Financial Accounts Profit Prior to Incorporation

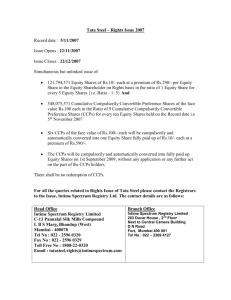

advertisement

Study Circle

Company Accounts

Cs Executive Refresher Course

Financial Accounts

Profit Prior to Incorporation

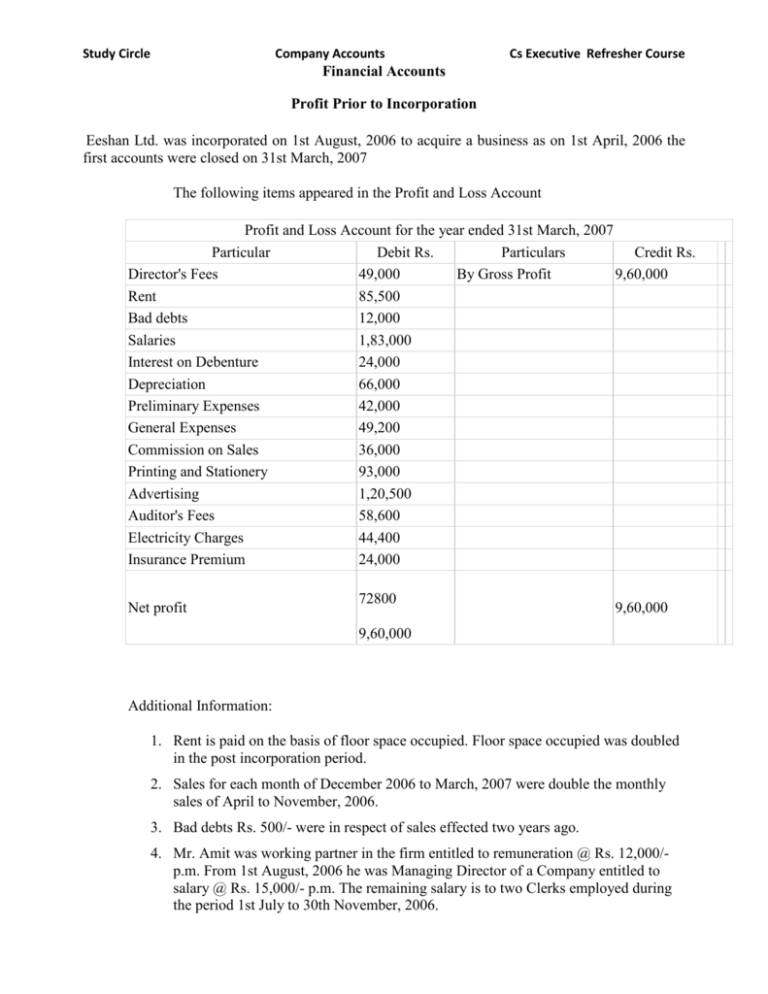

Eeshan Ltd. was incorporated on 1st August, 2006 to acquire a business as on 1st April, 2006 the

first accounts were closed on 31st March, 2007

The following items appeared in the Profit and Loss Account

Profit and Loss Account for the year ended 31st March, 2007

Particular

Debit Rs.

Particulars

Credit Rs.

Director's Fees

49,000

By Gross Profit

9,60,000

Rent

85,500

Bad debts

12,000

Salaries

1,83,000

Interest on Debenture

24,000

Depreciation

66,000

Preliminary Expenses

42,000

General Expenses

49,200

Commission on Sales

36,000

Printing and Stationery

93,000

Advertising

1,20,500

Auditor's Fees

58,600

Electricity Charges

44,400

Insurance Premium

24,000

Net profit

72800

9,60,000

9,60,000

Additional Information:

1. Rent is paid on the basis of floor space occupied. Floor space occupied was doubled

in the post incorporation period.

2. Sales for each month of December 2006 to March, 2007 were double the monthly

sales of April to November, 2006.

3. Bad debts Rs. 500/- were in respect of sales effected two years ago.

4. Mr. Amit was working partner in the firm entitled to remuneration @ Rs. 12,000/p.m. From 1st August, 2006 he was Managing Director of a Company entitled to

salary @ Rs. 15,000/- p.m. The remaining salary is to two Clerks employed during

the period 1st July to 30th November, 2006.

Study Circle

Company Accounts

Cs Executive Refresher Course

You are required to prepare profit and loss account for the year ended 31st March, 2007 and

show 'Pre' and 'Post' incorporation period profit or loss.

Underwriting of Shares

Emeses Ltd. Issued 40,000 shares which were underwritten as:

P : 24,000 shares Q : 10,000 shares and R : 6,000 shares. The underwriters made applications for

firm underwriting as under:

P: 3,200 shares; Q: 1,200 shares; and R: 4,000 shares. The total subscriptions excluding firm

underwriting (including marked applications) were 20,000 shares.

The marked applications were – P: 4,000 share; Q: 8,000 shares; and R: 2,000 shares.

Prepare a statement showing the net liability of underwriters.

Study Circle

Company Accounts

Cs Executive Refresher Course

Valuation of Shares & Intangible Assets

Following is the summarised Balance Sheet of M/s. Vijay Engineers as on 30.9.2006.

LIABILITIES

Rs.

ASSETS

Rs.

Share Capital

30,000 Equity shares of

Plant

Rs. 10 each

3,00,000

Reserve and surplus

50,000

Property

1,20,000

Stock

3,10,000

General

1,20,000

Debtors

2,03,000

Capital

1,40,000

Bank

1,17,000

Profit & Loss A/c

1,20,000

Cash

1,700

Total

8,01,700

2,80,000

Current Liabilities &

Provision

Creditors

93,700

I.T. payable

11,500

Proposed Dividend

34,000

Provision for Taxes

82,500

2,21,700

Total

8,01,700

Net Profit before taxation for three years ended 30th September, 2004 Rs. 1,38,000 30th Sept.,

2005, Rs. 1,83,000; and 30th September, 2006, Rs. 1,98,000; freehold property was valued at Rs.

