AGRARIAN SOCIETY

advertisement

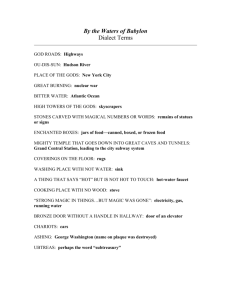

WWDMAGIC A SUPPLEMENT TO WWD AGRARIAN SOCIETY Straight off the farm, denim-on-denim, slouchy layers and heavy-duty outerwear work in the concrete jungle, too, for fall at WWDMAGIC and MAGIC International. KEY TRENDS ACROSS ALL CATEGORIES MEN’S ON THE MOVE Shows converge at Mandalay Bay INNOVATIONS IN JUNIORS 0202MAGa001a;14.indd 1 ON HER: Coat from Latte by Coffeeshop, Wow Couture’s sweater and Mine’s dress. Carolina Amato scarf; ck socks; boots from Bed:Stü. ON HIM: Woolrich’s jacket, Dickies’ shirt, Redsand’s T-shirt and Levi’s jeans. Trafalgar belt; boots from Red Wing Shoes. 1/25/10 4:30:30 PM Las Vegas Convention Center Booth 73708 www.desigual.com OVERVIEW shaking things up MAGIC’s show family is spreading out around town. By Rachel Brown LAS VEGAS TRADE SHOWS ARE ON wear show maintain its individual aesthetic identity. the move. WWDMAGIC’s floor has been divided into three This season, MAGIC is raising the curtain on its areas: Loft for youth-oriented brands such as Junk Food, two-campus layout for the Feb. 16 to 18 program. The Levi’s, Trinity and XOXO; Studio, with an eclectic men’s wear venue, setting up shop in The Mandalay mix of lines that includes Free People, Mac & Jac, Bay Convention Center, comprises MAGIC Desigual and Hobo International, and Plaza, an open Menswear, Project, Premium, Street and S.L.A.T.E., square to allow mingling with brands such as Karen a venue dedicated to an edited mix of street, surf and Kane, 172 Grams, Fabrizio Gianni and Silk Culture. skate brands. An expanded WWD MAGIC will “In the North Hall, there were booths in every constitute the women’s wear arena at the central hall single inch of space. We wanted to give a little bit of the Las Vegas Convention Center, which also will more room to breathe,” said DeMoulin of the WWD house the Pool Trade Show, Sourcing at MAGIC and MAGIC design improvements. “We will have more the premiere of the footwear expo FN Platform. brands than we have ever had, but there is going to “What people are going to see in February is the be a little more space and a little more focus on the culmination of plans we have been working on for fashion aspect of the industry in the space.” years,” said Chris DeMoulin, The debut FN Platform, MAGIC International a joint venture between president and executive vice MAGIC and WWD sister president of MAGIC owner publication Footwear News, Advanstar. “The buyers have will include more than 500 been asking us to make the brands in women’s, men’s, shows more convenient.… kids’, athletic and comfort They are encouraged about categories. (For more on FN bringing all the men’s shows Platform, see adjacent story.) next to Project. They can DeMoulin predicts FN focus on spending their time Platform will spur a “huge with brands rather than in increase” in footwear-only cab lines.” buyer registration. He added, The response to the however, that ready-to-wear changes has been positive so buyers are also enthusiastic far, according to DeMoulin. about attending FN In its survey research, he Platform and, in market For the show calendar, see WWD.com. noted MAGIC has found surveys conducted by that 90 percent of buyers MAGIC, about 70 percent intended to visit exhibitors at of rtw buyers indicated they both The Mandalay Bay and wanted to see an enlarged LVCC. And MAGIC expects footwear presence at the that buyer traffic will climb shows. For buyers across the overall during the three-day spectrum, DeMoulin said series of shows. More than FN Platform would be a 2,000 brands have signed on, showcase “to really see the including Current Elliott, dynamics of what is going on Magic’s two campuses are at the Mandalay Bay (top) and AG Adriano Goldschmied, in footwear in the context of Las Vegas Convention Center (above). Vince, Adrienne Vittadini, the ready-to-wear business.” Stuart Weitzman, Nine West, DKNY, Trina Turk, Regardless of location or fashion category, Ella Moss, Stüssy, Obey, 10 Deep, Famous Stars & trade show participants and organizers embark Straps and Perry Ellis. to Las Vegas with confidence that retailers will be “It is really giving all the buyers [access] to the in a buying mood. “Everybody was looking at last fashions, the trends and brands across the entire year in terms of trying to find out what the new fashion landscape,” said DeMoulin of the updated [consumption] level was,” observed DeMoulin. layout. “We are looking forward to what we believe will “The feedback that we hear from vendors and be one of the most successful shows we have ever had.” buyers is that they have found that footing a little bit, MAGIC has paid attention to the look and and everybody is coming into this show [positively], feel of its men’s and women’s exhibitions. It hired to see which brands, trends and partners they will architectural firm Cleanroom Inc. to help each men’s choose to grow their business going forward.” COVER PHOTO BY JOHN AQUINO. MODELS: ELLIZABETH WHITE/NEW YORK MODEL MANAGEMENT AND BOBBY/FORD; HAIR BY RYAN TANIGUCHI FOR KATE RYAN INC. USING TRESEMME; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: BRITTANY ROBINSON; STYLED BY COURT WILLIAMS (WOMEN’S) AND LUIS CAMPUZANO (MEN’S) 4 Stuart Weitzman will show at FN Platform. KICKING INTO HIGH GEAR A NEW FOOTWEAR SHOW IS stepping out in Las Vegas this month. FN Platform — a joint venture between MAGIC and Footwear News — will include more than 500 brands spanning roughly 60,000 square feet of exhibition space at the Las Vegas Convention Center. The dedicated footwear show, running concurrently with the MAGIC marketplace Feb. 16 to 18, will be divided into five distinctly themed sections to service different categories of the shoe market. “Each of the areas of the show has its own neighborhood and is anchored by its own lounge,” said MAGIC president Chris DeMoulin. The Cosmo women’s section will include brands such as Aquatalia by Marvin K., Stuart Weitzman, Steve Madden and Ralph Lauren. Camp features fashion athletic and lifestyle merchandise like Sperry Top-Sider, Auri, Palladium and G.H. Bass & Co. Bond showcases men’s dress brands such as Donald J Pliner, Mezlan, Bacco Bucci and Cole Haan. Comfort brands in the Zen area will include Easy Spirit, Naturalizer and Aetrex. Finally, InPlay features juniors’ and kids’ labels like Stride Rite, Poetic License, Lelli Kelly and XOXO. An additional 200 shoe brands will be exhibited elsewhere in the MAGIC family of shows, but DeMoulin said eventually they would likely move into FN Platform. Several events also are scheduled during the show. On opening night, FN Platform will team with YP for 210, a networking group of young footwear professionals organized by the Two Ten Footwear Foundation, the industry’s main footwear charity, to host a fund-raiser bowling party at the Orleans Bowling Center at The Orleans hotel. FN Platform will also honor a number of brands celebrating milestone anniversaries, including Sperry Top-Sider’s 75th, and 20 years each for Steve Madden and Donald J Pliner. — Wayne Niemi WWDMAGIC 0202MAGa004b;11.indd 1 1/25/10 3:32:20 PM Sleek looks bolster the contemporary market. By Marc Karimzadeh THE CONTEMPORARY SCENE, LONG A but we refined the look with an elegant haven for cool T-shirts and jeans, is growing up. glamour and a more wearable approach.” Chalk it up to the seriousness of these She said that in Yummie Tummie’s sinister economic times, or just to the increasing fall