3-7 Liquids Demand - The National Petroleum Council

advertisement

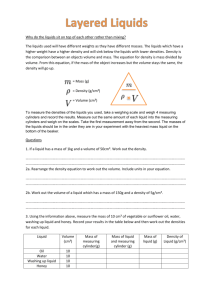

Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Paper #3-7 LIQUIDS DEMAND Prepared for the Demand Task Group On September 15, 2011, The National Petroleum Council (NPC) in approving its report, Prudent Development: Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources, also approved the making available of certain materials used in the study process, including detailed, specific subject matter papers prepared or used by the study’s Task Groups and/or Subgroups. These Topic and White Papers were working documents that were part of the analyses that led to development of the summary results presented in the report’s Executive Summary and Chapters. These Topic and White Papers represent the views and conclusions of the authors. The National Petroleum Council has not endorsed or approved the statements and conclusions contained in these documents, but approved the publication of these materials as part of the study process. The NPC believes that these papers will be of interest to the readers of the report and will help them better understand the results. These materials are being made available in the interest of transparency. The attached paper is one of 57 such working documents used in the study analyses. Also included is a roster of the Subgroup that developed or submitted this paper. Appendix C of the final NPC report provides a complete list of the 57 Topic and White Papers and an abstract for each. The full papers can be viewed and downloaded from the report section of the NPC website (www.npc.org). 1 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Demand Task Group Chair Kenneth L. Yeasting Government Cochair James M. Kendell Assistant Chair James A. Osten Assistant Government Cochair Raymond J. Braitsch Secretary John H. Guy, IV Members Industrial Subgroup Chair Kenneth S. Bromfield Industrial Subgroup Assistant Chair Scott Engstrom Power Subgroup Chair Kurtis J. Haeger Senior Director, Global Gas and North American Gas IHS Cambridge Energy Research Associates, Inc. Director, Office of Oil, Gas and Coal Supply Statistics, Energy Information Administration U.S. Department of Energy Director, North American Natural Gas IHS Global Insight General Engineer, Office of Planning and Environmental Analysis U.S. Department of Energy Deputy Executive Director National Petroleum Council U.S. Commercial Director, Energy Business Dow Hydrocarbons and Resources LLC Director, Global Energy Sourcing International Paper Company Managing Director, Wholesale Planning Xcel Energy Power Subgroup Assistant Chair Jeanette Pablo Director of Federal Affairs and Senior Climate Advisor 2 PNM Resources, Inc. Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Residential/Commercial Subgroup Chair Thomas J. Massaro, Jr. Vice President, Marketing & Business Intelligence Residential/Commercial Subgroup Assistant Chair Richard D. Murphy Senior Vice President, Energy Solution Services Transportation Subgroup Chair William C. Lawson Director of Finance At-Large Members James Edward Burns John P. DeGeeter Leslie J. Deman John Hull Jose Alberto Torres Lima Robert L. Perez Clean Energy & Innovation Senior Counsel – Antitrust President Managing Director, Fundamentals Vice President, LNG, Gas Monetization, and Wind Energy Vice President, Mexico Ventures 3 New Jersey Natural Gas Company National Grid The Williams Companies, Inc. Shell Upstream Americas ConocoPhillips Les Deman Energy Consulting Iberdrola Renewables Shell Upstream Americas Tennessee Gas Pipeline Company Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 US NON-TRANSPORT LIQUIDS DEMAND – DRAFT 4-18-2011 OVERVIEW LPGs account for about one-third of Non-Transport US Liquids demand – which account for only 29% to Total US Liquids demand currently. Breaking down Non-Transport US Liquids demand: the Industrial sector accounts for about 80%, while the Residential and Commercial sectors together account for about 15%. Most of the Residential and Commercial demand