1,60,000. Average yield in this type of business is 10% capital employed. You are required to find

out the value of each equity share on :

(i)

Net Assets basis

(ii)

Yield basis.

(iii)

Fair value basis

The company has a practice of transferring 20% of its yearly profit after tax to General

reserve.

Assume tax at 50%.

Study Circle

Company Accounts

Cs Executive Refresher Course

Valuation of shares

(i)

Intrinsic value method

Rs.

All Assets (AV) including Goodwill,

Investments but excluding Fictitious

Assets

Less: All Outside Liabilities (AV)

Net assets Available for Shareholders

Less: Preference Shareholders Claim

a) Preference Share Capital

b) Arrears of Preference Dividend

Net Assets available for ESH’s

Intrinsic value of shares (each share) = Net Assets

No. of shares

Yield value method

Total profit of last three year

Add/Less: Any other Adjustment

Average profit before Tax

Less: Tax @ ----%

Average Profit After Tax

Less: Transfer to reserve @ __%

Rs.

Study Circle

Company Accounts

Cs Executive Refresher Course

Less: Current Year Preference Dividend

Earnings Available for ESH

ERR =

EAESH

X 100

Equity Share Capital

Yield Value of each share=

ERR / N.R.R X paid up value of each shares

(iii)Fair value method

Fair value of each shares = Intrinsic value + Yield value

2

Study Circle

Company Accounts

Cs Executive Refresher Course

ISSUE OF SHARES

Journal Entries

1) For Equity Share Application Money Received

Cash/Bank A/c

Dr

To Equity Share Application A/c

2) For Equity Share Application Money Transferred to Share Capital

Equity Share Application A/c

Dr

To Equity Share Capital A/c

3) For Equity Share Allotment Due

At Par:

a) Equity Share Allotment A/c

Dr

To Equity Share Capital A/c

At Premium

b) Equity Share Allotment A/c

Dr

To Equity Share Capital A/c

To Securities Premium

At Discount

c) Equity Share Allotment A/c

Discount on issue of Shares A/c

Dr

Dr

To Equity Share Capital A/c

4) For Equity Share Allotment Money Received

Cash/Bank A/c

Dr

To Equity Share Allotment A/c

5) For Equity Share 1st Call Due

Equity Share 1st Call A/c

Dr

To Equity Share Capital A/c

6) For Equity Share 1st Call Money Received

Study Circle

Company Accounts

Cash/Bank A/c

Dr

To Equity Share 1st Call A/c

7) For Equity Share 2nd & Final Call Money Due

Equity share 2nd & Final Call A/c

Dr

To Equity Share Capital A/c

8) For Equity Share 2nd Call money Received

Cash/Bank A/c

Dr

To Equity Share 2nd & Final Call A/c

For Forfeiture of Shares

If Premium is received

1) Equity Share Capital A/c

Dr

To Calls in Arrears A/c

To Share Forfeiture A/c

If Premium is not received

2)

Equity Share Capital A/c

Dr

Securities Premium A/c

Dr

To Calls in Arrears A/c

To Share Forfeiture A/c

For Re-issue of Shares

1) Cash/Bank A/c

Dr

Share Forfeiture A/c Dr

To Equity Share Capital A/c

2) Share Forfeiture A/c Dr

To Capital Reserve A/c

For issue of Shares for Consideration other than Cash

1) When Assets are acquired from Vendors

Sundry Assets A/c

Dr

Cs Executive Refresher Course

Study Circle

Company Accounts

Cs Executive Refresher Course

To Vendors A/c

2) When Shares are issued to Vendors

Vendors A/c Dr

To Equity Share Capital

3) When Shares are issued to Promoters

Goodwill A/c

Dr

To Equity Share Capital A/c

Other Entries

1) Interest on Calls in Arrears

Sundry Shareholders A/c

Dr

To Interest on Calls in arrears A/c

2) Interest on Calls in Advance

Interest on Calls in Advance A/c

Dr

To Sundry Shareholders A/c

Practical Problem

The quality product Ltd. issued 12, 000 Equity shares of Rs. 15 each at par. The amount is

payable as under:

On Application

Rs.3 per share

On Allotment

Rs.7 per share

On First Call

Rs. 3 per share

On Second Call

Rs. 2 per share

The company received application for 20, 000 shares. The Directors rejected application for

1000 shares and allotted shares on pro-rata basis to the remaining applicants. 120 shares were

allotted to Sachin who failed to pay first call and his shares were forfeited. 240 shares were

allotted to saurav who failed to pay second call his shares were also forfeited.

Journalize the above transaction in the book of kwality product Ltd.

Study Circle

Company Accounts

Cs Executive Refresher Course

REDEMPTION OF PREFERNCE SHARES

POINTS TO BE NOTED

(1) Preference shares can be redeemed only if it is fully paid up. If the shares are partly paid up

make them fully paid up by making a call.

(2) Preference shares can be redeemed either out of proceeds of fresh issue or divisible profits.

(2a) Fresh issue means issue of equity shares or preference shares but not debentures.

(2b) Face value

100

100

100

Issue Price

100

110

90

(2b)

DIVISIBLE PROFITS

(Available for dividend redemption)

(1) General Reserve

(2) Revenue Reserve

(3) Dividend equalization Reserve

(4) Reserve Fund

(5) Sinking Fund

(6) Profit & Loss

FACE VALUE OF

PREF. SHARES TO

Be REDEEMED

=

Proceeds

100

100

90

PROFITS.

NON DIVISIBLE PROFITS

(1) Capital Reserve

(2) Capital Redemption Reserve

(3) Security Premium

(4) Share forfeited A/c

(5) Revaluation Reserve

PROCEEDS OF FRESH ISSUE + Divisible Profits

(C.R.R)

(3) Face value of preference shares redeemed out of divisible profit should be transferred to a

special Reserve called “ CAPITAL REDEMPTION RESERVE “ (C.R.R)

(4) C.R.R. can be used only for the issue of fully paid BONUS SHARES.

(5) Preference shares can be redeemed either at par or at premium. If redeemed at premium

such premium on Redemption (loss) will be met either out of SECURITIES

PREMUIM OR DIVISIBLE PROFITS.

