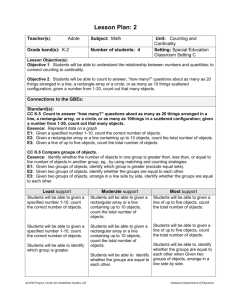

Cat - University of Oregon Investment Group

advertisement

11/25/2013 Industrial Caterpillar Ticker: CAT Current Price: $83.00 Key Statistics 52 Week Price Range 50-Day M oving Average Investment Thesis 83.50 - 84.11 1.35 Dividend Yield 2.40% M arket Capitalization 54.36B 3-Year Revenue CAGR 26.60% Given the cyclical nature of this stock, I believe that underlying financial strength and the ability to generate positive cash flow is more important than near-term earnings or EPS. China’s global share is construction industry forecast to rise from 18 percent today to 26 percent in 2025 as a result of increased urbanization and a growing middle class. US construction markets are expected to experience improving conditions over the next five years, as both residential and nonresidential markets rebound as a result of increasing consumer and business sentiment translating to greater investment. Low interest rates and improved consumer outlook, caused by declining unemployment and rising household disposable income, are expected to precipitate greater demand for housing. Trading Statistics Average Volume (3-M onth) Institutional Ownership Insider Ownership EV/EBITDA (LTM ) Price Target: $91.59 79.49 - 99.70 Estimated Beta Diluted Shares Outstanding Recommendation: Hold 647.6 5,060,770 64% 1% 8.51 Margins and Ratios Gross M argin (LTM ) 33.09% EBITDA M argin (LTM ) 17.84% Net M argin (LTM ) Debt to Enterprise Value 6.08% 45.45% Covering Analysts: Guoyi Chen Name 1 University of Oregon Investment Group University of Oregon Investment Group 11/25/2013 Business Overview General Overview Caterpillar Inc. is the world’s leading manufacturer that designs, manufactures, markets and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives via a worldwide dealer network. In addition, Caterpillar Inc. also provides financial products to its customers through Caterpillar Financial Services Corporation (Cat Financial). The company originally organized as Caterpillar Tractor Co. in 1925 in the State of California and reorganized as Caterpillar Inc. in 1986 in the State of Delaware. Currently, Caterpillar Inc. operates in 2 primary segments: Machinery and Power System (M&PS) and Financial Products. Machinery and Power System consists of Construction Industries, Resource Industries, Power Systems and all other segment. Financial Products includes the Company’s Financial Products Segment. This category includes Cat Financial, Caterpillar Insurance Holding Inc. and their respective subsidiaries. By the end of 2012, its 2 main businesses generated 65.8 billion dollars, but have been hit hard by decreasing in customer demand, especially in mining industry. Construction Industries: 29% Sales Comparison Construction Industries $6,000.00 $4,000.00 $2,000.00 $1Q 2Q 2012 3Q 2013 4Q The Construction Industries is responsible for supporting customers using machinery in infrastructure and building construction applications. Responsibilities include business strategy, product design, product management and development, manufacturing, marketing and sales and product support. Sales made in this segment have been increased stably from 2009 to 2011 (60% in 2010 and 45% in 2011) as customers felt the need to upgrade old fleets and replace old equipment and also due to the recovery of the global economy. However, due to the nature of cyclical industry, the sales in this segment started to decrease in 2013. To be more specific, the sales in this segment down by 17% versus the first quarter of 2012 and keep decrease in the following quarters, 9% in second quarter and 7% in the third quarter compared with the same period in 2012. Geographically, North America, Latin America, EAME and Asia Pacific’s sales were all decline 7.7%, 8%, 20% and 12%, respectively during the 3 quarters in 2013. The decline in EAME was primarily due to changes in dealer inventory and construction activity in Europe remains low. In Asia/Pacific, sales increases in China were more than offset by sales declines in other countries due to slower economic growth. UOIG 2 University of Oregon Investment Group 11/25/2013 Resource Industry: 32% Sales Comparison Construction Industries $6,000.00 $4,000.00 $2,000.00 $1Q 2Q 2012 3Q 4Q 2013 The Resource Industries segment is primarily responsible for supporting customers using machinery in mine and quarry applications. It also serves forestry, paving, tunneling, industrial and waste customers. In July 2011, Caterpillar Inc. acquired Bucyrus International Inc. and now offers mining customers the broadest product range in the industry. Over the past two years, Caterpillar Inc. has added capacity for mining products to better align production with expected demand. As a result, sales in 2012 are higher than 2011. In addition, during the second quarter of 2012, the acquisition of Siwei was completed. Siwei is a Chinese company that primarily designs, manufactures, sells and supports underground