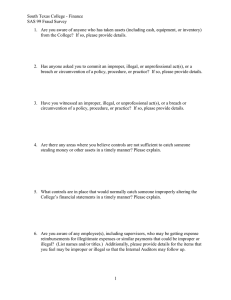

Post-Conference Auditing and Investigating Fraud Seminar

advertisement

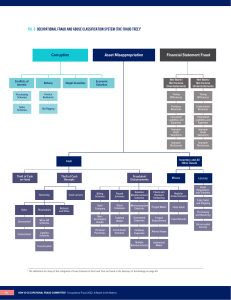

Post-Conference Auditing and Investigating Fraud Seminar Auditing Track Financial Statement Fraud Schemes Introduction to Financial Statement Fraud Least common but most costly form of occupational fraud Almost always involves upper management Undertaken to: Misrepresent the company’s financial health to outsiders • Meet compensation-linked performance goals • 2 of 12 Financial Statement Fraud Schemes Overstated assets or revenues Understated liabilities or expenses Improper disclosures 3 of 12 Overstated Assets or Revenues Fictitious revenues Timing differences • • Improper matching of revenues and expenses Early revenue recognition Improper asset valuation 4 of 17 4 of 12 Understated Liabilities and Expenses Liability/expense omissions Recording expenses in the wrong period Improper capitalizing/expensing Returns/allowances and warranties Post-retirement benefits Operating vs. capital leases 5 of 17 5 of 12 Improper Disclosures Related-party transactions Liability omissions Significant events Management fraud Accounting changes 6 of 17 6 of 12 Red Flags of Financial Statement Fraud Slowdown for previously fast-growing company Industry changes Significant pressure to obtain additional capital Unusually high dependence on debt Significant, unusual, or highly complex transactions, especially close to year-end Significant estimates involving unusually subjective judgments or uncertainties 7 of 17 7 of 12 Red Flags of Financial Statement Fraud Significant high-risk investments Management incentives tied to unreasonable growth or profitability expectations Lax attitudes about regulatory requirements History of claims alleging fraud Lack of established policies or controls Lack of proper training Lack of enforcement of procedures 8 of 17 8 of 12 Detection of Financial Statement Fraud Vertical analysis Horizontal analysis Ratio analysis 9 of 17 9 of 12 Vertical Analysis Analyze relationships between items on a financial statement by expressing components as percentages of specific line item. • • On income statement, net sales = 100% On balance sheet, total assets/total liabilities and equity = 100% 10 of 12 Horizontal Analysis Analyze the percentage change in individual financial statement items from one year to the next. 11 of 17 11 of 12 Ratio Analysis Means of measuring the relationship between two different financial statement amounts • • • • • Accounts receivable turnover Sales to total assets Related-party sales to total assets Leverage ratios Ratios involving non-financial data 12 of 17 12 of 12