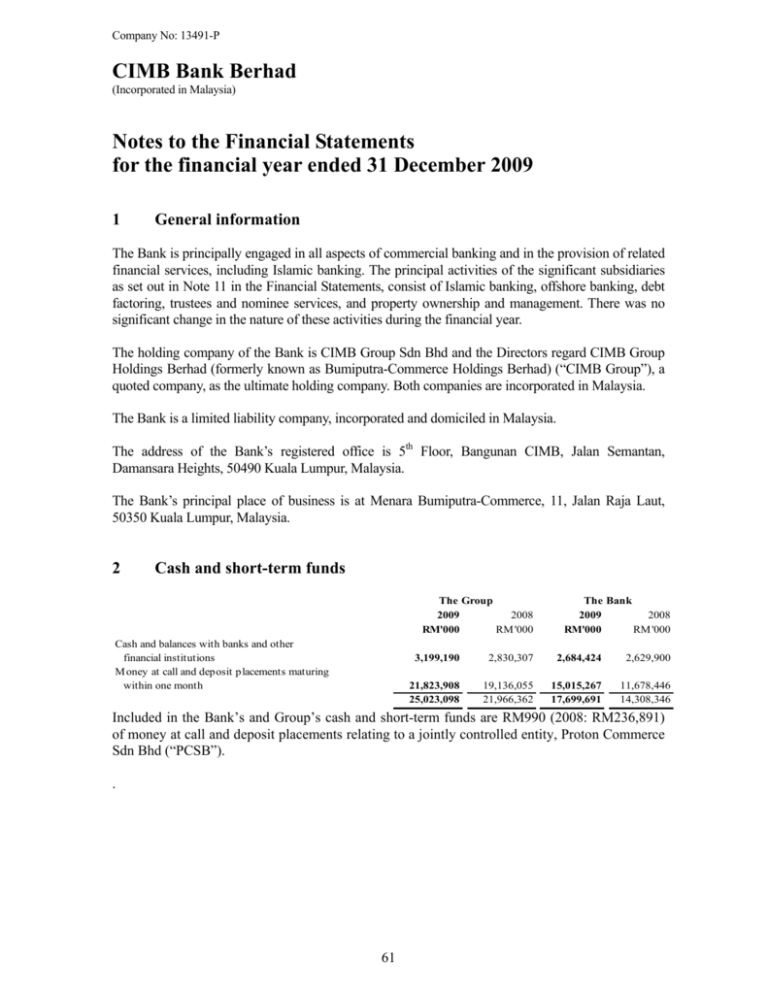

CIMB Bank Berhad Notes to the Financial Statements for the

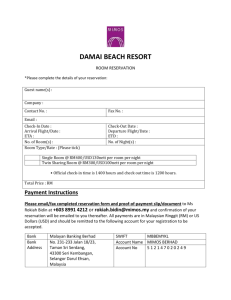

advertisement