MASTER MINDS

No.1 for CA/CWA & MEC/CEC

13. JOB COSTING & BATCH COSTING

SOLUTIONS TO ASSIGNMENT PROBLEMS

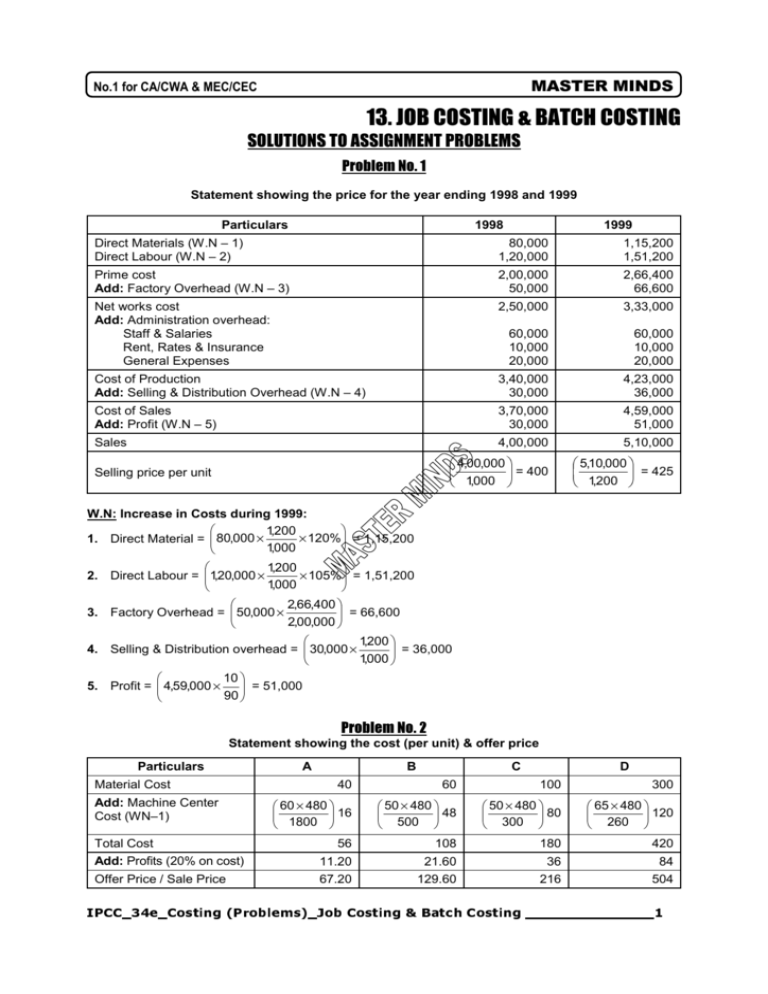

Problem No. 1

Statement showing the price for the year ending 1998 and 1999

Particulars

1998

1999

Direct Materials (W.N – 1)

Direct Labour (W.N – 2)

80,000

1,20,000

1,15,200

1,51,200

Prime cost

Add: Factory Overhead (W.N – 3)

2,00,000

50,000

2,66,400

66,600

Net works cost

Add: Administration overhead:

Staff & Salaries

Rent, Rates & Insurance

General Expenses

2,50,000

3,33,000

60,000

10,000

20,000

60,000

10,000

20,000

Cost of Production

Add: Selling & Distribution Overhead (W.N – 4)

3,40,000

30,000

4,23,000

36,000

Cost of Sales

Add: Profit (W.N – 5)

3,70,000

30,000

4,59,000

51,000

Sales

4,00,000

5,10,000

4,00,000

=

1,000

Selling price per unit

400

5,10,000

1,200

= 425

W.N: Increase in Costs during 1999:

