Byrne, and J. Pettit, “Stock Splits: What Good Are They?“ Shareholder Value, vol. 2, 2002, pp. 34-39. K. H. Al-Yahyaee, “Shareholder wealth effects of stock dividends in a unique environment,” J. Int. Finance. Mark. Institutions Money, vol. 28, pp. 66–81, Jan. 2014. K. Chang, E. Kang, and Y. Li, “Effect of institutional ownership on dividends: An agency-theory-based analysis,” J. Bus. Res., Oct. 2015. A. De Cesari and W. Huang-Meier, “Dividend changes and stock price informativeness,” J. Corp. Financ., vol. 35, pp. 1–17, Dec. 2015. E. Floyd, N. Li, and D. J. Skinner, “Payout policy through the financial crisis: The growth of repurchases and the resilience of dividends,” J. finance. econ., vol. 118, no. 2, pp. 299–316, Aug. 2015. J. Kanniainen, “Option pricing under joint dynamics of interest rates, dividends, and stock prices,” Oper. Res. Lett., vol. 39, no. 4, pp. 260–264, Jul. 2011. D. Brawn and A. Sevǐc, “Net payout return: An alternative to the traditional returns approach based on dividends and share repurchases,” Finance. Res. Lett., vol. 13, pp. 66–73, May 2015.