JOURNAL ENTRIES IN CBS ACCOUNTS

RECEIVABLE

Default GL account numbers ........................................................................................................................ 1 Accrual basis clients...................................................................................................................................... 2 Sales Tax Adjustment (STA) .................................................................................................................. 3 Cash basis clients ......................................................................................................................................... 4 Journalizing all activity through the Accounts Receivable account............................................................... 5 The purpose of this document is to provide information on how CBS Accounts Receivable posts journal

entries to general ledger accounts.

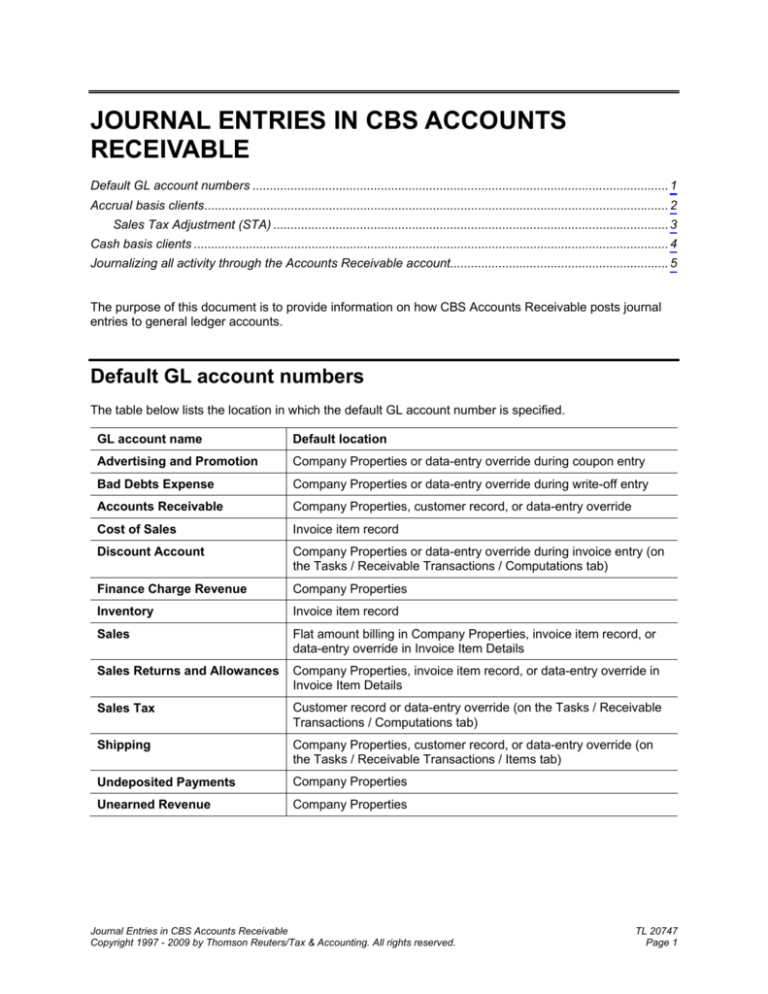

Default GL account numbers

The table below lists the location in which the default GL account number is specified.

GL account name

Default location

Advertising and Promotion

Company Properties or data-entry override during coupon entry

Bad Debts Expense

Company Properties or data-entry override during write-off entry

Accounts Receivable

Company Properties, customer record, or data-entry override

Cost of Sales

Invoice item record

Discount Account

Company Properties or data-entry override during invoice entry (on

the Tasks / Receivable Transactions / Computations tab)

Finance Charge Revenue

Company Properties

Inventory

Invoice item record

Sales

Flat amount billing in Company Properties, invoice item record, or

data-entry override in Invoice Item Details

Sales Returns and Allowances

Company Properties, invoice item record, or data-entry override in

Invoice Item Details

Sales Tax

Customer record or data-entry override (on the Tasks / Receivable

Transactions / Computations tab)

Shipping

Company Properties, customer record, or data-entry override (on

the Tasks / Receivable Transactions / Items tab)

Undeposited Payments

Company Properties

Unearned Revenue

Company Properties

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

TL 20747

Page 1

Accrual basis clients

If your accountant set up your CBS program to use the accrual basis accounting method, the program will

post a journal entry to the specified GL account at the time the transaction is finalized. If a transaction is

subsequently voided or deleted, the program creates a reversal entry for that transaction.

The tables below identify the specific GL accounts to which the program posts the journal entry in the

given situation.

Notes

When voiding or deleting a transaction, CBS creates a reversal transaction of the entries listed below.

When unapplying a payment, CBS creates a reversal transaction of the entries listed below for

applying the payment type.

CBS allows you to void or delete a refund invoice, but it does not allow you to unapply a refund

invoice.

Debit entries

Credit entries

Invoice (entering)

Accounts Receivable

Cost of Sales

Inventory

Sales

Shipping

Sales Tax

Discount offered

Discount Account

Accounts Receivable

Created and dated with

the same date as the

transaction date.

Discount expired

Accounts Receivable

Discount Account

Created and dated the

day after the discount

expiration date.

Discount used

(discount honored)

Discount Account

Accounts Receivable

Created and dated the

day after the discount

expiration date.

Depositable payment

(entering)

Undeposited Payments

Unearned Revenue

Depositable payments

include cash, credit card,

check, COD.