collection, “you will find softer sophistication of runway trends that trickle interpretations of color, luxurious fabrics, down to the category, but many makers of cleaner finishing and refined detailing. More contemporary and young contemporary clothing sophistication and less shock value.” are tipping their hat to the more polished girl — Jennifer Ashley, owner, founder, designer even if she isn’t completely ready to abandon her and creator of Hippie Ink by Jennifer Ashley, alter-ego rock chick quite yet. said graphics will play a key role for fall. She Lilla P., New York, is best known for its also finds much inspiration in the music scene, Pima cotton tops with novelty details, but for particularly in rock ’n’ roll, though she has also this edition of WWDMAGIC, it is adding been incorporating more Asian influences. sophisticated draping, tucking and pleating in “My shirts started off with peace signs and the fall designs. love [themes], and five years on, it’s still in that “For me, the sophistication and the seriousness vein, but I do a lot of interesting graphics,” of the pleating and draping, really, are a result of the Los Angeles-based designer said. “It’s all people taking everything a little bit more seriously original artwork. It’s still faces, Asia-inspired now and looking at things in the way customers designs, animal prints and Mod. Everyone is are living and dressing,” said Pauline Nakios, wearing big oversize shirts with leggings.” owner and creative director at Lilla P. For inspiration, she cited several impulses, Color, she added, will be key in but increasingly, Ashley said social awareness underscoring the new mood. “Coming off a plays a key role for designers, and for their Jack by BB Dakota’s polyester, viscose and elastane jacket; BCBGeneration’s polyester top, and Blue difficult economic period, people are willing customers. This show, Ashley will offer a shirt Tassel’s embroidered cotton skirt. Hunter boots. to inject a little color into their wardrobe,” printed with the phrase “Love Is the Answer.” Nakios said. “This season, it’s a very modern A portion of sales is designated to Millennium color palette. It’s fall but, particularly in our Promise, a nonprofit organization that hopes category, there are a lot of sun colors, and a lot to halve the extreme poverty in Africa by 2015, of fuchsias, teals and celadon.” and worldwide poverty by 2025. It works with Heather Thomson, creator and founder of communities to implement programs in those New York-based Yummie Tummie, said today’s regions, and builds Millennium Villages across customer wants “style, trend-right fashion, and sub-Saharan Africa. quality,” but “she still wants it at a great price.” “People are more conscious of helping one At Yummie Tummie, key trend inspirations another,” Ashley said. “That’s the direction include Glam Rock with an undertone of our country is going, and people in fashion Eighties and today’s pop culture — “Be it ‘Mad have the ability to help, too.” Men,’ Lady Gaga or ‘Avatar’-inspired,” Thomson At Spanish label Desigual, “happy” is a key said. “At Yummie Tummie, our focus is always theme with a collection that draws from “wellon the architecture of the garment. The Eighties being, color, joy and sincerity,” according to design inspiration resulted in a collection of a company statement. Details will include soft, superstretch fabrics, refined detailing, handmade concepts, like denim patches. The strong shoulders, sophisticated construction and looks are inspired by a search for well-being asymmetric prospects for fall.” and positive energy — suitable at a time when Thomson noted that runways customers are looking to spend more time and subsequent cyclical with family and friends. fashions continue to dictate Charlotte Tarantola, founder and designer trends at her label. of the namesake line and the Laquette label, “Our broad said she will continue to focus on novelty appeal and broad knitwear, with an emphasis on prints, demographic do not CC Couture’s wool and elastane coat, Chaudry’s cotton top and David Kahn embellishments and, for fall, horizontal stripes. Jeanswear’s cotton and polyester denim jeans. Girlprops earrings. allow us to focus “My print business is totally out of control,” on only one target, one defined customer,” she Los Angeles-based Tarantola said. “For fall, for example, I’ll still have print said. “As much as the Eighties inspiration is cardigans, and will be showing floral prints, some modern takes on animal clearly evident in our prints, and a lot of looks accentuated with ruffles. For me, [customers] are collection, we honor the looking for cheerful, surprising, out-of-the-ordinary product and things that Nic + Zoe’s cotton, silk and Modal sweater. history of the Eighties are really signature,” she said. 0202MAGa006(7)a;22.indd 1 PHOTOS BY ROBERT MITRA; MODELS: BETTINE AND DIANA PENTY, BOTH AT MUSE; HAIR BY JOEL GUNDERSON FOR CUTLER/REDKEN AT ATELIER MANAGEMENT; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: ASHLEY JOHNSON; STYLED BY KIM FRIDAY; LOCATION: HOMESTEAD INN – THOMAS HENKELMANN, HOMESTEADINN.COM CONTEMPORARY/YOUNG CONTEMPORARY modern polish 1/25/10 4:45:14 PM PHOTOS BY JOHN AQUINO; MODELS: ELIZABETH WHITE/NEW YORK MODEL MANAGEMENT (JUNIORS) AND MARIA SHUMAKH/Q (SWIM); HAIR BY RYAN TANIGUCHI FOR KATE RYAN INC. USING TRESEMME; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: BRITTANY ROBINSON; STYLED BY COURT WILLIAMS; LOCATION: GRACE, A ROOMMATE HOTEL Junior firms try creative tactics. By Khanh T.L. Tran WHILE THE FASHION INDUSTRY HAS been buzzing about value for the past few seasons, a new mantra is echoing across juniors companies exhibiting at WWDMAGIC: Innovation. As businesses stabilize after trimming costs and managing inventory tightly in the direst fiscal crisis since the Great Depression, designers and manufacturers are strategizing how to entice fickle teenage girls to return to stores and shop. Some companies are playing it safe by tweaking past bestsellers, while others are forging ahead to push extreme styling as seen on the runways and streets of Europe and Asia. “It’s not good to be as good,” said Deke Jamieson, executive vice president of marketing and licensing at Los Angeles-based YMI Jeanswear. “You need to come up with new products and concepts — anything that entices retailers to take a look at your brand.” That means an expanded array of outerwear — triple the number of styles from last year — for YMI. Among the cover-ups are puffer jackets, lined hoodies, faux leather jackets and plaid wool coats, all retailing from $49 to $115. The company also plans to capitalize on the trend for denim leggings with a crinkled version at $38 retail. “We suggest to consumers that they tie it up and throw it in the washing machine and dry it that way,” Jamieson said. “When they put it on, it feels like second skin.” Los Angeles’ Z Cavaricci is also promoting denim leggings made of blue and black 8.5-ounce denim with 40 percent stretch. Having taken a six-month hiatus from shipping, the brand is in the midst of a revamp with better-priced denim. Wholesale prices now run from $18 to $28, compared with its previous price range of $12 to $16. The styles veer toward ultratrendy, such as motorcycle-style jeans and a skinny leg in an ombré wash that is drenched in a vibrant color before fading to white. “The key to this whole thing is getting quality product at a low price,” said Martin Barrack, Z Cavaricci’s sales director. “The