The Challenges of Currency Fluctuation and Its Impact

advertisement

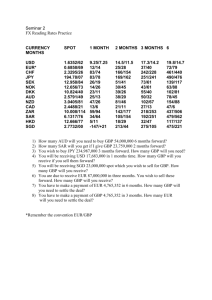

The Challenges of Currency Fluctuation and Its Impact on Expatriate Compensation Packages Yvonne Traber, Mercer Geneva Catherine Gervais, Mercer London www.mercer.com Agenda Introduction: Exchange rates and the global economy Exchange rate fluctuations: The company’s and expatriate’s perspectives Cost of living indices Pay delivery and protecting expatriates Impact of exchange rates on expatriate pay and the host location spendable Conclusion Mercer 1 Introduction: Exchange rates and the global economy Major FX rate movements against the euro, April 2009 – April 2011 Mercer 2 Company’s perspective How do currency appreciations/ depreciations affect companies? It depends … Home Balance Sheet compensation approach (EMEA 67%) – Some gains, some losses Headquarters Balance Sheet compensation approach (EMEA 7%) – Potential significant losses or gains Home Plus or Host Plus compensation approach (EMEA 5%) – Potential significant losses or gains Host compensation approach (EMEA 14%) – Potential significant losses or gains Source: Mercer 2010/2011 Worldwide Survey of International Assignment Policies and Practices Mercer 3 Impact on companies for UK to US moves London to New York City, GBP 75,000, FS 3 April 2010 COL Index FX Rate COL Differential Annual Housing Allowance April 2011 130.265 114.744 * 1.4350 1.620 GBP 9,130 GBP 4,448 GBP 56,864 GBP 50,383 GBP 65,994 GBP 54,831 13% variation 3-BR apt USD 6,800 per month Total Cost Impact GBP – 11,163 20% variation * Includes pricing effect of -0.67 index points Mercer 4 Impact on companies for US to Euro zone moves New York City to Brussels, USD 100,000, FS 3 April 2008 COL Index FX Rate April 2010 165.085 182.912 * 0.798 0.716 COL Differential USD 31,443 USD 40,254 Annual Housing Allowance USD 54,121 USD 60,352 USD 85,564 USD 100,606 12% variation 3 bed apt EUR 3,600 per month Total Cost Impact 18% variation USD 15,042 * Includes pricing effect of +1.18 index points Mercer 5 Expatriate’s perspective What does this mean for the expatriate? Cost of living differential – London to New York down by GBP 4,682 – US to Brussels up by USD 8,811 … Which assignee is unhappy? Mercer 6 Cost-of-Living Index Calculated by comparing home and host prices, whilst taking into account expenditure patterns Prices converted to the same currency for comparison purposes, so index and exchange rate are intrinsically linked Mercer 7 Calculating the COL Index Example: Year 1, UK to Copenhagen, GBP 1 = DKK 9.50 UK price GBP Copenhagen price DKK Copenhage n price converted to GBP Item UK weight % Cigarettes 27.54 5.12 35.18 3.70 0.723 19.911 9.84 16.27 184.58 19.43 1.194 11.749 Beer 38.43 4.31 55.90 5.88 1.364 52.419 Wine 24.19 6.25 120.35 12.67 2.027 49.033 Whiskey Category Index Mercer 100.00 Price ratio (host price/ home price) Index points (weight x price ratio) 133.112 8 Calculating the COL Index Example: Year 2, UK to Copenhagen, GBP 1 = DKK 10.96 Copenhagen UK price GBP Copenhagen price DKK Item UK weight % Cigarettes 27.54 5.12 35.18 3.21 0.627 17.268 9.84 16.27 184.58 16.84 1.035 10.184 Beer 38.43 4.31 55.90 5.10 1.183 45.463 Wine 24.19 6.25 120.35 10.98 1.757 42.502 Whiskey Category Index 100.00 price converted to GBP Price ratio (host price/ home price) Index points (weight x price ratio) 115.439 When the exchange rate increases, the index decreases because the home currency goes further in host location. Mercer 9 Pay delivery Three alternatives 1. Pay total amount in home-country currency 2. Pay total amount abroad in local currency 3. Split pay between home and assignment-country currency Factors to consider Legislative or governmental policies Exchange rate volatility Payroll structure/capabilities Mercer 10 Delivery of expatriate remuneration (%) 41 35 32 Worldwide EMEA 22 22 19 16 10 2 Home currency Host currency 3 3d country currency Split pay Case by case Source: Mercer 2010/2011 Worldwide Survey of International Assignment Policies and Practices Mercer 11 Split pay practice 35 32 27 23 Worldwide EMEA 13 10 Per expat's wishes Per company policy Based on tax consideration 8 9 Based on gov't regulations Source: Mercer 2010/2011 Worldwide Survey of International Assignment Policies and Practices Mercer 12 Methods of pay 100% at Home Amount paid directly into home bank account; need for FX Ease of administration Monitoring – employee speculation Lead time between pay determination and exchange rates may cause large gains/losses Mercer 13 Challenges of companies paying expatriate compensation packages in home currency Mercer 14 Methods