coal mining equipment and is known for its expertise in manufacturing mining support equipment. However, the revenue generated from this segment in the first, second and third quarter of 2013 were down by 23%, 16% and 42%, respectively compared with the first quarter in 2012. Geographically, sales were lower in every region of the world, with the most significant decline in Asia/Pacific region, where is on average 50% lower than the first 3 quarters in 2012. Sales in North America, Latin America and EAME regions are all lower 29%, 20% and 19% than the same period in 2012. According to the management analysis, this big decline in sales is because after several years of increasing capital expenditures, mining customers in all geographic regions have reduced spending across the mining industry and they do not expect the sales in mining increase in the following year. Power Systems: 34% Sales Comparison - Power Industries $6,000 $4,000 $2,000 $1Q 2Q 2012 3Q 2013 4Q Power Systems segment is primarily responsible for supporting customers using reciprocating engines, turbines and related parts across industries serving electric power, industrial, petroleum and marine applications as well as rail-related businesses. The demand for Power Systems products and services increased significantly in the developing world and Caterpillar Inc. have made investments to increase their production in line with regional demand. During the 2011 and 2012, Caterpillar opened a new Electro-Motive Diesel Inc. manufacturing facility in Brazil and also acquired MWM, a leading supplier of nature gas and alternative-fuel engines, in response to increasing customer demand for sustainable power alternatives. In addition, U.S. Environmental Protection Agency (EPA) required Caterpillar Inc. make significant investments in research and development that will continue as new products are phased in over the next several years. In this segment, Caterpillar Inc.’s main competitors include Cummins Inc., Tognum AG etc. Sales made in this segment decreased a little bit compared with 2012, but the change is flat. UOIG 3 University of Oregon Investment Group 11/25/2013 Financial Products: 5% Sales Comparison Financial Products $850 $800 $750 $700 1Q 2Q 2012 3Q 2013 4Q Financial Products segment provides financing to customers and dealers for the purchase and lease of Caterpillar and other equipment, as well as some financing for Caterpillar sales to dealers. This segment also provides various forms of insurance to customers and dealers to help support the purchase and lease of our equipment. In 2012, the revenue was up 4% compared with 2011. The increase was primarily due to the favorable impact from average earning assets and an increase in Cat Insurance. Cat Financial operates in a highly competitive environment, with financing for users of Caterpillar equipment available through a variety of sources, principally commercial banks and finance and leasing companies. Main competitors include Wells Fargo Equipment Finance Inc. General Electric Capital Corporation and various other banks and finance companies. Strategic Positioning Vision 2020 Strategy Caterpillar Inc. has established the new business strategy called Vision 2020. The strategy sets the stage for next phase of the company’s leadership and growth in the global industries it servers. The 3 strategic goal set by company are “Superior result”, “Global Leader” and “Best Team”. Based on this strategy, Caterpillar Inc. develops “Big 8” imperatives for its business. During the following years, Caterpillars Inc.’s first goal is to win the competitions in Chinese mining and construction market, and to become more competitive in India and ASEAN (Association of South East Asian Nation). In order to winning in China, Caterpillar Inc. acquired Zhengzhou Siwei and Shandong Engineering Machinery Co. (SEM) recently. Both Siwei and SEM are leading providers in the industries they operates. Second, Caterpillar Inc. aims to expending leadership in Mining and Quarry industry. In July of 2011, Caterpillar Inc. acquired Bucyrus International Inc. The acquisition was the largest in the company’s history. By acquiring the Bucyrus, Caterpillar Inc. established the leadership in mining industry across the world. According the Bloomberg business Week, Bucyrus gives Caterpillar an opportunity to gain from growth in emerging markets since the increasing rate of globalization and urbanization in the emerging countries. UOIG 4 University of Oregon Investment Group 11/25/2013 Business Growth Strategies Winning in China Caterpillar Inc.’s management made it clear that in the next five years, their main goal in terms of growth is to capture more market shares in emerging markets, especially in China. Currently, Sales and revenues generated from China is only a small portion of total revenue. However, along with the increasing demand of globalization and urbanization, China becomes the most profitable market