Depositable payment

(applying to an

invoice)

Unearned Revenue

Accounts Receivable

Depositable payment

(depositing)

Cash

Undeposited

Payment

Coupon (entering)

Advertising and

Promotion

Unearned Revenue

Coupon (applying to

an invoice)

Unearned Revenue

Accounts Receivable

Write-off (entering)

Bad Debts Expense

Unearned Revenue

TL 20747

Page 2

Notes

A coupon is a nondepositable payment.

A write-off is a nondepositable payment.

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

Debit entries

Credit entries

Notes

Write-off (applying to

an invoice)

Unearned Revenue

Accounts Receivable

Credit memo

(entering)

Inventory

Sales

Sales Tax

Shipping

Cost of Sales

Unearned Revenue

Credit memo

(applying)

Unearned Revenue

Accounts Receivable

Finance charge

invoice

Accounts Receivable

Finance charge

revenue

Refund invoice

(creating)

Accounts Receivable

Undeposited

Payments

Occurs at the same time

as applying a refund

invoice.

Refund invoice

(applying)

Unearned Revenue

Accounts Receivable

Occurs at the same time

as creating a refund

invoice.

Refund check or other

payment (creating)

Undeposited Payments

Cash

Created in the

CheckWriter checkbook.

Sales Tax Adjustment (STA)

The program creates a Sales Tax Adjustment journal entry under the following conditions:

You marked the Include Discount checkbox for the sales tax code. (CBS subtracts the discount from

invoice subtotal before applying the sales tax.)

Your accountant set up your CBS program to use the accrual basis accounting method.

The Discount Honored amount is not equal to the Discount Offered amount when you close the

invoice.

Debit entries

Credit entries

Discount Honored is greater than Discount Offered

Sales tax payable

Accounts Receivable

Discount Honored is less than Discount Offered

Accounts Receivable

Sales tax payable

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

TL 20747

Page 3

Cash basis clients

If your accountant set up your CBS software to use the cash basis accounting method, the program will

post a journal entry to the specified GL account once cash is received for revenue or dispersed for

expenses.

The tables below identify the specific GL accounts to which the program posts the journal entry in the

given situation.

Notes

When voiding or deleting a transaction, CBS creates a reversal transaction of the entries listed below.

When unapplying a payment, CBS creates a reversal transaction of the entries listed below for

applying the payment type.

CBS allows you to void or delete a refund invoice, but it does not allow you to unapply a refund

invoice.

Amounts posted to the Accounts Receivable account will always be zero because CBS debits and

credits the Accounts Receivable account at the time a payment is applied to an invoice. The Accounts

Receivable account is not included on the Transactions List report.

Debit entries

Credit entries

Notes

Depositable payment

(entering)

Undeposited

Payments

Unearned Revenue

Depositable payments

include cash, credit card,

check, COD.

Depositable payment

(applying to an invoice)

Unearned Revenue

Accounts Receivable

Coupon (entering)

Advertising and

Promotion

Unearned Revenue

Coupon (applying to an

invoice)

Unearned Revenue

Accounts Receivable

Write-off (entering)

Bad Debts Expense

Unearned Revenue

Write-off (applying to an

Invoice)

Unearned Revenue

Accounts Receivable

Credit memo (entering)

Inventory

Sales

Sales Tax

Shipping

Cost of Sales

Unearned Revenue

Credit memo (applying)

Unearned Revenue

Accounts Receivable

Payment or credit

memo (applying to an

invoice)

Accounts Receivable

Cost of Sales

Inventory

Sales

Sales Tax

Shipping

TL 20747

Page 4

A coupon is a nondepositable payment.

A write-off is a nondepositable payment.

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

Debit entries

Credit entries

Notes

Discount used

(honored)

Discount Account

Unearned Revenue

Created when a payment

is applied to an invoice.

Depositable payments

(depositing)

Cash

Undeposited

Payment

Finance charge invoice

Accounts Receivable

Finance Charge

Revenue

Refund (creating a

refund invoice)

Accounts Receivable

Undeposited

Payments

Occurs at the same time

as applying a refund

invoice.

Refund (applying a

refund invoice)

Unearned Revenue

Accounts Receivable

Occurs at the same time

as creating a refund

invoice.

Refund check or other

payment (creating)

Undeposited

Payments

Cash

Created in the

CheckWriter checkbook.

Journalizing all activity through the Accounts Receivable

account

If you do not want to journalize undeposited payments through the Undeposited Payment account and

unapplied payments through the Unearned Revenue account, you can set up these accounts to use the

Accounts Receivable account. (Select the same GL account number for the Accounts Receivable,

Undeposited Payment, and Unearned Revenue accounts on the Accounts Receivable tab of the File /

Company Properties dialog.) If you do this, the following ramifications will occur.

All activity will flow through the Accounts Receivable account, and CBS will create many in and out

journal entries.

You should deposit depositable payments before you export to your accountant; otherwise, these

amounts will not affect the general ledger. CBS does not validate your data to confirm that

depositable payments have been deposited before you export.

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

TL 20747

Page 5

TL 20747

Page 6

Journal Entries in CBS Accounts Receivable

Copyright 1997 - 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

![Job Description [DOCX - 56 KB]](http://s3.studylib.net/store/data/006627716_1-621224f86779d6d38405616da837d361-300x300.png)