fabric, the denim, everything is equivalent to, say, a premium Guess item but the prices are half as much.” At XOXO, the juniors brand owned by Kellwood, lightweight fabric that feels like nothing on the skin is key to the spring collection — for more immediate deliveries — it will present. Voile, gauze and the color white will emerge as key trends for the line, which wholesales from $17 to $27. Rompers and skirts will be the new silhouettes. XOXO isn’t the only exhibitor highlighting spring and summer looks at the February trade show, which traditionally focuses on fall. Madison Brands Inc., New York, said since retailers are buying closer to the season, it’s showing pieces that will ship between March and June. It’s also bringing casual looks, like tunics to wear with leggings, chambray, ditsy prints and big floral patterns. “In the past, we did button-down shirts that fit at the waist, that you can wear to work with black pants,” said Chasen Mintz, account executive at Madison Brands. “Seventy percent of the line will be casual. It’s what’s been retailing for us.” New Breed Girl is also chasing the casualloving teen with the launch of hoodies, ranging from heavy-duty basics to fashion fleece. It’s also introducing backpacks, totes, wallets and beanies. “We are continuing with street trends that influence our demographic,” said Patrick Wood, BRIGHT OUTLOOK FOR SWIM THINGS ARE HOLDING STEADY ON THE SWIMWEAR FRONT FOR spring. Much like last season, swim vendors expect retailers’ eyes to be on color and cost for the coming market. “Color is the first thing people look toward,” said David Burnett, vice president of merchandising for In Gear. “Fluorescents look right on. They look happy and there’s a lot of energy with them.” This is particularly true in the active swim category, which Burnett sees as a prime market for bright tones. “It’s a new approach to active, which we haven’t seen in a long time,” he said. Within that vibrant spectrum, several firms cited tie-dye as a key look. “All of the tie-dye and the ombré prints that are really color driven still seem to be carrying the same weight,” said Natalie Wierzba, national sales manager and merchandiser at Beach Rays, a division of Southern California swimwear manufacturer J.Y. Rays. “Better specialty stores are looking for product that’s well merchandised, so they literally see visual that Nylon and spandex makes an impact.” That includes embellishments such bikini from as hardware, crystals and beading. Trina Turk “Swimwear has become a fashion statement,” at Apparel said Rosie Kendall, designer and an owner of Ventures. JUNIORS/SWIM inventive ideas YMI’s polyester and cotton vest and cotton, polyester and spandex jeans with cotton T-shirt from Rockware at Freeze Clothing. AV Max sequin bracelet; Bed:Stü boots. vice president at the Los Angeles-based maker. In light of the still-weakened economy, Salt & Pepper Clothing in Vernon, Calif., is continuing silhouettes that have done well in the past but sprucing them up with new fabrics and prints. For instance, it’s updating the kimono top with allover prints in an abstract floral or in solid colors accented with embroidery. “We want to be safe but not too safe, because we don’t want our customers to think we’re boring,” said Warren Hong, sales representative at Salt & Pepper, where the average wholesale price is $15. “It’s a fine line we’re walking.” See-through styles are also big for Wow Couture, a Los Angeles-based firm that counts Arden B., Forever 21 and Charlotte Russe among its retail accounts. Instead of lace, it’s knitting cardigans out of rayon. Black and white are the colors for its summer palette of items at $10 to $18 wholesale. Mike Guimm, general manager for Wow, said, “We’re adding variety with lightweight yarn so people can wear them all year.” Las Vegas-based Unleashed Swimwear, which is launching at WWDMAGIC. “In Vegas, I see a lot of trends. It’s really important to look hot and sexy, and bring your personality out. Retailers want something that will draw attention to their customers.” According to Burnett, such decorative effects “give a sense of perceived value,” or bang for the buck, which helps justify price. In Gear’s stable of labels retails from $10 for junior sets to $29.99, $49.99 and $79.99 tiers before hitting the highest mark, $122, for the Plunge line. “Everything is price-driven,” he added. “They’re value-oriented with embellishments and we’re seeing the payoff. People are buying for looks first, but at an enticing price.” In terms of silhouette, while bikinis still reign supreme for most labels, monokinis and one-pieces are edging in. “One-pieces are incredibly important across [all of our lines],” said Wierzba. Meanwhile, Kendall was sure to include a range of monokinis and cutout styles in her debut collection. “They’re sexy and really flirty,” she said. As for the bikini market, Burnett said In Gear’s sales indicate Seventies-style bandeau “sunworshipper” silhouettes will continue to be hot. — Jessica Iredale WWDMAGIC 0202MAGa006(7)a;22.indd 2 7 1/25/10 4:45:43 PM ACCESSORIES DELIVER COMING OFF A BETTER-THAN-EXPECTED holiday after a long period of bone-dry consumer spending, accessories vendors are upping their game with differentiated product and price, aiming to prod customers to open their wallets once again. “The consumer is looking for more value and for more novelty, more artisanal detailing, more embroidery, beading. There’s no interest in classic. This trend started over a year ago,” said Carolina Amato, designer and president of Carolina Amato, a New York-based company specializing in cold weather accessories. Amato is bringing summer and cold weather accessories to the show, including gloves, hats and scarves in polkadot and leopard intarsia patterns in gray, brown or 8 Clockwise from left: Old Gringo’s leather boots; Berek’s leather jacket, Silk Culture’s beaded silk tank top and Not Your Daughter’s Jeans’ cotton and spandex denim jeans; JSong’s wool and viscose coat, Barbara Lesser’s cotton T-shirt and Silk Culture’s silk skirt with a J. Jansen necklace. Coast stores “are starting to feel like business is coming around,” but the rebound is a little slower in the South, according to Girard. “Jeggings” — jean-type leggings — should be “a huge trend for fall,” she said. Stores like the fact that Fabrizio Gianni has American factories, which allows them to reorder in a timely fashion. “They know they can buy a little and get back into it easily,” Girard said. “We make everything in L.A. so we don’t have to deal with holidays in other countries or having things get held up in Customs.” Girard started selling Puli, a Canadian label of blouses and jackets, in the U.S. about 18 months ago. She said it has also become more popular in recent months. Several better specialty stores have picked up the collection because the prices are appealing and the design looks more expensive. Blouses wholesale from $35 to $55 and jackets are in the $45 to $75 range. black with orange or turquoise contrasting patterns. The designer, whose accessories sell in boutiques and better department stores, is also bringing men’s and women’s leather gloves with detailing like buckles. Business has been good for Amato, whose price points are in the better to upper-better range. “The volume of product that retailers were able to sell has dropped off, but the cold weather really helped a lot,” she said. Alexia Crawford, president of her namesake firm and a 