1,200

× 120% = 1,15,200

1. Direct Material = 80,000 ×

1

,

000

2. Direct Labour = 1,20,000 ×

1,200

× 105% = 1,51,200

1,000

3. Factory Overhead = 50,000 ×

2,66,400

= 66,600

2,00,000

4. Selling & Distribution overhead = 30,000 ×

5. Profit = 4,59,000 ×

1,200

= 36,000

1,000

10

= 51,000

90

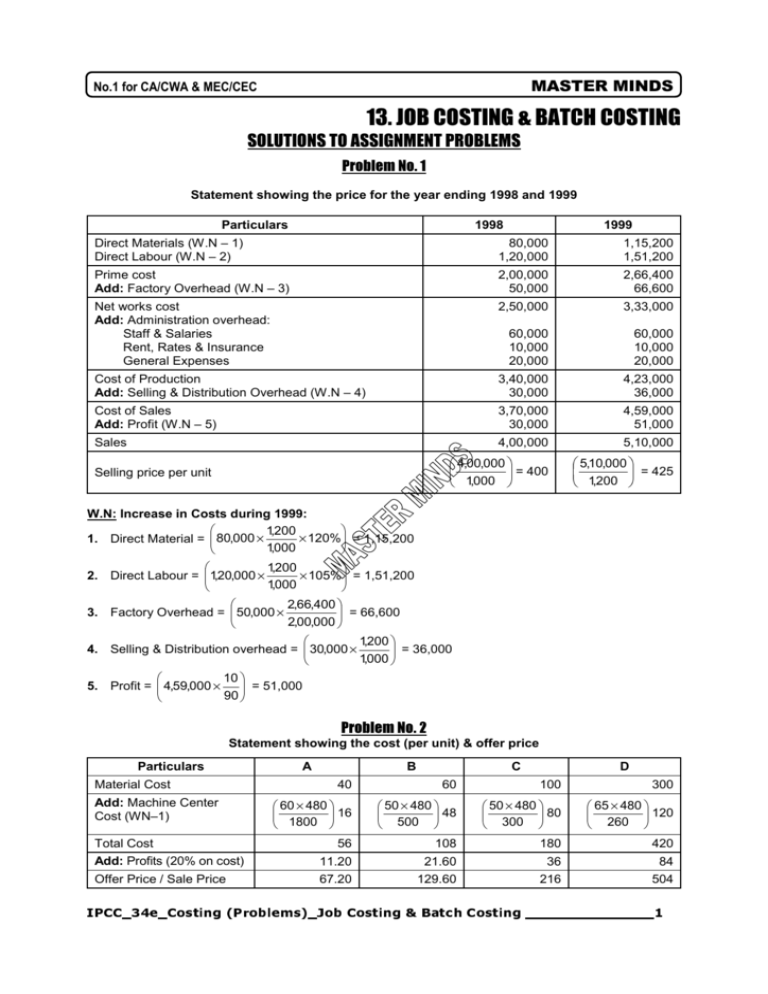

Problem No. 2

Statement showing the cost (per unit) & offer price

Particulars

Material Cost

A

B

C

D

40

60

100

300

60 × 480

16

1800

50 × 480

48

500

50 × 480

80

300

65 × 480

120

260

56

108

180

420

Add: Profits (20% on cost)

11.20

21.60

36

84

Offer Price / Sale Price

67.20

129.60

216

504

Add: Machine Center

Cost (WN–1)

Total Cost

IPCC_34e_Costing (Problems)_Job Costing & Batch Costing ______________1

Ph: 0863 – 22 42 355

www.gntmasterminds.com

W.N-1: Calculation of Overhead Distribution to Products on the basis of Machine Hours

1800

Machine hours for Product A =

= 60 Machine hours

30

500

Machine hours for Product B =

= 50 Machine hours

10

300

Machine hours for Product C =

= 50 Machine hours

Copy Rights Reserved

6

To MASTER MINDS, Guntur

260

Machine hours for Product D =

= 65 Machine hours

4

Total Machine Hours

= 225 Machine hours

Total Factory Overhead per month = (50,000 + 10,000 + 2,000 + 6,000 + 40,000) = Rs.1,08,000

1,08,000

= Rs. 480 per Machine Hour

Factory Overhead Recovery rate per machine hour =

225

PROBLEM NO.3

Customer Details ———

Date of commencement ——

Job Cost Sheet

Job No._________________

Date of completion _________

Particulars

Direct materials

Direct wages :

Deptt. X Rs. 2.50 × 8 hrs. = Rs. 20.00

Deptt. Y Rs. 2.50 × 6 hrs. = Rs. 15.00

Deptt. Z Rs. 2.50 × 4 hrs. = Rs. 10.00

Chargeable expenses

Prime cost

Overheads:

5,000

Deptt. X=

X100 = 50% of Rs. 20 = Rs. 10.00

10,000

Deptt. Y =

Amount(Rs.)