is from distillate and LPGs for home heating. As for the future, per EIA’s preliminary 2011 Annual Energy Outlook Reference Case (AEO 2011 Reference Case), the Industrial sector will account for over 95% Non Transport US Liquids demand growth. Within the Industrial sector, AEO 2011 Reference Case expects nearly 40% of the liquids demand growth to come from LPGs. CONTEXT AND HISTORY U.S. LIQUIDS DEMAND IN ALL SECTORS INCLUDING TRANSPORTATION As can be seen in the Figure 1 below from the AEO 2011 Reference Case, the Transportation sector’s liquids demand has dwarfed demand in the other sectors, and this spread has mostly widened over the last 10 years as rising oil prices (among other things1) have affected liquids demand more in the Non-Transport (Residential, Commercial, Industrial, and Electric Power Generation) sectors than in the Transportation sector. 1 E.g., GHG considerations/policies, energy security issues, electrification, and efficiency improvements. 4 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 2005 2000 Transportation Industrial 2009$/BBL 140 120 100 80 60 40 20 0 1995 14 12 10 8 6 4 2 0 1990 MMBD Figure 1: U.S. Liquid Fuels Demand by Sector vs. Oil Price History Res & Comm Electric Generation AEO'11 Oil Price File: F igure73_data A EO2009.xls Breaking down 2010 Total Demand for liquids by fuel, as seen in the far right column of Figure 2 below, shows gasoline demand dominant at 46%, followed by distillate (diesel, home heating fuel, etc.) at 19%, other miscellaneous products – including petroleum coke, asphalt, road oil, lubricants, still gas, and miscellaneous petroleum products – at 11%, and LPG2 at 11%. U.S. demand for liquids in the Non-Transport sectors in 2010 was 6.3 mmbd, just 29% of liquids Total Demand of 19.7 mmbd. The bulk of the Non-Transport demand is from LPG and the other miscellaneous products (see Figure 2). The fact that LPG (derived from processing NGL3 and distilling crude oil) make up about one-third of price-sensitive Industrial liquids demand means that changes to their price relative to competing fuels (e.g., natural gas) could have a discernable effect on Industrial demand. 2 LPG – Liquefied Petroleum Gases: Ethane, Propane, and Butane gases which are liquefied through pressurization. EIA and IEA both count these as liquids in their analysis. 3 NGL – Natural Gas Liquids: comprised of LPG, pentanes plus, and lease condensate 5 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 20 Figure 2: 2010 U.S. Liquids Demand by Sector & Fuel 11% MMBD 15 19% Pet Chem F eed Fuel O il Distillate 10 46% 5 0 Other* 11% 33% 31% 2010 2010 Residential & Industrial Commercial 2010 Powergen 2010 Total Non-­‐ Transport 2010 Transport Kerosene/Jet Gasoline LPG 2010 Total Demand AEO 2011 * Includes petroleum coke, asphalt, road oil, lubricants, still gas, and miscellaneous petroleum products. File: AEO2011 vs AEO2010 NGL production & consumption.xls U.S. LIQUIDS DEMAND IN ALL SECTORS EXCEPT TRANSPORTATION Liquids demand in the four Non-Transport sectors fell in the 19 years between 1990 and 2009 at a compound annual growth rate (CAGR) of a negative 0.36%, while GDP CAGR was 2.5% on average (see Figure 3). But these declines in liquids demand were more than offset by the growth of natural gas demand in three (Residential, Commercial, and Power Generation) of the four sectors between 1990 and 2009 (see Figure 4). Figure 5 shows overall energy demand growth averaged 2.1%/year in those three sectors between 1990 and 2009, but a decline in Industrial energy demand as a result of energy conservation, exporting of manufacturing, etc. Projecting out from 2009 to 2035, the AEO 2011 Reference Case sees a continuation of the modest declines in Non-Transport liquids demand (down 0.1% annually versus expected GDP growth of 2.7%/year; see Figure 3), but growth across all sectors in natural gas demand (up 0.5% annually; see Figure 4) and total energy demand up 0.8%/year on average (see figure 5). 