ACC 2204-01 Intermediate Accounting II Spring 2016 H AZAD

advertisement

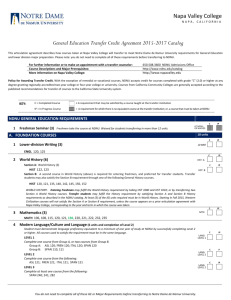

Notre Dame de Namur University Course Syllabus ACC 2204 Intermediate Accounting II Spring 2016 Instructor: Hamid R. Azad Ph.D., CPA, CMA Class Day/Time: Wednesday 6:00 pm– 9:00 pm (1/15/2016 – 5/6/2016) Class Room: CH-21 Office: Ralston Annex Room 5 Phone: 650-508-355 E-mail Address: hazad@ndnu.edu Office Hours: T, R 7:00am- 8:00am Wednesday 4:00pm – 6:00pm, other times by appointment Class Time/Day: Wednesday 6:00pm – 9:00 pm Credit Hours: 3 Credit Hours Prerequisite: Intermediate Accounting I BUS 2202 or equivalent with a grade of C or higher Textbook: Intermediate Accounting, 15th edition FASB UPDATE , 2015, Kieso, Weygandt, Warfield; Wiley Publishing Co. Course Description: Continuation of intermediate accounting I. Topics include: Acquisition and disposal of plant assets, intangible assets, long term liabilities, stockholders’ equity, Compensation, deferred income taxes, Pension and leases. Course learning Objective: After completion of this course the student should be able to: - Understand the nature, characteristics, measurement, and disclosure practices to a variety of current assets including cash, accounts receivable, and inventories. - Describe the initial valuation, treatment of subsequent costs to acquisition, and disposal of property, plant, and equipment. - Explain the procedures for depreciation of tangible and amortization of intangible assets and accounting issues related to asset impairments. - Describe the nature, type, and valuation of current and long-term liabilities including loss contingencies. Class Assessment: Course grade is based on four quizzes, three tests, a paper, and class participation. Quizzes 3x20 = 60 Tests 150 Final Exam 50 Paper 20 Attendance 10 Assignment 10 ______ TOTAL 300 - Students are expected to attend all classes prepared and participate in class discussions. There is one point deduction for missing each class and two point deduction for not doing the homework. Missing more than three classes will result in zero point for attendance. - Students are required to write a paper on Statement of Financial Accounting Concept No. 7. The paper should be 4 to 5 pages long (Double Spaced). - If a student is unable to take a test or quiz as scheduled, for a justifiable reason, the instructor must be contacted before the exam date and prior arrangements must be made concerning the exam. - Assignments will be checked at the beginning of class and late submission of assignments will not be accepted. Grading: Total points possible for the course is 300 and the following scale will be used to assign your course grade: 92%-100% 90%- Less than 92% 87%-Less than 90% 82%-Less than 87% 80%-Less than 82% 77%-Less than 80% A AB+ B BC+ 72%-Less than 77% 70%-Less than 72% 67%-Less than 70% 62%-Less than 67% 60%-Less than 62% Less than 60% C CD+ D DF Academic Honesty: Academic honesty is a cornerstone of our values at NDNU. If any words or ideas used in an assignment, submission do not represent your original words or ideas, you must cite all relevant sources and make clear the extent to which such sources were used. Words or ideas that require citation include, but are not limited to, all hard copy or electronic publications, whether copyrighted or not, and all verbal or visual communication when the content or such communication clearly originates from an identifiable source. Consult the NDNU student handbook regarding consequences of misrepresenting your work. Privacy and Confidentiality: One of the highlights of the NDNU academic experience is that students often use real-world examples from their organization in class discussions and in their written work. However, it is imperative that students not share information that is confidential, privileged, or propriety in nature. Students must be mindful of any contracts they have agreed to with their companies. Learning and Other Disabilities: If you have a learning disability or other circumstances that requires accommodations in this class, you must bring it to the attention of program for academic support and services (PASS) to arrange for possible accommodations. (650-508-3670) Tentative Schedule: Date Discussion Chapter 8 – Valuation of Inventories January 20 January 27 February 3 February10 February 17 February 24 March 2 March 9 March 16 March 23 Chapter8 E8- 23, 24, 25, 26 Quiz # 1 on Chapter 8 Chapter 9 – Inventories, Additional valuation Issues Chapter 9 E 9 – 2, 4, 5, 6, 12, 14, 15, 18, 19, 20 Test # 2 on Chapters 8 and 9 Chapter 10: Acquisition and Disposal of Property, Plant, and Equipment Chapter 10 Chapter 11: Depreciation, Depletion, and Impairment E 10-5, 8, 9, 13, 17, 20 Quiz # 2 on Chapter 10 Chapter 11 E11-2, 6, 8, 12, 13, 15, 16 Spring Break Test # 2 on chapters 10 and 11 Chapter 12: Intangible Assets Chapter 12: Intangible Assets March 30 Quiz # 3 on Chapter 12 Chapter 13: Current Liabilities April 6 Chapter 13 Paper on SFAC NO. 7 is Due April 13 Test # 3 on Chapters 12 and 13 April 20 Chapter 14: Long-Term Liabilities April 27 April 30 Chapter 14 May 2 - 6 Final on Chapter 14 NOTE: Assignment E 8-1, 6, 9, 13, 15, E 12 – 3, 6, 8, 11, 13, 15, 17 E 13-7, 8, 10, 12, 13, P 13 -7 Chapter 14 This Course syllabus and Schedule are subject to change in the event of extenuating circumstances. Revised 10/21/2015