in the world for companies like Caterpillar Inc. Over the past years, the increasing investments made in China indicates that Caterpillar Inc. hold a long-term view in China. Last year, Caterpillar Inc. acquired ERA mining, which provided it with crucial share in the underground rood support segment of China’s mining equipment market. Besides, Caterpillar Inc. opened a large wheel loader manufacturing facility and proving ground in Tongzhou, Jiangsu Province. In total, Caterpillar Inc. now has 24 existing manufacturing facilities, four R&D centers, three logistics and parts centers and a few other facilities under construction. According to the statistics data from Morningstar, currently, 50% of China’s population lives in cities, compared to an urban population of 80% in the UK and 82% in the U.S. The increasingly demand for urbanization demands more construction projects on residential housing and infrastructures. In addition, demand for power and energy will increase in the next few years as well. Currently, the level of energy consumption per person in China is well below that of in the developed country. For example, China consumes around 3.5 MWh of electricity per person per year, compared to 12.5 MWh of electricity consumed per person per year in the U.S. That been said, Caterpillar Inc.’s new strategy that focus on China’s market will reward them with a great profit in a long run. This strategy has been success so far as the company published their third quarterly report. Based on the operating results, while sales in Asia/Pacific declined overall, sales in China increased as they focus on increasing field population, improving customer loyalty and providing superior customer support in conjunction with their independent dealers. The total sales and revenues made in China were about 800 million in the third quarter 2013 as compared with about 600 million in the same period 2012. Sales and revenues in China represented about 6 percent of total company sales and revenues in the third quarter of 2013. UOIG 5 University of Oregon Investment Group 11/25/2013 Industry Overview This industry mines various types of coal. According to the IBIS World, in the next five years, mining industry is anticipated to grow moderately due to the projected slowdowns in Brazil, Russia, India and China, whose economics serves as important indicators of global trends. However, the challenge that mining industry face is the increasing use of nature gas is expected to continue to eat into coal demand over next five years. Consequently, the US Coal mining industry’s revenue is projected to rise at a slower average annual rate of 1.5% to 46.8 billion in the five years to 2018. The whole industry is highly sensitive to global economic conditions and the demand in this industry is very cyclical. This industry, which had been in the midst of a recovery, is once again facing a number of challenges. According to a new report, construction output is expected to increase by more than 70 percent – to $15 trillion worldwide, by 2025. China, India, and the United States are expected to account for nearly 60 percent of that growth, whereas growth in Japan will be considerably less robust during that time. The report indicates that at present 52 percent of all construction activity is taking place in such emerging markets as China and India and predicts that by 2025 those markets will account for 63 percent of all activity. United States GDP Growth Outlook 4.000% 3.000% 2.000% 1.000% 0.000% China GDP Growth Outlook 10.000% 8.000% 6.000% 4.000% 2.000% 0.000% Macro Factors – United States The Gross Domestic Product (GDP) in the United States expended at an annual rate of 2.8 percent in the third quarter of 2013 over the previous quarter. Economic activity in the manufacturing sector expended in October for the fifth consecutive month, and the overall economy grew for the 3rd consecutive month. The PMI (Purchasing Managers Index) rose to 56.4 percent in October from September’s reading of 56.2 percent. PMI is an indicator of the economic health of the management sector. It is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. US industrial production fell 0.1% in October according to official data from the Federal Reserve, dashing expectations of a 0.2% rise among economists polled by Reuters. However, the fall was largely blamed by the Fed on oil and gas rig shutdowns in the Gulf of Mexico. Forwarding looking, both business surveys and official payrolls data indicate that companies continues to hire extra people in October, which suggests that firms have confidence that business levels will continue to rise. Macro Factors – Emerging Markets China: Since 2010, China become the world’s largest construction market, and although construction is expected to slow in China because of slower production growth. China’s global share is forecast to rise from 18 percent today to 26 percent in 2025 as a result of increased urbanization