6 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 3: U.S. Non-­‐Transport Liquids Demand with CAGRs by Segment vs GDP C AGR; History & AEO'11 Forecast 12 4.0% -­‐5.79% 0.04% 3 3.0% 2.0% 1.0% 0 1990 -­‐2.69% -­‐0.47% -­‐0.49% -­‐1.13% 2009 2035 GDP Growth Rate 2.7% 2.5% 0.37% 6 PowerGen Industrial Commercial Residential GDP 0.0% File: A EO2011 y earbyyear.xls Figure 4: U.S. Non-­‐Transport Natural Gas Demand with CAGRs by Segment; History & AEO'11 Forecast 25 0.47% 20 Quad Quad 9 0.76% 4.83% 15 -­‐1.12% 10 5 0 1990 PowerGen 0.74% Commercial 0.78% 0.77% 0.40% 0.02% 2009 2035 7 Industrial Residential File: A EO2011 y earbyyear.xls Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 5: U.S. Non-­‐Transport Energy Demand with CAGRs by Segment; History & AEO'11 Forecast 100 Quad 80 0.71% 1.30% 60 40 Industrial 1.09% -­‐0.67% 20 0 1990 PowerGen 1.23% 0.65% 1.01% 0.19% 2009 2035 Commercial Residential File: A EO2011 y earbyyear.xls EIA AEO 2011 REFERENCE CASE OUTLOOK TO 2035 Figure 6: U.S. Liquid Fuels Demand by Sector vs. AEO'11's Oil & Gas Price Forecast $150 10 $100 5 $50 0 $0 Industrial 2009$/BOE 15 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 MMBD Transportation Res & Comm Electric Generation AEO'11 Oil Price AEO'11 Henry Hub File: F igure73_data A EO2009.xls As Figure 6 above shows, the EIA expects oil (and product) prices to rise more than U.S. natural gas prices through 2035, and, consequently, recent liquids demand trends to continue; i.e. • Transport demand rises slowly from 2009 recession-driven lows reaching 16 mmbd and a 75% share of total liquids demand by 2035. 8 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 • Industrial liquids demand flattens at about 6 mmbd after rebounding a bit from the recent recession. • Residential, Commercial and Power Generation liquids demand remain de minimis. When all AEO 2011 Reference Case Non-Transport Liquids demand is examined by fuel in 2010 and 2035, as seen in Figure 7 below: • Residential and Commercial demand declines 140 mbd (mostly distillate). • Power generation demand is flat4. • Industrial demand for miscellaneous other5 fuels – which is not particularly pricesensitive – and petrochemical feed (naphtha) both rise about 250 mbd, while LPG demand rises only 70 mbd. 6 Figure 7: Non-­‐Transport Liquids Demand by Fuel in 2010 and 2035 Other* Pet Chem Feed Fuel Oil Distillate Kerosene/Jet Gasoline LPG MMBD 5 4 2.06 3 0.73 2 1 0 0.50 1.61 2.31 0.97 0.49 2010 2010 Industrial Residential & Commercial 2010 Powergen 1.68 2035 2035 Industrial Residential & Commercial 2035 Powergen AEO 2011 * Includes petroleum coke, asphalt, road oil, lubricants, still gas, and miscellaneous petroleum products. File: AEO2011 vs AEO2010 NGL production & consumption.xls As a way of explaining this phenomenon, AEO 2011 Reference Case says: “Industrial natural gas demand grows sharply in the near term…This growth reverses the recent downward trend, 4 Oil-fired Electric Power Generation exists only in places where the cost of supplying coal or natural gas is prohibitive (e.g., Hawaii), and even these cases have declined by half since 1998. 5 Includes petroleum coke, asphalt, road oil, lubricants, still gas, and miscellaneous petroleum products. 9 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 as a result of a strong recovery in near-term industrial production… and relatively low natural gas prices.” Figure 8 below shows the widening spread in AEO 2011 Reference Case Outlook between natural gas prices to Industry and those for LPG and distillate that EIA expects to follow crude prices up. Clearly, higher liquid prices motivate energy efficiency investments / conservation, and substitution of natural gas for LPG where possible, all of which dampen Non-Transport liquids demand growth. Figure 8: AEO'11 LPG, Distillate, Crude, and Natural Gas Pricing To Industry $30 $/MMBTU $25 $20 LPG $15 Distillate F uel Oil $10 Crude Oil $5 Natural G as 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 $0 File: A EO2011 y earbyyear But, AEO 2011 Reference Case also forecasts U.S. NGL production by 2035 to be up about half – almost 1.00 mmbd to 2.90 mmbd from 1.96 mmbd in 2010 (see Figure 9). • This AEO 2011 Reference Case is much higher than their AEO 2010 Reference Case: 0.9 mmbd greater by 2025 and 1.1 mmbd greater by 2035. • It appears that EIA has “gotten on the shale gas bandwagon,” and believes the U.S. shale gas producers who are saying that they will preferentially produce from “wet” zones. 