70

45

5

120

9,000

X100 = 75% of Rs. 15 = Rs. 11.25

12,000

2,000

X100 = 25% of Rs. 10 = Rs. 2.50

8,000

Works cost

20,000

Selling expenses =

X100 = 10% of work cost

2,00,000

Total cost

Profit (20% of total cost)

Selling price

Deptt. Z =

23.75

143.75

14.38

158.13

31.63

189.76

PROBLEM NO.4

Particulars

Direct Materials

Direct Wages

Price Cost

Add: POH

Last year

9,00,000

7,50,000

16,50,000

4,20,000

Relationship

Actuals

Actuals

Actuals

Rs. 4,50,000

=60% on Wages

Absorbed at

Rs. 7,50,000

Next year

12,00,000

7,50,000

19,50,000

4,50,000

IPCC_34e_Costing (Problems) _ Job Costing & Batch Costing ______________2

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Cost of Prodn

Add: S & D OH

25,20,000

5,25,000

Cost of Sales

Add: Profit

30,45,000

6,09,000

Sales

36,54,000

Taken at

Rs. 5,25,000

= 25% on Factory Cost

Rs. 21,00,000

+ 15% thereon

Rs. 6,09,000

= 20% on Cost of Sales

Rs. 30,45,000

28,80,000

6,00,000 +

15% =

6,90,000

35,70,000

7,14,000

42,84,000

PROBLEM NO.5

Particulars

Direct Materials

Direct Labour: Department A

Department B

Department C

Prime Cost

Add: Overheads: Department A

Department B

Department C

Total Cost

th

Add: Profit (25% i.e. 1/4 on

Price = 1/3th on Cost)

Quoted Selling Price

Job 1

Job 2

154.00

20 hours X Rs.7.60 = 152.00

12 hours X Rs.7.00 = 84.00

10 hours X Rs. 6.80 = 68.00

458.00

20 hours X Rs. 12.86 = 257.20

12 hours X Rs. 12.40 = 148.80

10 hours X Rs. 14.03 = 140.03

1,004.03

108.00

16 hours X Rs. 7.60 = 121.60

10 hours X RS. 7.00 = 70.00

14 hours X Rs. 6.80 = 95.20

394.80

16 hours X Rs. 12.86 = 205.76

10 hours X Rs. 12.40 = 124.00

14 hours X Rs. 14.03 = 196.42

920.98

334.68

1,338.71

306.99

1,227.97

PROBLEM NO.6

Job cost sheet

Particulars

Direct material (a)

Direct wages (b)

Prime cost (a) + (b)

Add: Factory overhead:

Machining department – 15h x 4

Finishing department – 150% on DW

Total cost / works cost

No .of units

Cost per unit

Amount

57

85

142

60

60

262

10

26.2

Working notes:

Overhead recovery rate =

Estimated overhead

Estimated base

80,00,000

= Rs.4 M.H

20,00,000

60,00,000

For finishing department =

x 100 = 150%

40,00,000

For machining department =

PROBLEM NO.7

Job costing

Particulars

Direct material

Direct wages

Prime cost

(+) Factory overhead

Job 1

17,150

12,500

29,650

43,750

Work in progress

Job 2

29,025

23,000

52,025

80,500

Finished goods

Job 3

4,500

4,500

1,50,750

IPCC_34e_Costing (Problems)_Job Costing & Batch Costing ______________3

www.gntmasterminds.com

Ph: 0863 – 22 42 355

(350% on wages)