and a growing middle class. UOIG 6 University of Oregon Investment Group Inida GDP Growth Outlook 8.000% 7.000% 6.000% 5.000% 4.000% 3.000% 2.000% 1.000% 0.000% 11/25/2013 India: India’s share of the global construction market is expected to increase from 4% to 7% by 2025, and will overtake Japan as the world’s third-largest market. Competition 2011 2012 2013 2014 2015 2016 2017 2018 Latin America GDP Growth Outlook 5.000% 4.000% 3.000% 2.000% 1.000% 0.000% 2011 2012 2013 2014 2015 2016 2017 2018 As the world biggest manufacturer in the construction and mining equipment industry, Caterpillar Inc. faces the competition both domestically and internationally. According to the IBIS World, the Construction Machinery Manufacturing industry displays a medium level of market share concentration. The four largest players in the industry account for an estimated 39.2% of industry revenue. Domestically, Caterpillar Inc. and Deere & Company are the largest players in the industry, accounting for 29.9% and 7.8% of industry revenue respectively. The industry also has a number of smaller players, the most notable being Komatsu Ltd, CNH Global NV and Terex Corporation, each controlling less than 5.0% market share. Internationally, Caterpillar Inc.’s major competitor is Komatsu, which is the Japan-based company that operates in construction & mining industry in Asia/Pacific regions. Over the past 5 year, Caterpillar Inc.’s market shares have been increased due to the merging &acquisition activities. However, its biggest competitor Deere & Company is expected to lose some market shares due to the rising companies such as CHN Global NV. Management and Employee Relations Douglas R. Oberhelman - CEO Oberhelman joined Caterpillar in 1975 and has held a variety of positions including senior finance representative, region finance manager and district manager for the company’s North American Commercial Division. Oberhelman was elect a vice president in 1995, serving as Caterpillar’s chief financial officer with administrative responsibility for the corporation’s accounting, information service, tax, treasury, investor relations and marketing support services areas from1995 to November 1998. He was elected a group president and member of Caterpillar’s executive office in 2002. In October 2009, the caterpillar Board of Directors named Oberhelman vice chairman and CEO-Elect. During this time, he led a team that developed the future strategic plan for the company. Oberhelman was elected chief executive officer and a member of Board of Directors effective July 1, 2010, and become chairman effective November 1, 2010. UOIG 7 University of Oregon Investment Group 11/25/2013 Bradley M. Halverson - CFO Brad Halverson is a group president and CFO of Caterpillar Inc. He has responsibility for Finance Service Division, Human Service Division, Global information Service Division and Financial Products Division, as well as Strategy & Business Development, Corporate Auditing and Investor Relations. Halverson joined Caterpillar in 1988 as an accountant after your years of public accounting experience. In 1993, he moved to Switzerland to become a strategy and planning consultant with Caterpillar Overseas. From 1998 until 2002, Halverson managed a variety of business resource departments in Caterpillar’s Engine Division and was the director of Corporate Business Development. Management Guidance Revenue Forecast: The year 2013 has been a challenging year to Caterpillar Inc. During this year, management overestimated their revenue 3 times in a row. At the April 22nd, they revised their forecast on revenue down from $60B – 68B to 57B – 61B due to the decline in mining industry. Besides, they lowered the forecast for capital expenditures and expected to be less than $3 billion for the year of 2013. In the second quarter, they lowered their forecast on revenue again to 56B – 58B, with the decrease in profit of about $7 per shares to $6.5 per share. Once again, at the end of the third quarter, they lowered the outlook for 2013 revenues to about 55 billion dollars and now expecting profit in 2013 to be about $5.5 per share, and that is down from $6.5 at the middle of the previous sales outlook range. Outlook for 2014: In general, when the economic indicators began to look more positive, they will forecast better growth on revenue since the macroeconomic plays a key role in forficate revenue. Due to the uncertain of U.S. fiscal and monetary policy, unhealthy of Eurozone economy and the continued transition to a more consumerdemand led economy in China, management expect 2014 sales and revenues to be flat, with +/- 5% range. Management believe that it is really hard to predict the growth for the mining industry, which is the most important and profitable business segment to Caterpillar Inc. they would not be increasing their expectations for resource industries until mining orders improve despite of the expected economic growth in 2014 and a