10 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Given this very bullish NGL production outlook, it is hard to see how EIA LPG prices will be as strong as expected, and, consequently, how Industrial demand for LPG will not rise at least somewhat more than the AEO 2011 Reference Case.6 Figure 9 US Liquids Production AEO 2011 vs AEO 2010 12 Other MMBD 10 Ethanol 8 6 1.96 1.74 1.83 2.63 2.90 Refinery G ain NGLs 4 Alaska 2 Lower 48 Onshore 0 Lower 48 Offshore 2010 AEO'10 AEO'11 2025 2025 AEO'10 AEO'11 2035 2035 . File: U S O il Prod & Imports & Total S upply PET_SU M_SN D_D_N U S_MBBLPD_A_cur.xls OTHER POSSIBLE FUTURES To think the AEO 2011 Reference Case Non-Transport liquids demand forecast is mistaken, a person could instead believe any one, or perhaps even a combination of, the following: • That oil and product prices will not rise as swiftly as in the AEO 2011 Reference Case. For instance, in IEA’s World Energy Outlook “New Policies” Scenario oil prices are at least $10/b below the AEO 2011 Reference Case post-2020 (see Figure 10). Other forecasts are even less bullish. Assuming demand is elastic, lower prices would argue for higher liquids demand across the board. 6 On the other hand, it is difficult to envision a significant penetration of LPG into the Residential/Commercial and Industrial sectors as those connect to a natural gas system will most likely not revert to LPG storage, especially given low natural gas prices. 11 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 • But, much bigger factors affecting Non-Transport liquids demand could be: • The spread between oil (and product including LPG) prices and natural gas prices doesn’t expand as much as the AEO 2011 Reference Case differential – which widens to over $80/boe. An example is IEA’s “New Policies” Scenario which maintains about a $50/boe differential between oil and U.S. gas prices (see Figure 10 above). • LPG (especially ethane) prices lag behind any upward move in oil/product prices. As Figure 11 below shows, U.S. spot ethane prices have spread apart from butane and propane prices over the last decade, and have occasionally dropped below natural gas. 12 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 11: U.S. Crude, LPG, & Natural Gas Pricing History 800 700 Naphtha 500 Spot Normal B utane 400 Spot Propane 300 Crude Oil 200 Spot Ethane 100 Henry H ub 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 $/tonne 600 File: A EO2011 v s A EO2010 NGL production & consumption.xls • Regardless of how it might come about, a narrower price spread between ethane and natural gas would lead to less natural gas substitution at the margin, and, therefore, higher Industrial liquids demand. And, clearly if EIA is right in forecasting a 50% increase in U.S. NGL production, there will be plenty of ethane around to satisfy any demand. But, it is problematic whether its price will be low enough to allow U.S. ethylene plants to expand significantly. • Even a somewhat less bullish U.S. NGL production case also could lead to additional Non-Transport demand for liquids (i.e., LPG). For instance, the aggregated Industry and Consultant median U.S. NGL production forecast – obtained from surveys sent out to companies by the NPC – is upbeat too (2.3 mmbd in 2030 versus 2.7 mmbd in AEO 2011 Reference Case), and their high case is even more robust at 2.9 mmbd in 2030 (see Figure 12). 