4Q14 Caterpillar Inc. Results

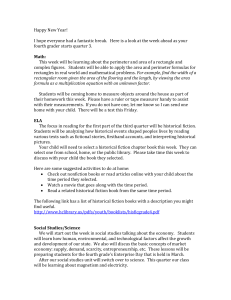

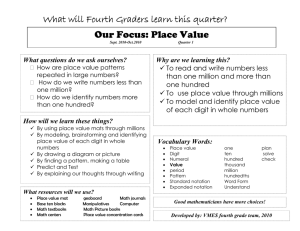

advertisement