10-year veteran of WWDMAGIC, is focusing on hair accessories, scarves, handbags and jewelry, all retailing for between $3 and $38. “We’re more fashion-oriented, so our stuff seems to be bigger,” she said, noting her best performers are stretch cocktail rings with large glass stones, as well as long, layered industrial chains and leather and suede bracelets. Her accessories are tied to jewelry in some way, and usually have some embellishments — even the scarves. “Scarves are not as good as last year, so we have added more novelty-driven scarves,” with details like lace, she said. Patti McKillop, chief executive officer of Potluck Paris, a Seattle-based company that imports jewelry from mostly French designers, also stressed the importance of unique product. McKillop said she will bring new styles of bracelets, necklaces, earrings and rings, all made of mixed metal with an “antique finish, yet a modern look.” They retail between $30 and $300. “I think the biggest focus from this season is all the types of chains,” she said, adding PHOTOS BY ROBERT MITRA; MODEL: DIANA PENTY/MUSE; HAIR BY JOEL GUNDERSON FOR CUTLER/REDKEN AT ATELIER MANAGEMENT; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: ASHLEY JOHNSON; STYLED BY KIM FRIDAY; LOCATION: HOMESTEAD INN – THOMAS HENKELMANN, HOMESTEADINN.COM WITH THE RECESSION STILL INHIBITING SOME SHOPPERS FROM spending, sportswear makers are trying to encourage them to loosen up their purse strings by offering a greater assortment of interchangeable items. Today’s thrifty shoppers might be more inclined to buy something new that can update pieces they already own. Domestically made products are also offering another reason to buy, as some consumers have become more conscientious about supporting local businesses. Len Shemin, owner of Nomadic Traders, a Berkeley, Calif.-based company, said more stores are placing orders for the company’s domestically made NTCO sportswear label. Aside from meriting a Made in the USA label, the collection has allowed Shemin to develop more lasting relationships with factories in the Bay Area. “We feel particularly good about that, and it helps to be closer to the production source,” he said. In addition to its Nomadic Traders label, which consists of sweaters and sportswear, the firm is branching out with Apropos, an updated sportswear line that will bow this fall. Sweaters, soft dressing, coats, jackets and multicolored wraps are part of the mix. Many of the firm’s 900 store accounts had requested another label to build on its success while introducing something new, he said. Apropos will wholesale from $22 for a top to $82 for a coat. It should account for 40 percent of the overall fall business and will be sold in about 350 stores, he added. Neve Designs, a Boulder, Colo.-based company, is extending its ski sweater assortment with coordinated separates that will launch in the fall. Dresses, pants and tops will be among the offerings. The aim is to sell more head-to-toe outfits, said design director Carol Gantos. There is also a Prima Belle group made of a silk, merino wool and Lycra spandex blend that should help boost fall sales, she added. Those crewneck and zip-front tops, leggings and other separates have ski-inspired graphics and coordinate with the brand’s ski sweaters. Neve has made a concerted effort to improve fit for its athletically inclined customers. The company also just hired a European sales rep who will initially focus on opening accounts in Italy, Germany, France and the U.K. Another recent initiative was the overhaul of its catalogue to make the photography and marketing more sophisticated, Gantos said. Lynn Girard, who owns a signature showroom in Los Angles, said she has seen retailers’ interest in Fabrizio Gianni sportswear accelerate in recent months. A five-pocket jean in cotton twill, which is available in 25 colors including neons and other bright hues, is particularly popular, she said. Matching tops and scarves are also in demand, especially in Dallas and Los Angeles. West PHOTO BY JOHN AQUINO WOMEN’S DRESSES/SPORTSWEAR/ACCESSORIES mix and match Sportswear houses are playing the versatility card. By Rosemary Feitelberg WWDMAGIC 0202MAGa008(9)a;18.indd 1 1/25/10 4:24:06 PM PHOTO BY ROBERT MITRA; MODEL: DIANA PENTY/MUSE; HAIR BY JOEL GUNDERSON FOR CUTLER/REDKEN AT ATELIER MANAGEMENT; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: ASHLEY JOHNSON; STYLED BY KIM FRIDAY; LOCATION: HOMESTEAD INN – THOMAS HENKELMANN, HOMESTEADINN.COM Makers hope unique details will entice retailers. By Ross Tucker VENDORS EXHIBITING IN WWDMAGIC’S premium segment, a recent addition to the show, are entering with the knowledge that they’ll need to attract retailers with a balance of proven sales winners and unique products. While the worst of the recession might have passed, vendors realize that retailers are still waiting for their customers to return in force. As a result, it’s likely that those retailers will opt to chase business rather than burdening themselves with excess inventory. That said, the mood has greatly improved and retail buyers aren’t necessarily looking to play it safe when it comes to style. Rick Guido, owner and designer of Noblita, launched his business four years ago with what he dubs “nondenim jeans.” “It looks like denim, but it feels like french terry, which is a knit,” said Guido. The Los Angeles-based label sells to Fred Segal, Nordstrom and Bloomingdale’s, among others, with price points ranging from $100 to $120. Noblita has also expanded into tops and motorcycle jackets to match its nondenim jeans looks. Guido said he’s added a lot of extra detail work to the collection ahead of the show, including studs, patches and hand-painting work. “We’re adding things like studding on the waistband, belt loops and pocket treatments,” said Guido. “We’re adding 200 to 300 studs around the waistband. We’re also adding patches — we believe patches are going to be very hot.” Guido said he’s seen the business environment improve even from the beginning of the year. Retailers, he said, now have a clear picture of where their businesses stand and the direction in which they are going to head. They also want to bring in goods within four to six weeks. “They’re looking [for] much closer [deliveries],” he said. “I think they’re looking for anything new and different. I think they have enough jeans lines.” Jared Langleben, owner and designer of New York-based Jared Lang, which specializes in men’s and women’s woven shirts, said his collection will focus on prints. Like Guido, that another big trend is rings with a metal elastic band. In fact, her strongest seller is the elastic ring, most of which are adorned with rhinestones and Crystallized-Swarovski Elements crystals. The rings, which are available in a variety of shapes, such as a flower shape, retail Wool and rayon from $65 to $100. Differentiation is also hat from Peter Grimm Headwear. a theme in handbags, according to Adrienne Vittadini Handbags design director Elena Humphreys. While the styles in handbags are “all over the map,” Humphreys said the one trend that has emerged is “ladylike and embellished” Langleben has also added more details to the line, including double buttons and stitching on collars and cuffs. “Detail work is strong and for next season, we believe prints is the up-and-coming trend,” said Langleben. Langleben says retailers are still reluctant to buy new lines unless they have a unique perspective. “They’ll only buy