PREMUIM ON

REDEMPTION =

SECURITIES PREMUIM + DIVISIBLE PROFITS

(B/S + FRESH ISSUE)

Study Circle

Company Accounts

Cs Executive Refresher Course

JOURNAL ENTRIES

(A) IF THE SHARES ARE PARTLY PAID UP.

(1) Making the final call.

Final call A/C

Dr.

To Pref. Share capital

(2) Receiving the final call

Cash /Bank A/c

Call in arrears

To Final Call A/c.

Dr.

Dr.

(3) Receiving the calls in arrears

Cash / Bank A/c

Dr.

To Calls in arrears A/c.

(4) Forfeiture of shares

Preference share Capital (F. V)

To call in arrears A/c (amt. unpaid)

To Share forfeited A/c ( bal.fig.)

(5) Re issue of Forfeited share

Cash/ Bank A/c (amt recd)

Shares forfeited A/c (Amt unpaid)

To Share Forfeited A/c

Dr.

Dr.

(6) Transfer to Capital Reserve.

Share forfeited A/c

Dr.

To Capital Reserve A/c.

(B) IF THE SHARES ARE FULLY PAID UP.

(7) Sale of investment

Cash/ Bank A/c

Dr.

To Investment A/c.

(Any diff will be transferred to profit & loss A/c)

(Bal fig)

Study Circle

Company Accounts

(8) For Fresh issue of shares.

Cash /Bank A/c

Dr.

To equity share Capital A/c

To security premium A/c

(9) Redemption of Preference shares

Preference share capital A/c

Dr.

Premium on Redemption A/c

Dr.

To Preference shareholder A/c.

(10)

(11)

(12)

(13)

Meeting the Premium on redemption.

Security Premium A/c

Dr.

Divisible Profits A/c

Dr.

To Premium on redemption A/c

Transfer to C.R.R.

Divisible Profit A/c

Dr.

To C.R.R

A/c.

Pay off

Preference Shareholder A/c

Dr.

To Cash / Bank A/c

Declaration of Bonus.

C.R.R A/c

Dr.

Security Premium A/C

Dr.

Capital Reserve A/c

Dr.

Divisible Profit A/c

Dr.

To Bonus to shareholder A/c.

Cs Executive Refresher Course

Study Circle

Company Accounts

Cs Executive Refresher Course

The Balance Sheet of M. Ltd. as on 31.12.2006 is given below :

LIABILITIES

Rs.

ASSETS

Rs.

9% Redeemable Preference

Sundry Assets

9,50,000

Shares of Rs.100 each,

Investments

2,75,000

fully paid up

6,50,000

Cash at Bank

67,500

Equity Shares of

Rs.5 each fully paid up

2,25,000

General Reserve

1,00,000

Profit & Loss Account

2,60,000

Sundry Creditors

57,500

12,92,500

The

Preference

Shares

are

to

be

12,92,500

redeemed

on

1.1.2007,

at

a

premium

of 7½%. In order to facilitate redemption, the company has decided :

i)

To sell the Investments for Rs. 2,60,000.

ii)

To finance part of the redemption from company’s fund; and

iii)

To issue sufficient equity shares at a premium of Rs1/- per share to raise

the balance of funds required.

iv)

Minimum Bank Balance to be retained at Rs. 10,500. The investments were

sold, equity shares are fully subscribed and the shares were duly redeemed.

Show the entries and prepare the Balance Sheet.

Note : Minimum reduction is to be made against Reserve.

Study Circle

Company Accounts

Cs Executive Refresher Course

Buy Back of Equity Shares

Buy back of equity shares can be done only if it is fully paid up.

If the shares are partly paid up they should be made fully paid up by making a final call.

Buy back of shares can be done either out of proceeds of fresh issue or out of free reserve

(a) Free Reserve means securities premium and divisible profit.

(b) Fresh Issue Means :(i)

If equity shares have to be bought back fresh Issue means Issue of Preference

shares or Debentures.

(ii)

If Preference shares have to be bought back fresh Issue means Issue of Equity

shares or Debenture

Formula:Face value of Equity Shares to be bought back = Proceeds of Fresh Issue + Securities Premium

(B/s + F.I)

Premium of Buy back = Securities Premium

( B/s+F.I – 1st Formula)

+

Divisible Profit

Study Circle

Company Accounts

Journal Entries

A) If the shares are partly paid up.

(1) Making a final call

Final Call A/c

Dr

To equity Share capital A/c

(2) Receiving a final call.

Cash /Bank A/c

Dr

Calls in Arrears A/c

Dr

To Final call A/c

(3) Receiving a Call in Arrears

Cash /Bank

To Calls in arrears

Dr

(4) Forfeiture of shares.

Equity Share capital A/c

Dr

To shares forfeited A/c

To calls in Arrears A/c

(5) Re Issue of forfeiture shares

Cash/Bank

Dr.

Share forfeited A/c

Dr.

To Equity share Capital A/c

(6) Transfer to Capital Reserve

Share forfeited A/c

Dr.

To Capital Reserve A/c

B) If the shares are fully paid –up

(7) For sale of investment

Cash/ Bank A/c

Dr

To Investment A/c

(Any diff will be transferred to Profit and loss A/c)

(8) For Fresh Issue.

Cash/ Bank A/c

Dr

To Equity share capital A/c

To Securities Premium A/c

(9) Buy back of equity shares

Equity share capital A/c

Dr

Cs Executive Refresher Course

Study Circle

Company Accounts

Cs Executive Refresher Course

Premium on Buy Back A/c

Dr

To Equity share holders A/c

(10) Meeting the premium on Buy back

Securities premium A/c

Dr

Divisible profit A/c

Dr

To premium on Buy back A/c

(11) Transfer to CRR.

Securities Premium A/c

Dr

Divisible Profit A/c

Dr

To CRR A/c

(12) Pay off

Equity share holders A/c

To Cash/ Bank A/c

Dr.