13 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 12:U.S. NGL Production Forecasts AEO 2011 vs Industry+Consultant Views 3.5 3 2.5 2 1.5 1 0.5 0 Ind+Con High 1.96 2010 2.2 1.7 2.0 2.3 2015 2015 2015 2015 2.7 2.0 2.3 2.9 Ind+Con Median Ind+Con Low AEO'11 2030 2030 2030 2030 AEO2011 v s A EO2010 NGL production & consumption.xls • On the other hand, the IEA forecasts declines in North American NGL production through 2035 in their 2010 World Energy Outlook “New Policies” Scenario as Figure 13 below shows. While WEO’10 doesn’t publish country breakouts, it hard not to think that their U.S. NGL production forecast declines in tandem with their North American decline. Consequently, it looks like their U.S. forecast would be compatible with AEO 2010 Reference Case – EIA’s outlook before it “got on the shale gas bandwagon”. 14 MMBD Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Figure 13: US and NA NGL Production WEO 2010 vs AEO 2011 vs AEO 2010 0.37 2.9 0.64 1.91 Mexico NGLs 2.6 2.4 Canada NGLs 2.90 2.63 US NGLs 1.83 1.74 NA NGLs per IEA . File: U S O il Prod & Imports & Total S upply PET_SU M_SN D_D_N U S_MBBLPD_A_cur.xls If IEA’s case were to come about, the likelihood of little growth in Non-Transport Liquids demand through 2035 would increase significantly because there would not be additional NGLs to place in the market, and consequently, LPG prices could easily move in tandem with their expectation of rising oil prices. ECONOMIC GROWTH AS A DRIVER OF US LIQUID DEMAND Historically, one of the most important long-term drivers of energy demand is the rate of economic growth. This has also applied to the demand for US liquids. The impact of economic growth on US liquids demand can be seen by comparing the AEO 2010 Reference Case with AEO 2010 High Macro and Low Macro sensitivities which had real GDP growth rates of 2.4%, 3.0% and 1.8%, respectively. The AEO 2010 Reference Case had US Total Liquid Demand growing from 21 quads in 2010 (9 MMBD) to 47 quads in 2035 (22 MMBD) (see Figure 14). For the High and Low Macro Cases, 2035 Total Demand was 47 quads (22 MMBD) and 37 quads (18 MMBD), respectively. Most of the range in 2035 Total Demand occurs in the Transportation sector (about 70%) and the Industrial sector (about 29%). 15 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 14: US Liquids Demand [NARD DTG Liquid Demand 3-28-2011] 50 45 Quads 40 35 Transport 30 Power 25 Industrial 20 Commercial Residential 15 10 5 0 Reference Reference High Macro Low Macro 2010 For the Industrial sector, LPG demand accounts for about 37% of the total range between high and low forecasts in industrial liquids demand (see Figure 15). Other petroleum (includes petroleum coke, asphalt, road oil, lubricants, still gas, and miscellaneous petroleum products) accounts for about 36% of the total range in industrial liquids demand. 16 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Figure 15: US Industrial Liquids Demand [NARD DTG Liquid Demand 3-28-2011] 12 10 Quads 8 Liquefied Petroleum Gases Other Petroleum 6 Petrochemical Feedstocks Residual Fuel Oil 4 Distillate Fuel Oil 2 Motor Gasoline 0 Reference Reference High Macro Low Macro 2010 IN THE FINAL ANALYSIS How Non-Transport Liquids demand grows probably will depend on how much North American NGLs are produced, and what the prices are for natural gas, LPG and more specifically, ethane, which comprises half of all NGL production. As mentioned earlier, substitution of ethane and other LPG for natural gas in Industrial applications depends heavily on their relative prices. If the relative value of sending unprocessed wet natural gas to a consumer exceeds the value of extracting ethane, then in some cases a gas processing plant may not be built or may not be run. If some ethane cannot be sold to chemical plants (that convert it to the chemical ethylene), it will have to compete with natural gas in heating applications. However, there are strict limits in quality provisions of pipeline tariffs on how much ethane can be left in the natural gas stream. 17 Working Document of the NPC North American Resource Development Study Made Available September 15, 2011 Low ethane prices relative to natural gas, and/or any inadequacy of NGL gathering and processing infrastructure in liquids-rich shale plays will tend to physically limit shale’s development pace thereby curbing NGL production – which will feed back to NGL prices and demand. 18