what sells — unless there’s something eye-catching,” he said. “The new guys are going to have to be really strong and powerful and have something unique in the industry.” Marguerite Moye, designer for Erge Designs and new brand Eyelid, said retailers aren’t limiting themselves to one or two trends, so Erge is playing with several. Moye has seen a return of oversize Eighties looks combined with the return of leggings. “We’re trying to do a bit of both,” she said, adding that she’d even used small shoulder pads in a few items. The line will also incorporate tie-dye effects. Moye said she’s working with a lot of burnouts this season. “We try and put a little bit of everything out there,” she said. “From us, people love color. They don’t want to see drab.” Like Moye, Alex Vedder, brand manager for juniors label Closet Romantic, sees an opportunity for mixing trends. “We’re seeing a lot of grunge coming through,” said Vedder. Closet Romantic launched in July and is one of the new labels aiming to appeal to retailers with an edgy look at a good price. “We’re focusing on bringing in that grunge trend but mixing with a little more girly,” she said. “Our line is feminine-meets-edgy.” Vedder believes retailers will be looking for looks that are easy to wear and comfortable. “A lot of our burnout stuff has done great, as well as our looser styles,” she said. She also feels the pressure from retailers to offer more for the money. “Like they have been doing for the last year or so, retailers are looking for lines that stick out and are at a great price point,” said Vedder. “They want more value for the money they’re spending.” bags at attainable prices. “Adrienne Vittadini is doing a luxury collection for an affordable price,” she said, explaining that the bags feature jewelry-like hardware. Through “smarter design” and “great sourcing,” the New Yorkbased company is able to offer the bags in the $200-to-$400 price range, Humphreys said, adding that the bags look like they cost $700 but they will sell for $300. “With the economy still soft, people are buying investment pieces,” she observed. “I’m sure low-end apparel is doing better than low-end accessories. I think people would rather have 20 cheap sweaters than 20 cheap handbags.” Designer Michelle Cravens, owner of Michelle Monroe Studios, a Yorba Linda, Calif.-based luxury handbag firm, concurred with Humphreys. “If people are going to spend money, it’s going to be on jewelry or handbags versus apparel,” she said. The bags, which are higher-end, retailing from $300 to $670 and often “on the same shelves as Gucci and Prada,” have been featured in magazines for their unique look, mixing feathers, leather and detailing like studs and gold hardware. Cravens will bring six to seven of her signature feather bags to the show. “I have seen a feather trend but not much on bags,” she said. “I did a few pieces last year and got a lot of encouraging feedback.” — Alexandra Steigrad WWDMAGIC 0202MAGa008(9)a;18.indd 2 WOMEN’S PREMIUM/ACCESSORIES Knitmania UK’s Modal jersey dress. Stuart Weitzman shoe boots. novel approach 9 1/25/10 4:24:25 PM MEN’S PREMIIUM Triple Fat Goose. Right: Tokyo Five. spare parts High-end and contemporary brands focus on cleaner designs and lower prices for fall. By David Lipke A PARED-DOWN, LESS-EMBELLISHED DESIGN AESTHETIC and value pricing are the watchwords in the premium market for fall, as vendors strike a cautious stance in the face of an unpredictable retail climate. “Consumers have gotten pickier, purchases are less frequent and fashion has become less disposable,” said Michael Silver, president of Winnipeg, Canada-based Silver Jeans. Despite the down economy, Silver Jeans enjoyed a 20 percent increase in men’s sales last year on the strength of its value pricing. The brand’s jeans mostly retail for between $80 and $105 and sell best in the Midwest, at retailers such as The Buckle, Von Maur, Dillard’s and Nordstrom. “I think we found ourself at a very effective price point,” said Silver. “We’ve found a lot of new customers that were looking for a great value, and we have the right jean at the right price.” In denim, slim legs and stretch fabrics continue to grow in popularity among men, even in the heartland, added Silver. The company will introduce its first collection of women’s tops at the show, with men’s tops to come next season. Also sporting accessible price tags is new denim and sportswear brand Tokyo Five, which was launched last year by New York-based Brand Resource. The collection features a classic Americana workwear aesthetic mixed with Japanese-inspired graphics and type treatments. “We use a lot of thick, chunky zippers, heavy cast-iron buttons and hand-sewn bar tacks,” said Charles Jebara, president of Brand Resource. “It’s a masculine brand. We’re steering away from the overembellished look — the last thing we need is another guy in a thick-stitched jean.” Tokyo Five jeans retail from $89 to $110, panel-printed jersey T-shirts from $40 to $60 and track jackets from $68 to $88. “We’ve seen tremendous downward pressure on prices and this brand is aspirational without being overpriced,” said Jebara. Outerwear maker Triple Fat Goose is adding denim and wovens to its assortments this year in an effort to create a year-round business. “We’re going for a clean look with nice details,” said James Chung, an owner of New Jerseybased Turbo Holdings, which owns the Triple Fat Goose and First Down brands. Preppy-tinged patches and appliqués adorn the line’s polos, wovens and cardigans. Jeans retail from $60 to $80, and tops from $60 to $90. Buyers may be in for a shock at Ed Hardy, as the brand long known for its aggressive, gaudy aesthetic is cleaning up its designs this year. The company is pushing a core basics line that features solid Ts with a simple chest embroidery 10 that retails for $40, hoodies from $70 to $80 and lounge bottoms from $50 to $60. “We want to cater to a larger demographic,” said Caleb Westbay, vice president of sales at Ed Hardy. “This is a much cleaner commodity product, with lower prices than our fashion collection — but it still retains the excitement and personality of the brand. It’s everyday casualwear.” Ed Hardy will also introduce a new line under the True Vintage sublabel, which is inspired by motorcycle culture. “It has a grungier-type feel, with slub cottons, mineral washes and stitching details,” said Westbay. The centerpiece of the Ed Hardy installation at MAGIC — which including licensees covers about 100,000 square feet — will be a fully loaded Ed Hardy retail store, including windows and cash wraps. “We plan on expanding our retail network very aggressively in 2010 and we want to showcase our entire lifestyle story,” said Westbay. The company operates 23 full-price stores in the U.S., as well as a handful of outlets. Worldwide there are 73 Ed Hardy stores. The Ed Hardy brand is owned 50/50 by Iconix Brand Group Inc. and Ed Hardy, the pioneering tattoo artist whose work is the basis for the brand. Culver City, Calif.