Study Circle

Company Accounts

Cs Executive Refresher Course

Limits of Buy Back

(1) No. of shares to be bought back should not exceed

(25% of paid up Equity share capital) divide by face value

(2) No. Of shares to be bought back should not exceed

(25% of paid up share capital + Free Reserves) divide by Purchase Price

(3) After buy back the debt equity ratio should not exceeds 2:1

List of free Reserve

(1) General Reserve

(2) Revenue Reserve

(3) Dividend equalisation Reserve

(4) Reserve Fund

(5) Sinking Fund

(6) Profit and loss A/c

(7) Securities premium

(8) Subsidiary Reserve

(9) Investment Allowance (utilised) Reserve

(10) Export Profit ( utilised) Reserve

(11) Foreign Project ( utilised ) Reserve

Practical Problem

Infobyte Ltd. resolved to buy back 30,000 of its fully paid equity shares of Rs. 10 each at Rs. 12 per

share. For this purpose, it issued 1,000 10% preference shares of Rs. 100 each at par. The Total

amount was payable on application. The company has Rs. 85,000 balance to the credit of the

Securities Premium Account, which was to be used for buy-back. The company had sufficient

balance in the General Reserve to meet the legal requirements for buy-back. Pass the necessary

journal entries.

Study Circle

Company Accounts

Cs Executive Refresher Course

Issue & Redemption of Debentures

The summarised Balance Sheet of Convertible Limited, as on 30th June, 2006, stood as follows :

Liabilities

Rs.

Share Capital : 5,00,000 Equity shares of Rs. 10 each fully paid

50,00,000

General Reserve

75,00,000

Debentures Redemption Fund

50,00,000

13.5% Convertible Debentures 1,00,000

Debentures of Rs. 100 each

Other Loans

Current Liabilities and Provision

1,00,00,000

50,00,000

1,25,00,000

4,50,00,000

Assets

Fixed Assets (at cost less depreciation)

1,60,00,000

Debentures Redemption Fund Investments

40,00,000

Cash and Bank Balance

50,00,000

Other Current Assets

2,00,00,000

4,50,00,000

The debentures are due for redemption on 1st July, 2006. The terms of issue of debentures

provided that they were redeemable at a premium of 5% and also conferred option to the debentureholders to convert 20% of their holding into equity shares at a predetermined price of Rs. 15.75 per

share and the payment in cash.

Assuming that :

i)

except for 100 debenture-holder holding totalling 25,000 debentures, the rest of them

exercised the option for maximum conversion;

ii)

The investments realise Rs. 44 lakhs on sale; and

iii)

all the transactions are put through, without any lag, on 1st July, 2006.

Redraft the Balance Sheet of the Company as on 1st July, 2006 after giving effect to the

redemption. Show your calculation in respect of the number of equity shares to be allotted and the

cash payment necessary.

Study Circle

Company Accounts

Cs Executive Refresher Course

Company Final Accounts

1

2

3

4

5

6

Particulars

Overall Managerial remuneration

(Exclusive of fee for attending meetings)

If the company has one managing director or wholetime director

If the Company has more than one managing

Director or whole time director (for all of them)

Remuneration of part time director where the

company has one or more managing director (for all

of them)

Remuneration of part time director where the

company has one or more managing director (for all

of them)

Remuneration to the manager

Maximum Limit

11% of net profit

5% of net profit

10% of net profit

3% of net profit

1% of net profit

5% of net profit

Section 349 and 350 of the companies act contain the provision relating to the manner of

determination of net profits for the proposed of calculating the managerial remuneration.

The provisions of the above sections are require that in computing net profits of a company in any

financial year for the purpose of calculating managerial remuneration the following points should

be considered:

1. Credit shall be given forBounties and Subsidies received from any government or any public authority constituted

or authorized in this behalf by the government unless the central Government otherwise

directs.

2. Credit shall not be given for the following suma. Profit, by way of premium, on shares or debentures of the company which are issued or

sold by the company;

b. Profit on sale by company of forfeited shares

c. Profit from capital nature including profit from the sale of the undertaking or any of

the undertaking of the company, or of any part thereof;

d. Profit from sale of any immovable property or fixed assets of a capital nature

comprised in the undertaking or any of the undertaking of the company unless the

business of the company consist whether wholly or partly of buying and selling any

such property or assets

Provided that where the amount for which any fixed assets is sold exceeds the written

down value thereof referred to in section 350, credit shall be given so much of the

excess as is not higher than the difference between the original cost of that fixed assets

and it’s written down value.

3. The following sums shall be deducted:

a. All the usual working charges;

Study Circle

Company Accounts

Cs Executive Refresher Course

b. Director’s remuneration;

c. Bonus or commission paid or payable to any member of the company’s staff, or to any

engineer, technician or person employed or engaged by the company, whether on an

whole-time or on a pat time or a part time or on a part time basis;

d. Any tax notified by the central government as being in the nature of a tax on excess or

abnormal profit;

e. Any tax on business profit imposed for special reason or in special circumstances and

notified by the central in this behalf;

f. Interest on debenture issued by the company;

g. Interest on mortgages executed by the company and on loans and advances secured by a

charges on its fixed or floating assets;

h. Interest on unsecured loans and advances;

i. Expenses on repair, whether to immovable or to movable property, provided the repair

are not of a capital reserves

j. Outgoing, inclusive of contribution made under clause (e) of subsection (1) of section

293 which states as follows:

“The board of Directors of a public company or of a private company which is

subsidiary of a public company, shall not, except with the consent of such public

company or subsidiary in general meeting, contribute to charitable and other funds not

directly relating to the business of the welfare of its employees, any amounts the

aggregate of which will, in any financial year, exceed Rs. 50, 000 or 5% of its averages

net profits as determine in accordance with the provision of section 349 and 350 during

three financial years immediately proceeding, whichever is greater:”

k. Depreciation to the extend specified in section 350 whichever allows following

deductions:

i.

Normal depreciation including extra and multiple shift allowances calculated at

the rates specified in the schedule XIV

ii.

Excess of written down value over the sale proceed or scrap value of the assets if

it is sold, discarded, demolished or destroyed before the depreciation on such

assets has been provided in full.

But section 350 does not allow the following deductioni.

Special depreciation.

ii.

Initial depreciation.

iii.

