Full Report - 4.9MB - Department of Housing

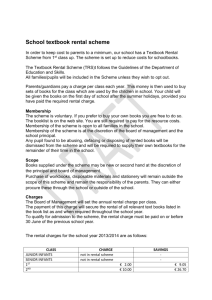

advertisement