-based Nervous Tattoo Inc., which is owned by Christian Audigier, is the master licensee for Ed Hardy and produces the sportswear and headwear lines, which are a $165 million business at wholesale. The company also sublicenses the brand in about 70 other categories, ranging from fragrance and candles to beverages and car floor mats. In total, the Ed Hardy brand rings up about $600 million at retail. Another major footprint at MAGIC will be the Defiance USA booth, which will show its English Laundry, Fender, Da Vinci and John Lennon collections. The company will introduce new licensed product in shoes, eyewear, underwear and home categories. Value pricing is a key component of all the company’s brands, and over the past 18 months those prices have decreased 33 percent. “We are trying to offer as competitive a price point as possible. Those reductions have all come out of our own margins, but we’ve made up for it with greater volume,” said Christopher Wicks, chief executive officer and creative director of Defiance USA, noting the company posted a 30 percent sales increase in 2009. “I think people who survived this very chaotic financial arena are thinking more nimbly. It’s a stripped-down environment, and people aren’t paying ridiculous amounts of money for things anymore,” added Wicks. “This shakeout has left the players who know how to dance.” WWDMAGIC 0202MAGa010(11)a;10.indd 1 1/25/10 3:05:17 PM Gray and plaid dominate the fashion trends for fall, with a hint of brown to come. By Vicki M. Young MEN’S SPORTSWEAR WILL BE DECIDEDLY CONSERVATIVE IN anymore. The season starts with rich autumnal colors in tactile fabrics, and tone for fall, as slimmer silhouettes in shades of gray, a brown color palette newness in all classifications. A breath of new plaids, and iconic graphic and subdued plaids permeate the market. applications are important parts of the mix. Deeper into the season the This return to basics is expected to connect with consumers who are palette evolves into saturated jewel tones based off of black and charcoal. The embracing classics as the next big trend. revival of the shirt jacket, slim-fit jeans and nautical military details are key Tim Bess, men’s fashion-trend analyst at The Doneger Group, is elements of the season.” predicting a “great season.” At Christopher Lena Shirt Co., Leonard Kang, vice president for “I’ve been walking the [men’s shows at market week] and the buzz has operations, said the “basic shirt is conservative, with a slimmer cut.” He been about how they’ve all been good shows,” Bess said. “There’s a lot of said color is fairly basic, although “one can have a wild color and still be optimism out there, with everyone very upbeat about the business.” conservative depending on trimming and how it is worn.” In terms of trends, “plaid is still big this season,” according to Bess. Following the conservatism in trends, “Fabrics tend to be more Brooks “While young men’s will see more of the explosive plaid designs, men’s will Brothers, but with toned-down trimming, [such as] slightly smaller be more mid-scale. You’ll also see more colorblocking, such as collars,” Kang said. a sweater with the upper body a solid gray and the rest of the He’s noticed people are less willing to take risks with fashion body in blue.” given the economic backdrop, resulting in conservative He expects a “season of gray — all shades of gray.” trends, as consumers want the items they purchase to He noted gray denim bottoms did well last season, last several seasons. and that continues to be the color palette of choice. Ron Rheingold, president of the men’s sportswear New neutrals being introduced include brown, division at Weatherproof, said consumers are featuring shades such as sienna and camel that looking for value and will buy if they perceive value are also worked into a variety of patterns, such in the offerings. as “brown plaid wool coats.” Shades of blue In addition to the core classic Weatherproof and red are also showing up as subdued accent brand, the firm also offers Vintage by Weatherproof, colors in plaids. a more fashion-forward line. “You’ll see different Also big this year is the outdoor category, with patterns in the fabrications and more vintage looks patterns reminiscent of Western wear found in in sportswear.” He said a key item this fall will be the Woolrich and Pendleton, said Bess. He noted puffer vest featuring matted ciré on the outside. It’s the ubiquitous denim jacket is being updated the American version of the European-style puffer to offer a slimmer fit, and denim shirts will be jacket showcasing a shinier fabric. available in a variety of shades ranging from He noted Vintage by Weatherproof also dark indigo to a lighter bleached-out tone. offers corded polar fleece as its fashion item, According to Stephen Hooper, vice allowing the company to obtain a slightly higher president of design for DKNY Men’s price. “It has a corded texture and it costs a few sportswear, “We were inspired by the effortless dollars more, but the [fabric is] different from our mix of sport and active with updated men’s wear competitors,” Rheingold said. patterns — sporty nylon and waxed cotton Lori Medici, vice president of marketing at in sleek urban silhouettes mixed with more Perry Ellis International, noted a variety of traditional men’s wear patterns and prints. That brands under the Perry Ellis umbrella will be dichotomy represents the classic DKNY DNA.” showcased at MAGIC. Hooper said the color palette for fall The namesake Perry Ellis line will showcase starts with grays and blues, and moves toward “color statements, coat-front knits, peak lapels and rich burgundy, olive and brown shades as the double-breasted sport coats, microstripe wovens Christopher Lena shirts. season progresses. and wrinkle-free shirts. We concentrate on expanding He said DKNY Men’s has focused much attention on wear-now fabrics our ‘fits’ to cover both the city and classic looks combining mainstream and for fall, such as resin-coated cottons and nylons in outerwear; cotton and aspirational styles. Focus will be on crafting assortments down to the door cotton-cashmere-blend sweaters; mercerized cotton, pima cottons and slub level specified by region and climate,” she explained. jerseys for the base fabrics in knits, and shirting patterns in checks, plaids and The company will also be launching Pierre Cardin sportswear with casual stripes in high-count cotton. bottoms, denim, outerwear, leisure and warm-up suits, knits and sweaters. Another key feature in the offerings for fall centers on versatility, such as According to Medici, the line will feature Cardin’s iconoclastic “use of design button-out or zip-out liners in hybrid blazers and outerwear. “These can be and color such as geometric shapes and patterns” that fuses French savoir worn in early fall to holiday, making them great two-for-one pieces at a price faire and metropolitan style to resonate with a cross-generational consumer. point of under $200 retail,” Hooper said. Perry Ellis’ Hispanic brands — Cubavera, the Havanera Co. and Centro Nautica is also placing emphasis on wear-now pieces, according to Chris — continue to evolve as the landscape of America becomes more diverse, Cox, creative director. “For fall, we are focused on ‘buy now, wear now’ in Medici said. An example of an essential timeless look is the “guayabera,” the both sportswear and jeanswear offerings. It is still critical and important now four-pocket pleated tropical shirt within the Latin culture and which serves as to have these types of items for our consumers. No one is buying and holding the foundation and inspiration for the firm’s Hispanic lifestyle brands. WWDMAGIC 0202MAGa010(11)b;11.indd 2 MEN’S SPORTSWEAR conservative party 11 1/25/10 3:51:44 PM Men’s Accessories/Tailored american heritage Manufacturers turn their eyes to the past for inspiration. By Brenner Thomas “We upgraded the leather, linings and