Development rebate reserve or investment allowance reserve;

l. The excess of expenditure over income, which had been arisen in computing the net

profit in accordance with section 349 in any year which begins at or after the

commencement of this Act, in so far as such excess had not been deducted in any

subsequent year preceding the year in respect of which the net profit have to be

ascertain;

Study Circle

Company Accounts

Cs Executive Refresher Course

2. Any compensation or damage to be paid by virtue of any legal liability including a

liability arising from a breach of contract;

3. Any sum paid by way of insurance against the risk of meeting any liability such as is

referred to in clauses (m);

4. Debt considered bad and written off or adjusted during the year of account.

4.

The following sums shall not be deducted;

a. Income tax and super tax payable by the company under the income tax Act, 1961 or

any other tax on the income of the company not falling under clauses (d) and (e) of (3)

above;

b. Any compensation, damages or payments made voluntarily that is to say, otherwise than

in virtue of ability such as is referred to in clauses (m) of 3 above.

c. Loss of a capital nature including loss on sale of the undertaking or any of the

undertaking of the company or of any part thereof not including any excess referred to

in the company or of any section 350 of the written down value of any assets which is

sold, discarded, demolished or destroyed over, its sale proceed or its scrap value.

It is important to note here that the above provision do not apply to a private company,

unless it is subsidiary of a public company.

The following is the Profit and Loss account of S.S. Ltd for the year ended 31st March 2008.

PARTICULARS

RS

PARTICULARS

RS

To Salaries & wages

1,50,000 By Gross Profit

40,00,000

To Repairs to Fixed Assets

50,000 By Profit on sale of Machinery

4,50,000

(Cost Rs 8 lacs and WDV Rs 4

lacs)

To General Expenses

40,000 By Subsidy from the

1,00,000

government

To Compensation for breach of

25,000

Contract.

To Depreciation

2,40,000

To Loss on sale of investment

35,000

To expenditure on Scientific

2,50,000

Research ( Cost of Setting up a

new laboratory)

To debenture interest

75,000

To interest on unsecured loans

15,000

To Provision for tax

16,00,000

To Proposed dividends

10,00,000

To balance c/d

10,70,000

45,50,000

45,50,000

Calculate the overall managerial remuneration under section 198.

Study Circle

Company Accounts

Cs Executive Refresher Course

Given is the Trial Balance of Marathon Limited as on 31st March, 2012. You are require to

prepare the Profit and loss Account and Balance Sheet on 31st March, 2012

Authorised Share capital divided into 8,000,

6% preference shares of `100 each and 20,000

equity shares of `100 each

28,00,000

Subscribed Capital

5,000 6% preference shares of `100 each

5,00,000

Equity Share Capital

8,00,000

Capital Reserve

5,000

Purchases - Coco, Tea, Coffee

58,800

- Bakery products

36,200

Wages and Salary

15,300

Rent, Rates and Taxes

8,900

Laundry

750

Sales - Coco, Tea and Coffee

82,000

- Bakery products

44,000

Coal and Firewood

3,290

Carriage

810

Sundry Expenses

5,840

Advertising

8,360

Repair

4,250

Rent of Rooms

48,000

Study Circle

Company Accounts

Cs Executive Refresher Course

Receipt from Billiards

5,700

Miscellaneous Receipts

2,800

Discount Received

3,300

Transfer Fee

700

Freehold Land and Building

8,50,000

Furniture and Fittings

86,300

Stock on hand, 1st April, 2011

Coco, Tea, Coffee

12,800

Bakery products

5,260

Cash in Hand

2,200

Cash with Bank

76,380

Preliminary and Formation Expenses

8,000

2000, 8% debentures of `100 each

2,00,000

Profit and Loss Account

41,500

Sundry Creditors

42,000

Sundry Debtors

19,260

Investment

2,72,300

Goodwill at Cost

5,00,000

General Reserve

2,00,000

19,75,000

Additional Information:

— Wages and Salaries outstanding 4,280

— Stock as on 31st march, 2012

— Coco, Tea, Coffee 22,500

— Bakery Products 16,400

19,75,000

Study Circle

Company Accounts

Cs Executive Refresher Course

— Provide 5% depreciation on Furniture and Fittings and 2% on Land and Building.

The equity capital on 1st April, 2011 stood at Rs 7, 20,000, that is 6,000 shares fully paid and

2,000 shares of Rs 60 paid. The directors made a call of Rs 40 per share on 1st October, 2011.

A shareholder could not pay the call on 100 shares and his shares were then forfeited and

reissued at Rs 90 per share as fully paid. The director proposes a dividend of 8% on equity

shares, transferring any amount that may be required from general reserve. Ignore taxation

Study Circle

Company Accounts

Cs Executive Refresher Course

Consolidation of Accounts-AS 21

Following are the balance Sheets of H Ltd. and S Ltd. as at 31st March, 2008.

I .EQUITIES AND

LIABILITIES

H Ltd.

S Ltd.

Amount (Rs.)

Amount (Rs.)

1 Shareholder’s funds

(a)Share Capital

Authorised, Issued subscribed and

paid up capital

Equity shares of Rs.100 each, fully

5,00,000

2,00,000

called up and paid up

(b)Reserve & Surplus

General Reserve

1,00,000

Profit & Loss A/c

1,40,000

60,000

2,40,000

90,000

80,000

40,000

50,000

1,50,000

2 Current Liability

Bills payable

Trade payables

Total

II.ASSETS

8,20,000

90,000

4,40,000

1 Non-current assets

(a) Fixed Assets

Machinery

1,60,000

90,000

Land & Building

2,00,000

40,000

1,30,000

30,000

Goodwill

(b) Long term Investment

1,500 Shares in S Ltd.(at cost)

4,00,000

2,50,000

2,40,000

3. Current Asset

Trade Receivables

Stock

Cash at Bank

Total

20,000

1,00,000

60,000

75,000

1,80,000

8,20,000

90,000

25,000

1,90,000

4,40,000

Study Circle

Company Accounts

Cs Executive Refresher Course

The Profit and Loss Account of S Ltd. showed a credit balance of Rs. 50,000 on 1st April 2007. A

dividend of 15% was paid in December 2007 for the year 2006-07. This dividend was credited to

Profit and Loss Account by H Ltd.