continuation od strong mine production around the world. UOIG 8 University of Oregon Investment Group 11/25/2013 Portfolio Strategy Currently, Caterpillar Inc. (CAT) has been hold 300 shares in Tall Firs portfolio with the portfolio weight about 2.69% at cost of $26,989 and as the 11/20/2013, the market value is $24,804, which indicates an unrealized loss of $2,185. At 10/16/2012, UOIG purchased 150 shares at $84.77 At 1/25/2013, UOIG purchased another 150 shares at $95.16 Recent News Caterpillar to close another mining equipment plant – Reuters 11/15/2013 “Caterpillar Inc. said on Friday that it will close another plant and lay off 240additional workers as it continues to respond to a sharp drop in demand for its earth-moving products from customers in the mining industry.” Caterpillar Inc. Stock Buy Recommendation Reiterated (CAT) – TheStreet.com 11/14/2013 “NEW YORK (TheStreet) -- Caterpillar (NYSE:CAT) has been reiterated by TheStreet Ratings as a buy with a ratings score of B. The company's strengths can be seen in multiple areas, such as its reasonable valuation levels, good cash flow from operations and notable return on equity. We feel these strengths outweigh the fact that the company has had sub par growth in net income.” China growth picture may dim but for Caterpillar it's a bright spot – Reuters 07/24/2013 “Alex Blanton, a senior analyst at Clear Harbor Asset Management in New York, says China's stated policy of accelerated urbanization - the government plans to move more than 20 million people a year from the farm to the cities in the coming decade - will drive growth. China will continue to require massive investments in infrastructure and other kinds of construction that will drive demand for the heavy machinery and other goods made by U.S. industrial companies like Caterpillar, he said.” Catalysts Upside Mining industry revenue is forecast to increases at the rate of 8.5% per year to reach $667.5 billion in 2018 and the UOIG 9 University of Oregon Investment Group 11/25/2013 global mining equipment market is expected to reach $117 billion by 2018 at a CAGR of 8.5%. The US Coal mining industry’s revenue is projected to rise at a slower average annual rate of 1.5% to 46.8 billion in the five years to 2018. The growth outlook for the Latin America region remains strong as demand for construction and infrastructure projects has spurred equipment demand in Brazil as the nation prepares for the 2014 World Cup and 2016 Olympic Games. Downside Slow economic recovery and continued low demand for mining equipment, which is the most profitable product to Caterpillar Inc. will prevent the company from reporting decent margins in the near future. From economic standpoint, the uncertain of U.S. fiscal and monetary policy, unhealthy of Eurozone economy and the continued transition to a more consumer-demand led economy in China cloud the company’s future Based on the mining industry survey, the total mining CapEx in 2013 is likely to be down 5% to 10% from 2012 and survey also indicates that further CapEx decline near 20% for 2014. Comparable Analysis Deere & Company (50%) “Deere and Company, incorporated in 1958, along with its subsidiaries, operates in three segments: agriculture and turf segment, construction and forestry segment and financial services segment. The agriculture and turf segment primarily manufactures and distributes a range of farm and turf equipment and related service parts. The construction and forestry segment primarily manufactures a range of machines and service parts used in construction, earth moving, material handling, crawler dozers, excavators and motor graders. The Financial Services segment provides wholesale financing to dealers of the foregoing equipment and provides operating loans.” – Reuters I chose Deere & Company as the most important comparable company and gave it a weight of 50% is because Deere shared same characteristics as Caterpillar Inc. in many ways. First, they are the two main players in the same industry (Farm & Construction). That is to say, risks that affect Caterpillar Inc. performance may also affect Deere vice versa. Besides, in terms of market UOIG 10 University of Oregon Investment Group 11/25/2013 capitalization, Deere is the closest company compared with Caterpillar Inc. (31.47B vs. 53.75B). Besides, Deere’s five years growth rate (CAGR) in Sales (8.5% vs. 7.9%), EBITDA (7.6% vs. 9.7%) and EPS (13.8% vs. 9.6%) are very similar to Caterpillar Inc. as well. Cummins Inc. (20%) Cummins Inc. manufactures diesel and nature gas engines, electric power generation system, and engine-related components. Slightly more than half of Cummins revenues are from its markets outside the US, including India, China, Europe, Middle East and Australia. Cummins Inc. has four business segments: engine segment, power generation segment, components segment and distribution segment. I chose Cummins Inc. and gave it a weight of 20% is not only because they have similar