Gross works cost

(+) Work in progress

73,400

8,500

81,900

1,32,525

1,32,525

20,250

46,000

66,250

Closing work in progress:

Job 1 + job 2 = 81,900 + 1,32,525 = 2,14,425

PROBLEM NO.8

Direct Material

Direct Wages

Particulars

Given

Department I Given

Department II Given

Department III Given

Prime Cost

Add: Factory Overheads (absorbed based on Direct Labour Cost)

Rs.8,000

Department I

= 80% on Direct Labour Cost of Rs. 2,000

Rs.10,000

Rs.4,000

= 50% on Direct Labour Cost of Rs. 1,500

Department II

Rs.8,000

Rs.7,200

= 60% on Direct Labour Cost of Rs. 3,000

Department III

Rs.12,000

Factory Cost

Rs.

6,800.00

2,000.00

1,500.00

3,000.00

13,300.00

1,600.00

750.00

1,800.00

17,450.00

Rs.11,420

Add: AOH absorbed based on Factory Cost =

= 10% on Works Cost

Rs.1,14,200

of Rs. 17,450

Total Cost

th

Add: Profit (20% on Price, i.e. 25% on Total Cost) i.e. 1/4 of Rs. 19,195

Estimated Selling Price

1,745.00

19,195.00

4,798.75

23,993.75

Problem No. 9

Statement showing the profit from sale of 60% capacity and additional 20% capacity (i.e. at 80,000 units)

Particulars

Sales

Less: Variable cost:

Direct material (W.N – 1)

Direct wages (W.N – 2)

Factory Overhead

Selling Overhead

Contribution

Less: Fixed Cost (W.N – 3)

Profit required

60,000 units

Per unit

Total

15

9,00,000

4.20

1.20

3.00

0.25

6.35

2,52,000

72,000

1,80,000

15,000

3,81,000

2,47,500

1,33,500

20,000 units

Per unit

Total

(b/f)11.15 2,23,000

4.20

1.20

3.00

0.25

2.50

84,000

24,000

60,000

5,000

50,000

(Note) 50,000

80,000 units

Total

11,23,000

3,36,000

96,000

2,40,000

20,000

4,31,000

2,47,500

1,83,500

W.N-1: Revised Direct Material Cost = 4 X 105% = 4.20

W.N-2: Revised Direct Wages = 1 X 120% = 1.20

W.N-3: Calculation of Fixed Cost:

IPCC_34e_Costing (Problems) _ Job Costing & Batch Costing ______________4

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Particulars

Factory Overhead = 6 X 50% = 3 X 60,000

Selling Overhead = 1 X 75% = 0.75 X 60,000

Add: Increased by 10%

Total Fixed Cost

Amount

1,80,000

45,000

2,25,000

22,500

2,47,500

2,23,000

= Rs. 11.15 per piece.

20,000

Note: Fixed Cost is to be ignored, as there will be no increase in it, on acceptance of this order.

Selling Price per piece =

BATCH COSTING

Problem No. 1

EQB

=

2DS

=

C

2 x 500 x 12 x 60

0.1x 20

= 600 units.

Problem No. 2

1. EBQ =

2AS

C

Where:

A = Annual Demand for Finished Product = 2,40,000 units

S = Set-Up Cost per batch = Rs.75

C = Carrying Cost per unit of Finished Product per annum = Re. 1.00

On substitution, EBQ = 6,000 units.

2. Comparison of Associated Costs at different Batch Output Levels:

a.

b.

c.

d.

Particulars

Batch Quantity

Number of Batches

p.a

Set-up Costs p.a. at

Rs.75

Average Inventory

e. Associated Costs

p.a. = (c + e)

EBQ

6,000 units

2,40,000 ÷ 6,000 =

40

40 X Rs. 75 = Rs.

3,000

½ X 6,000 = 3,000

units

Rs. 6,000

Existing Policy

20,000 units

2,40,00 ÷ 20,000 = 12

Arun’s suggestion

5,000 units

2,40,000 ÷ 5,000 =48

12 X Rs. 75 = Rs. 900

48 X Rs. 75 = Rs.

3,600

½ X 5,000 = 2,500

units

Rs. 6,100

½ X 20,000 = 10,000

units

Rs. 10,900

Note: At EBQ using the above formula, Set-up Costs p.a. = Carrying Costs p.a. = ½ of Associated

Costs p.a.