H Ltd. acquired the shares in S Ltd. on 1st October, 2007.

The Bills Payable of S Ltd. were all issued in favour of H Ltd. which company got the bills

discounted.

Included in the Creditors of S Ltd. is Rs. 20,000 for goods supplied by H Ltd. Included in

the stock of S Ltd. are goods to the value of Rs. 8,000 which were supplied by H Ltd. at a profit of

331/2 on cost.

In arriving at the value of S Ltd. shares, the plant and machinery which then stood in the

books at Rs. 1,00,000 on 1.4.2007 was revalued at Rs. 1,50,000. The new value was not

incorporated in the books. No changes in these have been made since then.

Prepare the consolidated balance sheet as on that date.

Study Circle

Company Accounts

Cs Executive Refresher Course

ECONOMIC VALUE ADDED

A concept critical in evaluating the performance of any business is economic value added. It measures the

economic rather than accounting profit created by a business after the cost of all resources including both

debt and equity capital have been taken into account.

Economic value added (EVA) is a financial measures of what economists sometimes refer to as economic

profit or economic rent. The difference between economic profit and accounting profit is essentially the

cost of equity capital – an accountant does not subtract a cost of equity capital in the computation of

profit, so in fact an accountant’s measures of income or profit is in essence the residual return to that

equity capital since all other costs have been deducted from the revenue stream. In contrast, an economist

charges for all resources in his computation of profit – including an opportunity cost for the equity capital

invested in the business – so an economist’s definition and computation of the profit is net above the cost

of all resources.

HOW TO CALCULATE ECONOMIC VALUE ADDED (EVA)

The under given table gives a view for how to calculate “ Economic Value Added ”

Earnings before Interest and Taxes (EBIT)

XXX

Less: Interest

XXX

Net Income

XXX

Less : Cost of Equity Capital

XXX

Economic Value Added (EVA)

XXX

Expressed as a formula:

EVA = “Net Operating Profit after Taxes “ – (Equity Capital X % Cost Of Equity Capital).

Study Circle

Company Accounts

Cs Executive Refresher Course

ILLUSTRATION

Balance Sheet of ABC Limited

As at 31st March, 2012

I.EQUITY AND LIABILITIES

Rs.

1.Shareholder’s Funds

Equity

2. Non- Current Liabilities

Long Term Debt

3.Current Liabilities

(a) Account Payables

(b) Bank Overdraft

Total

II.ASSETS

1.Non-current assets

(a) Fixed Assets

2.Current Assets

(a) Inventories

(i) Raw Material

(ii)Finished Goods

(b) Account Receivable

(c) Cash

Total

40,00,000

60,00,000

2,08,000

4,84,000

1,06,92,000

1,00,00,000

86,400

1,71,360

4,29,300

4,940

1,06,92,000

STATEMENT OF PROFIT OF ABC LIMITED

Sales

Less: Operating Expenses

EBIT

Less: Tax Expenses

NOPAT

28,62,000

11,48,400

17,13,600

6,85,440

10,28,160

The average rate of return on similar types of companies is 20% while risk free is 12.5%. Rate of return as

charges by bank is 18% and the tax rate is 40%.

Calculate Economic Value Added.

Study Circle

Company Accounts

Cs Executive Refresher Course

VALUATION OF GOODWILL

ILLUSTRATION

A Ltd. Proposed to purchase the business carried on by M/s. X & co. Goodwill for this purpose is agreed to

be valued at 3 year’s purchase of weighted average profit of the past four year’s. The appropriate weights

to be used are:

2007-2008

2008-2009

1

2

2009-2010

2010-2011

3

4

The profit for these years are : 2007-2008- Rs.1,01,000; 2008-2009- Rs.1,24,000;

2009-2010- Rs. 1,00,000 and 2010-2011- Rs. 1,40,000

On a scrutiny of the accounts the following matters are revealed:

(i)

(ii)

(iii)

On 1st December, 2009 a major repair was mad in respect of the plan incurring Rs.30,000 which

was charged to revenue. The said sum is agreed to the Capitalised for goodwill calculation

subject to adjustment of depreciation of 10% p.a. on reducing balance method.

The closing stock for the year 2008-2009 was overvalued by Rs.12,000.

To cover management cost & annual charge of Rs.24,000 should be made for the purpose of

goodwill valuation.

Compute the value of goodwill of the firm.

Study Circle

Company Accounts

Cs Executive Refresher Course

LIQUIDATION OF COMPANIES

st

The following information is extracted from books of Mehsana Limited on 31 July, 2012 on

which date a winding up order was made.

Unsecured creditors

3,50,000

Salaries due for five months

20,000

Managing director’s remuneration

30,000

Bills payable

1,06,000

Debtors - good

4,30,000

Doubt full (estimated to produce Rs.62,000)

1,30,000

- Bad

88,000

Bill Receivable(good Rs.10,000)

16,000

Bank Overdraft

40,000

Land(Estimated to produce Rs.5,00,000)

3,60,000

Stock (Estimated to produce Rs.5,80,000)

8,20,000

Furniture & fixtures

80,000

Cash in hand

4,000

Estimated Liabilities for Bills discounted

60,000

Secured Creditors holding first mortgage on land

4,00,000

Partly Secured Creditors Holding Second Mortgage on land

2,00,000

Weekly wages unpaid

6,000

Liabilities under work men’s compensation act, 1925

2,000

Income Tax due

8000

th

5000 9% mortgage debentures of 100 each interest payable to 30 June &

5,00,000

st

th

31 December, Paid 30 June 2012

Share Capital:

2,00,000

20,000 10 % Preference share of Rs. 10 each

50,000 Equity shares of Rs. 10 each

5,00,000

st

General reserve since 31 December,2004

1,00,000

In 2009, the company earned profit of Rs.4,50,000 but thereafter it suffered trading losses

totaling Rs.5,84,000. The company also suffered a speculation loss of Rs. 50,000 during the year

2010. Excise authorities imposed a penalty of Rs. 3,50,000 in 2011 for evasion of tax which was

paid in 2012.