beta as Caterpillar Inc. but also because Cummins’s power generation segment contributed 20% of Cummins’ sales. Caterpillar Inc.’s power system segment is also an important channel to generate revenue, their power system segment contributes 34% of Caterpillar Inc.’s revenue. Komatsu (15%) “Komatsu, together with its subsidiaries, engages in the development, manufacture, marketing and sale of various industrial-use products and services. Its construction, mining and utility equipment segment offers excavating equipment, such as hydraulic excavators, mini excavators and backhoe loaders. The company’s industrial machinery and others segment offers metal forging and stamping presses; sheet-metal machines, plasma cutting machines and press breakers.” –Yahoo! Finance Besides having similar beta and profit margin, Komatsu is a good comparable company to Caterpillar Inc. because Komatsu is the biggest player in the machinery and construction industry in Asia/Pacific region. Since one of Caterpillar Inc.’s strategic goal in the next five year is winning in Asia/Pacific region, use Komatsu as a compare company to see how Caterpillar Inc. performance in Asia/Pacific region is fair. ABB U.S. (10%) “ABB Ltd, incur incorporated on March 5, 1999, is engaged in power and automation technologies committed to improving performance and lowering the environmental impact for utility and industry customers. The Company provides a broad range of products, systems, solutions and services that are designed to power grid reliability boost industrial productivity and enhance energy efficiency.” -- Reuters ABB U.S has the similar market cap and beta as Caterpillar Inc. In addition, ABB has closely worked with key customer Caterpillar for about 30 years on sustainable, energy efficient turbocharger UOIG 11 University of Oregon Investment Group 11/25/2013 solutions for a variety of Caterpillar industrial engines. Like ABB U.S, Caterpillar Inc. acquired MWM in October 2011. MWM is a leading supplier of natural gas and alternative-fuel engine, in response to increasing customer demand for sustainable power alternatives. Moreover, both ABB U.S and Caterpillar Inc. have similar sales growth rate during the past 5 years. PACCAR Inc. (5%) “Founded in 1905 in Bellevue, Washington, Paccar Inc. becomes a Fortune 500 company and was ranked the third-largest manufacturer of medium- and heavy-duty trucks in the world in 2011-12. The company offers its trucks for use in the over-the-road and off-highway hauling of freight, petroleum, wood products and construction. It also provides finance and leasing products and services, such as inventory financing for independent dealers.” – Yahoo Finance PACCAR Inc. is a reasonable comparable company to Caterpillar Inc. because they have similar beta and profit margin. Besides, PACCAR Inc. mainly focuses on manufacturing on heavy-duty truck that used in construction industry. In addition, both companies are utilizing Six Sigma to help suppliers manage their business by focusing on reducing cost by shortening cycle times and simplifying logistic flow. Discounted Cash Flow Analysis Revenue Model Aggregated Revenue Model: This one is on the top of the Reveue Outlook 80000 60000 40000 20000 0 five models I built for Caterpillar Inc. Since Caterpillar Inc. operates in 4 regions, I built revenue for each of the region and then aggregated them together as the revenue model for Caterpillar Inc. As a result, I projected the revenue for 2013 to be about $55 billion, which mainly contributed by construction industrial ($18 billion, down by 5%), resource industries (13 billion, down by 38%), power system industries (19.7 billion, down by 7%) and Financial industries (3.2 billion, up by 4.8%) North America: In 2013, the housing industry has improved and many state and local government budgets are showing signs of improvement. However, the changes in dealer inventory negatively impact the business and offset the increasing demand in North America. Based on the guidance, I projected the sales and revenues from construction segment, power system segment and financial segment to be flat and the resource segment down by 5%. From the 2014 through 2018, I projected the sales and revenues on all the business segment would increasing at the rate of 3%. UOIG 12 University of Oregon Investment Group 11/25/2013 Latin America: The increasing in my projection in 2013 on construction segment was mainly due to the continuing sales from a large government order in Brazil. In 2014, I projected that the sales on all of business segment will increase 7%. From the 2014 through 2018, I projected the increase rate would be 5% on the Caterpillar Inc.’s main business segment. EAME: In 2013, the demand declined as a result of continuing economic weakness in Europe, dealer inventory changes were negatively affect the sales. In 2014, I projected the sales and revenues to be flat mainly because the slow economic growth rate in Eurozone. From