created new When MAGIC takes over Mandalay Bay Convention Center on Feb. 16, Tandy Brands packaging for the line,” said Hilda McDuff, chief will unveil a booth designed around the company’s merchandising officer for Tandy Brands. These vintage designs shadow a growing trend in recently revamped logo and branding campaign. But as far as the leather goods and belt markets go, sportswear toward classic American looks, but also that’s likely all that will be new at MAGIC. Vendors reflect retailer demand for styles that are tested and this season are otherwise looking to the past, where familiar. The exception appears to be the young men’s market, where belts and small leather goods continue vintage and heritage styles will dominate in the fall. “Two years ago, this market was much more to be driven by fashion. Tandy Brand’s Surplus line driven by trend,” said Laura Drnek, vice president is showing innovative screen prints on its belts. Marc of merchandising at Randa Accessories. “Now it’s all Ecko Cut & Sew, a Randa license, is moving toward about brand authenticity.” jean-friendly but playful styles with exaggerated For many, that means focusing on vintage-inspired hardware, like studding and mixed metals, used on product. Levi’s, which Randa produces under license, worn leathers with raw edges. is showing belts in burnished leather with lots of highs The price-value equation, that buzz phrase of 2009, and lows and smoked, antiqued hardware. “These belts will continue to drive business in the fall look like your grandfather wore them 20 as well. “The value component has years ago,” Drnek explained. obviously never been more critical,” “Black is still important but said Rick Luft, president of Swank Inc. His company is highlighting brown is really trending here.” Dickies is also looking value by increasing descriptive to its roots, with a belt and language on packaging for the wallet line that evokes the company’s small leather goods and company’s workwear heritage. belts, which it makes under license A Marc Ecko belt. for the likes of Kenneth Cole, Tumi and Guess, “It’s cleaner with polished finishes like among others. For instance, it’s promoting slim wallets antique nickel that reflects the literal nuts and bolts that a lot of Dickies consumers use in their jobs,” with tags that call out the product’s comfort. said Wava Junior, senior merchandiser at Randa Durability and comfort are also mandates at Accessories, where she oversees the Dickies license. Tandy, according to McDuff. “You have to offer Heritage is also a watchword at Wrangler, as well more for the price right now,” she said, adding that as Dockers, which is showing a range of less dressy the company is also scouring its suppliers for better belts that feature milled and burnished leathers with deals. “We’ve committed ourselves to leveraging our sourcing. The competitive landscape demands it.” unfinished edges and larger widths. Tandy is also relaunching one of its proprietary In such a market, it’s no surprise that reversible small leather goods brands, Rolfs, which will revolve belts — always a hit in the men’s market — have around a concept of heritage and craftsmanship. been trending across the market. Nuance and Nostalgia Tailored clothing vendors at MAGIC are hoping to jump-start suit sales by swapping basics for detail-rich sport coats and patterned suits with a distinctly old-school feel. “This is about newness and innovation at a price,” said Larry Drew, vice president of sales for the Trybus Group, which will be showing its Cesarani and Steve Harvey lines at the show. The Texas-based resource will highlight jackets with lots of talking points: leather under collars, hybrid sport coats with zip-out bibs, fauxsuede buttonholes. “If you don’t make it visually stimulating, it won’t sell,” Drew said, adding that vested suit separates and doublebreasted models will lead the silhouettes in his suit presentation. The other major current in tailored clothing are modern twists of traditional haberdashery classics such as tweed, flannel, Prince of Wales, subtle plaids and fancies cut in slimmer silhouettes for a younger guy who is discovering dressing up. “Everybody has their black suit by now. People want something new,” said Ed Gurdak, executive vice president of Marcraft Apparel, which is showing the trend in both its Tommy Bahama and Jones New York licenses. “Everything nostalgic is strong again. It’s a look that appears modern, but is not a loud fashion statement. It’s accessible.” — B.T. We See Opportunities Where Others See Issues Successful companies take advantage of the opportunities that changing times present. But growing companies often face financial issues in times of change. It takes a knowledgeable eye to see beyond fixed formulas or capital ratios to fully comprehend the complex financial needs of businesses. For over 70 years, mid-size and large businesses have relied on Rosenthal & Rosenthal to manage their accounts receivable and to provide timely financing for growth. Business owners and managers have access to the key decision makers at Rosenthal, which enables them to obtain quick and informed responses to their most pressing business needs. Domestic & International Factoring—Letters of Credit Working Capital Loans—Term Loans—Collateral Management Services NEW YORK LOS ANGELES For a conf idential consultation, please contact Michael Stanley: 212 356 -1497 or mstanley@rosenthalinc.com ROSENTHALINC.COM 0202MAGa012(13)a;11.indd 1 1/25/10 4:43:24 PM KIDS’ youth movement Innovations and value pace children’s wear. By Anne Riley-Katz THE CHILDREN’S SECTOR HASN’T BEEN HIT AS HARD OVERALL AS HAS the rest of the apparel world, but trade-show business has suffered with foot traffic way down, as buyers continue to cut buying and travel budgets. As such, with economic pressures high and inventories still tight, exhibitors of children’s apparel have tempered their sales expectations. Sea & Sun LLC holds licenses for Marvel Comics, True Religion and Ed Hardy swim and beach apparel for kids and adults and is exploring fabrics that change color when exposed to UV light or temperature changes, UV-resistant garments for kids with sensitive skin and 3-D swim goggles to differentiate its lines. “We used to project our sales and make a lot of everything. Now we do it the other way around, we see what the interest is first,” said Fawn Arthur, creative director for Sea & Sun. “People want more than just the clothing, they want more bang for their buck, so you have to be innovative. I think buyers are looking for things, especially in swim, that can be double-use and are street-ready.” “The kids apparel sector is a little less subject to pullback because parents will cut out their kids last,” said Eric Beder, a retail analyst for Brean Murray, Carret & Co. “But, as is true across the entire apparel world, there is an overall reduction in volume, higher-priced lines are faring worse, and there’s a lot of flight to value.” American Apparel Inc.’s new children’s line will be shown with the rest of the company’s wares. Founder Dov Charney said the youth line is a projected growth area for the company in 2010, despite the fact that American Apparel doesn’t sell to many outside retailers, relying on its own stores and private label accounts, like one with Levi’s, to sell clothing. “We’ve had a lot of velocity in our adult styles so making those for kids wasn’t a hard decision,” Charney said. “If Daddy likes the shirt, then