From the foregoing information, prepare the statement of Affairs and the Deficiency Account.

Study Circle

Company Accounts

CS Executive Refresher Course

CORPORATE RESTRUCTURING

st

Q.41)Under given is the balance sheet of Rajbhasha & co as on 31 march,2012

I .EQUITIES AND LIABILITIES

1 Shareholder’s funds

(a)Share Capital

Authorised,issued subscribed & paid-up capital

12,500 9% Preference shares of Rs.8 each

1,00,000

1,50,000 equity shares of Rs. 1 each

1,50,000

2,50,000

(b)Reserve & Surplus

Profit & Loss account

(98000)

2 Non-Current Liability

10% Debentures

60,000

3 Current Liability

Trade payables

50,000

Bank Overdraft (Secured by land & building)

20,000

Debenture Interest

4,200

Total

74,200

2,86,200

II.ASSETS

1. Non-current assets

(a) Fixed Assets

Free hold land & building

34,000

Plant

96,000

Tools & dies

27,300

1,57,300

(b)Other non-current expenses

Research & development Expenses

18,000

2.Current Assets

Stock

42,500

Trade receivable

53,400

Investment

15000

Total

Dr Jinesh Shah

2,86,200

Andheri/Dadar-28272829

Page 30

Study Circle

Company Accounts

CS Executive Refresher Course

The scheme of re-organisation detailed below has been agreed by the parties approved by the

Court. You are required to prepare:

(a) Journal entries recording the transaction in the books. Including cash;

st

(b) The balance sheet of the company as on 1 April,2012 after the completion of

the scheme.

(i)

The following assets are to be revalued as shown below: plant Rs. 59,000

tools and dies Rs. 15,000; stock Rs.30,000 and debtors Rs.48,700.

(ii)

The research and development expenditure and debit balance of Profit &

loss account are to be written off.

(iii)

Price of land recorded in the books at Rs. 6,000 is valued at Rs. 14,000 and is

to be taken over by the debenture holders in part repayment of principal. The

remaining freehold land and building are to be revalued at Rs.40,000.

(iv)

A creditor for Rs. 18000 has agreed to accept a second mortgage debenture of

11% per annum secured on plant for Rs. 15,500 in settlement of his debt. Other

creditors totaling Rs. 10,000 agreed to accept a payment of Rs.0.85 in the

rupee for immediate settlement.

The investment at a valuation of Rs.22,000 is to be taken over by the bank.

(v)

(vi)

The ascertained loss is to be met by writing down the equity shares to Rs. 1 each

and preference shares to Rs.8 each. The authorized share capital is to be

increased immediately to the original amount.

(vii)

The equity shareholders agree to subscribe for two new ordinary shares at par

for every shares held. This cash is all received.

(viii)

The costs of the scheme are Rs.3,500. These have been paid and are to be

written off. The debenture interest has also been paid.

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 31

Study Circle

Company Accounts

CS Executive Refresher Course

th

The following are the balance sheet of A Co. Ltd. & B Co. Ltd as on 30 September,2012

A Co. Ltd

Amount(Rs.)

I .EQUITIES AND LIABILITIES

1. Shareholder’s funds

(a)Share Capital

Authorised issued subscribed & paid-up capital

50,000 Equity shares of Rs.10 each ,

5,00,000

Fully called up & Paid up

(b)Reserve & Surplus

1,70,000

General Reserve

Profit & Loss account

30,000

2. Non-Current Liability

12% Debentures

1,00,000

Employee Provident Fund

15,000

3 Current Liability

Trade payables

50,000

Total

8,65,000

II.ASSETS

1) Fixed Assets

Building

1,50,000

Machinery

5,50,000

7,00,000

2.Current Assets

Stock

80,000

Trade receivable

70,000

Cash

15,000

Total

Dr Jinesh Shah

1,65,000

8,65,000

Andheri/Dadar-28272829

Page 32

Study Circle

Company Accounts

CS Executive Refresher Course

B Co. Ltd

Amount(Rs.)

I .EQUITIES AND LIABILITIES

1.Shareholder’s funds

(a)Share Capital

Authorised issued subscribed & paid-up capital

30,000 Equity shares of Rs.10 each ,

3,00,000

Fully called up & Paid up

2. Current Liability

Trade payables

40,000

Total

3,40,000

II.ASSETS

1. Non-Current Assets

(a) Fixed Assets

Tangible assets

Machinery

2,50,000

2. Current Assets

Stock

40,000

Trade receivable

50,000

Less : Provision for Doubtful Debts

5,000

Cash & Cash equivalents

45,000

5000

3. Total

90,000

3,40,000

The Two Companies agree to amalgamate and from a new company called C Co.Ltd. Which

st

takes over all the assets and liabilities of both the companies on 1 October, 2012.

The Purchase consideration is agreed at Rs. 6,61,500 and Rs. 3,15,000 for A Co. Ltd. And B Co.

Ltd. Respectively.

The entire purchase price is to be paid by C Co. Ltd. In fully paid equity shares of Rs. 10 each.

The Debentures of A Co. Ltd. Will be converted into equivalent number of debentures of C CO.

Ltd.

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 33

Study Circle

Company Accounts

CS Executive Refresher Course

Give journal entries to close the books of A Co. Ltd. And B Co. Ltd. And show the opening

entries in the books of C Co. Ltd. Also prepare the opening Balance Sheet in the books of C Co.

st

Ltd. As on 1 October, 2012. The authorised capital of C Co. Ltd. Is 2,00,000 equity shares of

Rs.10 each.

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 34

Study Circle

•

•

•

•

•

•

•

•

•

•

Company Accounts

CS Executive Refresher Course

Amalgamation

Determination of Purchase

Consideration

Net Assets Method

All Assets (AV)

xx

(xx)

Less: All Liabilities (AV)

Purchase Consideration

xx

Net Payment Method

-By Equity Shares in New Co

By Preference Shares in New Co.

By Debentures in New Co

By Cash/ Bank

Lumpsum Method: One Single Amount will be given as

Purchase Consideration.

AMALGAMATION

STEPS IN THE BOOKS OF OLD CO.