the 2014 to 2018, I expected the sales and revenues increasing at the rate of 3%. Asia/Pacific: My projection of revenue on Asia/Pacific in 2013 indicates the similar results as company’s 10-Q. According to 10-Q, the most significant reduction was in Asia/Pacific. It was primarily related to lower sales in Australia where the most significant decrease was in mining sales, due to continued low demand. In 2014, I projected the sales and revenues up by 5% and from the 2014 to 2018, the sales and revenues on all business segment would be grow at the rate of 5%. Beta To calculate the beta for my valuation, I ran beta for 1 year daily, 3 year daily, 3 year weekly, 5 year weekly, 1 year daily vasicek, 3 year weekly vasicek, 1 year daily Hamada and 3 year weekly Hamada. Among these 8 betas, I chose to weight equally on 1 year daily, 3 year daily, 5 year weekly, 1 year daily Hamada and 3 year weekly Hamada. Cost of Goods Sold This year has been tough for Caterpillar Inc. Due to the significant drop in sales, the management have been aggressively reducing cost to offset the impact of lower sales. Over the year, they have cut more than 13,000 jobs and temporarily shut down many mining plants across the world. In my DCF valuation, I reduced COGS for the 4th quarter. Overall, the annual COGS is about 67% of revenue, down 18% compared with 2012. Research and Development Management did not give a clear guidance on the R&D this year, but in order to comply with EPA’s emission standards for their products, they will continuously invest in R&D. I projected the R&D based on the percentage of Revenue with the increasing trend. Depreciation and Amortization Caterpillar Inc. calculates D&A using both straight-line and accelerating method. Since there is no guidance on this item, I calculate it based on the percentage of revenue. UOIG 13 University of Oregon Investment Group 11/25/2013 Capital Expenditures According to the management, they believe total mining CapEx in 2013 is likely to be down 5% to 10% from 2012 and it will decline near 20% for 2014. I projected CapEx based on this guidance. CapEx in 2013 is estimated at about $3023 million dollars, or 10% decrease compared with 2012. In 2014, I projected CapEx down by 14% compared with 2013. Acquisition Even though management did not provide any guidance on acquisition, I believe that they would not spend much more on acquisition since they acquired Bucyrus International and MWM Holding on 2011. And the acquisition of Bucyrus International was the largest acquisition over the past 50 years. For this reason, I projected acquisition based on the percentage of revenue. Tax Based on the company’s third quarter 10-Q, the provision for income taxes for the first nine months of 2013 reflects an estimated annual effective tax rate of 29 percent compared with 30.5 percent for 2012. The decrease is primarily due to the U.S. research and development tax credit that was expired in 2012, along with expected changes in company’s geographic mix of profits from a tax perspective. Recommendation I recommend a hold to Tall Firs portfolio. Even though the sales drop dramatically this year and would be drop again in next year, Caterpillar’s huge size, presence in China, brand equity, and diversification across the globe are advantages in the long term. Besides, the discounted cash flow valuation along with the comparable analysis indicates that Caterpillar Inc. currently is undervalue by 8.85%. The slowdown of mining industry activities negatively affect Caterpillar Inc. in 2013, but even during the downturn, Caterpillar Inc. demonstrates its ability to generate positive cash flow. Forward looking, the global economics would get better, especially in the emerging market. By implementing its new strategy “Winning in China”, Caterpillar Inc. will show a decent performance in the following year. UOIG 14 University of Oregon Investment Group 11/25/2013 Appendix 1 – Relative Valuation UOIG 15 University of Oregon Investment Group 11/25/2013 Appendix 2 – Discounted Cash Flows Valuation UOIG 16 University of Oregon Investment Group 11/25/2013 Appendix 3 – Revenue Model UOIG 17 University of Oregon Investment Group 11/25/2013 UOIG 18 University of Oregon Investment Group 11/25/2013 UOIG 19 University of Oregon Investment Group 11/25/2013 Appendix 4 – Working Capital Model UOIG 20 University of Oregon Investment Group 11/25/2013 Appendix 5 – Discounted Cash Flows Valuation Assumptions UOIG 21 University of Oregon Investment Group 11/25/2013 Appendix 6 –Sensitivity Analysis UOIG 22 University of Oregon Investment Group 11/25/2013 Appendix 8 – Sources SEC Filings Company Investor Relations page Company presentations Prospectuses Press releases Earnings call transcripts Inside ownership Databases available through UO Libraries IBIS World S&P Net Advantage ONEsearch Mergent Online Factset Seeking Alpha Bloomberg Business Week UOIG 23 University of Oregon Investment Group 11/25/2013 UOIG 24