of pay 100% at Host Need for FX monitoring – employee speculation Home obligations (storage costs, mortgage, etc.) Employee loses ability to save in home currency May be legal requirement Ensures local company bears full cost Highlights cost of expatriation to receiving company Mercer 15 Challenges of companies paying expatriate compensation packages in host currency Mercer 16 Methods of pay Split pay – Protecting the expatriate Stable number of local host currency units Stable number of home-country currency units Neutralised effect of foreign currency fluctuation Adjustment only when prices change (inflation) in the home country or in the host country Mercer 17 Split pay method Paid by Company Income Taxes Housing Goods & Services Paid at Home Mercer Paid at Host Premia & Incentives Savings/ Reserve 18 Split payment of expatriate compensation package New York to London Mercer 19 Impact of exchange rate fluctuations on expat package UK to Copenhagen: Base salary GBP 35,000 Family Size 4 Start of the assignment: COL Index FX Rate 1 GBP=DKK Home Spendable GBP 128 11.76 19,153 Mercer Differential GBP Assignment Spendable GBP Assignment Spendable DKK 5,321 24,474 287,863 20 Impact of exchange rate fluctuations on expat package, continued UK to Copenhagen: Base salary GBP 35,000 Family Size 4 Six months later: Home currency strengthens New exchange rate increases from 11.76 to 12.35 Index decreases from 128 to 122 Impact: COL Index FX Rate 1 GBP=DKK Home Spendable GBP 128 11.76 122 12.35 Mercer Differential GBP Assignment Spendable GBP Assignment Spendable DKK 19,153 5,321 24,474 287,863 19,153 4,155 23,308 287,863 21 Impact of exchange rate fluctuations on expat package, continued UK to Copenhagen: Base salary GBP 35,000 Family Size 4 Twelve months later: Home currency weakens New exchange rate decreases from 12.35 to 11.17 Index increases from 128 to 135 Impact: COL Index FX Rate 1 GBP=DKK Home Spendable GBP 128 11.76 135 11.17 Mercer Differential GBP Assignment Spendable GBP Assignment Spendable DKK 19,153 5,321 24,474 287,863 19,153 6,609 25,762 287,863 22 Going back to our question Cost-of-living differential – London to New York down by GBP 4,682 – US to Brussels up by USD 8,811 … Which assignee is unhappy? Mercer 23 Calculating the host location spendable London to New York City, GBP 75,000, FS 3 April 2010 COL Index April 2011 130.2646 114.7441 G&S Home Spendable GBP 30,167 GBP 30,167 Differential GBP 9,130 GBP 4,448 G&S Host Spendable GBP 39,297 GBP 34,615 1.4350 1.6196 FX rate G&S Host Spendable USD 56,390 USD 56,062 * * Small (0.6%) decrease caused by fall in prices in NY relative to London Mercer 24 Impact of exchange rates If the local currency weakens against the home currency, the index will…? a. Go up to reflect the increase in value of the home currency b. Go down, because the expatriate’s home currency goes further in the host location c. Remain unchanged, because we are only concerned with prices in hostlocation currency Mercer 25 Summary: Impact of currency fluctuations Example New York to London In other words, with 100 USD, you can buy now more GBP. You need fewer USD to buy the same goods and services in London. Strengthening USD Reducing COL Index = Reducing COL Allowance in USD In other words, with 100 USD, you can buy now fewer GBP. You need more USD to buy the same goods and services in London. Weakening USD Mercer Increasing COL Index = Increasing COL Allowance in USD 26 Conclusion Understanding, communicating changes caused by FX changes In economies where the currency is volatile, expatriates tend to start questioning their COLA and overseas purchasing power. Important to maintain a high level of communication with these expatriates. Expatriates might not actually be spending the entire host portion of salary in the host location; they could be saving more than expected and are sending more money back home. Consequently, with a strong currency devaluation, expatriates lose out on the additional saving opportunity of the salary. So discussions regarding changes in COL indices with expatriates may not be a true concern about their COLAs – but a concern about their additional savings opportunity. Mercer 27 Conclusion It is very difficult to estimate which part of salary will really be spent in the host country and which part will be kept in the home country Most companies will leave the decision on the split (within a certain limit) to the expatriate This approach avoids (or at least minimizes) difficult discussions with the expatriate in the future The responsibility is put on the expatriate’s shoulders Mercer 28 Questions/Answers www.mercer.com