•

STEP 1: TRANFER EACH & EVERY ITEM OF BALANCE SHEET OF OLD CO. AS

UNDER:

•

•

•

•

•

•

•

•

ASSETS SIDE

a) fictitious assets

b) Cash/Bank

-if taken over

-if not taken over

c) All other assets

(Whether taken over or

Not taken over)

Dr Jinesh Shah

TRANSFER TO

Equity shareholders A/c (Dr Side)

Realisation A/c ( Dr side)

Cash/Bank A/c ( Dr side)

Realisation A/c ( Dr side)

{ At Book Values}

Andheri/Dadar-28272829

Page 35

Study Circle

Company Accounts

CS Executive Refresher Course

Continued………………………………

•

•

•

•

•

•

•

Liabilities Side

a) Equity Share Capital

b) Reserves & Surplus

c) Preference Share Capital

d) All other Liabilities:

-if taken over

-if not taken over

•

Step : 2 Entry for PC

•

•

Step: 3 Discharge of PC

Equity Shares in New Co A/c Dr

Pref Shares in New Co A/c Dr

Debentures in New Co A/c Dr

Cash/Bank A/c Dr

To New Co A/c

•

Note: At the end of Step 3 New

Company Account Should Tally

Transfer to

Equity Shareholders A/c (Cr Side)

Equity Shareholders A/c (Cr side)

Pref Share holders A/c ( Cr side)

Realisation A/c ( Cr side)

Liabilities not taken over A/c (Cr side)

New Company A/c Dr

To Realisation A/c

•

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 36

Study Circle

•

•

Step 4: Sale of Assets not Taken

over

Step: 5: Realisation Expenses

Company Accounts

•

CS Executive Refresher Course

Cash/Bank A/c Dr

To Realisation A/c

Realisation Expenses A/c Dr

To Cash/Bank A/c

( If reimbursed by new Co)

Cash/Bank A/c Dr

To Realisation A/c

Step 6: Payment to Liabilities not taken

over

Liabilities not taken over A/c Dr

To Eq/Pref Shares in New Co

To cash/ bank A/c

(if any difference trf to Realisation A/c)

Step : 7: Payment to Preference Share

holders

Preference Shareholders A/c Dr

To Eq/Pref Shares in New Co.

To Cash/ Bank A/c

(If any difference trf to Realisation A/c)

Step 8: Close Realisation A/c & Transfer the difference to Equity

Shareholders A/c

Step 9: Close All other Accounts and transfer the Difference to Equity

Shareholders A/c

Step 10: Equity Shareholders A/c Should TALLY

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 37

Study Circle

Company Accounts

CS Executive Refresher Course

Journal Entries in the Books of New

Company

•

1) For issue of Shares

Cash/Bank A/c

Dr

To Equity share capital A/c

To Securities Premium A/c

2) For Preliminary Expenses

Preliminary Expenses A/c

To Cash/Bank A/c

Dr

3) For Business Purchase

Dr

Business Purchase A/c

To Liquidator of Old Co.

Continued……………………..

•

Step 4: For Take over Assets & Liabilities

All Assets taken over (At agreed Values)

Dr

Good will A/c

Dr

To All liabilities to taken over A/c

To Business Purchase A/c

To Capital Reserve A/c

Step 5: For Discharge of Liquidator

Liquidator of Old Co. A/c

Dr

Discount on issue on Shares A/c

Dr

To Equity Share Capital A/c

To Preference Share capital A/c

To Debentures A/c

To Securities Premium A/c

To Cash/Bank A/c

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 38

Study Circle

Company Accounts

CS Executive Refresher Course

Continued……………………..

•

•

Step 6: For Payment of Realisation expenses of Old Co.

Goodwill/Capital Reserve A/c

Dr

To Cash/Bank A/c

Step 7: For Cancellation of Mutual Debts

Dr

Creditors A/c

To Debtors A/c

Step 8: For Cancellation of Bills

Dr

Bills Payable A/c

To Bills Receivable A/c

Continued………………………..

•

Step 9: For Elimination of Unrealised Profit in Stock

Good will/Capital Reserve A/c

Dr

To Stock A/c

Step 10: For Carry Forward of Statutory Reserve

Amalgamation Adjustment A/c

Dr

To Statutory Reserve A/c

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 39

Study Circle

Company Accounts

CS Executive Refresher Course

PART I – Form of BALANCE SHEET

0

Balance Sheet as at

Particulars

1

I.

Note No.

2

31 March 2012

3

(in Rupees)

31 March 2011

4

EQUITY AND LIABILITIES

1 Shareholders’ funds

(a) Share capital

(b) Reserves and surplus

(c) Money received against share warrants

1

2

2 Share application money pending allotment

3 Non-current liabilities

(a) Long-term borrowings

(b) Deferred tax liabilities (Net)

(c) Other Long term liabilities

(d) Long-term provisions

3

4

5

4 Current liabilities

(a) Short-term borrowings

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

6

7

8

TOTAL

II.

ASSETS

Non-current assets

1 (a) Fixed assets

(i)

Tangible assets

(ii)

Intangible assets

(iii)

Capital work-in-progress

(iv)

Intangible assets under development

(b) Non-current investments

(c) Deferred tax assets (net)

(d) Long-term loans and advances

(e) Other non-current assets

11

12

2 Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

14

15

16

17

18

TOTAL

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 40

Study Circle

Company Accounts

CS Executive Refresher Course

PART II - Form of STATEMENT OF PROFIT AND LOSS

Profit and loss statement for the year ended 31.03.2012

( ` in Rupees)

Refer

Note No.

Particulars

I. Revenue from operations

19

II. Other income

20

31 March 2012

31 March 2011

III. Total Revenue (I + II)

IV. Expenses:

Cost of materials consumed

Purchases of Stock-in-Trade

Changes in inventories of finished goods work-in-progress

and Stock-in-Trade

Employee benefits expense

Finance costs

Depreciation and amortization expense

Other expenses

21

22

23

Total expenses

Profit before exceptional and extraordinary items and

V. tax (III-IV)

Dr Jinesh Shah

Andheri/Dadar-28272829

Page 41