he’ll buy it for the little ones, because it’s cute in their size.” The show is drawing some new children’s wear resources, like Bot Tots, a brightly colored organic cotton line of onesies, hoodies and T-shirts featuring printed drawings of robots. It’s geared primarily toward infants and toddlers, wholesaling from $5 to $12 with retail between $20 and $30. “I definitely thought twice before going into WWDMAGIC because of the relatively higher cost, but for my first show I wanted to invest in something I knew was big and worthwhile,” said Erin Saelans, who launched Bot Tots in October. “As a new business, just getting leads and writing an order would be success enough for me. I think I’m in an appealing spot as far as pricing. And obviously, my bigger goal is to make enough money to cover the costs of going to the show.” Jeph Hemmer, who co-founded Santa Cruz-based Avatar Imports in 1991 and has been exhibiting kids’ wear at WWDMAGIC for nearly 15 years, said buyers are pensive and waiting until later to write orders. “It’s a smaller part of our business than it used to be,” Hemmer said. “The [sales] numbers outside are getting bigger and there are just far fewer people at the shows, which, combined with buyers being more conservative, drives that decrease in share of sales.” Hemmer said Avatar actually saw better volume last show than the previous one, an increase he attributed to the company’s low- to midrange price points. “People are trading down from higher price to mid- and lower price but still looking for quality, and that’s where we’ve picked up market share,” Hemmer said. “For us, the show is still a good return on our investment. Hopefully, the good times will come back. Those days were fun.” 0202MAGa012(13)b;13.indd 2 Marvel swim trunks by Sea & Sun. 1/25/10 5:27:02 PM Fashion finds eco-friendly lines. By Matthew Lynch FIVE YEARS AGO, AN ANONYMOUS THIEF MADE OFF WITH ELI Nilsson uses recycled nylon zippers inside her bags. She said the closures Reich’s messenger bag. Instead of buying new, Reich crafted a new pack out of don’t tend to break or get caught as easily as metal, which can add to a necessity and used bike tubes. product’s sustainability in the long run. “I thought it would be funny and ironic to make a messenger bag out “The eco movement probably doesn’t think fashion is a good thing, of inner tubes,” the owner of Seattle-based Alchemy Goods said of his because they think it’s one season and it’s gone, but there is such a thing as company’s earliest days. sustainable fashion,” Nilsson said. In the intervening years, Reich’s Elizabeth Searle, designer for Earth Co. operations have grown to a staff of eight and b. organic, said the basics maker launched dovetailed with a developing public interest several years ago in largely earth and neutral in eco-friendly goods. Now in its third year, tones, but that demand has changed. MAGIC’s Ecollection focuses on exhibitors “Our customers were asking us, ‘What crafting apparel and accessories out of such about some bright colors?,’” Searle said. sustainable materials and with socially “The customer is looking for fashion. Our conscious philosophies. Alchemy, for example, colors for spring are really bright.” will show for the second year. Taking Reich’s She said the company is meeting demand early ingenuity to a mass scale, the company by using low-impact dyes for colors such harvests bike inner tubes for its bags from as cornflower blue, coral, sea blue and a nationwide network of bike shops and butter yellow. The company, which sources cyclists. Reused car seat belts also figure into cotton for its goods from locally owned Alchemy’s production. Its newest addition organic farms in Africa, also uses wooden is a line of handbags and totes made of vinyl beads and water-based screen prints for repurposed from old billboards. embellishments. “Just because it’s recycled doesn’t mean it Dallas-based Walleska Ecochicc creates has to look recycled,” Reich said. its lines out of materials like recycled Other Ecollection vendors echoed Reich’s aluminum and glass. Owner Walleska Earth Co. b.organic’s organic cotton pullover and organic cotton and spandex sentiment. While it can be tough to spot trends Tepping said she’s also been responding to jersey pants at Z-Ply Corporation. in a category where sourcing materials range customer demand for color and design. Converse Jack Purcell sneakers. from organic cotton to the pull tabs from “The product can be recycled and at the aluminum soda cans, Ecollection exhibitors same time look fancy or chic,” Tepping said. almost all agreed vendors in the category are “It doesn’t have to look rough.” starting to put more emphasis on fashion. A few She used her bags and tops crafted from years ago, eco-apparel might have attracted an soda can pull tabs as an example. audience on novelty alone, but that consumer is “They’re show pieces,” she said. “You put now demanding more from such brands. [one] on and people are going to notice you.” Arlene Nilsson, an owner of new exhibitor Hemptress, said eco lines Tepping’s designs are realized through a fair trade arrangement with a have tended to lean more toward the misses’ end of the spectrum, but are community in her native Brazil. In fact, many Ecollection exhibitors said they starting to have more of a fashion edge. Based in Los Angeles, Nilsson crafts adhere to fair trade practices. her handbags largely from hemp, which she calls “the strongest fiber on the Chicago-based Mata Traders Ltd.’s products are manufactured at co-ops planet.” She’s started using finished bonded leather, made from recycled in India using materials like recycled denim and saris. Co-owner Michelle scraps, for trim. The company uses a hemp/RPET lining for bags in its vegan King said the women who work in the co-ops are afforded paid sick and collection. RPET, made from recycled plastic, is biodegradable. maternity leave and have a “huge” chance for upward mobility. “I just love it; it wears so much more like real leather,” she said of the “We make sure that the people are being treated fairly,” King said, but added recycled product, which she compared with other faux leather materials. “If that the company’s fashions typically attract customers before its principles. you make a bag out of PVC, it’s still there in 10,000 years. That’s the kind of “It sells well on its own,” she said. “Our products are really well made. sustainability we don’t want.” [They’re] not mass produced. It’s a different production model.” PHOTO BY ROBERT MITRA; MODEL: BETTINE/MUSE; HAIR BY JOEL GUNDERSON FOR CUTLER/REDKEN AT ATELIER MANAGEMENT; MAKEUP BY WILLIAM MURPHY USING MAC; FASHION ASSISTANT: ASHLEY JOHNSON; STYLED BY KIM FRIDAY; LOCATION: HOMESTEAD INN – THOMAS HENKELMANN, HOMESTEADINN.COM ECOLLECTION green scene by Tricia Kesten Reading glasses & accessoRies 800.435.5747 www.icueyewear.com 0202MAGa014a;9.indd 1 1/25/10 4:13:47 PM S I LV E R J E A N S . C O M COVER YOUR RACK WITH SILVER JEANS TOPS THIS FALL g INTRODUCING SILVER JEANS TOPS A new collection of knit and woven tops for women launching for Fall 2010 Premium at Magic booth # PR 22353 USA CORPORATE SHOWROOM 212-354-1603 VP NATIONAL ACCOUNTS, USA 201-321-2259 NORTH EAST / MID ATLANTIC 212-354-1603 MID WEST 773-645-8980 / SOUTH WEST 214-634-9083 PACIFIC NORTH WEST 213-439-0900 CANADA 416-598-2545 AUSTRALIA, NEW ZEALAND 61-3-9636320 GERMANY, AUSTRIA, SWITZERLAND, SCANDINAVIA +49 7763 7021 UK 440-207-428-5800 / JAPAN 81-35-774-2172