Of Black Crows, Pregnant Candles and Evening Stars

advertisement

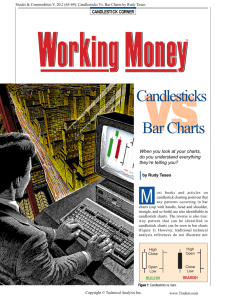

THE LONDON BULLION MARKET ASSOCIATION Of Black Crows, Pregnant Candles and Evening Stars An Introduction to Candlestick Charting by Nicole Elliott, Senior Analyst, Mizuho Bank Elliott switched to candlestick charts for her market analysis because she felt that they compress more information and display it graphically in a fashion more easily readable than the bar version. The Zen-like poetry of the naming conventions is an added benefit. Legend has it that, shortly after their invention almost 400 years ago, one very successful trader used candlestick charts to execute over 100 consecutive winning trades. But legend or not, candlestick charts have remained in use throughout the centuries – and in fact have enjoyed a surge in popularity in recent years. It was Japanese rice futures traders who first developed these candlestick charts in the 1600s, well pre-dating the first American bar charts of the 1880s.They are based upon the same information as bars and, as with bar charts, for any given period – a month, a day or an hour – prices are plotted vertically on a chart moving from left to right by the chosen time interval.The examples used in Chart 1 are based on days, but the rules apply equally to other periods. A note is made of the opening price, the high and low points, and the closing price that day. The high and low are treated in the conventional way, joined with a vertical line, but the other two points are configured differently than in a bar chart.The open and close are used to form the body of the candle page 18 the three key elements to study. fig 1 Some years ago, Nicole Open Close and are plotted as Open Big bodies logically a slightly wider Close mean that the market section around the has seen a sizeable move vertical line. On bar fig 2 Doji Patterns in price that day.The closer the charts the open is open and close are to the sometimes plotted as a extremes of the day’s range, small horizontal line to the bigger the body, and the the left of the bar, while more momentum in the market. the close is always Conversely, the smaller the plotted as a small fig 3 Spinning Tops & Bottoms body, the more evenly horizontal to the right. If matched are buyers and sellers, these were joined, you can and the higher the likelihood of a see that it is only a small step from trend reversal. Small bodies with bars to candles (Figure 1). lines of equal size at either end are called spinning tops or spinning If prices open high and trade fig 4 Shooting Stars bottoms depending on where they down towards the close, the lie at the end of a trend (Figure 3). body of the candle is coloured in black (or any other of the six A very reliable pattern has a small million colours available on body (of either colour) at one today’s computers). If end of a large daily range, the market closes above where it opened, then the fig 5 Hanging Man & Hammer showing that a market has opened and scurried all the body is left empty, or way to the other extreme, only to traditionally white, based upon the reverse direction and finish back use of white graph paper. where it started. The shadow is the long line attached to the small Patterns formed by the body. At the top of a bull trend, candlesticks are given a fig 6 Bullish Engulfing this formation is called a name when they signal a shooting star or hanging man; possible change in the at the bottom, it’s called a prevailing trend. One of the hammer, as the pattern looks most common of these is a like a mallet.These are doji – derived from the considered very powerful and Japanese for simultaneous – fig 7 Bearish Engulfing clear chart signals that warn of which occurs when the an immediate and often open and close are at violent change in trend exactly the same level and (Figures 4 and 5). the body is represented by a horizontal line (Figure 2). Other reversal patterns look at Shooting Star, Hanging Man, two or more candles in succession. A bullish Spinning Top engulfing pattern is one where, on day two, The total day’s range and how this lies relative there is a candle with a large white body to the body, the colour of the body, and the whose range is bigger than the previous day’s body size relative to the whole candlestick are (ideally a doji occurs on the first day, followed ALCHEMIST ISSUE THIRTY–FOUR This chart below of COMEX gold clearly illustrates several key formations. XAU=, Bid (Candle) Daily 20 December 2003 – 13 May 2004 Shooting Star Shooting Star Pr USD Spinning top Bearish Engulfing 425 420 415 410 405 400 395 Harami 390 385 Hammer 380 Hammer 375 370 29 Dec 03 12 Jan 03 26 Jan 03 09 Feb 03 23 Feb 03 by a candle whose body is bigger than the whole of the previous day’s range – Figure 6). A bearish engulfing pair is the opposite, with a large black body eclipsing the previous small body (Figure 7). 08 Mar 03 22 Mar 03 05 Apr 03 19 Apr 03 03 May 03 bodies) at the top of a bull trend are, as the name hints, an evil omen and suggest the trend will turn down.Three white soldiers at the bottom of a bear market are the opposite and hint at a bullish trend emerging. Other three-candle combinations are the morning Dark cloud cover is a similar topping pattern, and evening stars with the former at a bottom but the second day’s black body does not and the latter at a top.The first candle in an totally eclipse the previous evening star combo has a day’s white body, which can large white body; the fig 8 Dark Cloud Cover be as big as day two’s body second day’s small body (Figure 8). Piercing pattern is does not touch the first the name of this formation body, nor does it touch the when it occurs at the bottom third day’s big black body of a trend when a large white (Figure 11). The reverse candle does not quite overlap holds for a morning star the previous day’s black one where the third candle is (Figure 9). white and the first one has a fig 9 Piercing Pattern big black body. The middle Harami (stemming from the day must have a small body, but Japanese word for pregnant) are this can be of either colour (Figure patterns that are also made up of 12). two days’ worth of candles, where the second day’s body As with bar charts, we also look (which can be either colour) for bigger patterns made up fig 10 Harami lies totally within the from a series of candles such previous day’s big body. as head and shoulders, These are opposite of the triangles, double bottoms, engulfing patterns and and we use trendlines plus represent what we support and resistance western chartists would levels as in conventional call an inside day.These technical analysis patterns denote uncertainty, fig 11 Evening Star and show that a potential If all this is starting to turning point in that the sound complicated, do big day’s move has seen no not worry. The main follow-through (Figure advantage of using 10). candlestick charting is that the closing price Three black crows (three relative to the open fig 12 Morning Star consecutive big black stands out clearly, and spikes or false breaks of a trendline can be easily spotted, as they are shadows. With practice, your eyes become able to skim over lots of charts and pick out quickly those that are interesting and worth watching; the ones showing markets on the move or trends that are reversing. This article provides only a brief introduction to candlestick charting. For further reading, see Japanese Candlestick Charting Techniques and Beyond Candlesticks by Steve Nison, published by John Wiley and Sons Inc.There are also numerous websites devoted to candlesticks. ■ Nicole Elliott, a graduate of the London School of Economics and member of the Society of Technical Analysts, has worked in the City of London for over 20 years. In trading, sales or as an analyst within the treasury departments of major international banks, technical analysis has always formed the backbone of her methodology.As Mizuho Corporate Bank’s senior analyst in London she covers the foreign exchange, interest rate and commodity markets and equity indices. page 19