3. Number of Batches p.a. =

Annual Re quirement ( A ) 2,40,000

=

= 40 batches per annum. (for

PRoduction per Batch (Q)

6,000

least cost)

Problem No. 3

a. Optimum production run size (Q) =

2DS

C

IPCC_34e_Costing (Problems)_Job Costing & Batch Costing ______________5

Ph: 0863 – 22 42 355

www.gntmasterminds.com

Where,

D = No. of units to be produced within one year.

S = Set-up cost per production run

C = Carrying cost per unit per annum.

=

2DS

=

C

2 x 24,000 x Rs.324

= 3,600 bearings.

0.10 x 20

b. Total Cost (of maintaining the inventories) when production run size (Q) are 3,600 and 6,000

bearings respectively

Total cost = Total set-up cost + Total carrying cost.

Total set up cost

Total Carrying cost

Total Cost

When run size is 3,600 bearings

24,000

=

x Rs. 324 =Rs. 2,160

3,600

1/2×3,600 × 0.10P × Rs.12

= Rs. 2,160

Rs. 4320

When run size is 6,000 bearings

24,000

=

x Rs. 324 =Rs. 1,296

6,000

1/2 × 6,000 × 0.10P × Rs.12

= Rs. 3,600

Rs. 4,896

c. Minimum inventory holding cost = 1/2 Q × C

(When Q = 3,600 bearings) = 1/2 × 3,600 bearings × 0.10P × Rs. 12 = Rs. 2,160

Problem No. 4

Batch output (in units)

Sale value Rs.

Material cost Rs.

Direct wages Rs.

Chargeable expenses* Rs.

Total cost Rs.

Profit per batch Rs.

Total cost per unit Rs.

Profit per unit Rs.

Jan.

210

1,680

650

120

600

1,370

310

6.52

1.48

Feb.

200

1,600

640

140

672

1,452

148

7.26

0.74

March

220

1,760

680

150

672

1,502

258

6.83

1.17

April

180

1,440

630

140

621

1,391

49

7.73

0.27

May

200

1,600

700

150

780

1,630

-30

8.15

-0.15

June

220

1,760

720

160

800

1,680

80

7.64

0.36

Total

1,230

9,840

4,020

860

4,145

9,025

815

7.34

0.66

Overall position of the order for 1,200 units

Sales value of 1,200 units @ Rs. 8 per unit

Total cost of 1,200 units @ Rs. 7.34 per unit

Profit

Ch arg eable exp enses

xDirect labour hours for batch

*

Direct labour hour for the month

Rs. 9,600

Rs. 8,808

Rs. 792

Problem No. 5

1. Computation of OH Absorption Rates:

Rs. 6,000

Wedding Department:

= Rs. 4 per Labour Hou.

1,500

Rs.10,000

= Rs. 10 per Labour Hour.

Assenmbly Department:

1,000

2. Batch Cost Sheet:

Direct Material

Direct Wages

Particulars

Given

100 hours in Welding Shop at Rs. 10 per hour

Rs.

12,000

1,000

IPCC_34e_Costing (Problems) _ Job Costing & Batch Costing ______________6

No.1 for CA/CWA & MEC/CEC

200 hours in Assembly Shop at Rs. 8 per hour

Direct Expenses Hire of Special Scan Equipment

Prime Cost

Add: Overheads: 100 hours in Welding shop at Rs. 4 per hour

200 hours in Assembly Shop at Rs. 10 per hour

Factory Cost

Add: SOH absorbed at 20% on Factory Cost of Rs. 17,500

Total Cost

Cost per unit =

Rs. 21,000

= Rs. 84.00

250

MASTER MINDS

1,6000

500

15,100

400

2,000

17,500

3,500

21,000

THE END

IPCC_34e_Costing (Problems)_Job Costing & Batch Costing ______________7